ESG or “Environmental, Social and Governance” practices have influenced all sectors of society and the economy, and now business is in the spotlight. With growing concerns about social concepts such as diversity and inclusion and environmental issues such as climate change, it has become a priority for many organizations, and the financial services sector is no exception.

Sustainability or social responsibility may not be the first thing that comes to mind when you think of banking but there are many areas that indirectly play a role when it comes to lending and investment strategies. Ultimately, who financial institutions including credit unions choose to align with and where they fall on the ESG scoring scale can have tremendous impact on their reputation and business.

What is ESG in Business?

According to McKinsey, the “E” in ESG stands for environmental criteria which includes resources and energy usage, carbon emissions and climate change.

“S” is for social criteria which highlights how your company manages relationships and the reputation it has with other institutions, employees, customers and the communities they do business in. This includes diversity, equity, inclusion and labor relations.

And lastly, “G” represents governance and is how a company governs itself through practices, controls and procedures. This includes effective decision making, law compliance and meeting the needs of external stakeholders. More specific to banking would include information privacy and security as a key initiative.

An ESG score measures a company’s environmental, social and governance risk based on a set of criteria. Investors world-wide are paying attention and many are now integrating ESG data in their decision-making to drive sustainability efforts forward.

Now, let’s discuss the four reasons why financial institutions must have an ESG strategy in 2022 and beyond.

Customers Expect ESG Initiatives

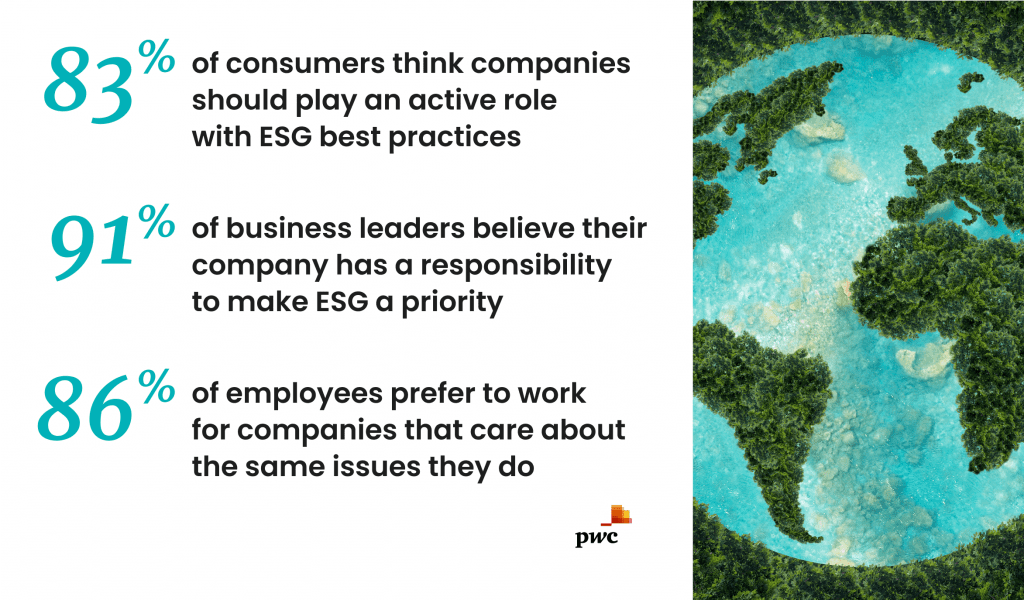

From companies to individuals, banking customers expect the financial institutions they do business with to prioritize ESG initiatives. From how they treat their customers and employees to how they support the community they do business in and what institutions and industries they choose to work with, all play a role in ESG.

An overwhelming majority of companies expect banks to offer sustainable financing products and to operate with social justice and environmental sustainability in mind from investments to partnerships. Individual consumers and employees also expect to see ESG initiatives that they value and align with when it comes to their employers.

