Business lending

Businesses clients are still struggling to secure the funding they need at every step of their business journey. Despite some progress in recognizing and overcoming obstacles to accessing capital, there is a long road ahead.

By taking a strategic and proactive approach to credit risk management you can position your financial institution for long-term success

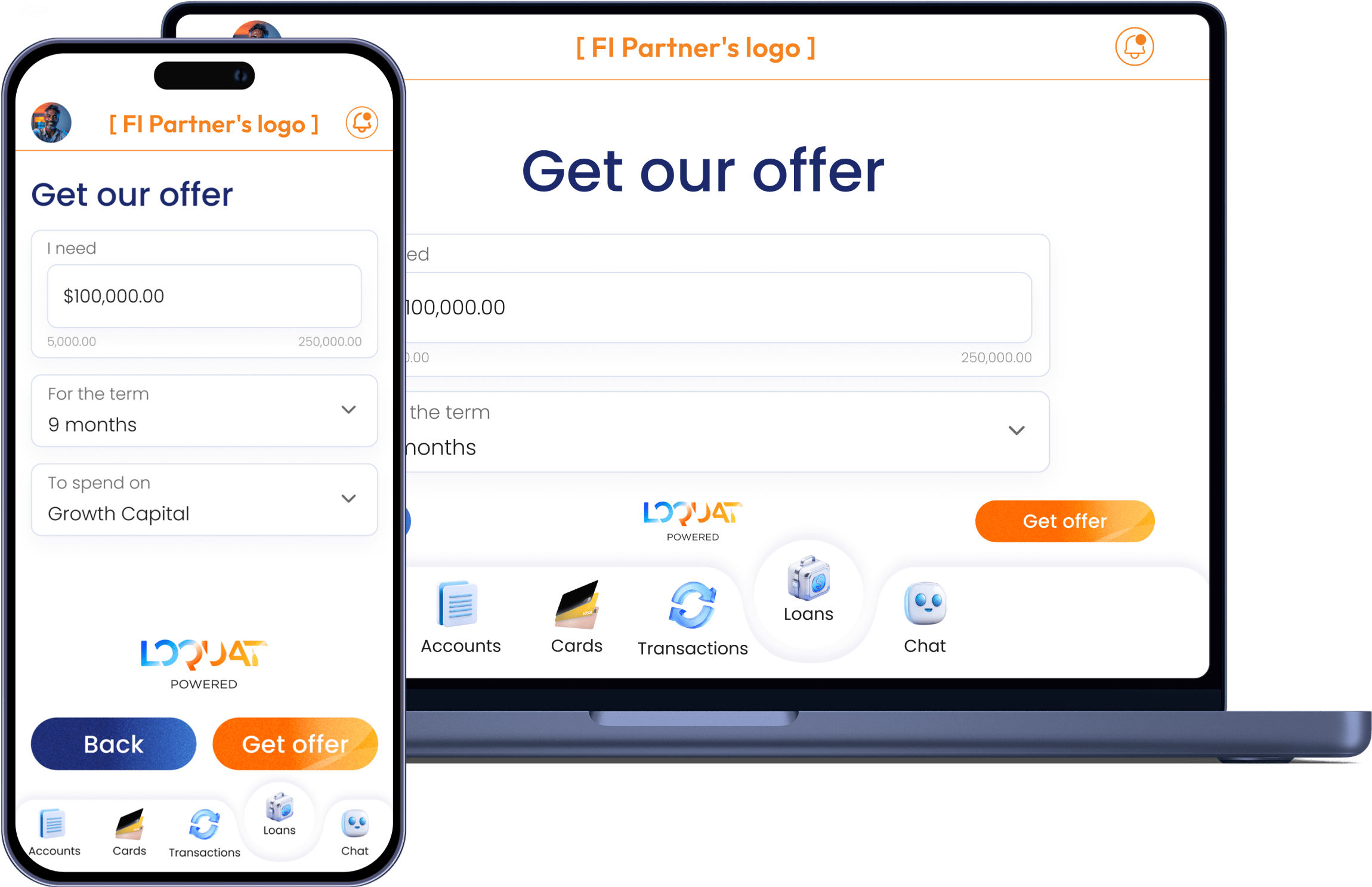

Loquat’s API-first lending and credit modules were built to enable every stage of the credit lifecycle – from origination to servicing, collections, and payments – giving financial institutions the freedom to launch, scale, and evolve any credit product with speed, precision, and trust

