Step into the new era of banking – built for you

Loquat IQ leverages each financial institution's data to deliver tailored insights for strategic and operational success.

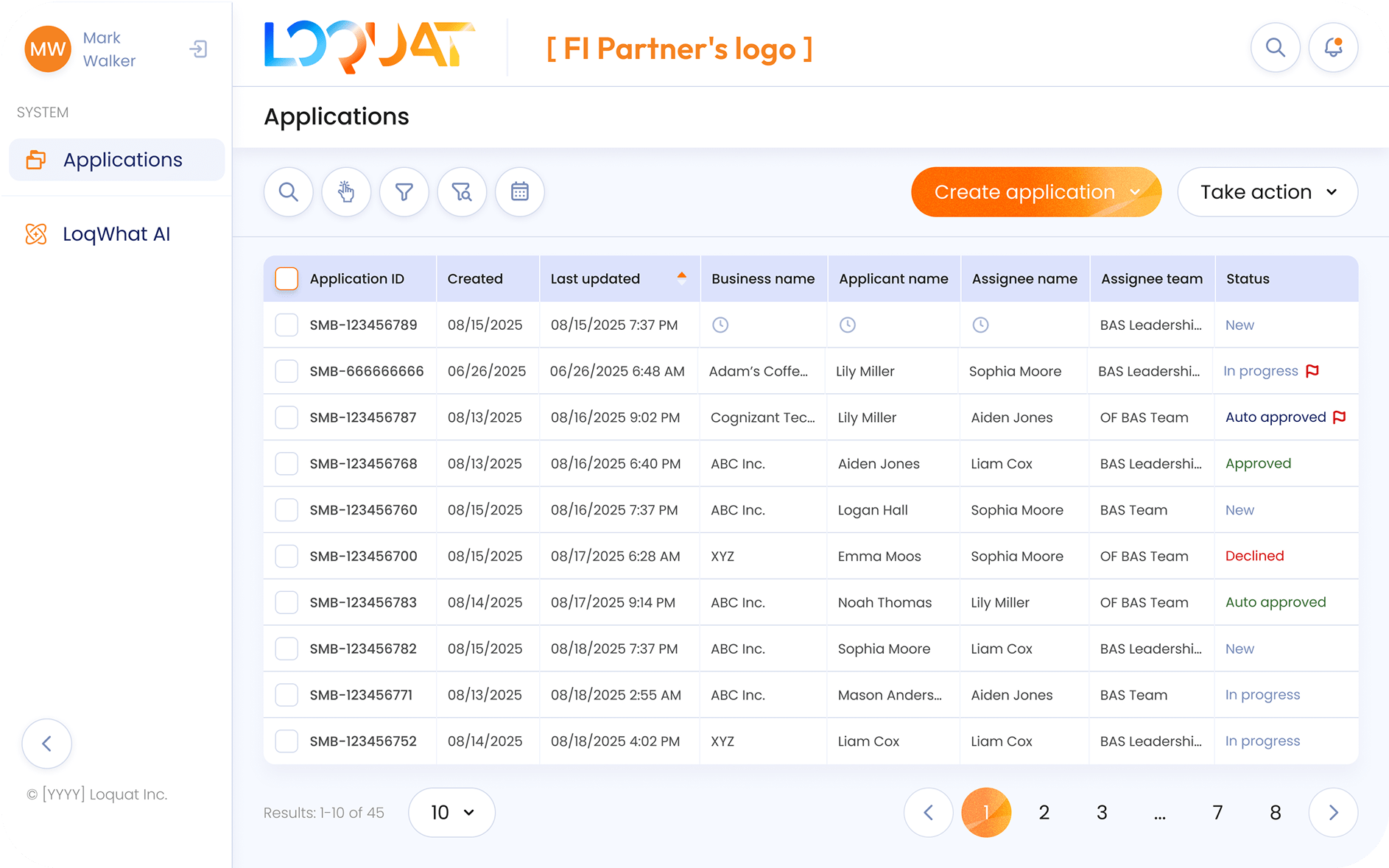

Track, manage, and gain insights for your organization via one intuitive Client Application & Lifecycle Management Portal

