Social media

Any thoughts? You can join a conversation on Loquat LinkedIn page or Instagram

- All years

- All months

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

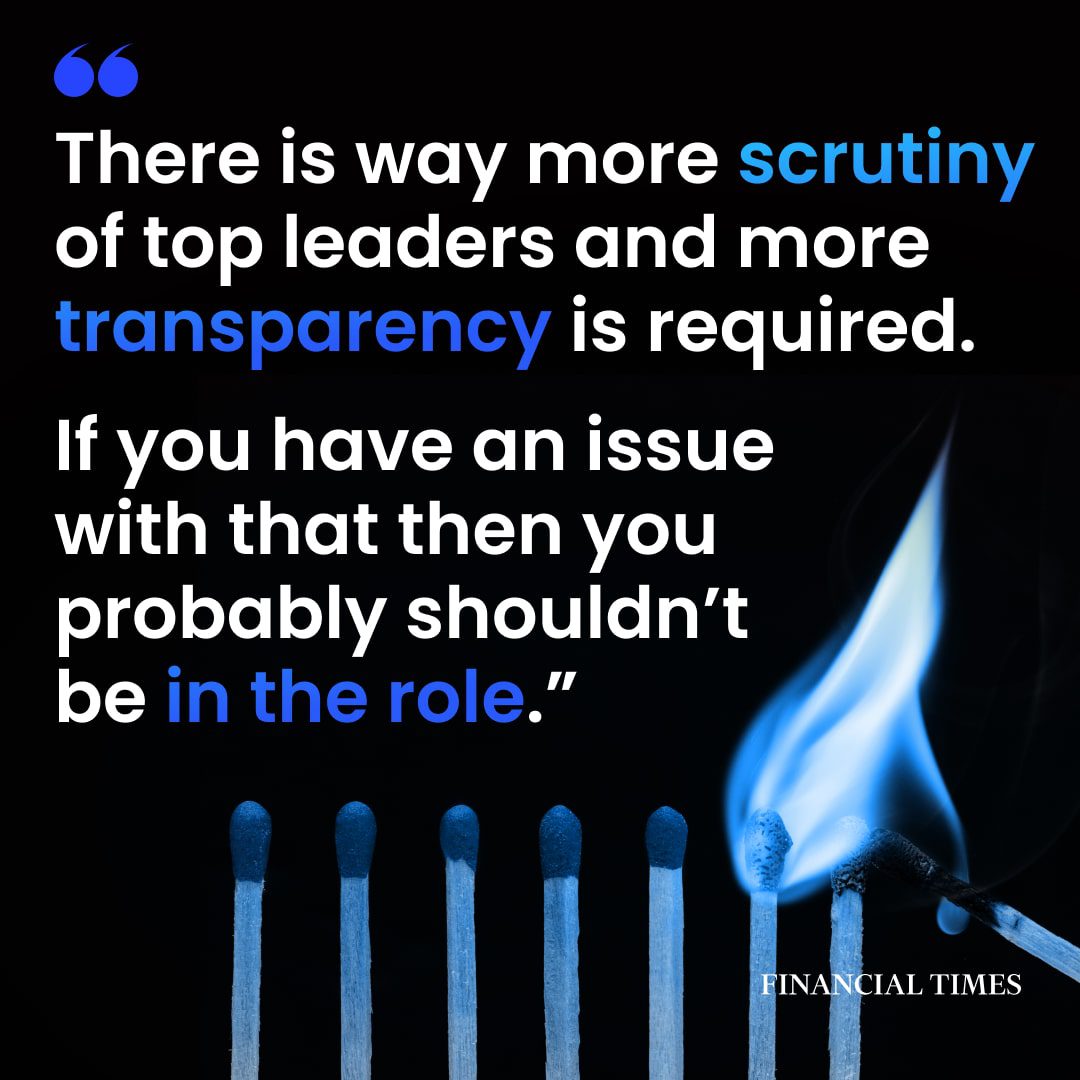

Leadership under uncertainty

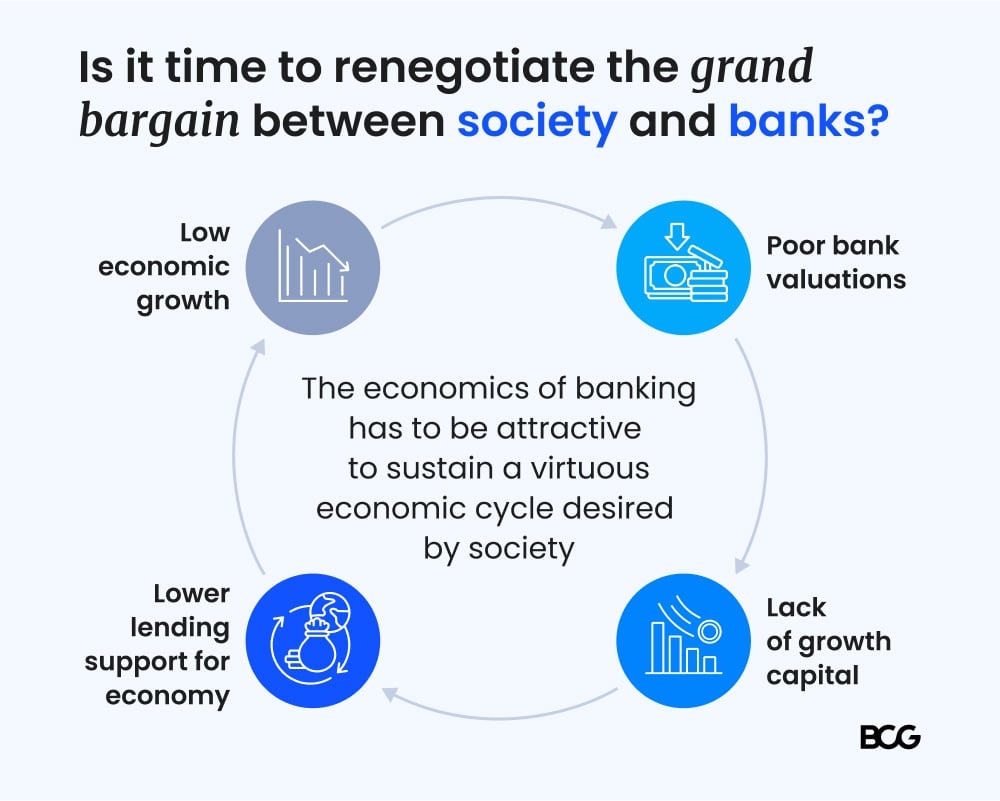

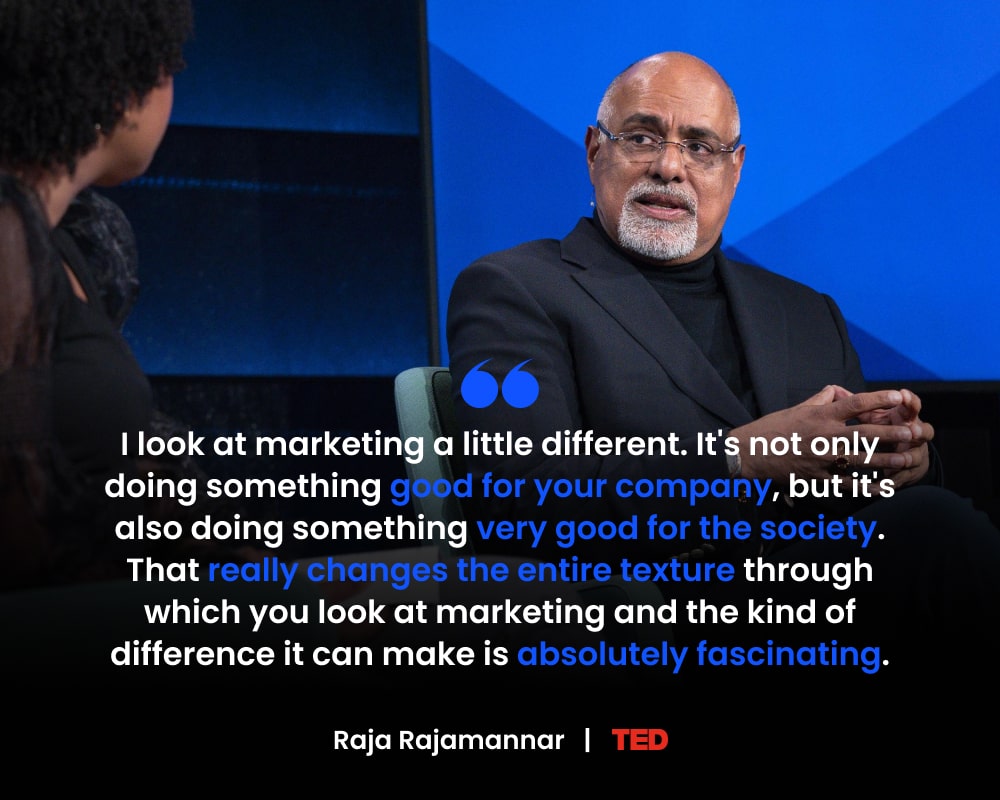

Periods of uncertainty test more than systems. They test leadership.