Underwriting process can be tailored to your institution's lending strategy, using unique AI/ML models to assess client creditworthiness accurately and fairly

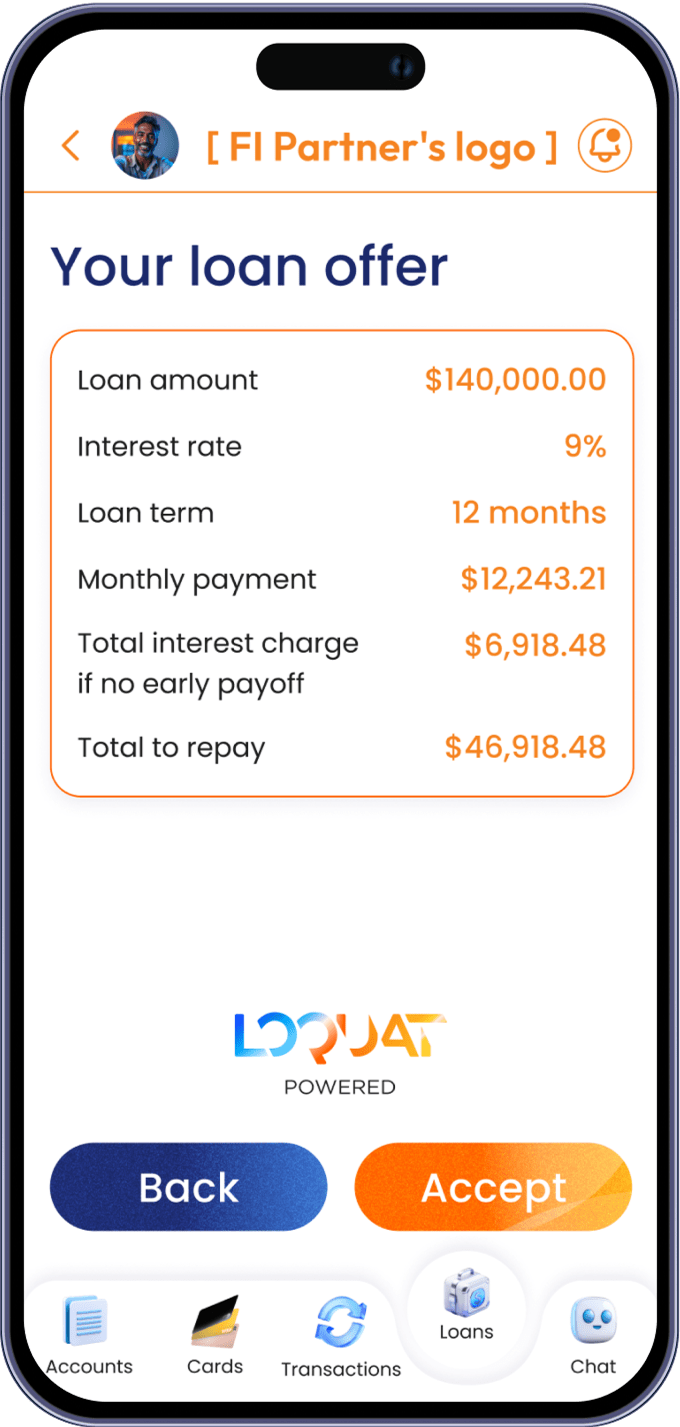

Digital document signing happens within minutes of the offer, with instant decisioning informing clients of their status and granting immediate access to funds

Exceptional client experience sets you up for growth and additional upselling and cross-selling opportunities