Learn more

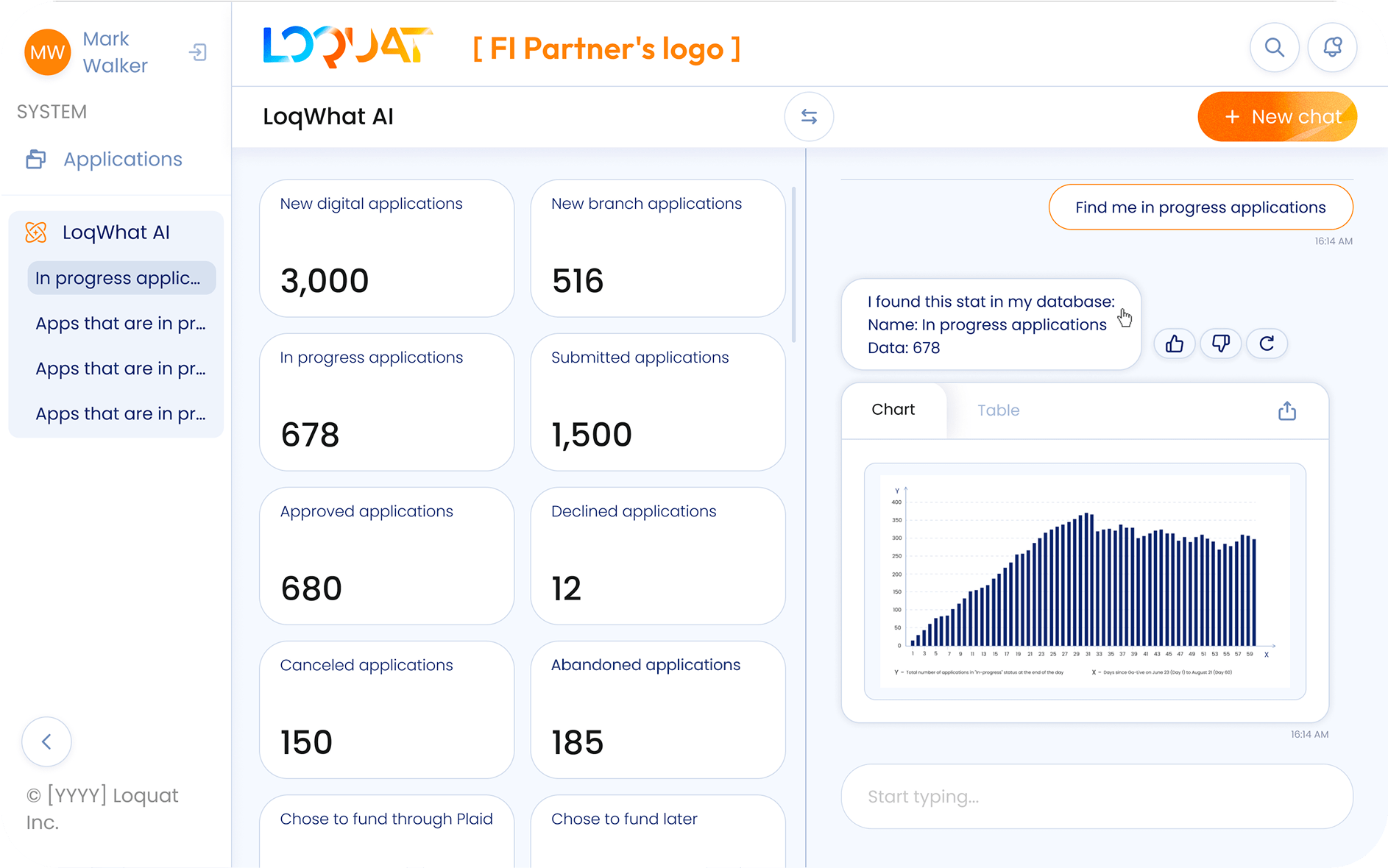

Empower your team with a tailored AI solution, leveraging your organization's unique data for process-specific insights that drive strategic and operational success