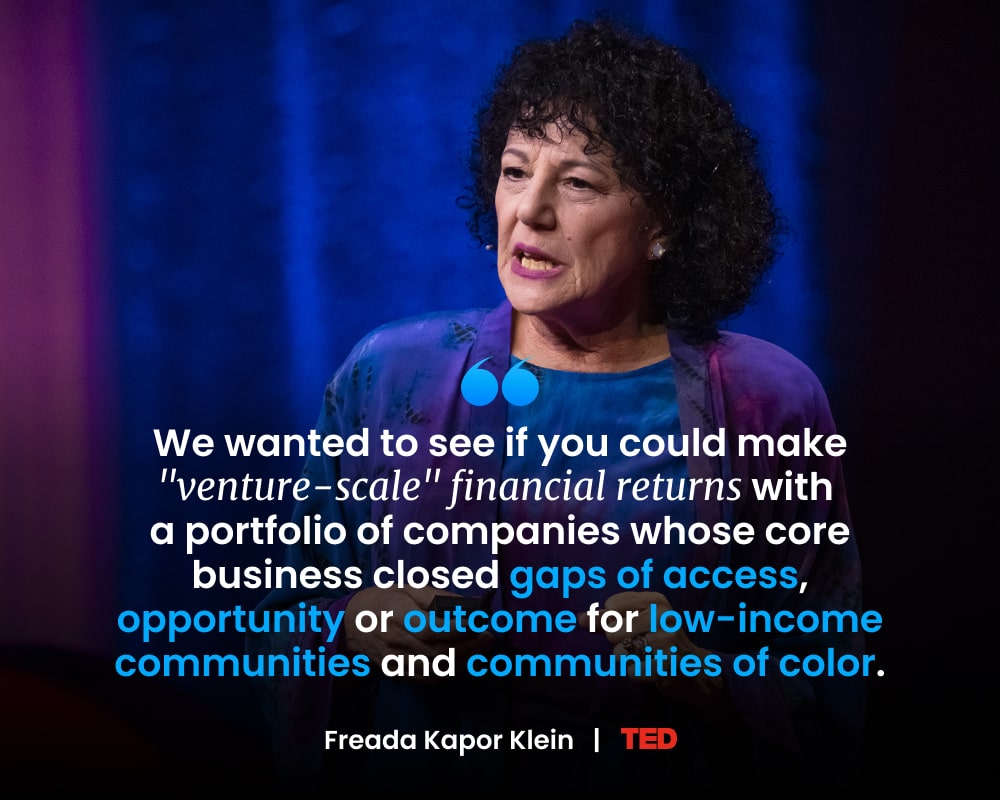

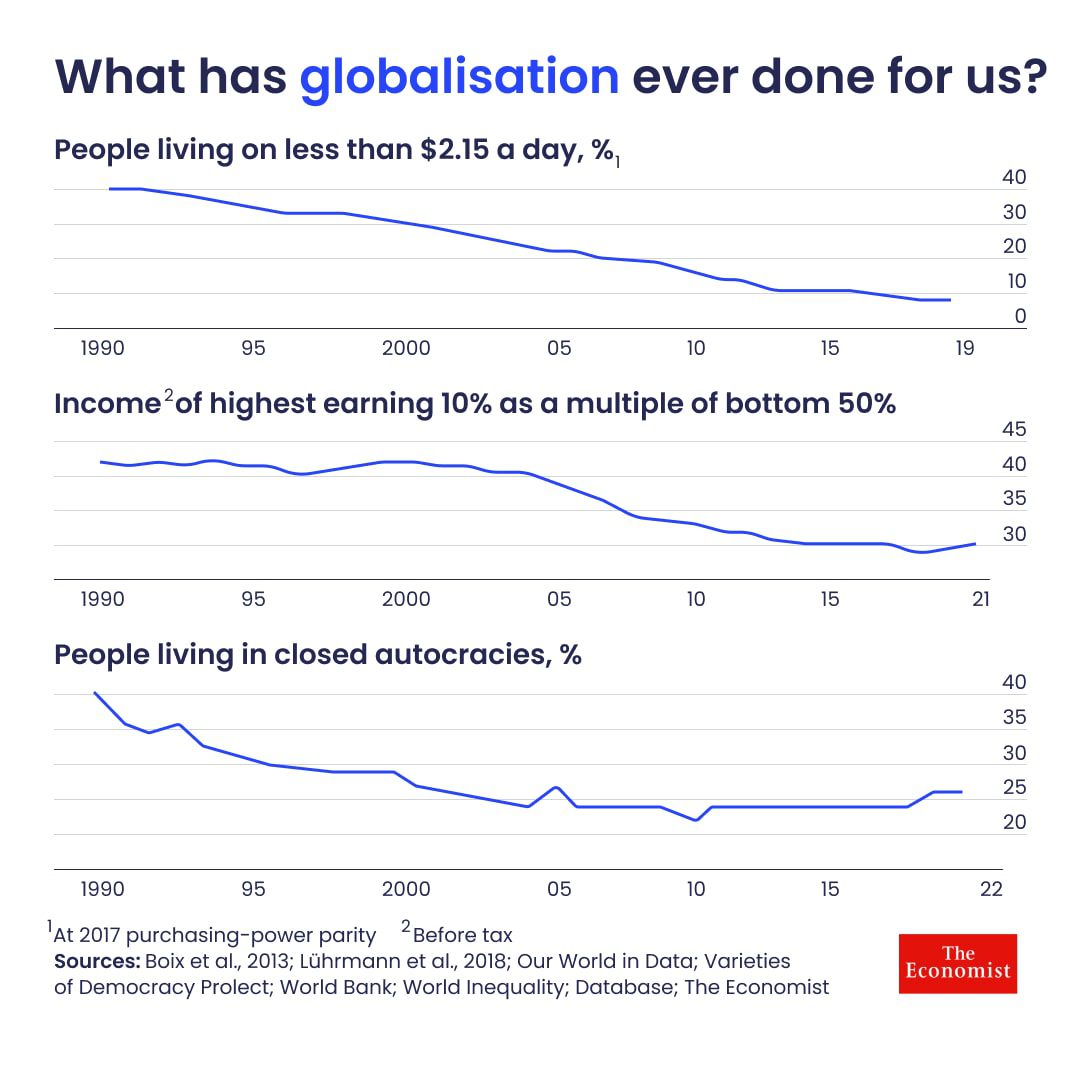

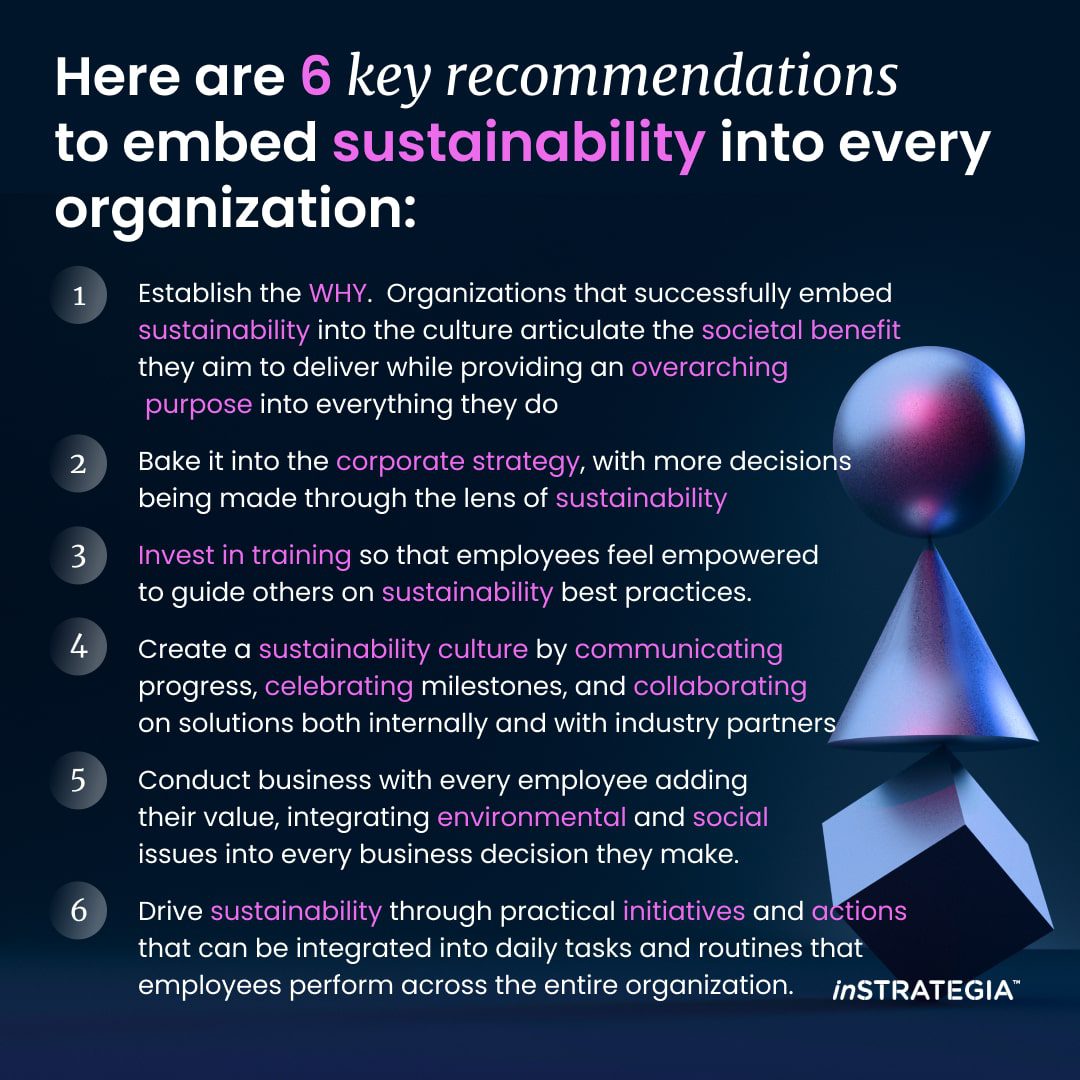

This reminder underscores the responsibility that comes with decision making. Sustainable progress happens when economic outcomes are aligned with broader societal impact, not detached from it.

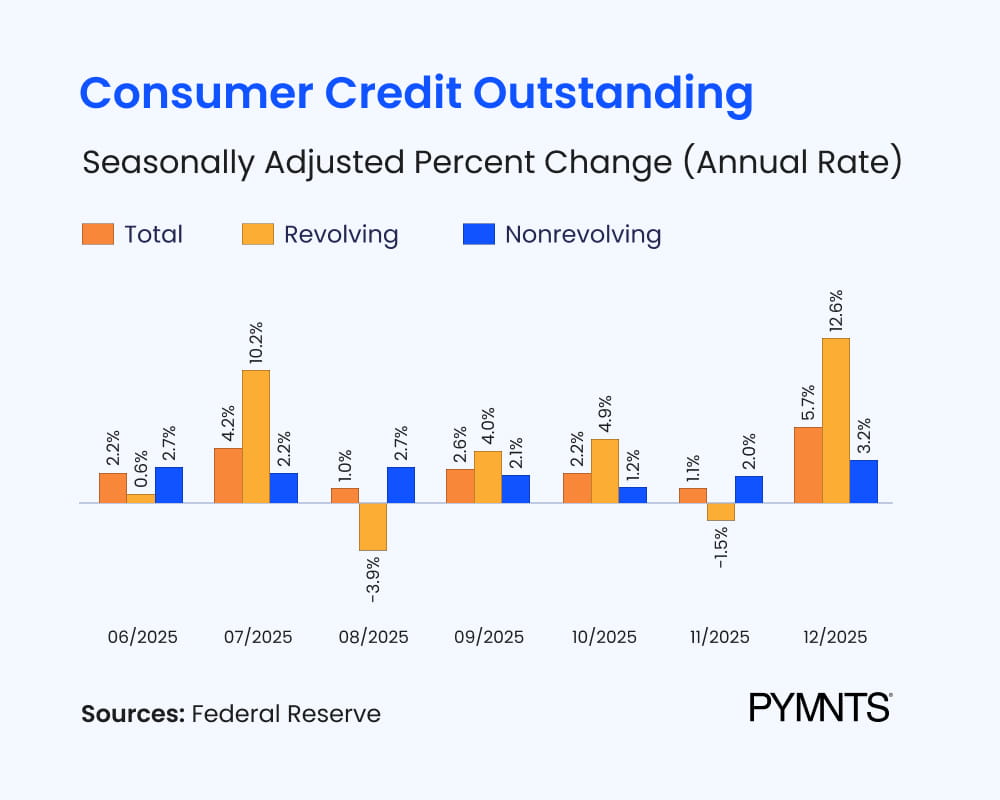

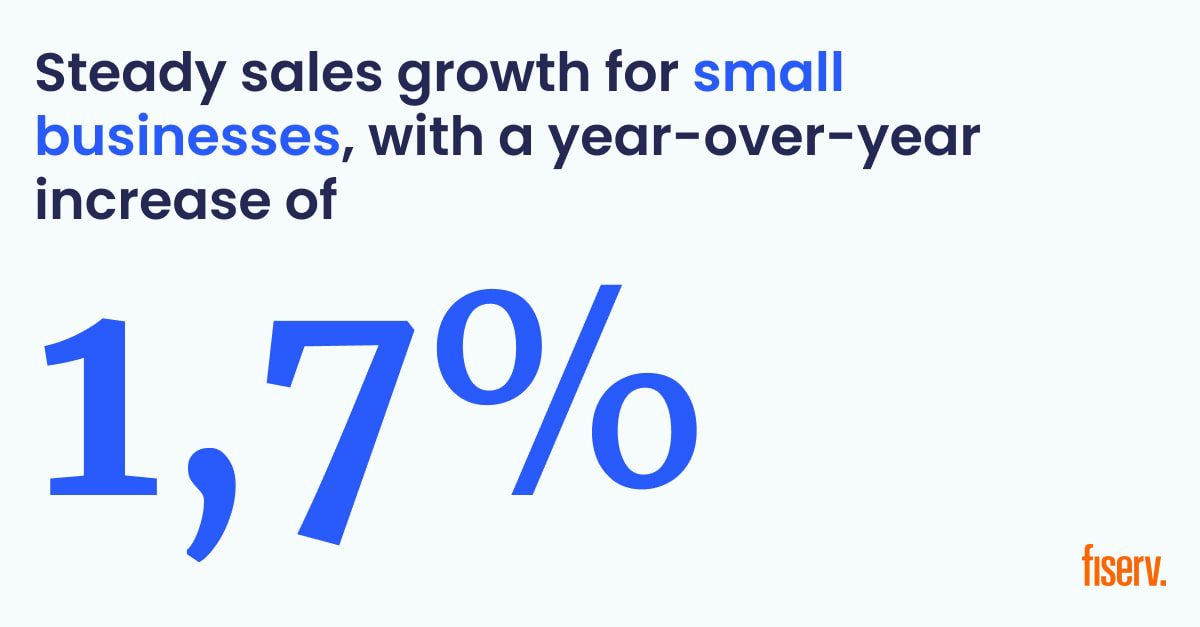

Card balances rose into year end, but spending did not spiral

According to the latest Fed G.19 data and PYMNTS Intelligence:

- Average monthly card balances rose by about $200 into December

- Households under financial strain saw larger increases, close to $600

- Visa, Mastercard, and American Express all reported continued volume growth

The takeaway is balance, not distress. Consumers are using revolving credit selectively as both a planning tool and a financial safety net, sustaining spending while navigating higher costs.

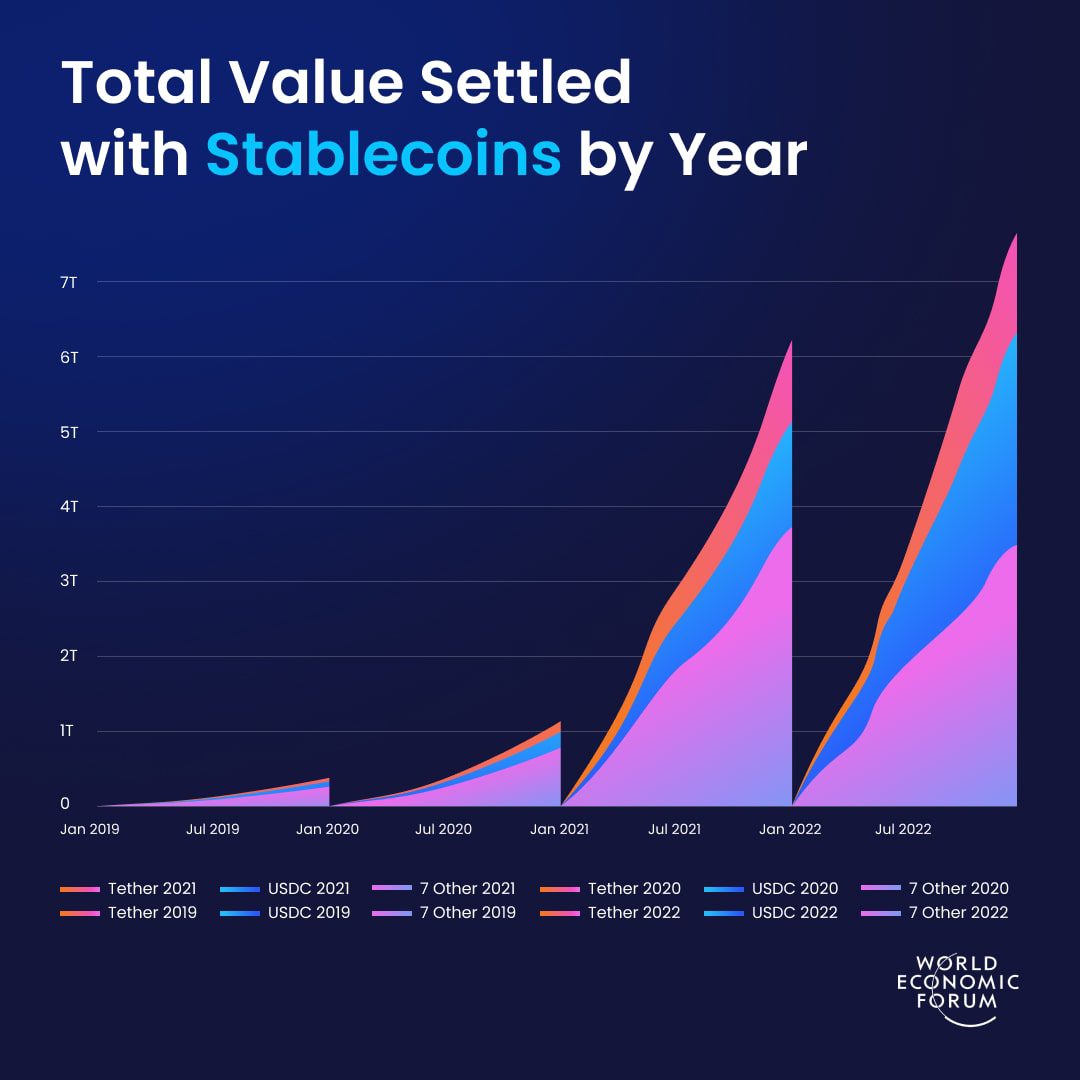

Stablecoins and the payments crossroads

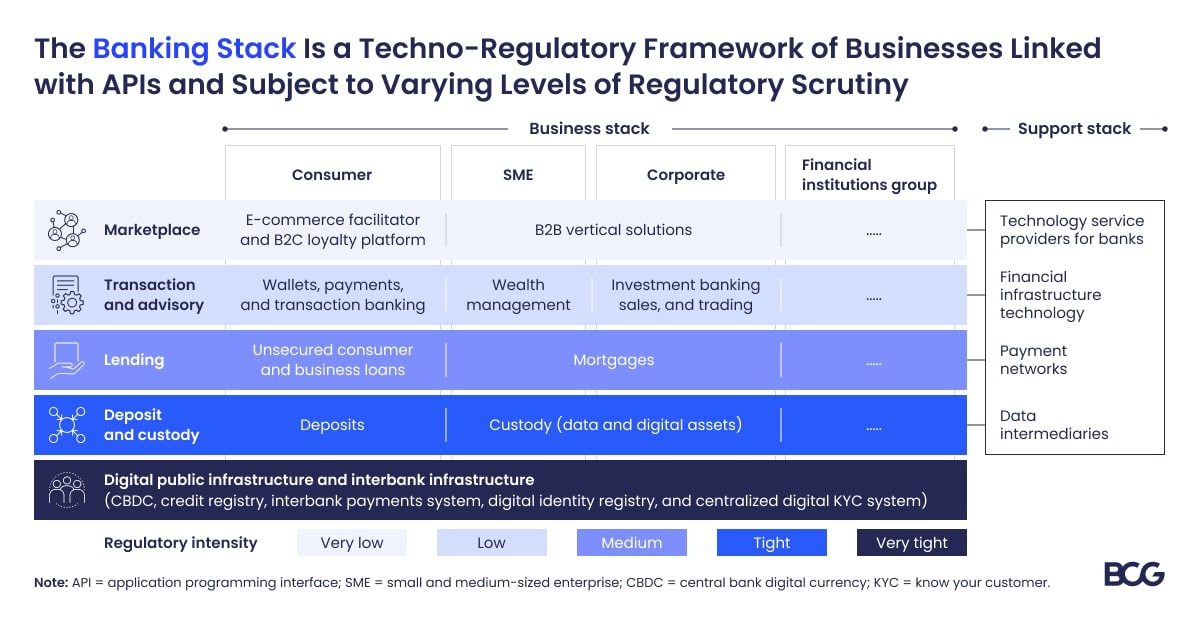

The debate around stablecoins increasingly feels less technical and more structural.

This piece frames stablecoins not as a breakthrough in payments mechanics, but as a response to political and regulatory friction in global money movement. Where payments fail today, the obstacle is often not technology, but control.

That tension is forcing adoption and pushing the industry toward a crossroads between traditional rails and emerging alternatives.

