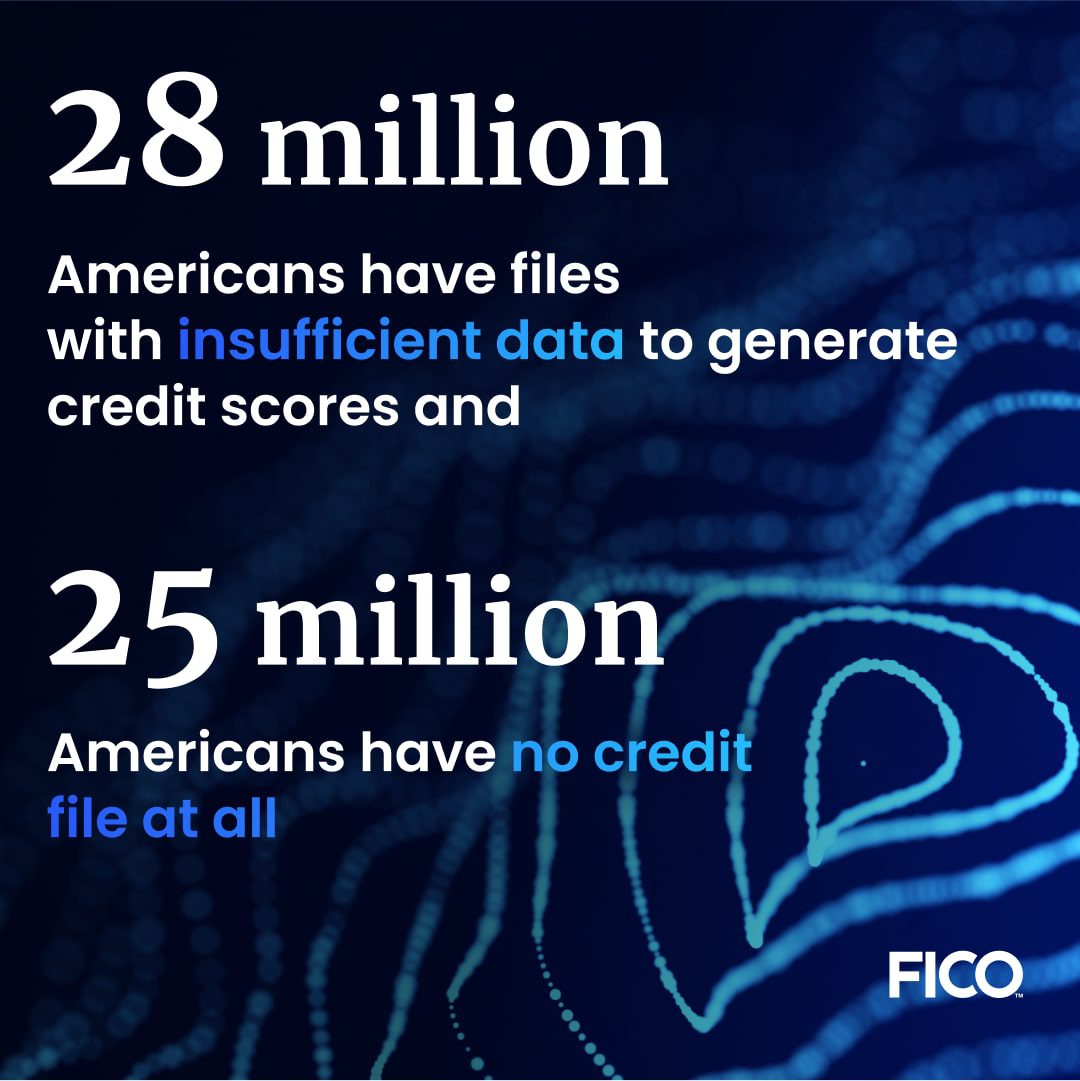

According to Fair Isaac Corporation (FICO) , a leading provider of credit scores, 28 million Americans have files with insufficient data to generate credit scores and 25 million Americans have no credit file at all.

“The beneficiaries of fintech underwriting models are low-credit score borrowers who would otherwise likely be denied credit under traditional underwriting models or subjected to high interest rates. Low-credit score individuals able to access credit also exhibit a much lower probability of defaulting on other liabilities, such as credit cards, and are often able to subsequently improve their credit scores, affording greater access to credit from traditional lending sources.”- https://www.nber.org/papers/w29840