Account opening

Business clients expect financial institutions to offer a modern and seamless digital experience that is intuitive, simple, instant, and personalized

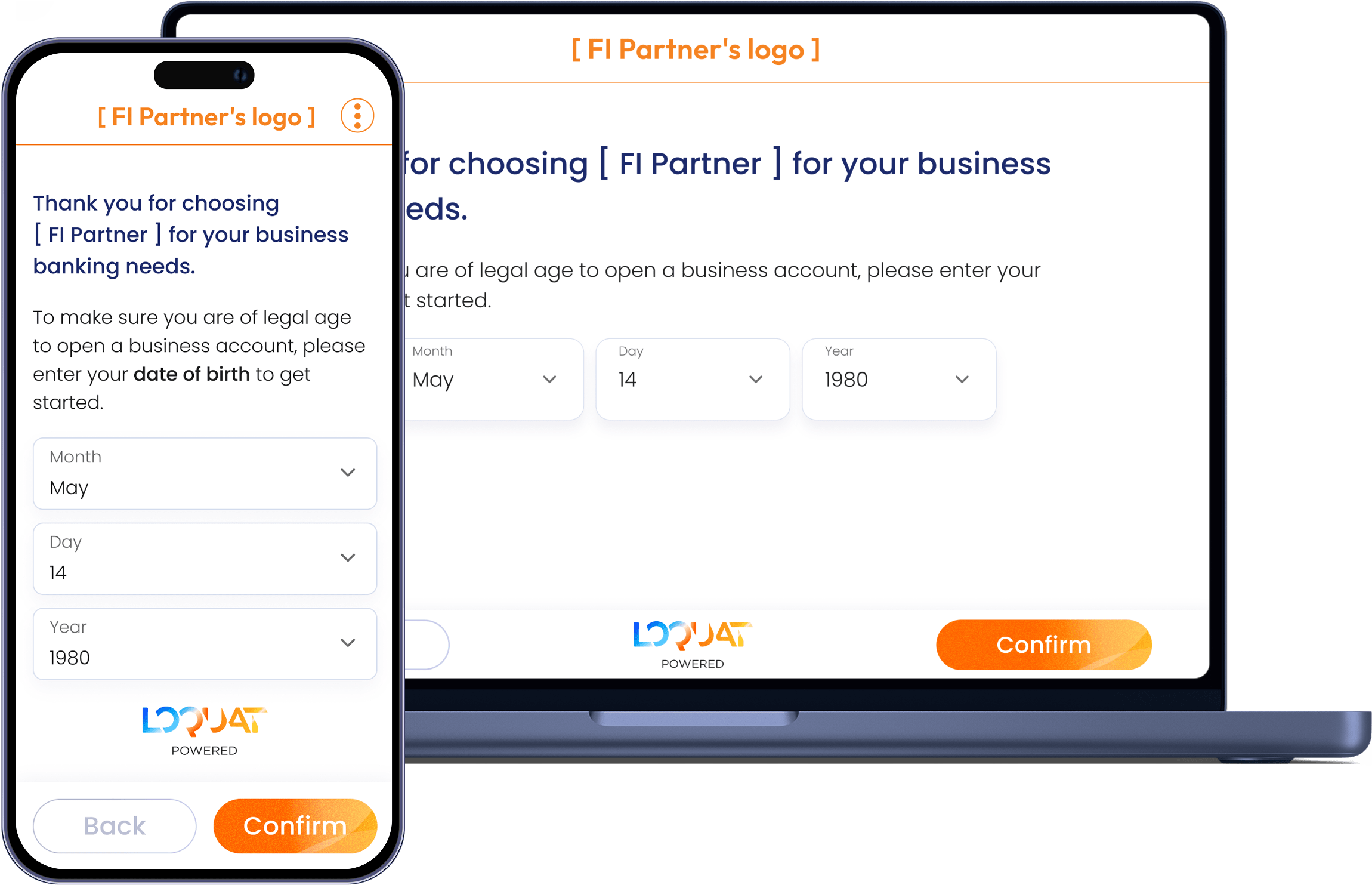

A streamlined client journey for consistent experiences and improved retention rates