Source: https://www.thisweekinfintech.com/the-battle-for-your-deposits/

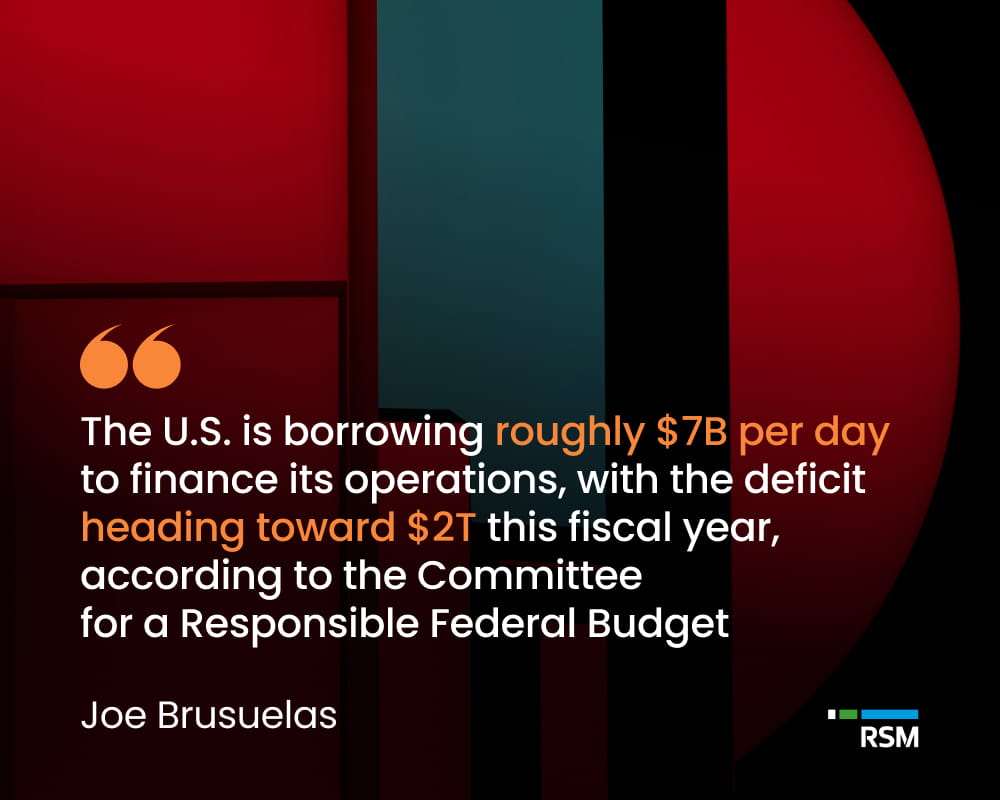

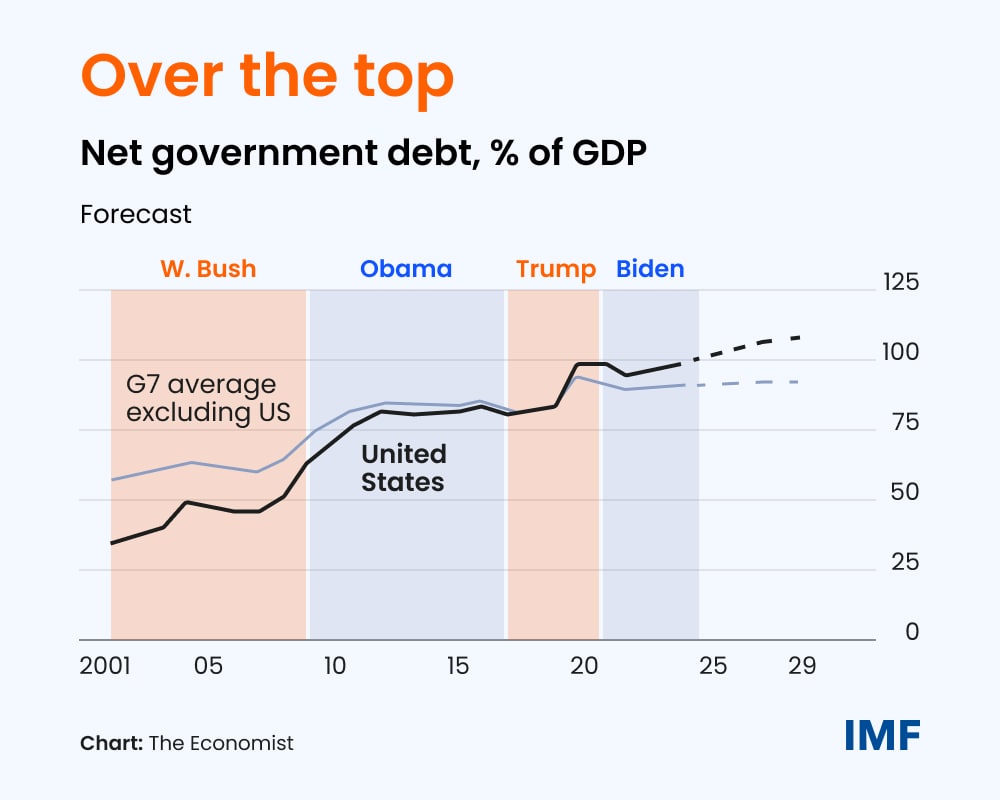

The rising cost of U.S. borrowing

The U.S. government is borrowing more, and paying more to do so.

Federal interest costs have already overtaken several major budget categories and are on track to rival defense spending as rates remain elevated and debt levels continue to climb.

With structural deficits driven by demographics, entitlement spending, and higher refinancing costs, debt sustainability is moving from a long-term concern to a near-term fiscal challenge.

Source: https://rsmus.com/insights/economics/growth-of-government-debt-and-consequences.html

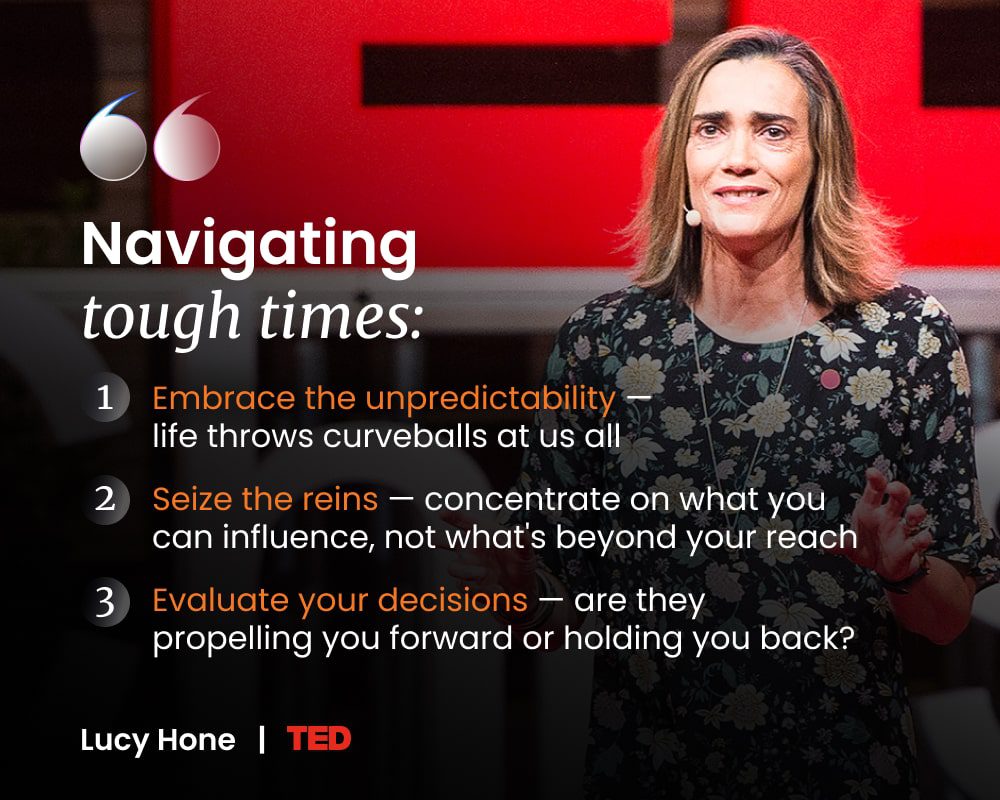

Feel good Sunday: What resilience really looks like

This TED Talk explores how loss can strip away assumptions and reveal what truly sustains us. Jane Marie Chen story is not about overcoming overnight, but about learning to move forward with intention and compassion.

A calm and grounding watch to close the week.

Source: https://www.ted.com/talks/jane_marie_chen_what_losing_everything_taught_me_about_resilience

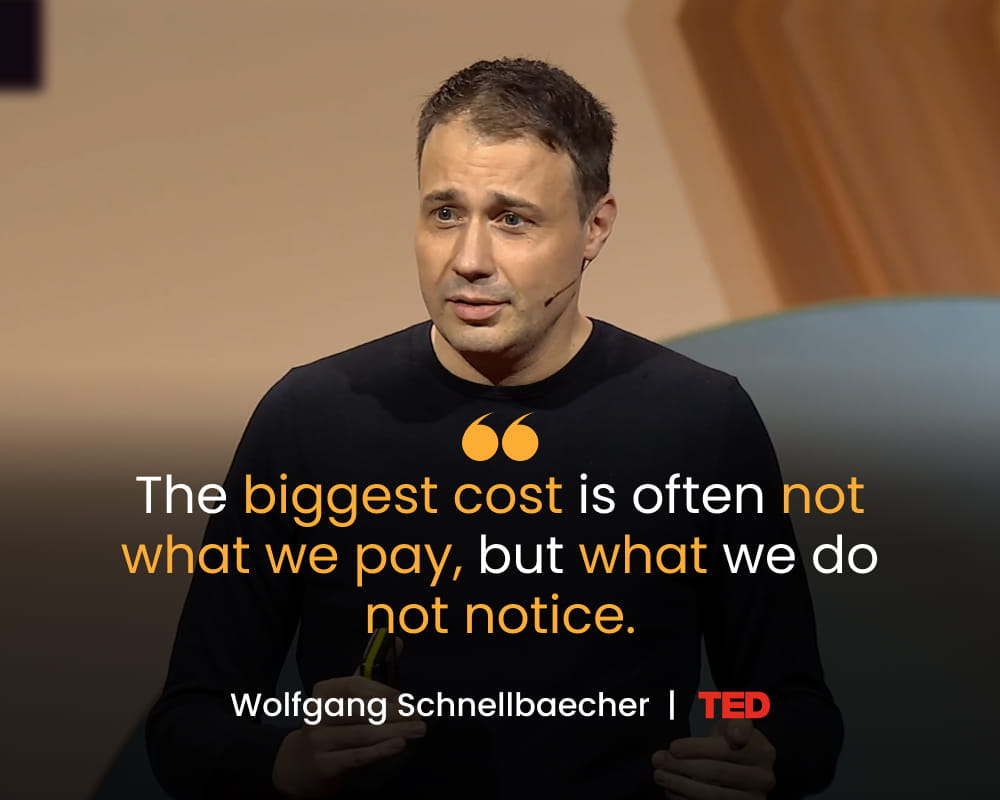

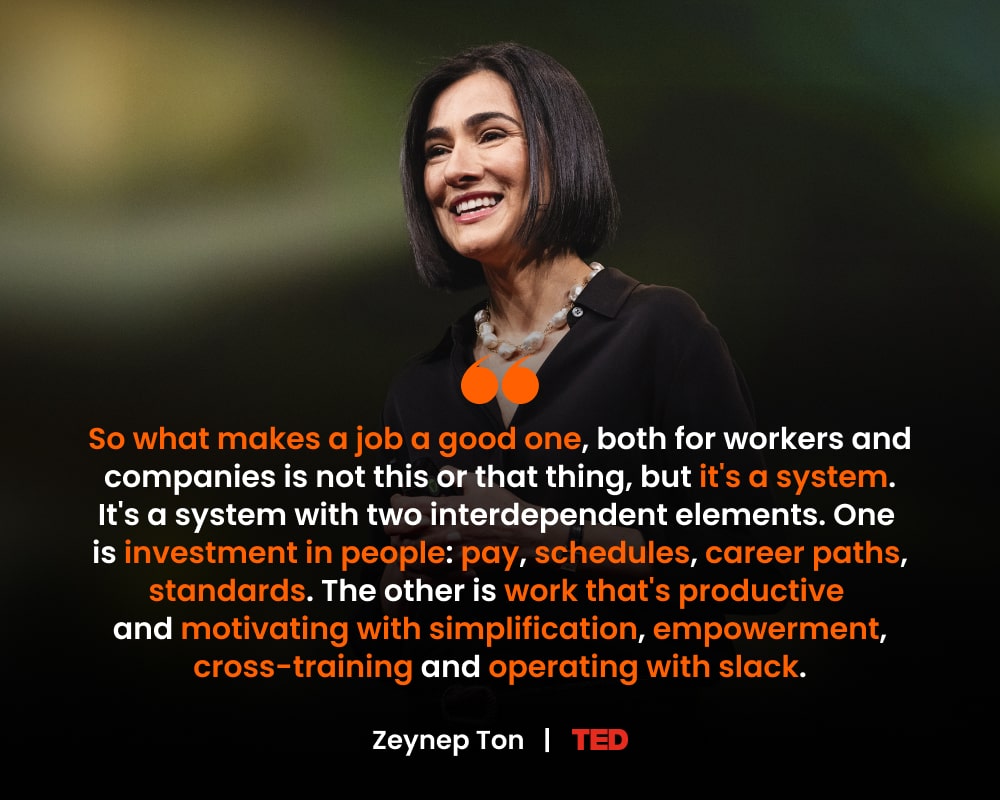

Curious Saturday – The psychology behind every purchase

Most of our financial decisions feel rational in the moment. Very few of them actually are. In this TED Talk, Wolfgang Schnellbaecher explores how habits, emotions, and mental shortcuts quietly shape how we spend. The real insight is not about budgeting better, but about understanding ourselves better.

Source: https://www.ted.com/talks/wolfgang_schnellbaecher_are_you_spending_your_money_wisely

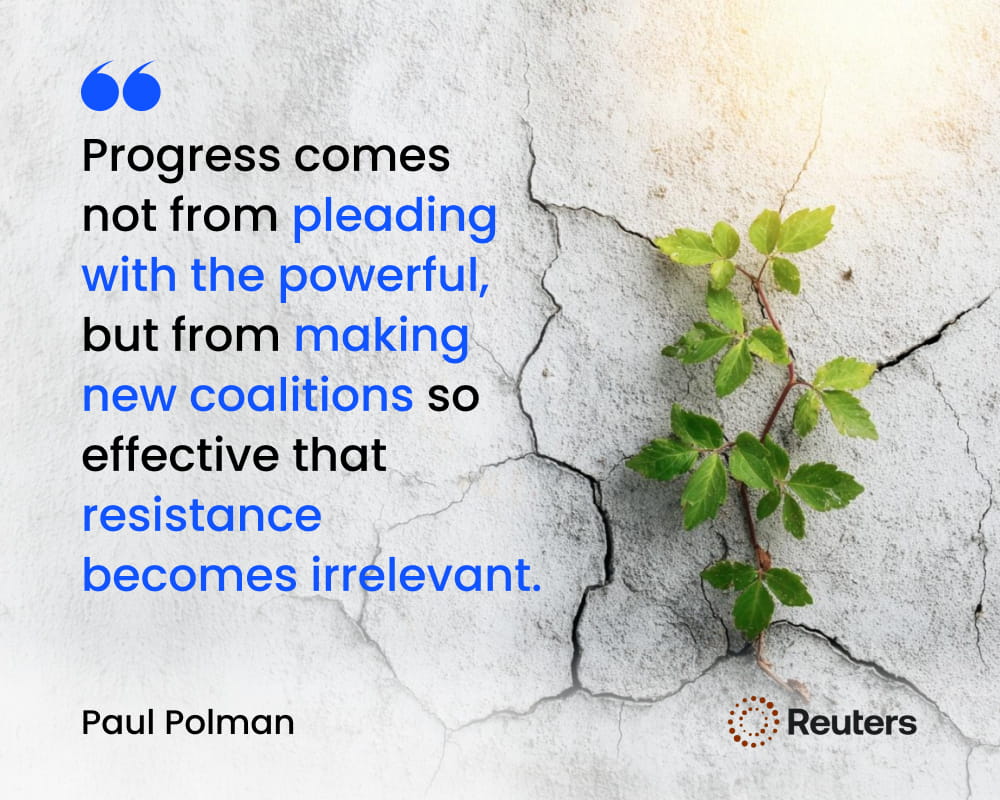

What Davos 2026 tells us about the state of the world

Davos 2026 did not fail because of a lack of ideas, data, or capital. It failed because collaboration fractured.

As Paul Polman writes, the World Economic Forum became a mirror of a world struggling to act collectively, even when the path forward is clear. Climate action stalls, multilateral agreements weaken, and shared goals drift, not from ignorance, but from misalignment.

The most hopeful signal did not come from the main stage, but from the margins, where coalitions quietly formed around nature restoration, regenerative agriculture, and long-term resilience.

Progress rarely starts at the top. It accelerates when those in the middle choose to move together.

Progress starts with change

Progress rarely fails because of a lack of ideas. It fails because we hold on to old assumptions for too long. Change begins with mindset. And real progress follows soon after.