Learn more

OurPartners

Curious Saturday: When technology shapes the way we speak

January 24, 2026

From crisis to inclusion: Rethinking refugee support

January 23, 2026

Loquat insights: A shift from transactions to experience-driven expectations

January 22, 2026

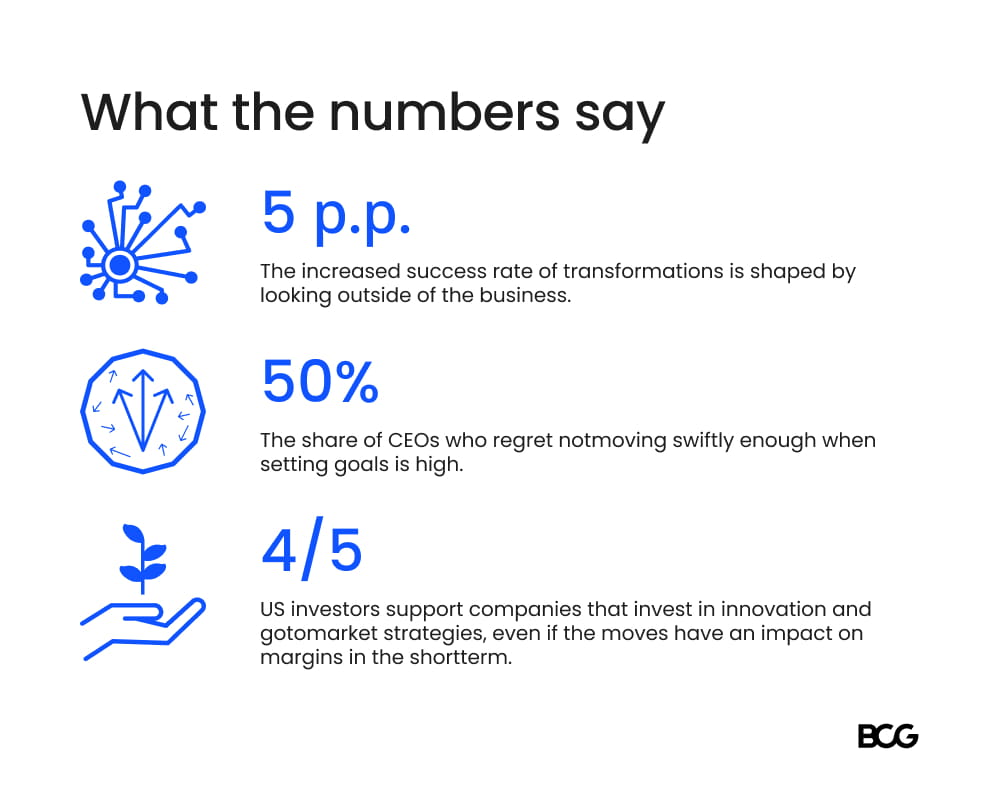

From caution to conviction in the C-Suite

January 21, 2026

Why Integrated Software Vendor maturity is becoming a payments imperative

January 20, 2026

Leadership guided by conscience

January 19, 2026

Feel good Sunday: Seeing humanity through art

January 18, 2026

Curious Saturday: How technology shapes everyday life

A climate anomaly that raises important questions

January 16, 2026

From days to minutes: Loquat’s blueprint for modern onboarding

January 15, 2026

Leapfrogging legacy in financial services

January 14, 2026

In financial services, AI value comes down to execution

January 13, 2026

A bullish start to 2026, with fewer fears of a market shock

January 12, 2026

Feel good Sunday: Small habits, big mental shifts

January 11, 2026Loquat is purpose-built for financial institutions — such as community banks, credit unions, and regional banks — looking to enhance their digital banking offerings for both, consumers and business clients, while supercharging the employee experience, from branch employees to compliance teams. Loquat platform is built with a flexible and modular architecture to suit the specific needs of consumer or business clients.

Loquat’s end-to-end platform allows financial institutions to quickly launch or improve streamlined digital banking functionalities aimed at attracting either consumer or business clients, including new account onboarding, virtual and digital cards and payments; and lending capabilities, alongside our Client Application & Lifecycle Management (CALM) portal.

