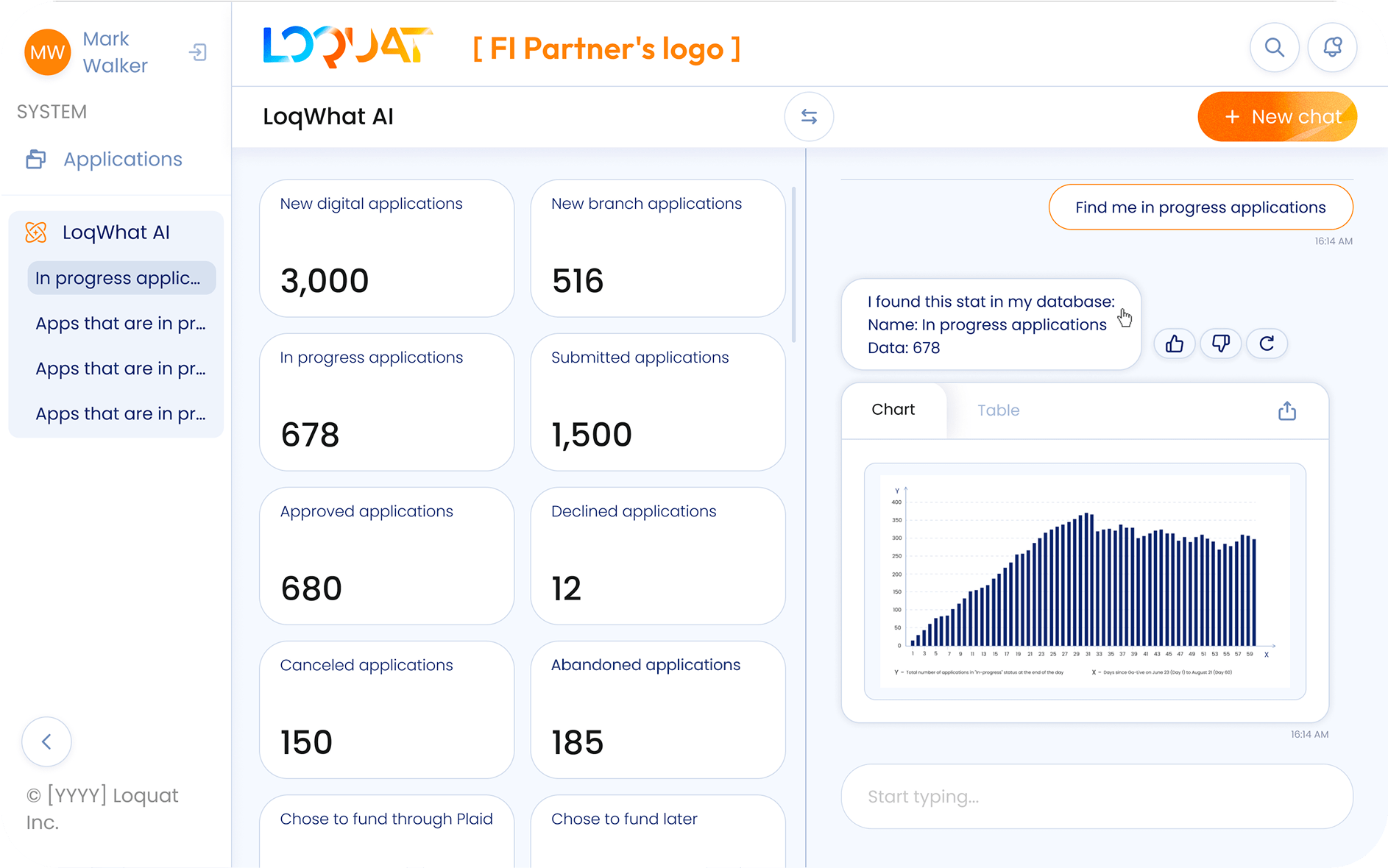

LoqWhat AI

built on each Financial Institution’s unique data for process-

specific insights that drive strategic and operational success

Institution-specific analysis of customer and enterprise data

Executive dashboards with actionable insights tied to growth, risk, and performance outcomes

Interactive AI chat to query data, deliver accurate and repeatable answers in real time, and explore myriad business scenarios

Continuous learning and enhancements to expand capabilities across additional lines of business

LoqWhat AI provides employees with a comprehensive view of all applications managed through CALM, enhancing transparency and aiding collaboration. Executives can swiftly make informed decisions to streamline operations and devise growth strategies. Additionally, team members can access critical application performance metrics for benchmarking against peers, driving continuous improvement efforts effectively. Reporting is as easy as asking a question and getting an answer, vs. having to request reports or dashboards from specialized teams.

LoqWhat AI supports all Loquat solutions, with the ability to ask questions about your consumer and business clients across account opening, cards, payments, and lending activities.

You can ask any data-related operational and strategic questions about CALM-managed solutions. Please see examples below:

- How many consumer account applications were approved this August?

- What was our approval rate for business accounts for July last year?

- How many applications processed this year include minors, under the age of 18?

- Which branch processed the most applications in Q3, 2025?

- Which state has the highest count and approval rates for LLC business accounts?

- Provide a breakdown of business account applications by legal type and state for Q2, 2025.

- How many credit cards were issued last week, broken down by branch? What was the average approved credit card limit?

LoqWhat AI delivers highly accurate answers by generating and executing question & answer pairs tailored to your organization’s data, leveraging its comprehensive understanding of all applications managed through CALM and your institution’s data. Once refined, any pair can be bookmarked for consistent, accurate reuse.

LoqWhat AI is highly effective for training your employees on the new system. In addition to providing answers to questions requiring a specific analytical result, LoqWhat AI can provide more general information about the system, enabling learning by doing. They can, for example, ask about membership criteria and accepted documents for KYC/KYB processes.

Loquat ensures data security by maintaining strict segregation in Loquat’s cloud, isolating each institution’s data and AI memory to prevent unauthorized access. LoqWhat AI accesses only the specific institution’s data during an active session. Any data provided during a chat session is retained solely for subsequent queries related to that institution, ensuring both privacy and security.

Our platform is designed to be intuitive and user-friendly — for both financial institution employees and Applicants — so most users can get up and running quickly with minimal effort. That said, we know every team is different, and we’re here to support you every step of the way.

Training is flexible and can be delivered through live sessions, recorded tutorials, and easy-to-follow documentation — based on what works best for your team. Most importantly, real people are always available to help when you need them.