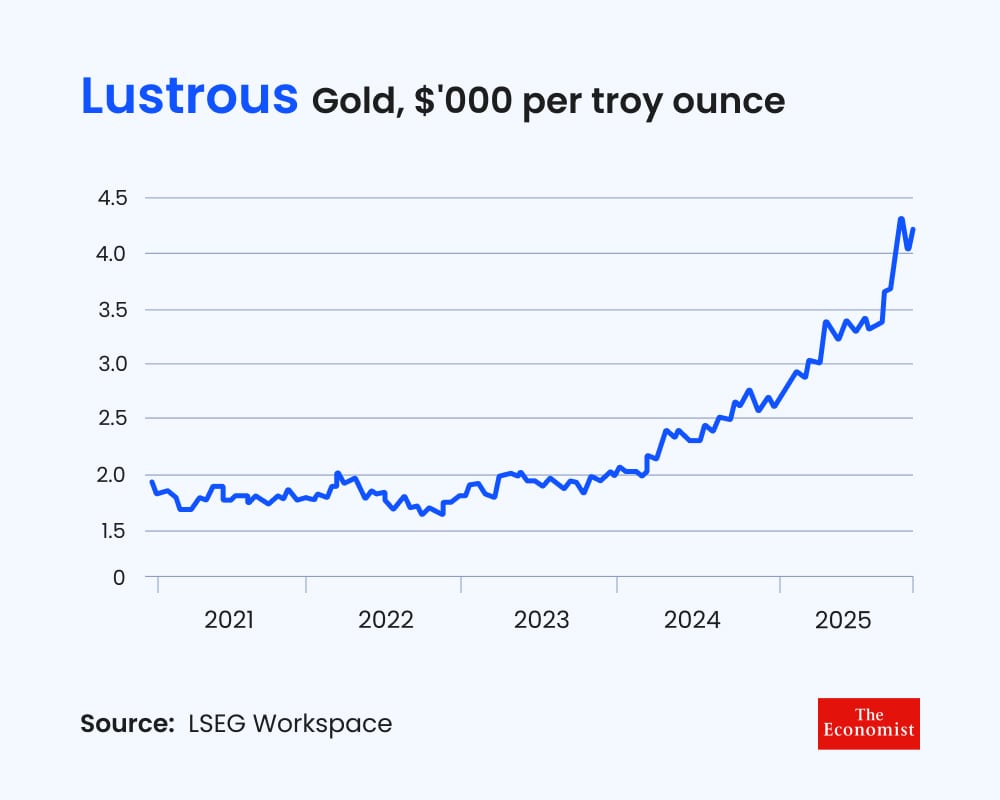

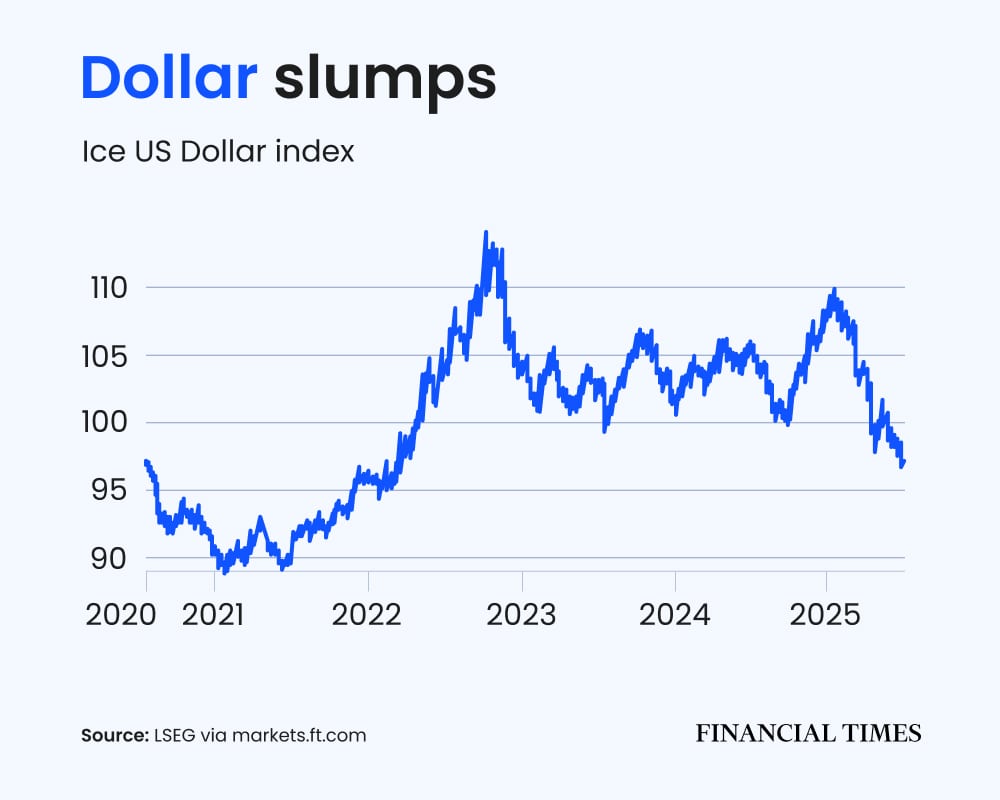

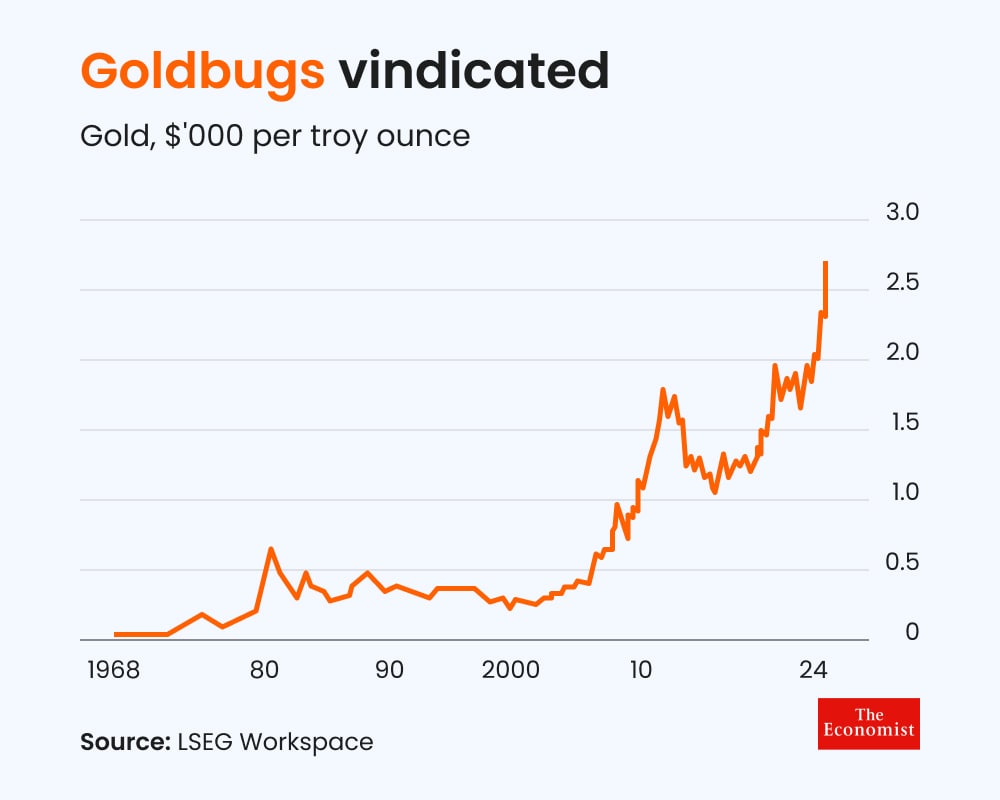

Gold’s rally is no longer just about fear

Gold has surpassed $5,000 per ounce, rising over 17% this year. This rally is notable for its consistency; gold gains even as markets fluctuate. Central banks initiated it, but now ETF inflows show wider investor interest for diversification and returns. Gold is shifting from an emergency asset to a strategic portfolio component.

Source: https://www.economist.com/finance-and-economics/2026/01/27/what-is-driving-golds-relentless-rally