Regulators Demand ESG Compliance

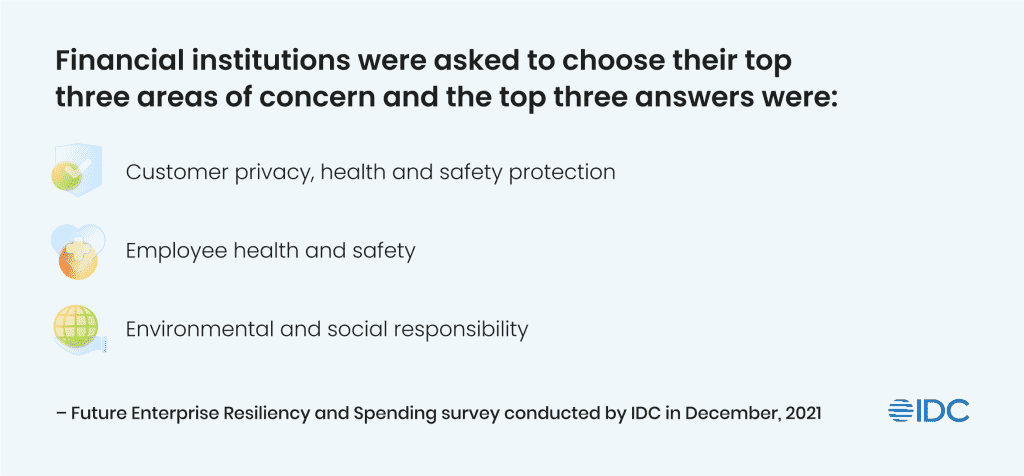

Financial institutions are faced with many demands these days including tightening compliance and regulations. They are not only dealing with internal scrutiny but they must understand the sustainability efforts of their suppliers as well. How can they collect the data that will help them better understand their suppliers ESG compliance such as carbon footprint or progress with diversity and inclusion? There is a gap that must be filled for many financial institutions in this area.

Your Competition is Already Implementing ESG Best Practices

Banks must act now to stay ahead of the competition by embedding ESG into their business strategy and operations. Many global financial institutions are systematically addressing ESG head on and developing key initiatives. For example, in Europe, 94% of the largest banks have made a voluntary commitment to the Paris climate agreement.

Financial Institutions Can Practice Good Business with ESG and Create More Business Opportunities in the Process

Overhauling your business strategy to incorporate ESG initiatives in the midst of a digital transformation is no easy feat but there is a lot to gain at the end of the day. By investing in sustainable technologies, operations and assets, the banks who fund these solutions will help to preserve the planet for future generations. They will position themselves as recognized ESG leaders by playing an integral role in building a sustainable future and a more inclusive society.

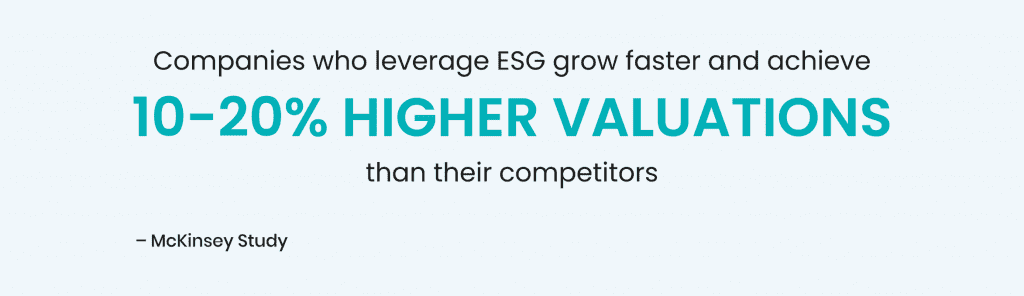

In the process they will gain new opportunities to attract new and diverse customers, improve their reputation, sell new products, reduce operating costs, maintain compliance and better manage risks. A recent McKinsey study noted that companies who leverage ESG grow faster and achieve 10-20% higher valuations than their competitors.

The Solution?

There is still much to be uncovered in the area of ESG for many industries including banking. Because ESG scores are based on non-financial factors, they are hard to quantify and the lack of transparency, legacy systems and siloed operations makes progress even slower.

Loquat Provides Speed, Efficiency, Transparency and Security to Financial Institutions

We partner with financial institutions such as credit unions, regional and community banks who want to close these gaps to achieve faster speed, efficiency, transparency and security.

Loquat, is an end-to-end Banking-as-a-Service (BaaS) technology platform with a commitment to ESG initiatives such as social responsibility, diversity and financial inclusion from the financial institutions we partner with to our SMB customers, investors and stakeholders.

We are passionate about helping small business owners from all walks of life, ethnicities and gender identities achieve their dreams by breaking down barriers to financial services. Learn more about our commitment and values.

This is possible with Loquat’s proprietary Banking-as-a-Service platform. We have partnered with best-in-class providers to solve the growing problem of security threats in banking and ensure all data that flows through our platform is secure, compliant and reduces the risks that legacy systems can no longer provide.

Small businesses are the backbones of families and communities. I founded Loquat to give SMB owners peace of mind so that they can focus on their business and not worry about cashflow. This begins with access to money today, not tomorrow.

– Zarina Tsomaeva, Founder and CEO of Loquat

If you are a credit union, regional or community bank who desires a fast, convenient and secure way to connect to your SMB customers, let us show you how Loquat works by requesting a demo today.