Social media

Any thoughts? You can join a conversation on Loquat LinkedIn page or Instagram

- All years

- All months

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

Pay over time is becoming everyday credit

Buy now, pay later is no longer about discretionary purchases. It is moving into groceries, utilities, travel, and subscriptions, becoming part of how households manage monthly cash flow.

PYMNTS data shows millennials and bridge millennials leading this shift, using BNPL and card installment plans interchangeably as budgeting tools rather than occasional financing options. For many consumers, paying over time now supports essentials, not indulgences.

For FIs, this evolution matters. When installment credit becomes embedded in recurring expenses, it reshapes engagement, risk management, and product design. Transparency, affordability, and seamless integration with existing credit products are becoming table stakes.

Emerging markets are showing staying power

While global markets continue to navigate volatility, emerging economies are quietly demonstrating resilience. Stronger fiscal discipline, deeper trade integration, and expanding consumer bases are helping these markets outperform many developed peers.

For investors and business leaders alike, the takeaway is clear: emerging markets are no longer just a cyclical trade. They are becoming durable contributors to global growth.

A reminder that long term fundamentals often matter more than short term noise.

Source: https://www.ft.com/content/067dc48b-f5a5-4604-a1c9-d1c728ba2a73

Feel good Sunday: Love with intention

We often talk about compatibility as fate. Sara Nasserzadeh suggests something more practical.

Lasting relationships depend on alignment, shared meaning, trust, intimacy and growth. When those foundations are present, love becomes resilient.

Whether in partnerships or in leadership, the strongest connections are built with intention.

A gentle Sunday reminder to nurture what matters most.

Source: https://www.ted.com/talks/sara_nasserzadeh_the_6_essential_ingredients_of_loving_relationships

Curious Saturday: Redefining success in health care

Millions live with preventable blindness, often without access to basic testing.

Andrew Bastawrous shares how portable technology can bring eye care to remote communities, challenging traditional assumptions about delivery and scale.

The bigger insight is universal: when we redefine success around access and outcomes, innovation follows.

Curiosity sparks change.

Source: https://www.ted.com/talks/andrew_bastawrous_a_different_way_to_measure_success_in_health_care

No business fit for the future tolerates modern slavery

An estimated 50 million people are living in forced labor or human trafficking, up 25% in the past decade. This is not a distant issue. It is a business risk embedded in global supply chains.

The new ISO 37200 standard will help organizations move beyond policy statements toward practical action.

Future ready businesses protect the people who power them.

Progress over perfection

Momentum beats hesitation every time. Waiting for the perfect conditions often delays meaningful action. Progress, even when imperfect, compounds over time and builds confidence, resilience, and results.

Keep moving. Refine as you go.

