4 of the 6 large banks will see Q3 profits fall after loan growth stalls

Net interest income — the difference between what banks pay on deposits and what they earn from loans and other assets — has in the past 18 months lifted earnings for the likes of JPMorgan Chase, Bank of America and Citigroup.

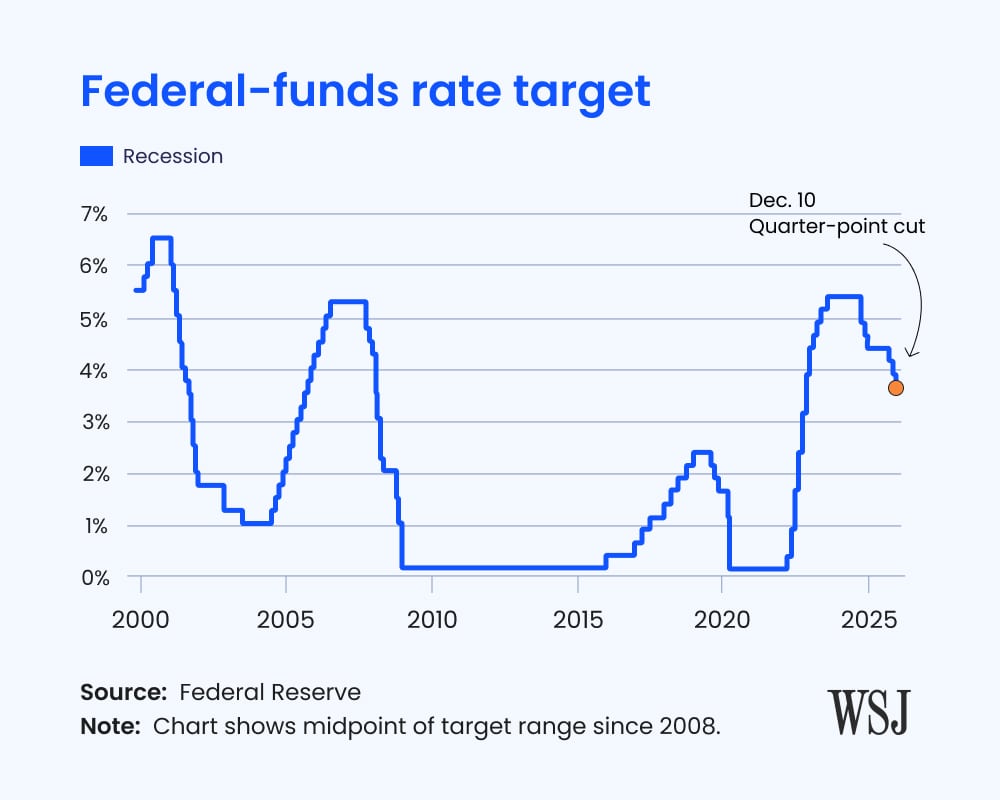

The biggest US banks have benefited from charging more for loans in lockstep with the Federal Reserve lifting benchmark rates without significantly raising interest rates for savers.

While weekly data from the Fed has shown credit card borrowing by consumers is still growing, albeit at a slower pace, corporate borrowing has fallen in the past six months, likely from rising rates.

Analysts forecast that the net charge-offs — the portion of loans with losses that are marked as unrecoverable — will rise for JPMorgan, BofA, Citi and Wells to pre-pandemic levels.

“At some point, presumably, even the strongest consumers will begin to fold under the pressure of higher rates,” said Scott Siefers, a bank analyst at Piper Sandler.

According to Morgan Stanley analysts, the 25 largest US banks by assets had loan growth slow considerably since the start of the year to about 1.5 per cent from a year earlier, when it had been tracking at 8 per cent.

https://on.ft.com/3PNQJdf