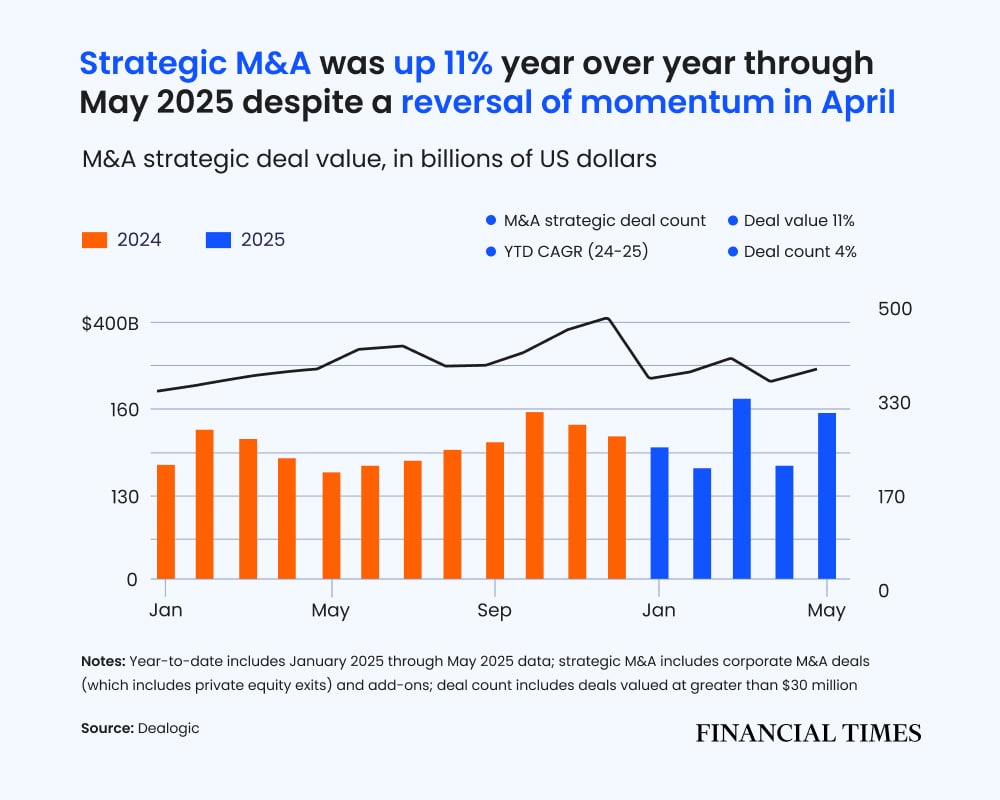

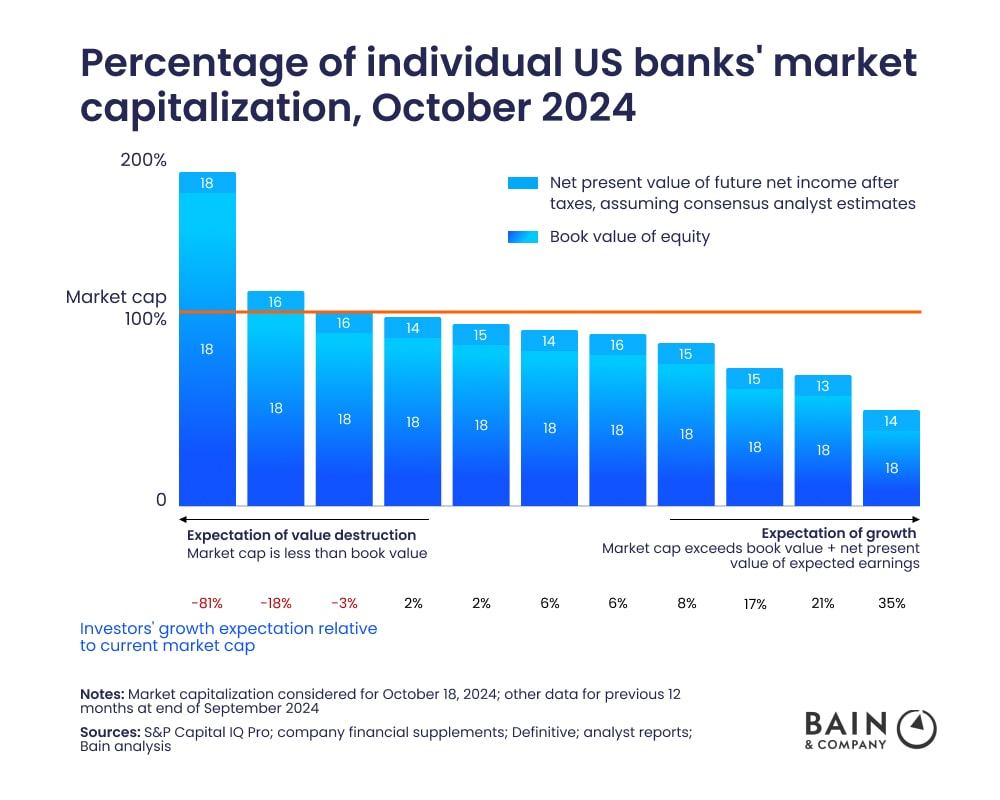

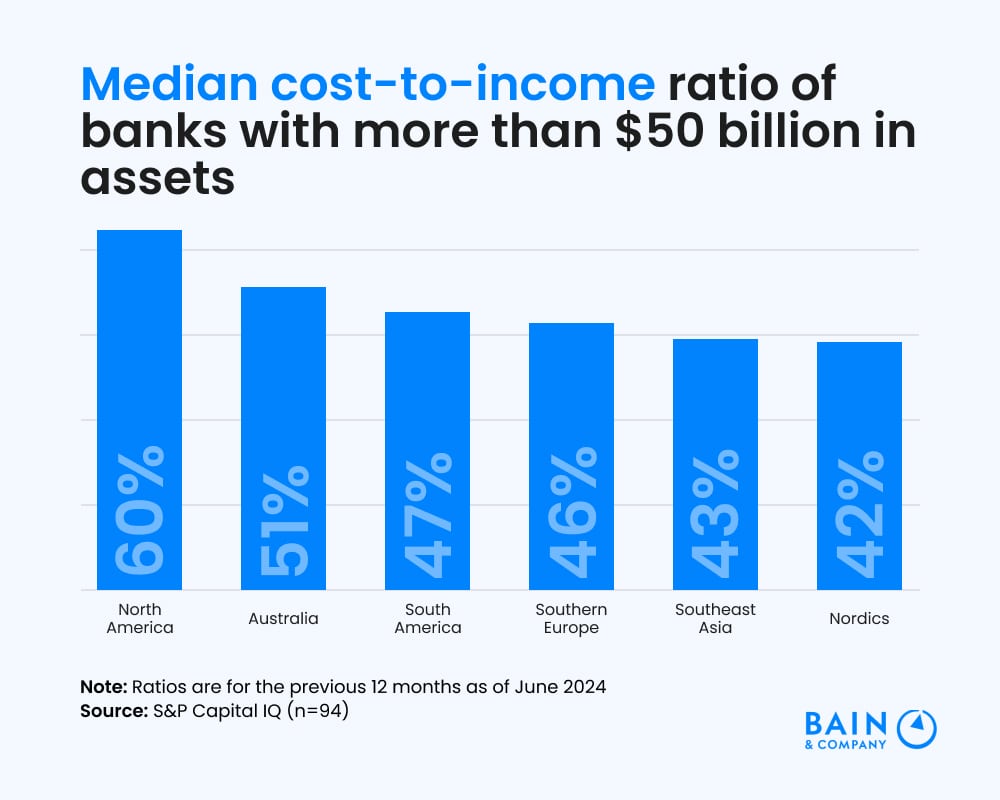

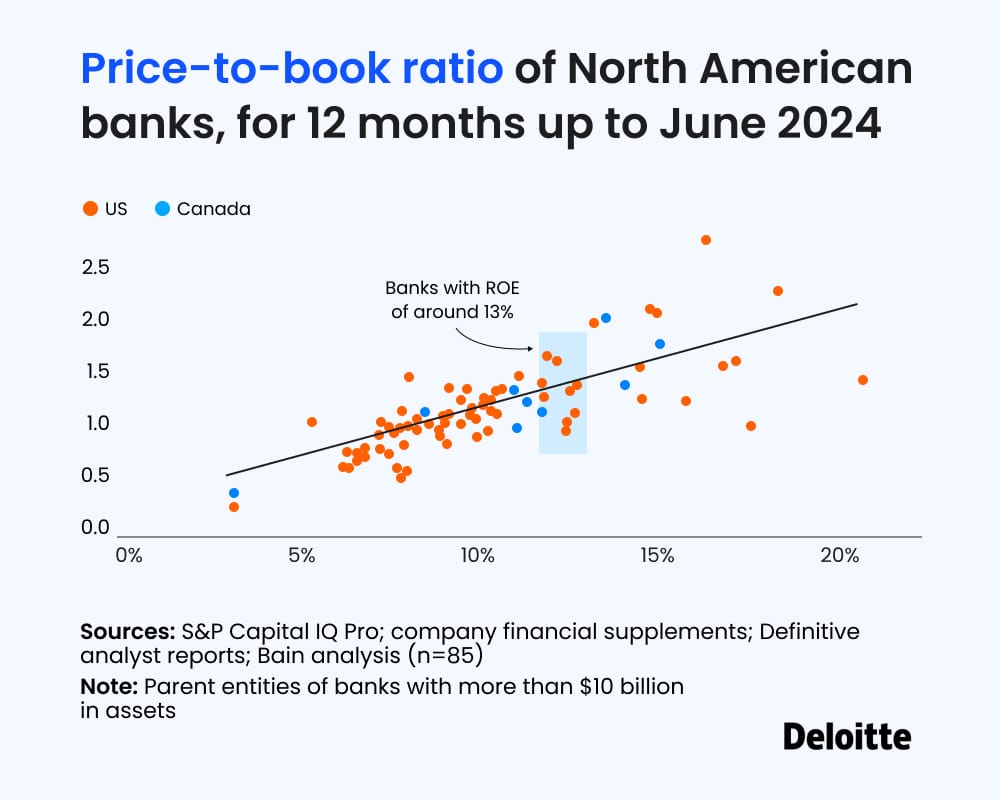

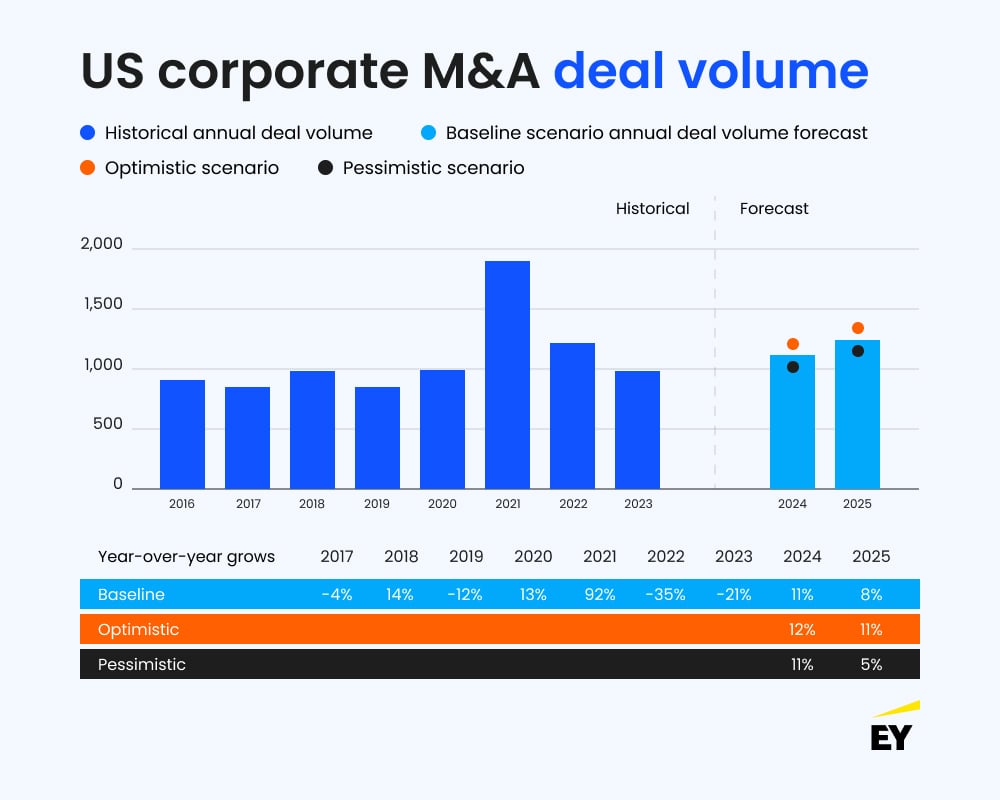

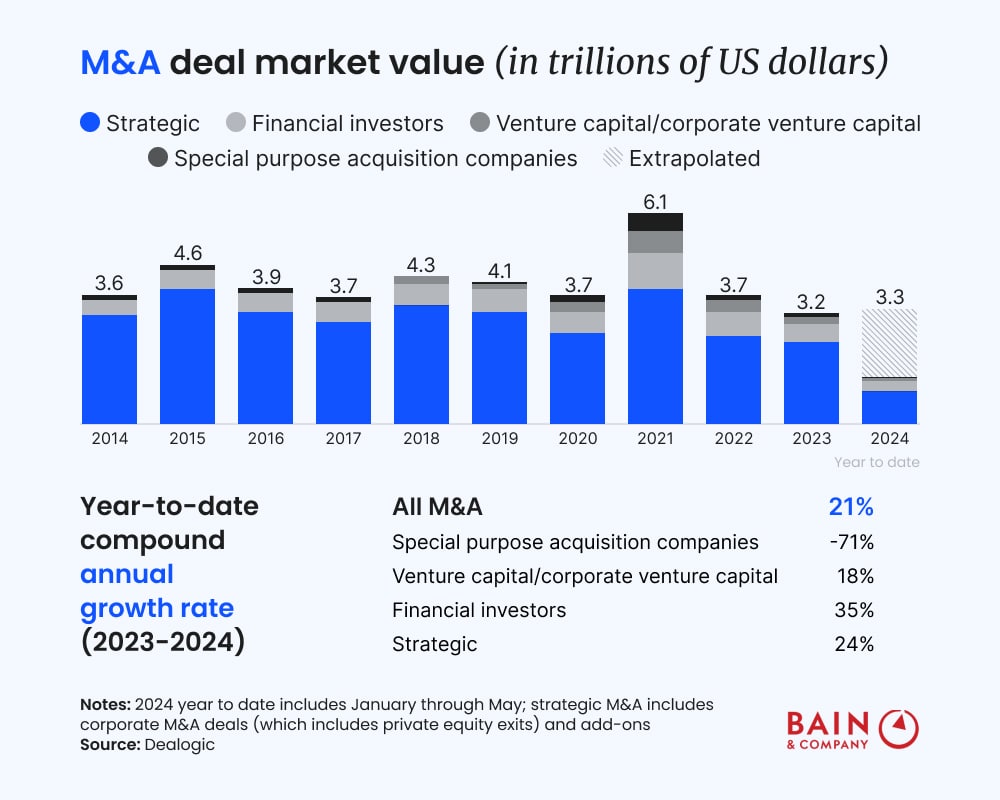

A new phase for bank M&A: Fewer deals, higher conviction

Banking M&A is showing signs of life again, but the playbook has changed. Bain’s 2026 Banking M&A Report highlights a shift away from scale-for-scale’s-sake toward deals that clearly strengthen core capabilities. Capital discipline, regulatory scrutiny, and execution risk are forcing banks to be far more selective. In this environment, success is less about doing more deals and more about doing the right ones, with a clear path to value creation from day one.

Source: https://www.bain.com/insights/banking-m-and-a-report-2026/

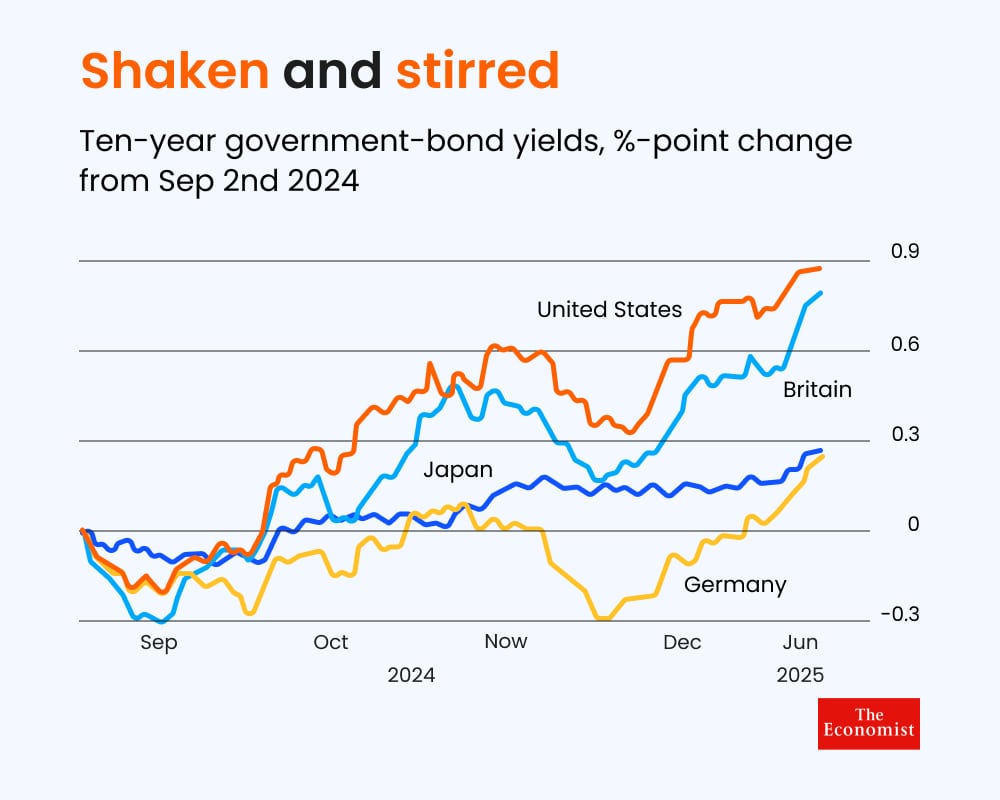

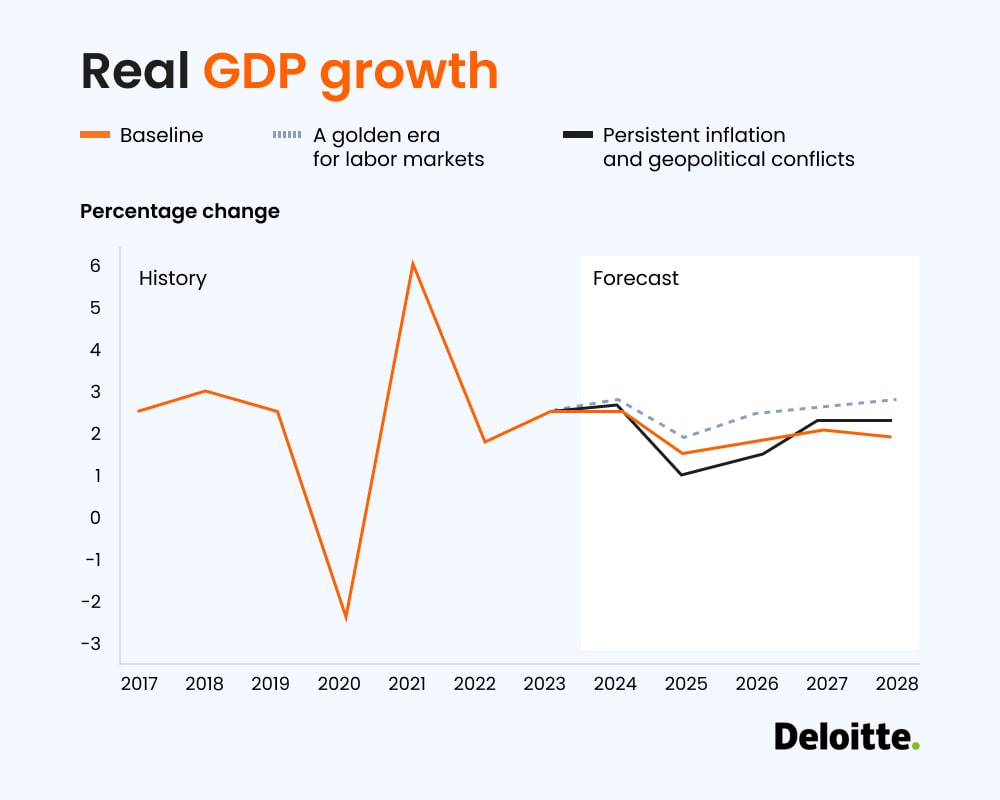

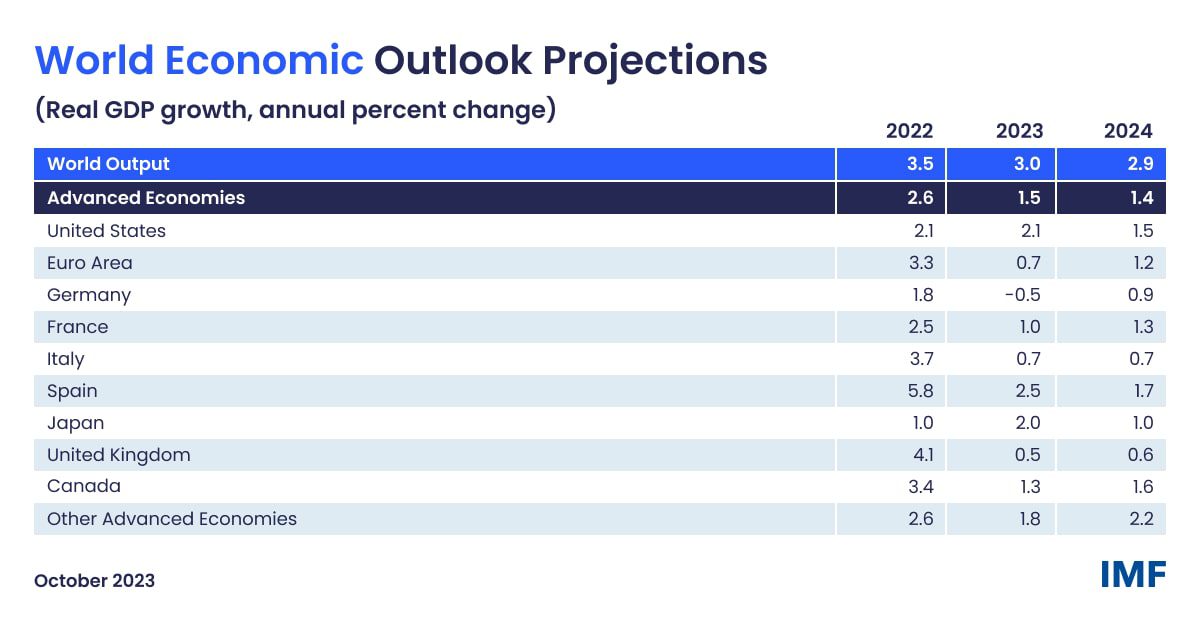

Global growth powered by deficits

Global growth is no longer being led by households or the private sector. It is being written into government budgets.

Across the U.S., Europe, Japan, and China, large fiscal stimulus packages are driving near-term growth, even as debt levels climb and interest rates remain elevated. Defense spending, aging populations, AI investment, and geopolitical uncertainty are reshaping what governments are willing to finance, and what voters are willing to tolerate.

The open question is not whether this works in the short term. It is how long markets remain comfortable underwriting it.

Source: https://www.wsj.com/economy/global/the-world-economy-is-hooked-on-government-debt-71491482

Feel good Sunday: A thought experiment on love, choice, and humanity

As technology advances, we are increasingly able to shape how we feel. Meghan Sullivan asks a powerful question: if love could be guaranteed, would it still matter? A timely reflection on choice, morality, and what it truly means to care for one another.