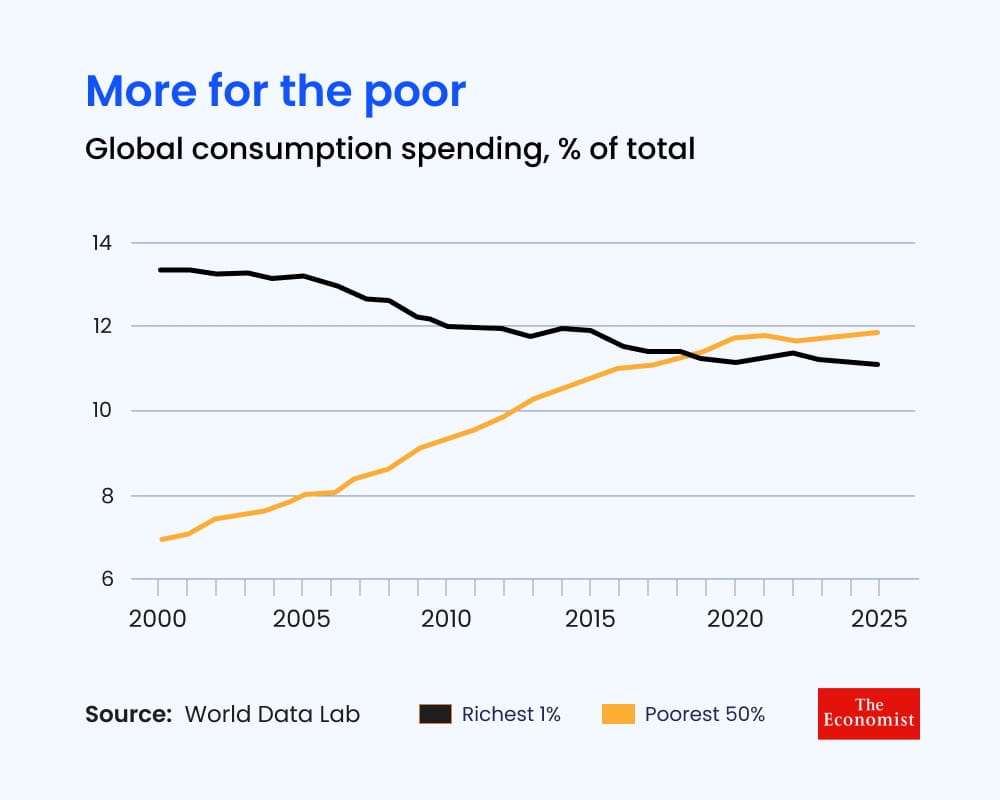

The world is more equal than it feels

Measured by consumption rather than wealth, inequality is moving in the right direction.

The spending gap between the richest and poorest households globally has narrowed significantly over the past two decades, challenging some of the most common assumptions about the global economy.

Source: https://www.economist.com/graphic-detail/2026/02/03/the-world-is-more-equal-than-you-think

Loquat insights: What makes a successful implementation?

Banks and credit unions know that successful implementation starts with alignment.

In this episode of Loquat Insights, Chris Cochran shares why early collaboration between business, compliance, and technology teams is critical. When goals are clear and teams work together from the start, decisions move faster and projects stay on track.

Strong partnership, clear communication, and early training ensure smoother launches and better outcomes.

Watch the episode to hear Chris discuss what turns implementation plans into success https://loquatinc.io/insights/chris-cochran-what-makes-a-successful-implementation/

Leadership that outlasts a term

President Day is a reminder that leadership is measured in impact, not title.

The leaders we remember are those who made hard decisions, stood by their values, and thought beyond the next headline. In business, as in public service, trust is earned through consistency, integrity, and long term thinking.

Today is a good moment to reflect on the kind of leadership we are building in our teams and organizations.

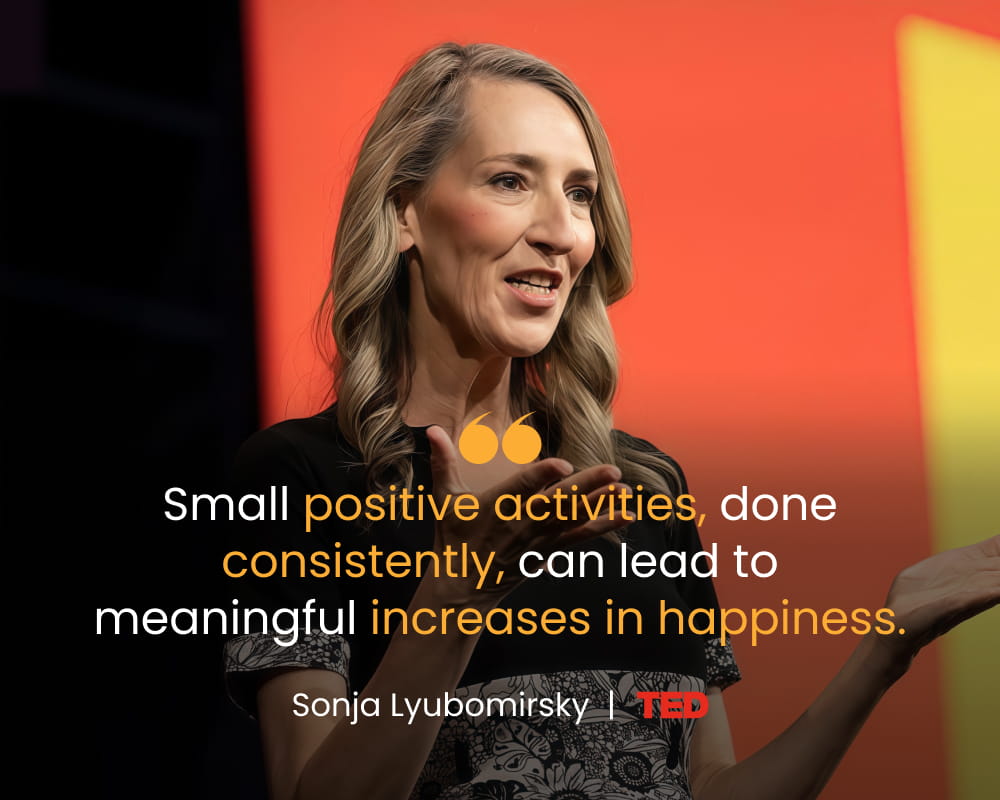

Feel good Sunday: The science behind everyday happiness

In this TED Talk, psychologist Sonja Lyubomirsky shares a powerful insight. Happiness is not something that just happens to us. It is something we actively practice.

