Consumer lending

Consumers are still struggling to secure the funding they need for life’s big moments. Despite some progress in recognizing and overcoming obstacles to consumers with a limited credit history (“thin file”) accessing capital – from early-in-career professionals to immigrants into the U.S. – there is a long road ahead

Adopting a thoughtful and forward-looking strategy for credit risk management can pave the way for your financial institution's enduring success

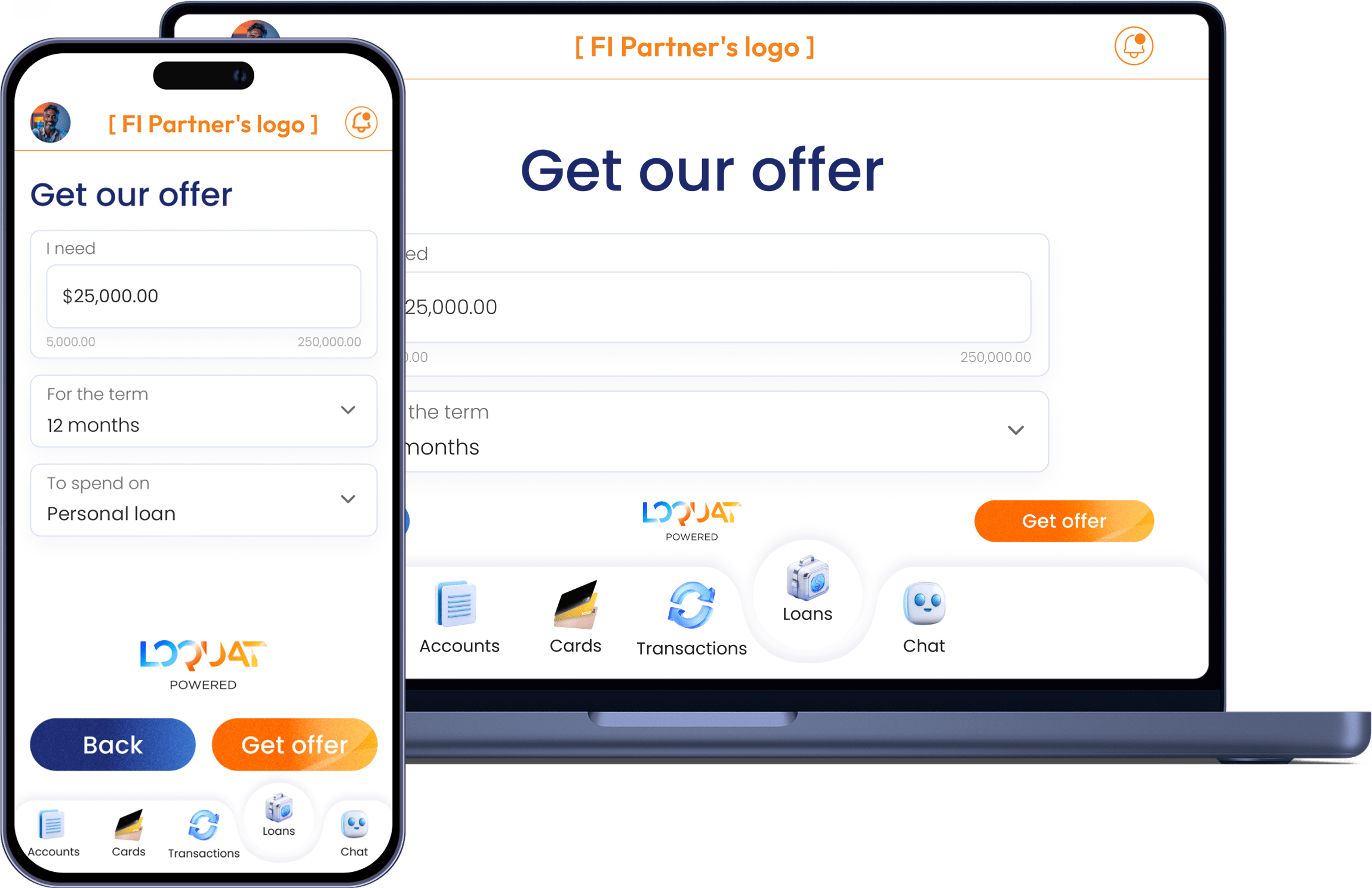

Loquat offers API-driven lending and credit solutions designed for every phase of the credit lifecycle.

From origination to servicing, collections, and payments, our modules empower financial institutions to swiftly launch and adapt any credit product with confidence and accuracy

The fair lending underwriting process can be customized to align with your institution's specific lending strategy. By incorporating advanced AI/ML models, you can evaluate client creditworthiness more accurately and equitably, ensuring compliance with regulations.

