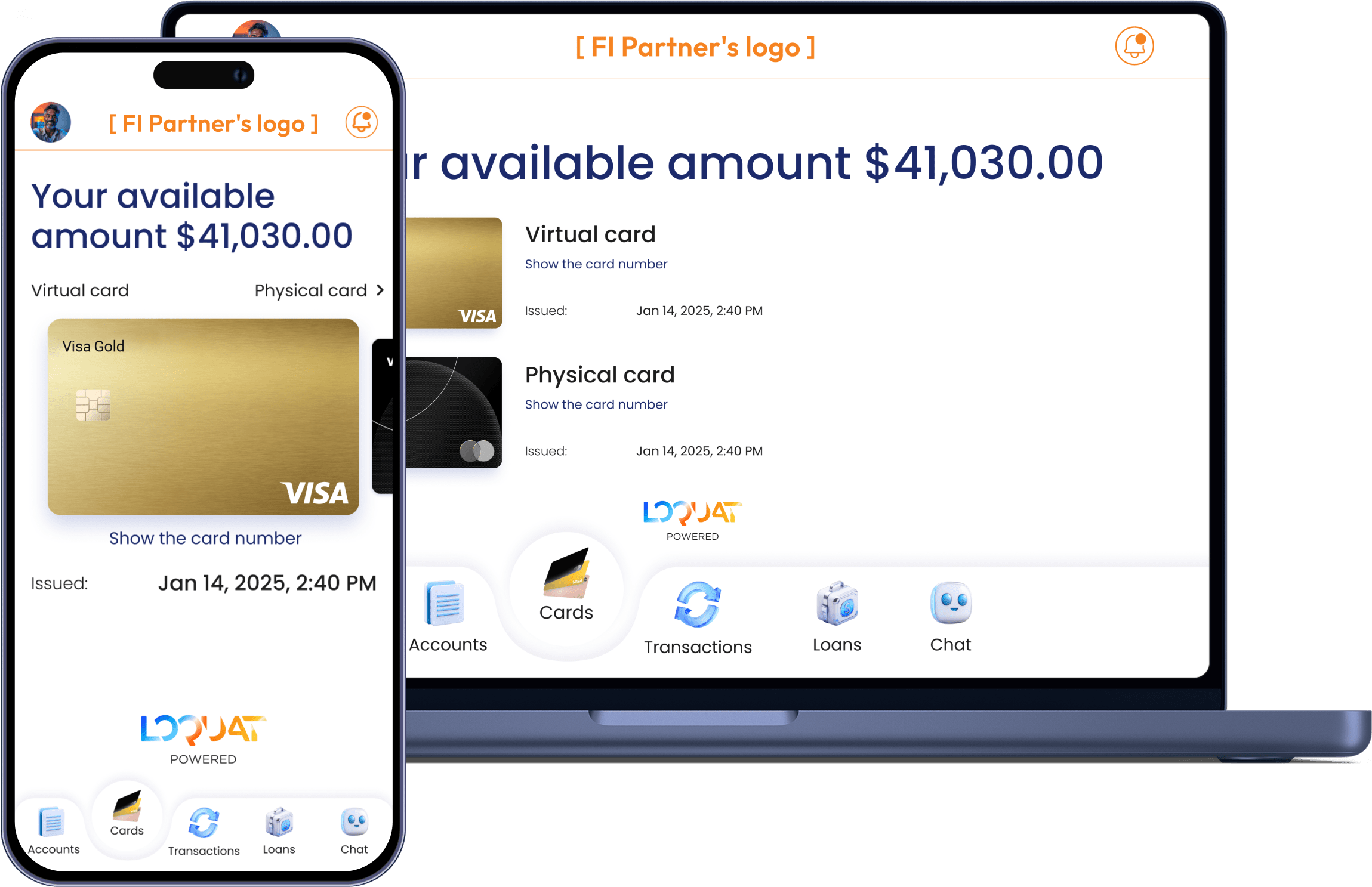

Cards & payments

Loquat surpasses standard debit and credit card services by offering innovative virtual credit cards. These cards provide exceptional security features, ensuring that financial information is protected against fraud.

Unique card details: Each virtual card is designed with a unique card number, expiration date, and security code. This enhances the primary account's protection against potential fraud or unauthorized access

Personalized spending controls: Customers have the flexibility to establish tailored spending limits and expiration dates for every card and joint account holder

Temporary or purpose-driven cards: Virtual cards can be created for a single transaction or tailored to meet specific needs

Instant issuance: Available for immediate use without having to wait for arrival in the mail

Simplified card control: Your clients can effortlessly handle their cards through the banking app. They have the flexibility to create, freeze, unfreeze, or delete cards whenever required.

Easy management: Cards can be easily managed in the banking app, allowing your clients to create, freeze, unfreeze, and delete cards as needed

Support for all major processing networks (Visa, Mastercard, Amex, etc.)

Loquat seamlessly integrates with your financial institution’s existing core systems and digital banking platforms to enable instant virtual debit card issuance at the moment of account opening. Our platform also supports real-time tokenization, allowing you to provision cards to Apple Pay, Google Pay, and other wallets immediately — driving instant engagement and top-of-wallet status from day one.

It’s considered best practice to issue a debit card at the time of account opening to increase activation rates and client stickiness. With Loquat, your clients can start transacting within minutes, while your financial institution benefits from enhanced interchange revenue, higher product adoption, and improved digital engagement.

Our cards are purpose-built for consumer and business use, offering flexible controls, role-based permissions, and robust security features — far beyond the limitations of traditional consumer card programs.

In addition to instant debit card issuance, Loquat enables your financial institution to offer credit card pre-qualification during account onboarding — helping you identify eligible clients early in the relationship. With no impact to credit scores, clients can view tailored credit offers within minutes, boosting engagement, deepening wallet share, and accelerating product adoption from day one.

Virtual cards are issued instantly upon account opening, allowing your consumer and business clients to begin using them immediately for transactions without waiting for physical cards to arrive.

Yes! While virtual cards provide immediate access to funds, companion physical cards can also be issued to businesses that prefer having a tangible payment option.

Each virtual card has unique card details (card number, expiration date, and security code), which keeps the primary account secure if a card is compromised. This limited exposure model protects clients’ credit card information from potential fraud and data breaches during online transactions.

Yes, virtual cards can be designated for use with specific merchants only, adding an additional layer of security and control over business spending.

Yes, Loquat’s platform allows for the creation of one-time-use virtual cards, which are ideal for single purchases where enhanced security is desired.

By offering Loquat’s virtual card solution, you can enhance your competitive position in the consumer and business markets with an innovative, secure, and convenient payment option that meets the evolving needs of your clients. This can help attract new consumer and business clients and strengthen relationships with existing ones.