Source: https://www.ted.com/talks/meghan_sullivan_would_you_take_a_pill_that_made_you_love_everyone

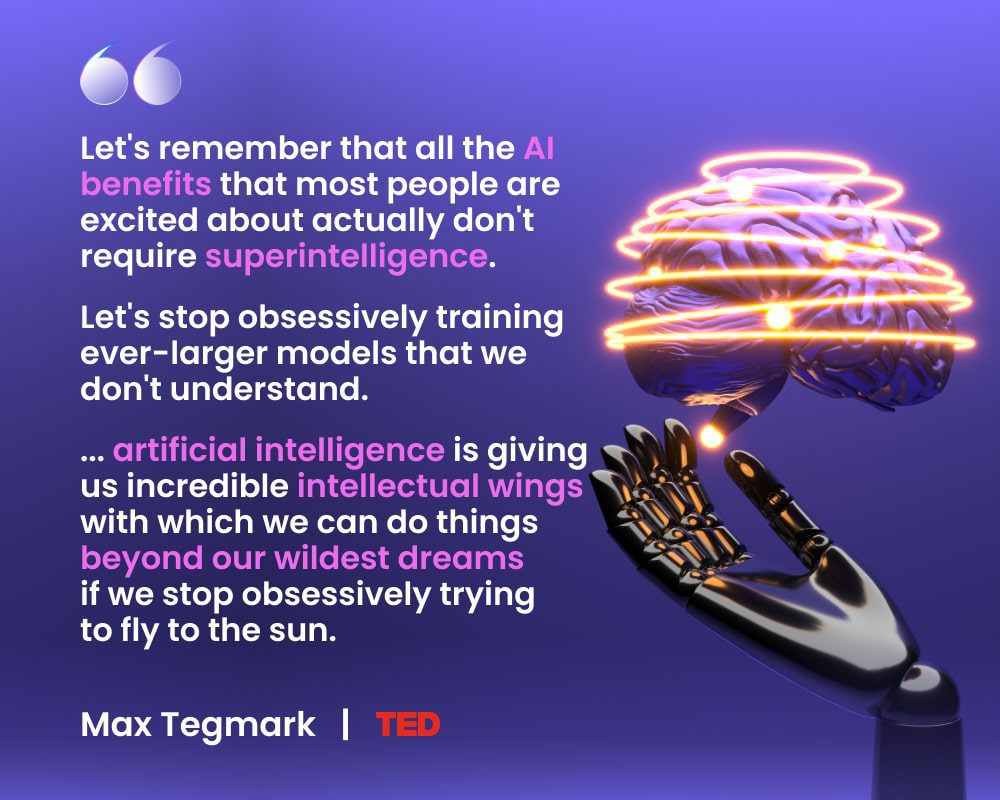

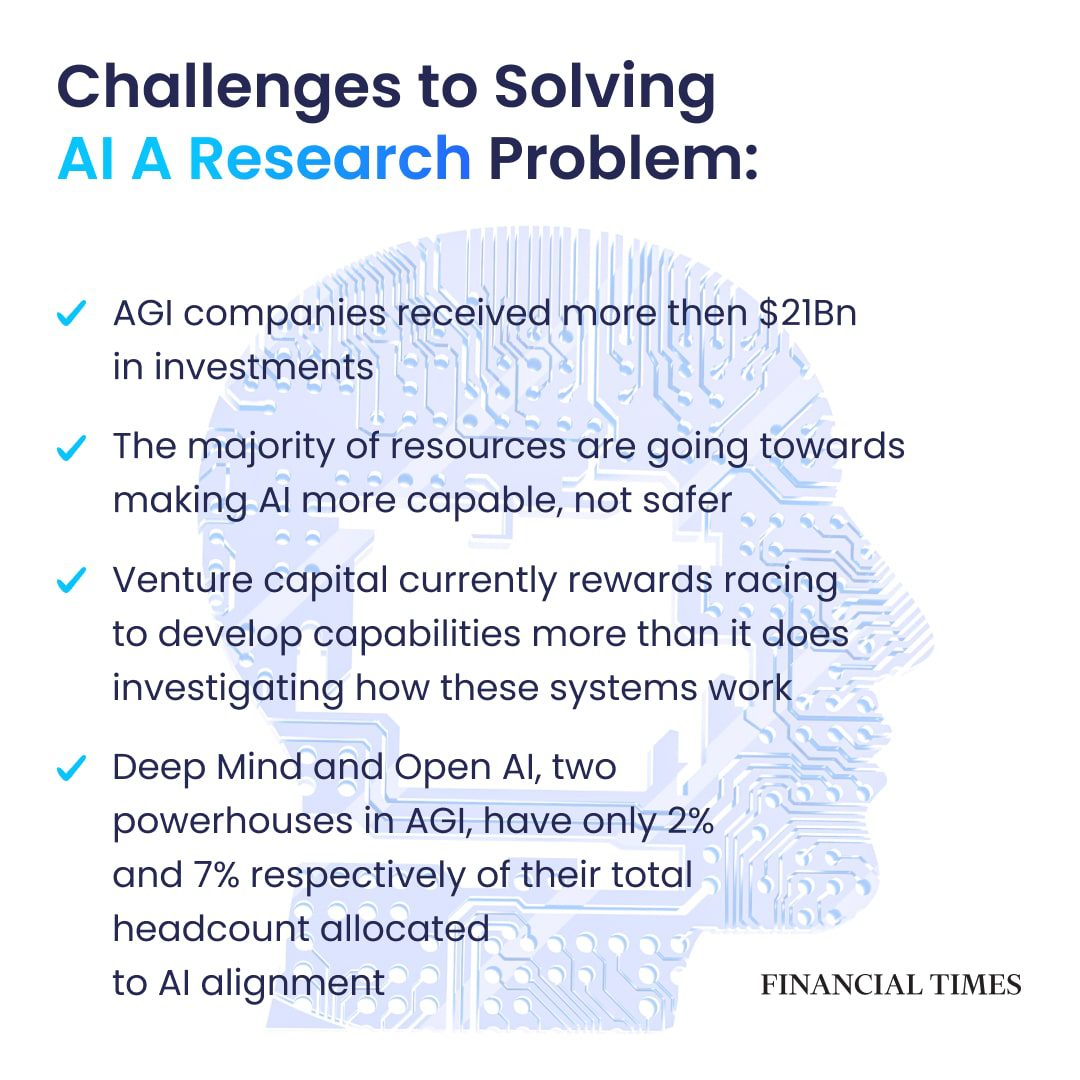

Curious Saturday: The future of AI depends on what we decide today

AI does not have a single, predetermined path. This TED Talk explores three possible futures for artificial intelligence, each shaped by human values, incentives, and choices. The technology may be advancing quickly, but the direction it takes is still very much up to us. A useful reminder that governance, ethics, and intention matter as much as innovation.

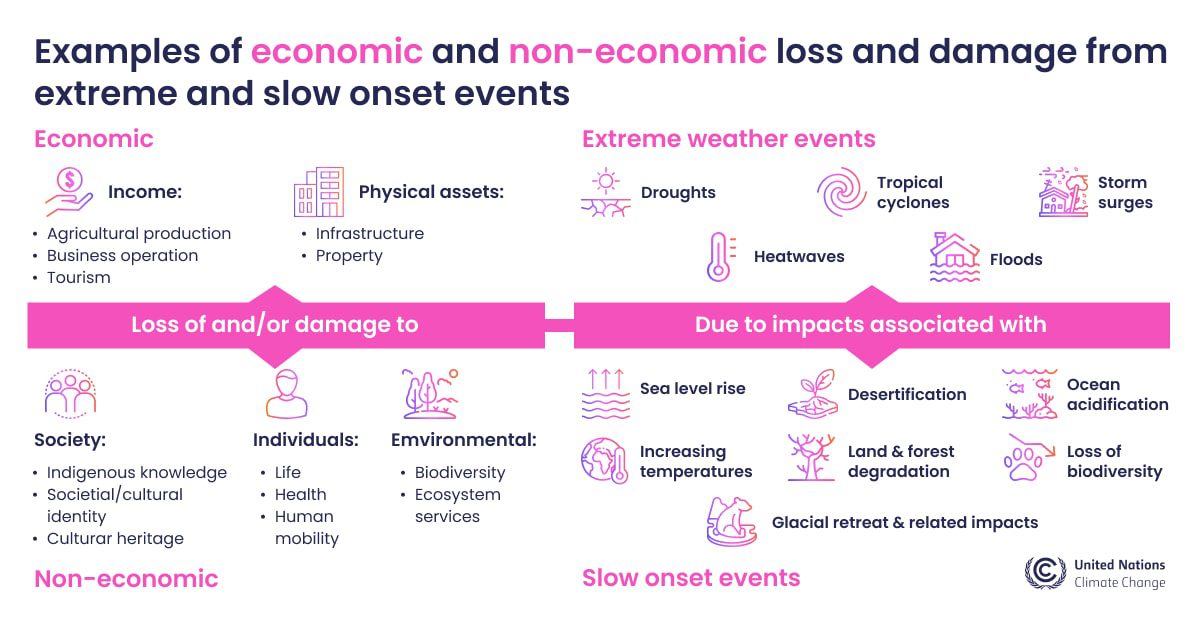

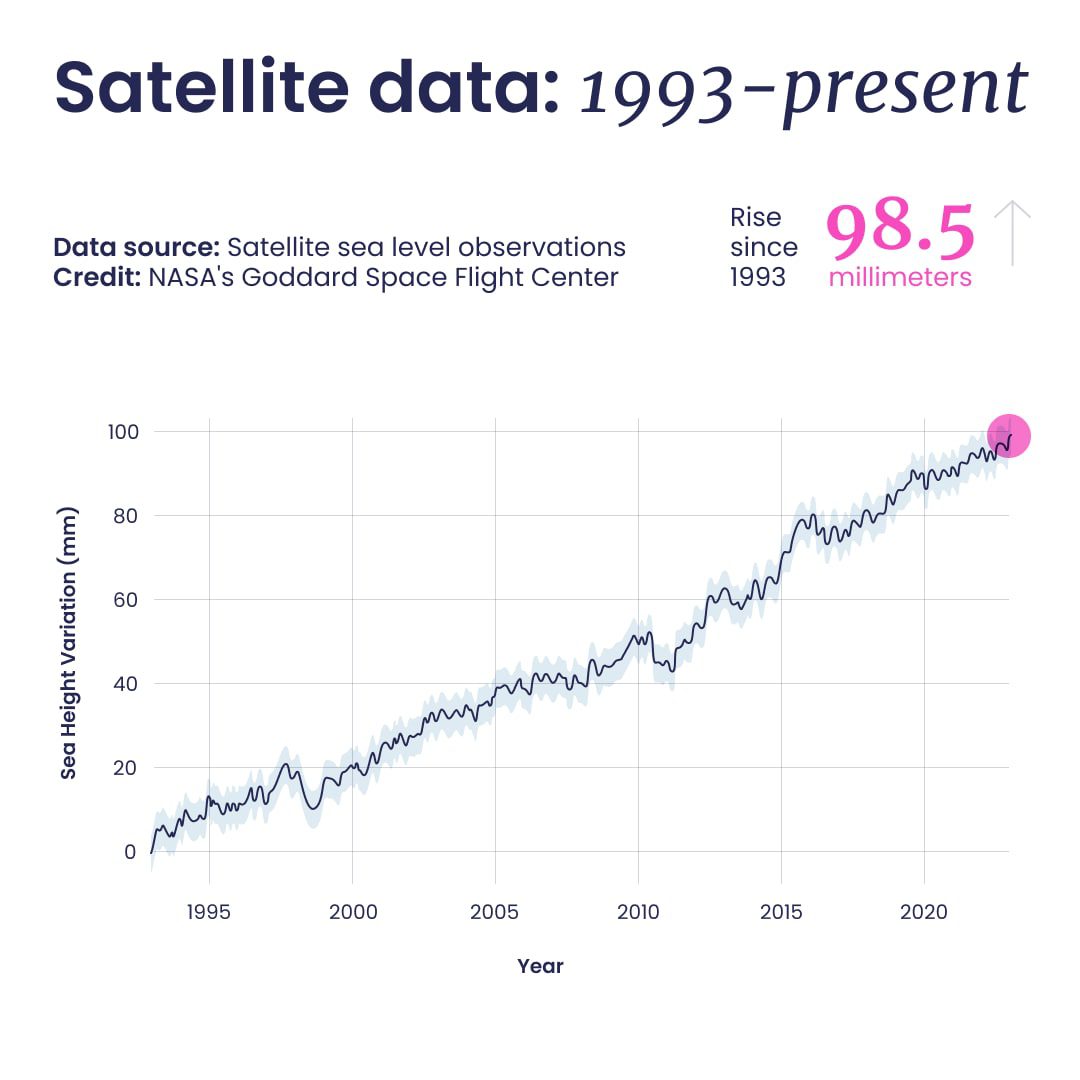

Why global warming is accelerating

2025 was expected to ease global temperatures, but it became the third hottest year on record. Despite La Niña replacing El Niño, temperatures remain high.

Rising greenhouse gas emissions and diminished mitigating factors signal that global warming is accelerating.

The focus now shifts from slowing warming to managing risks of overshoot —decisions made this decade will impact future generations.

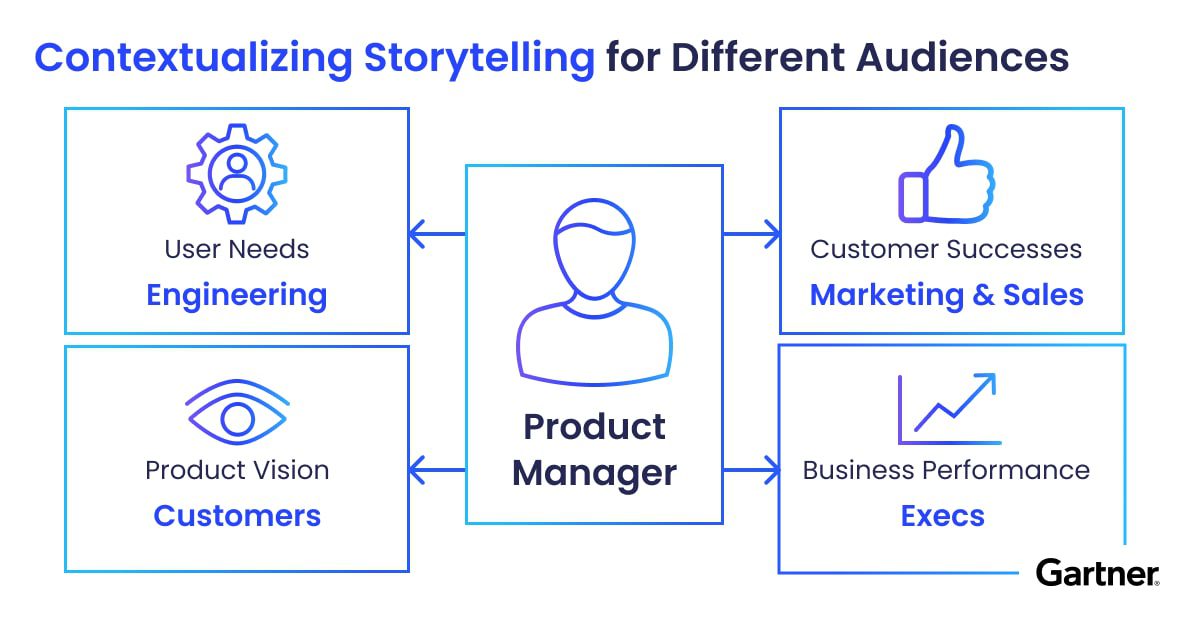

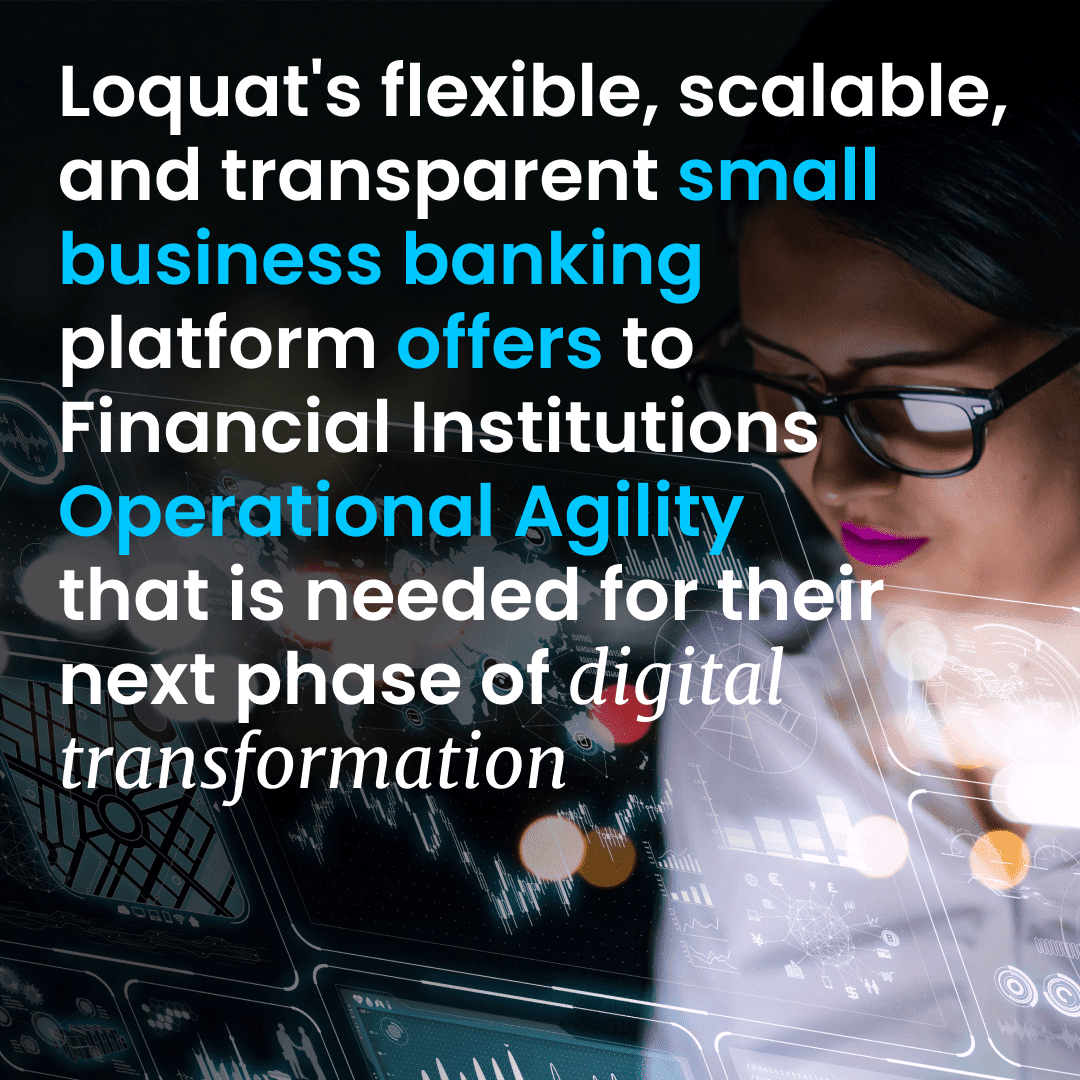

Where efficiency meets exceptional user experience

At Loquat, we build products that help financial institutions move faster, operate smarter, and serve customers better. From Account Opening to CALM and Loquat IQ, our solutions are designed to deliver measurable efficiency and effectiveness through a seamless user experience.