Loquat takes a hybrid approach to fraud prevention, combining advanced technology with human oversight to ensure both effectiveness and accuracy.

We employ 6+ layers of authentication and fraud detection across our advanced KYC, KYB, and AML workflows — including Identity Management System (e.g. ForgeRock, Ping Identity, Microsoft Entra), real-time data checks, and end-to-end encryption — to secure sensitive information and minimize client friction.

But we don’t stop at automation. Our fraud prevention strategy also includes human review, if needed, at key decision points, ensuring that nuanced cases receive expert evaluation. This balance of real-time tools and expert intervention helps reduce false positives and enables your institution to confidently onboard legitimate customers while mitigating risk.

Loquat is currently available to financial institutions in the United States. However, international expansion is on our roadmap as we’re growing fast with multi-national deployment capability, so please stay tuned for future updates.

Our pricing model is aligned on growth and digital adoption. We typically have 3 components to our pricing, including (1) an enterprise integration fee, (2) an annual platform fee, (3) and transaction fees based on usage.

Focus and simplicity. Loquat is purpose-built for regional and community banks and credit unions, with a deep understanding of the regulatory, operational, and user experience challenges you face.

What truly sets us apart is the “easy factor” with a single integration, your financial institution can seamlessly onboard both consumer and business clients, enabling a unified experience that’s intuitive for users and efficient for your frontline staff. Our platform is built by experts in banking, compliance, legal, technology, and marketing — so every feature is intentional and aligned with how financial institutions actually work to provide an elite user experience for both your consumer and business clients as well as your employees.

Implementation timelines vary based on your financial institution’s current technical infrastructure and customization requirements, if any. Most integrations are completed within 3 to 6 months. Factors like the number of modules and the degree of customization requirements will influence the final timeline.

Getting started is easy. Schedule a discovery call with our team to explore your goals, evaluate fit, and begin your journey toward a more efficient and effective consumer and business-friendly digital banking experience.

We can provide an integration roadmap within a few weeks, with full deployment timelines depending on your financial institution’s requirements and selected modules. Our platform is ready out of the box and can be tailored to move at your preferred pace.

Yes. The Loquat platform is designed to be co-branded, allowing for your financial institution’s logo, colors, and messaging to be prominently featured throughout the user experience. From onboarding flows to product interfaces, we collaborate with your team to ensure the platform feels like a natural extension of your bank or credit union — building trust, brand recognition, and client loyalty from day one.

Security is foundational at Loquat. Our platform uses end-to-end encryption, secure APIs, passkey authentication, and adheres to industry-leading cybersecurity standards. We also conduct regular audits and testing to ensure platform integrity and compliance.

Loquat provides built-in tools and workflows that help financial institutions stay compliant with relevant federal and state regulations. Our platform supports KYC/AML processes, audit trails, data retention policies, and reporting features designed to meet the needs of regulated financial institutions like banks and credit unions.

Loquat regularly releases platform updates to introduce new features, enhance performance, and strengthen security. Updates typically occur quarterly, with additional patches or improvements deployed as needed.

Yes. We provide train-the-trainer sessions, user documentation, and on-demand virtual training to help your staff confidently navigate and operate the platform. We also offer onboarding support tailored to your financial institution’s internal workflows.

Absolutely. Loquat is built with flexibility in mind. Our platform can be tailored to align with your financial institution’s operational needs, branding, workflows, and technology stack. The level of customization depends on your integration goals and requirements.

Not necessarily. Loquat provides detailed documentation, integration toolkits, and hands-on technical support to assist financial institutions of all sizes. Whether you have a large IT department or a lean tech team, we’ll work with you to ensure a smooth deployment.

We offer on-demand multi-lingual support to all our financial institution partners. This includes technical assistance, onboarding guidance, integration troubleshooting, and ongoing client service to ensure your financial institution is set up for long-term success.

Yes. Loquat is designed to scale alongside your financial institution. Whether you’re expanding your digital offerings, growing your client base, or launching new product lines, our modular platform grows with you — ensuring long-term agility and adaptability.