Research shows that small, intentional actions repeated over time can meaningfully improve how we feel and how we show up in the world. Happiness, it turns out, is built in ordinary moments.

A gentle reminder for Sunday. You do not need a life overhaul. One small, deliberate step can be enough to start.

Source: https://www.ted.com/talks/sonja_lyubomirsky_1_thing_you_can_do_today_to_be_happier

Curious Saturday: What happens when you measure your life

What would you notice if you tracked your life every day, not your output, but your experience?

In this TED Talk, Chris Musser shares how daily tracking helped him see patterns in energy, joy, and meaning that were easy to miss in the rush of normal life. The lesson is simple. Awareness, not optimization, can quietly change how we live.

Source: https://www.ted.com/talks/chris_musser_what_happened_when_i_started_measuring_my_life_every_day

Climate risk is already a business cost

Climate risk is no longer a future scenario. It is already a material business cost.

Extreme weather has wiped trillions from the global economy, with impacts showing up in insurance markets, supply chains, and asset values. As Dame Inga Beale argues, delaying action only turns manageable risks into expensive crises.

The choice for businesses is increasingly clear. Act now to build resilience and unlock value, or pay far more later.

Leadership under uncertainty

Periods of uncertainty test more than systems. They test leadership.

This reminder underscores the responsibility that comes with decision making. Sustainable progress happens when economic outcomes are aligned with broader societal impact, not detached from it.

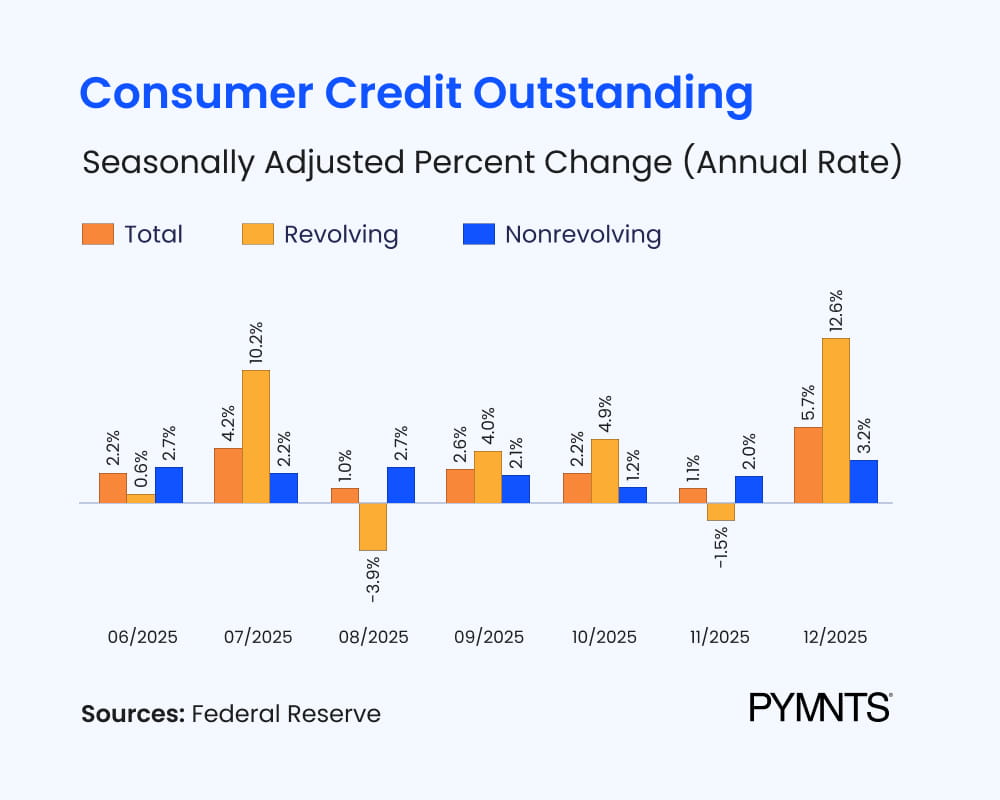

Card balances rose into year end, but spending did not spiral

According to the latest Fed G.19 data and PYMNTS Intelligence:

- Average monthly card balances rose by about $200 into December

- Households under financial strain saw larger increases, close to $600

- Visa, Mastercard, and American Express all reported continued volume growth

The takeaway is balance, not distress. Consumers are using revolving credit selectively as both a planning tool and a financial safety net, sustaining spending while navigating higher costs.