Ellina Astakhova leads our product vision with a strong belief that thoughtful design is a strategic advantage, helping FIs unlock value faster and with greater confidence.

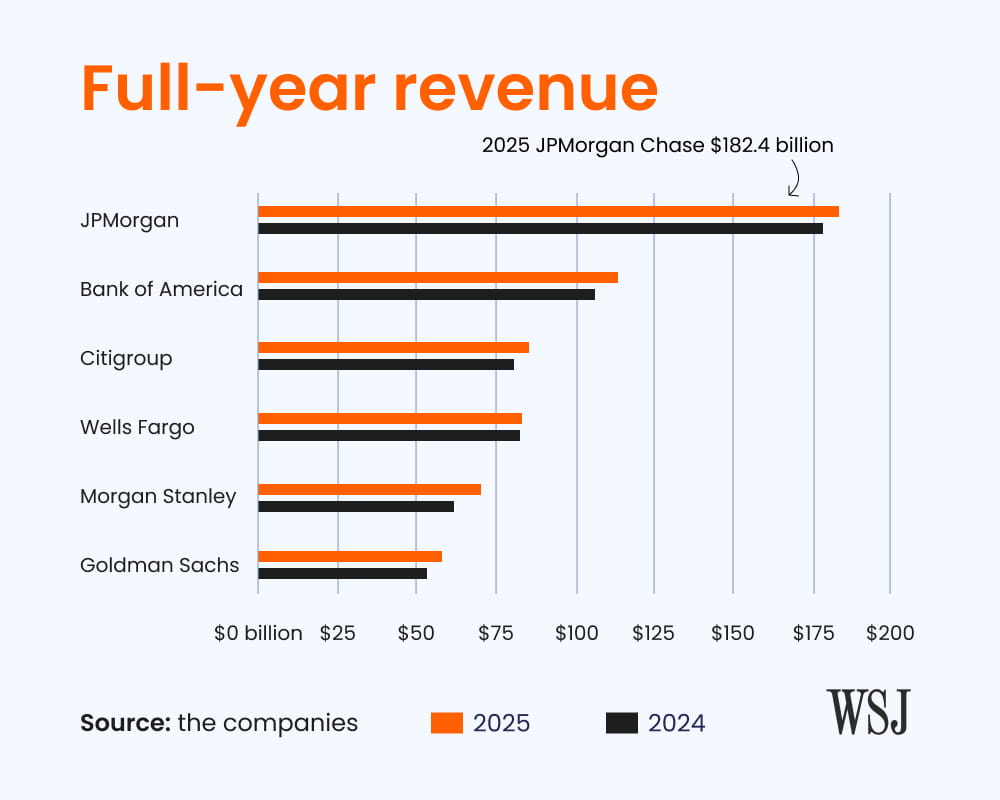

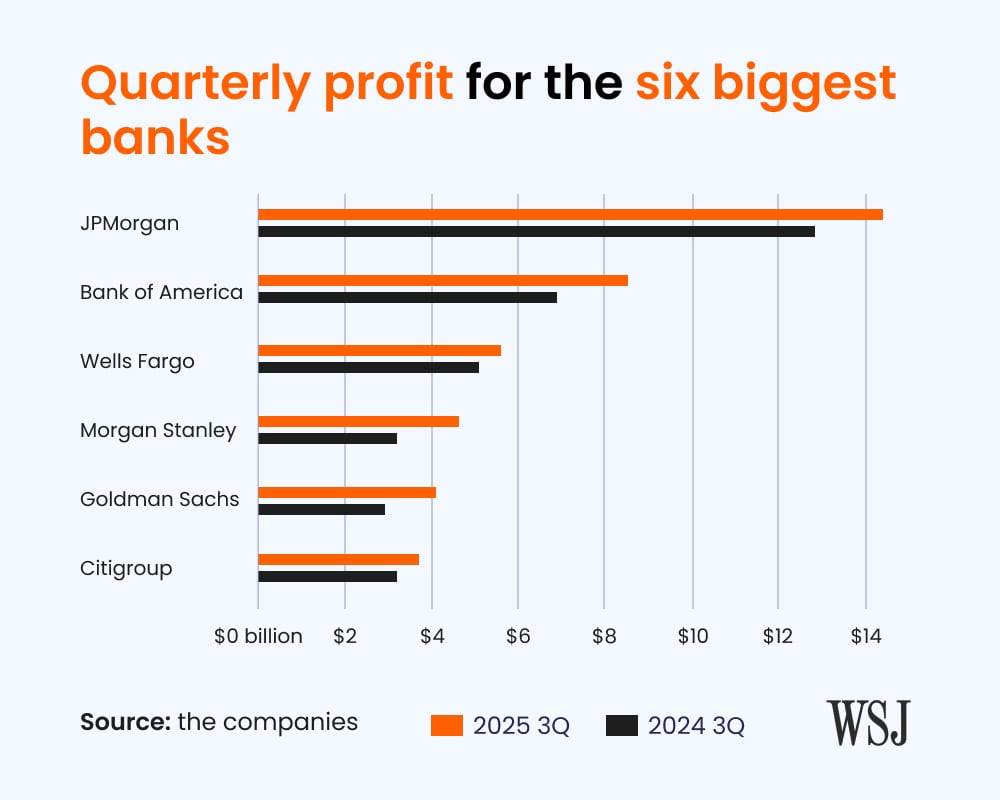

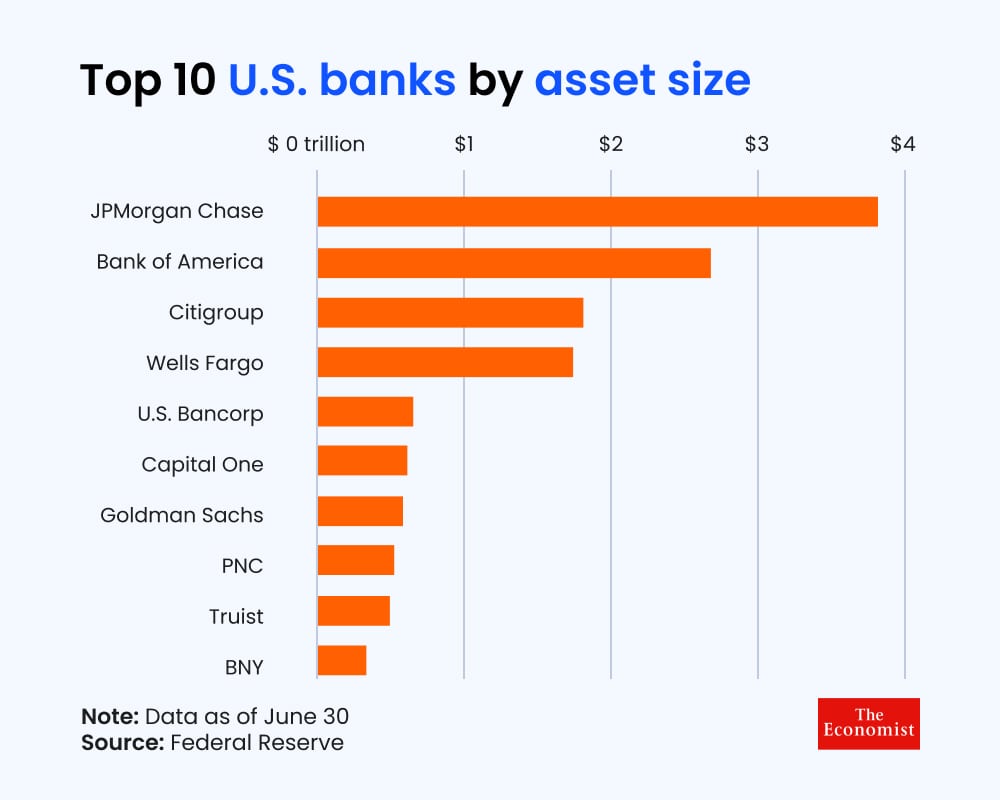

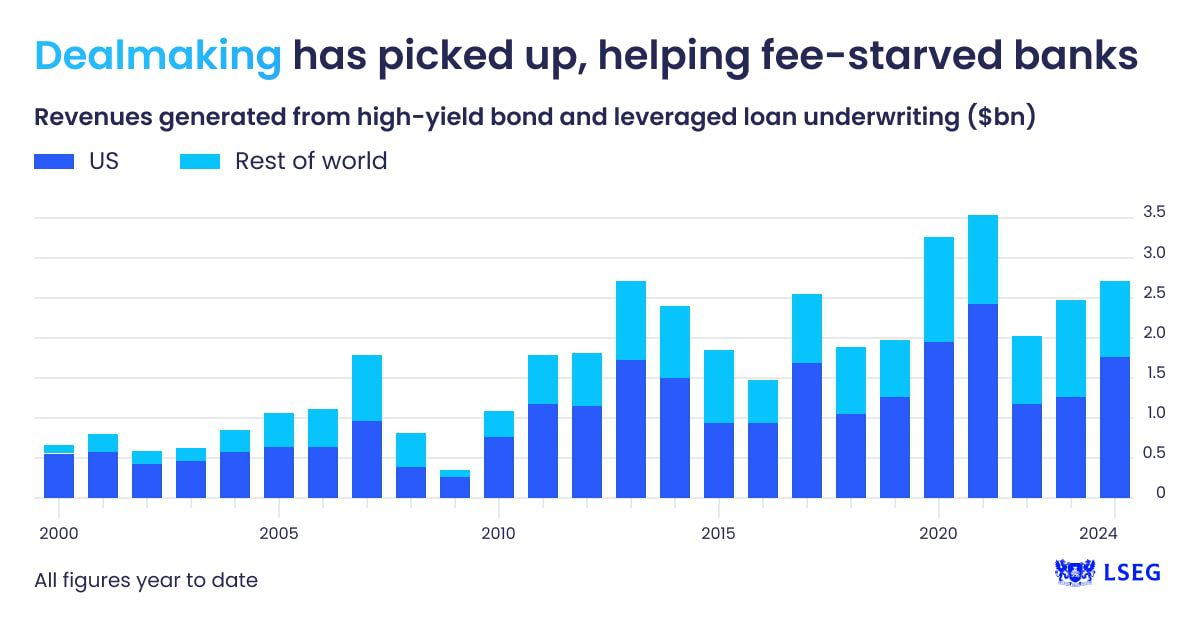

Big banks close 2025 at record highs

According to the WSJ, the biggest U.S. banks generated nearly $600 billion in revenue in 2025, driven by surging trading volumes, a rebound in #mergers, and rising demand for financing. The results highlight how scale, diversified business lines, and active markets continue to favor large FIs.

Source: https://www.wsj.com/finance/banking/wall-street-powers-nations-biggest-banks-to-record-year-4aa861a4

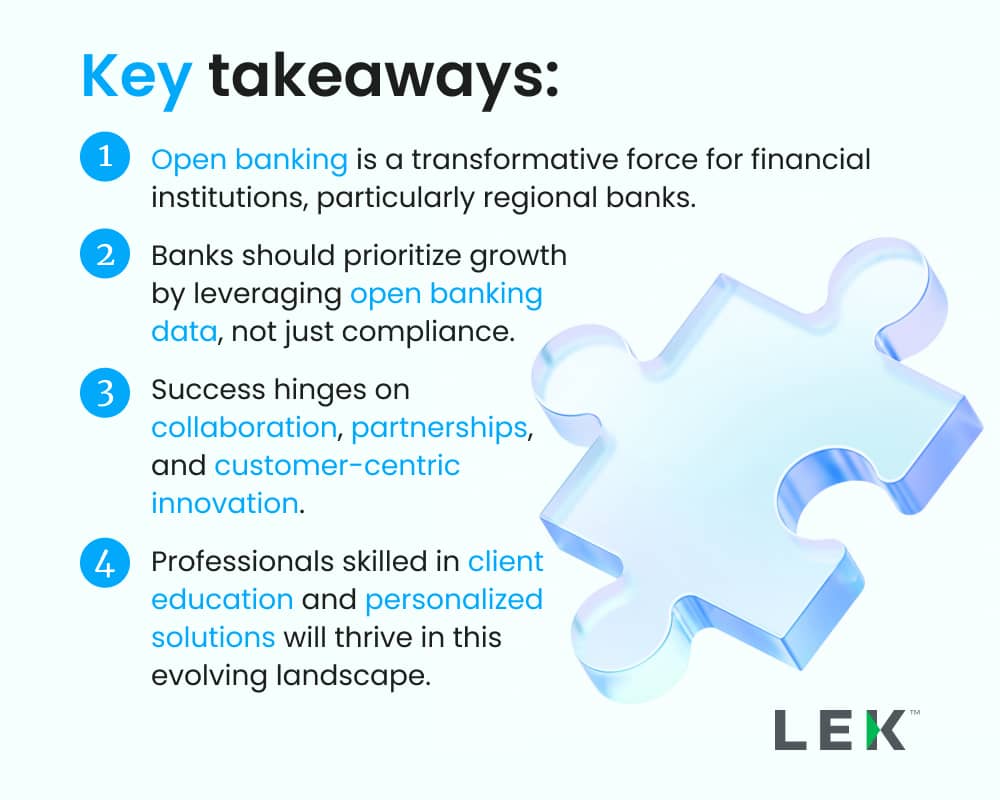

Stablecoins and the next leap in cross border payments

Cross border payments remain costly, slow, and opaque for many FIs and their clients. Bain highlights how stablecoins could materially improve settlement speed, reduce fees, and increase transparency across global payment rails. For banks and payment providers, the question is no longer if this matters, but how quickly capabilities must evolve to stay competitive.