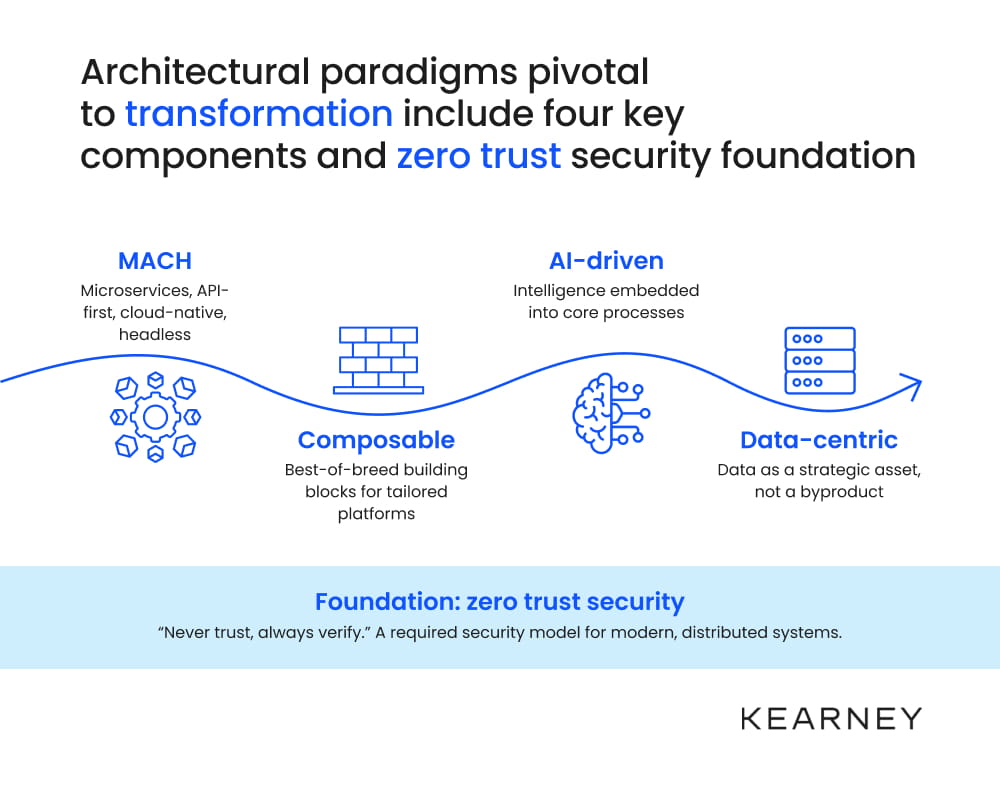

Loquat employs a modular architecture and can integrate with existing infrastructures, whether on-prem or in the Cloud.

Loquat’s platform is designed to integrate with a wide range of third-party services, tools, and systems that are critical for financial institutions to provide compliant digital banking solutions. These integrations enable the platform to offer enhanced functionality, ensuring seamless, efficient, and secure experience for both the financial institutions and their clients.

Loquat can integrate with private custom-built cores, leading bank core providers, and banking service aggregators. These integrations with digital banking solutions, fraud detection systems, KYC/AML tools, payment gateways, and client support platforms enable financial institutions to provide a comprehensive, secure, and seamless digital banking experience, which is crucial for financial institutions looking to modernize their services, streamline operations, ensure compliance, and improve client satisfaction.

We deploy API-based integrations and pre-built connections to common platforms such as GBG, FIS, Plaid and others. Loquat’s platform is flexible enough to integrate nearly any system that is not natively supported as long as an API or other acceptable access method is available.

If you want to use your payments partners, we will integrate them. We have partners that are best-in-class that you may be using or want to consider.

If you want to use your web/eCommerce partners, we will integrate them. We have partners that are best-in-class that you may be using or want to consider.

Loquat is designed to enhance your financial institution’s ability to deliver modern, responsive client service. Our platform includes built-in tools that make it easy for your team to engage with consumer and business clients — such as secure messaging, and case management workflows — all without relying on traditional call trees or manual processes.