Omni-channel continuity to seamlessly transition between web, mobile, and branch

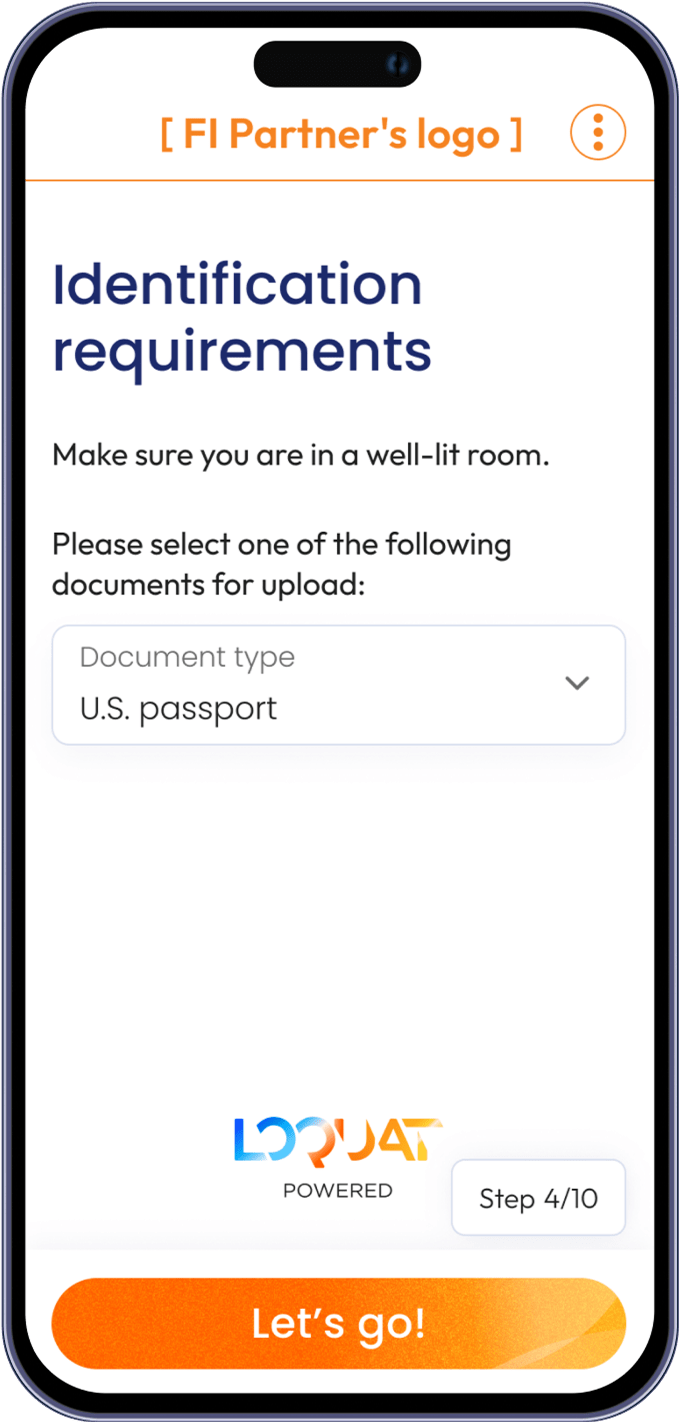

Best-in-class identity verification that will meet your compliance standards

Loquat empowers credit unions, regional banks, and community banks with sophisticated digital account opening capabilities superior to those offered by larger financial institutions. The platform combines the technological advantages of Loquat with your financial institution’s personalized service and community focus, creating a compelling value proposition for consumers and businesses in your market.

Loquat supports digital onboarding for a full suite of consumer and business accounts, including but not limited to:

- Checking

- Savings

- Money market

- Certificates of deposit (CDs)

Yes. Loquat enables end-to-end digital account opening — from identity & business verification, to document upload, to account selection, to cross-sell opt-ins, to approval, and ultimately funding — without requiring a branch visit or call center interaction. We reduce friction while improving speed, compliance and security.

Our platform includes complete KYC/KYB workflows for verifying business owners, signers, and the business entity itself.

Loquat also offers:

- AI tools for document capture and validation (e.g., personal ID, formation documents)

- Beneficial ownership attestation

- Fraud monitoring and flagging

- Integration with third-party data providers for watchlist screening

Loquat’s KYC/KYB capabilities ensure your financial institution remains compliant with BSA/AML regulations while reducing costly and error-prone manual review time.

Absolutely. Loquat is built to handle complex ownership structures and supports various business types including:

- Sole proprietorships

- Partnerships

- Corporations (C-Corp, S-Corp)

- LLCs (single- and multi-member)

- Nonprofits and professional associations

Most consumer and business clients can complete their application in under 10 minutes. With integrated verifications and digital document handling, accounts can be approved and funded in as little as one business day, depending on your financial institution’s application approval policies.

Loquat wants to be sure that you’re a live person. This is one of our 6+ layers of security.

We are checking the selfie against ID scans and using an AI-driven tool to make sure the person is a real human. The technology analyzes facial geometry to ensure a natural 3D structure – including shades and contours – and confirms that the uploaded image is not just a picture of a picture.

Loquat takes a hybrid approach to fraud prevention, combining advanced technology with human oversight to ensure both effectiveness and accuracy.

We employ 6+ layers of authentication and fraud detection across our advanced KYC, KYB, and AML workflows — including Identity Management System (e.g. ForgeRock, Ping Identity, Microsoft Entra), real-time data checks, and end-to-end encryption — to secure sensitive information and minimize client friction.

But we don’t stop at automation. Our fraud prevention strategy also includes human review, if needed, at key decision points, ensuring that nuanced cases receive expert evaluation. This balance of real-time tools and expert intervention helps reduce false positives and enables your institution to confidently onboard legitimate customers while mitigating risk.