AI systems have benefits but risks to stability must be managed

Will reliance on AI extend its power into the hands of technology companies? Tech companies are increasingly make inroads into finance but are not subject to strict oversight. There are parallels with the world of cloud computing in finance. In the west, the triumvirate of Amazon, Microsoft and Google provides services to the biggest lenders.

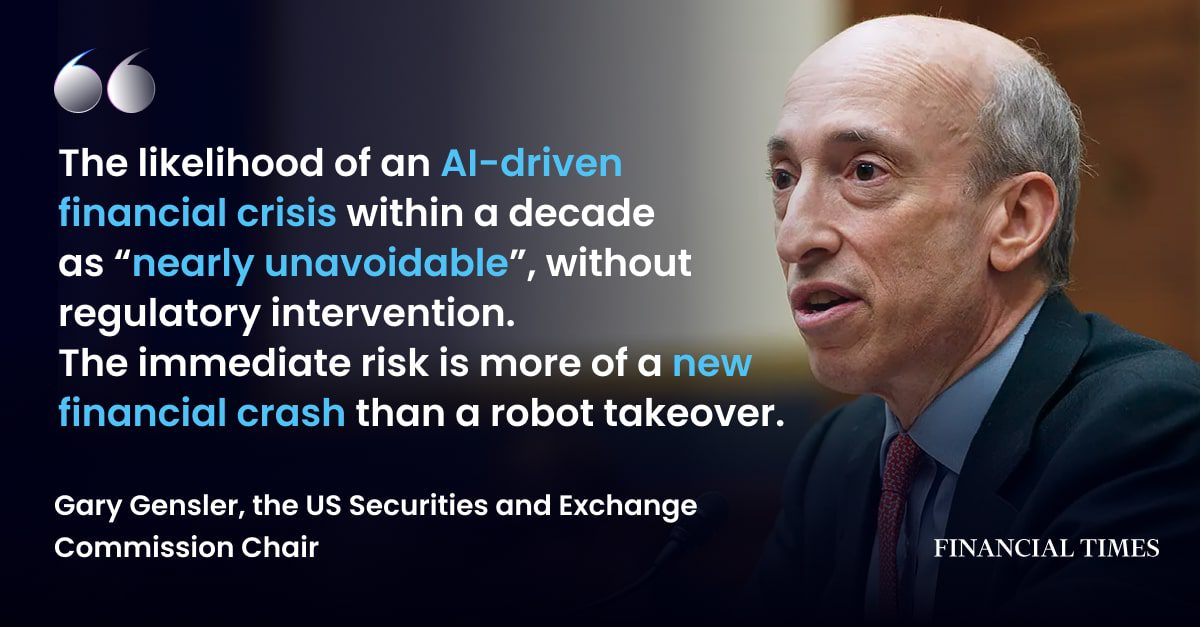

This concentration raises competition concerns, and affords at least the theoretical ability to move markets in the direction of their choice. It also generates systemic risk: an outage at Amazon Web Services in 2021 affected companies ranging from robot vacuum producer Roomba to dating app Tinder. An issue with a trading algorithm could trigger a market crash.

Watchdogs have pushed back against the awkward nexus of technology and finance in the past, as with Meta’s digital currency, Diem, formerly known as Libra. But to mitigate the risks from AI requires expanding the perimeter of financial regulation or pushing authorities across different sectors to collaborate far more effectively. Given the potential for AI to affect every industry, that co-operation should be broad. The history of credit default swaps and collateralised debt obligations shows how dangerous “siloed” thinking can be.

AI is not inherently negative for financial services. It can be used to speed up the delivery of credit, support better trading or combat fraud. It can ultimately be a friend to finance, if the watchmen have the right tools to keep it on the rails.