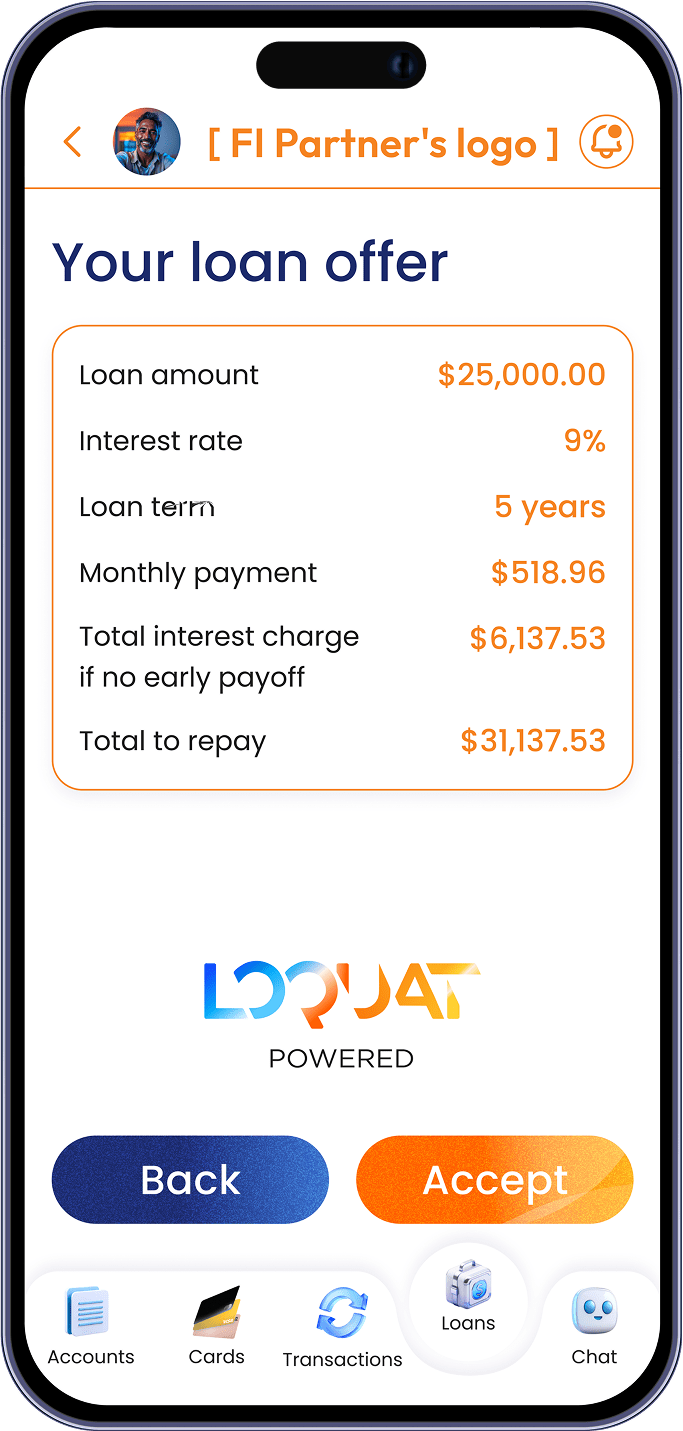

Digital document signing happens within minutes. Instant decisioning informs clients of their status and grants immediate access to funds.

Outstanding customer experience drives growth and creates upselling and cross-selling opportunities

Our lending module is powered by proprietary AI / ML models and is built using large volumes of transactional data. We create the risk parameters with you, so our model enables you to lend to consumers and businesses that were historically unbanked by your financial institution.

Our comprehensive loan origination system streamlines the entire lending process from application to funding. The platform handles digital application submission, document collection and verification, credit analysis using our proprietary AI/ML scoring models, automated decision support, loan approval workflows, and funds disbursement – all while maintaining compliance with regulatory requirements.

Loquat’s flexible platform supports a wide range of consumer and business lending products, including term loans and lines of credit.

Additionally, Loquat enables instant disbursement of approved funds to virtual debit or credit cards, giving consumer and business clients immediate access to capital. This feature is especially valuable for cash flow management, helping your clients address urgent needs like payroll, inventory purchases, or equipment repairs — without waiting days for funds to clear.

By offering fast, digital-first disbursement options, your financial institution can deliver a seamless lending experience that meets the expectations of today’s business owners while driving higher utilization and client satisfaction.