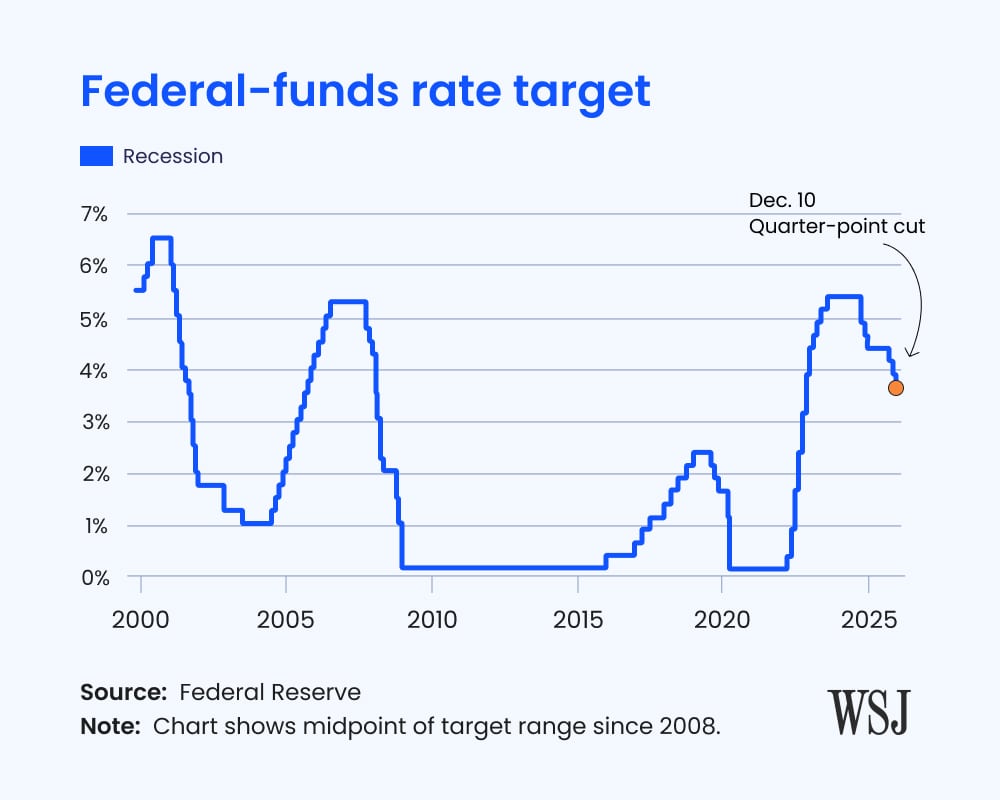

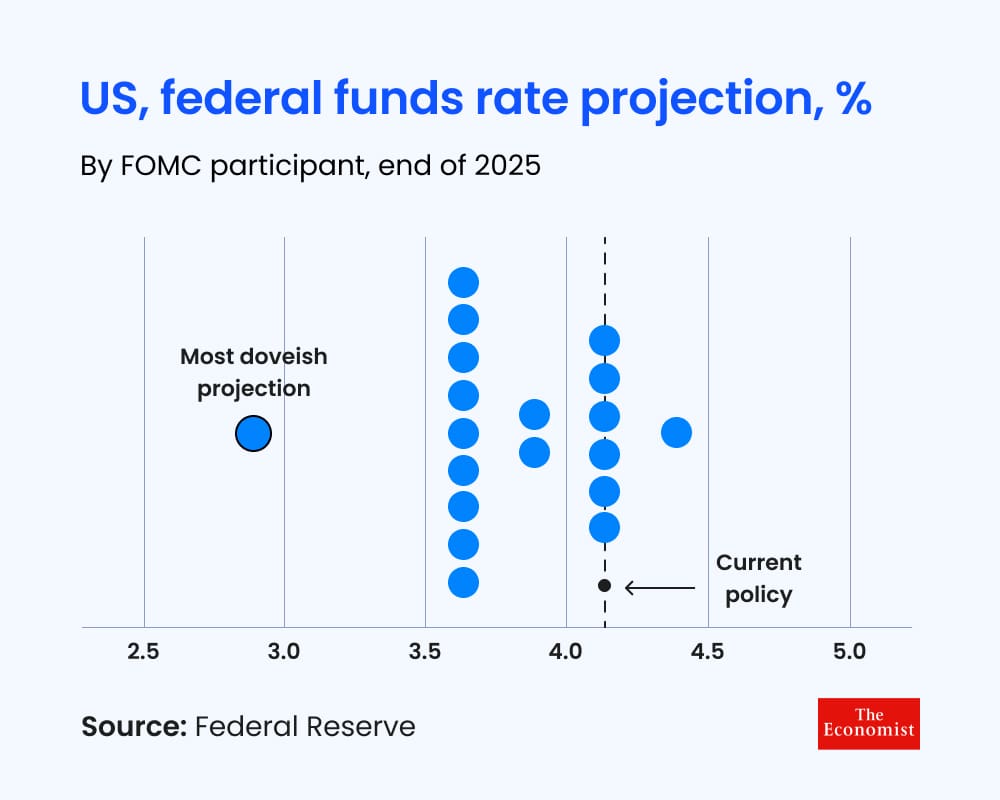

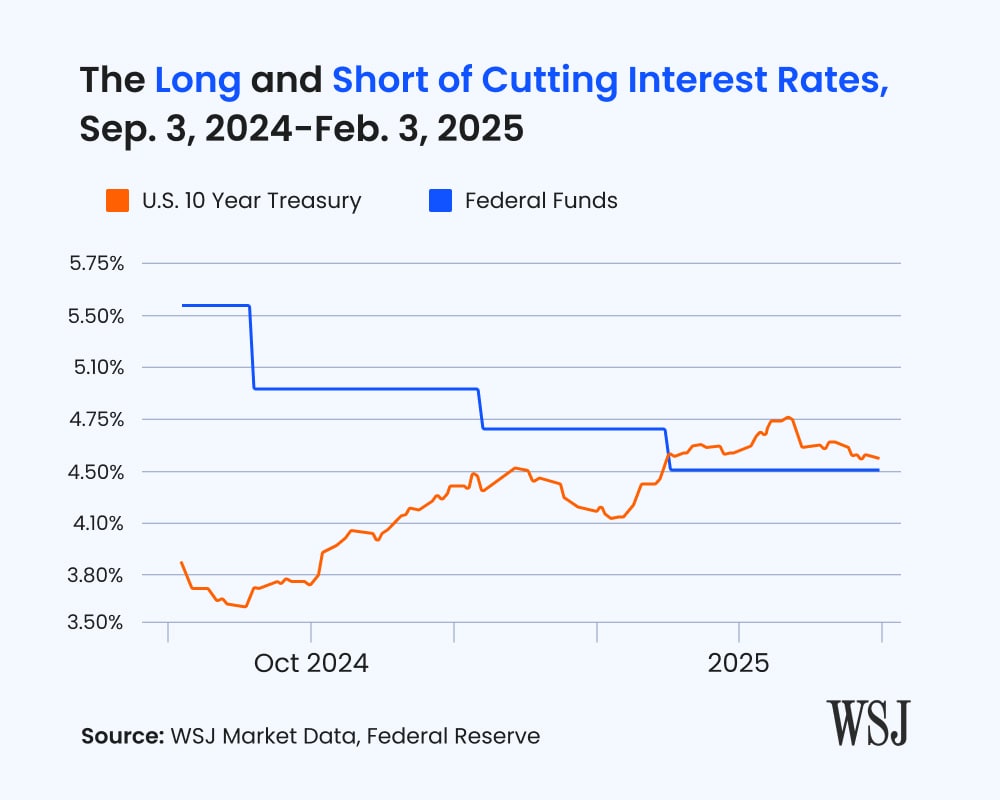

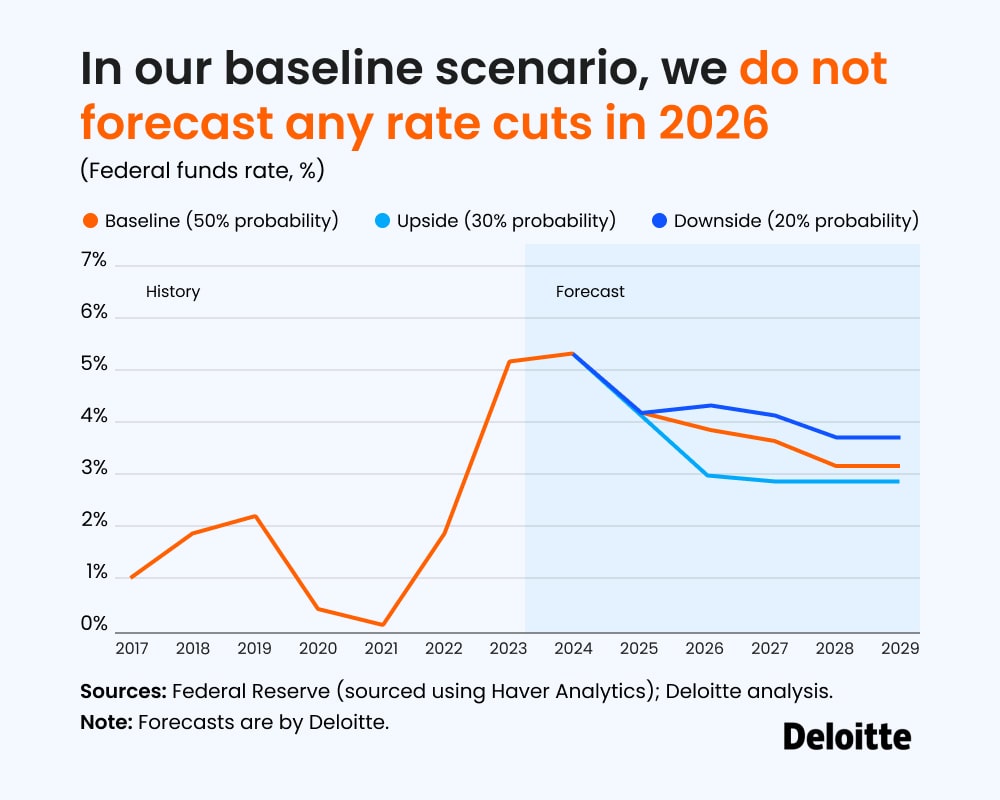

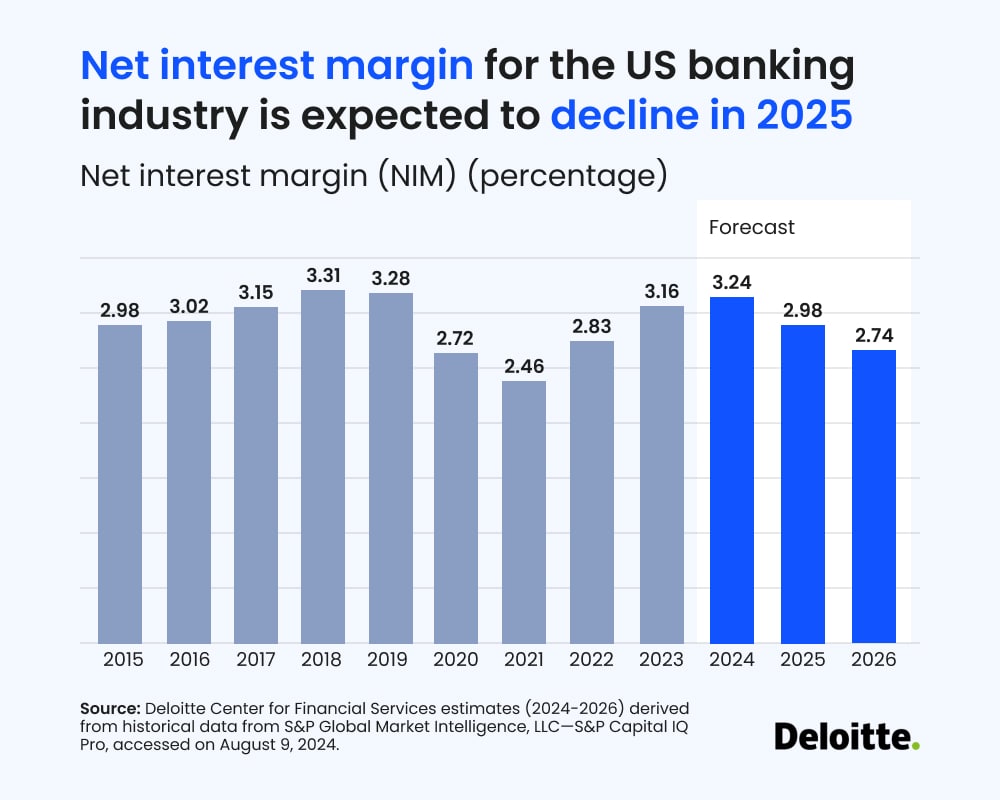

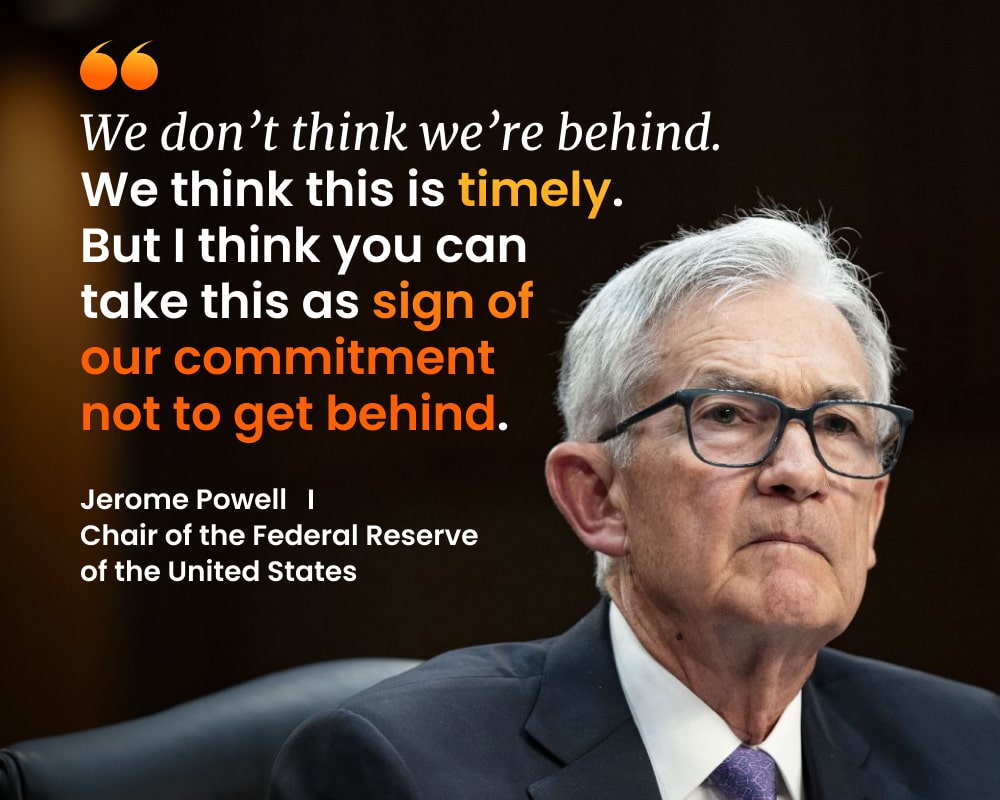

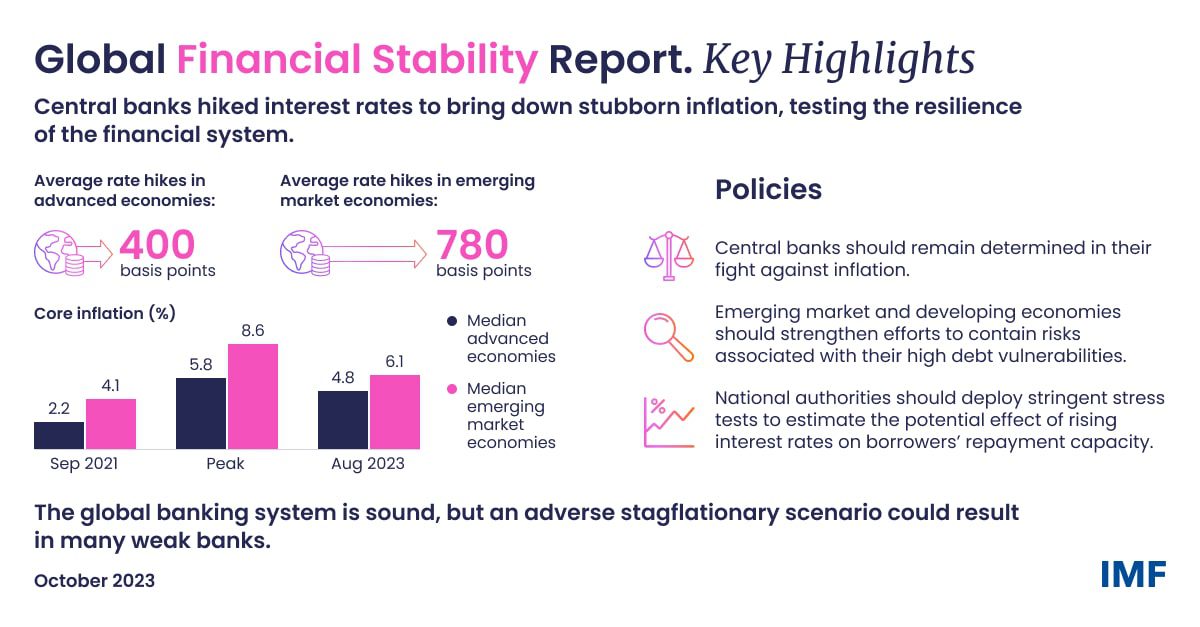

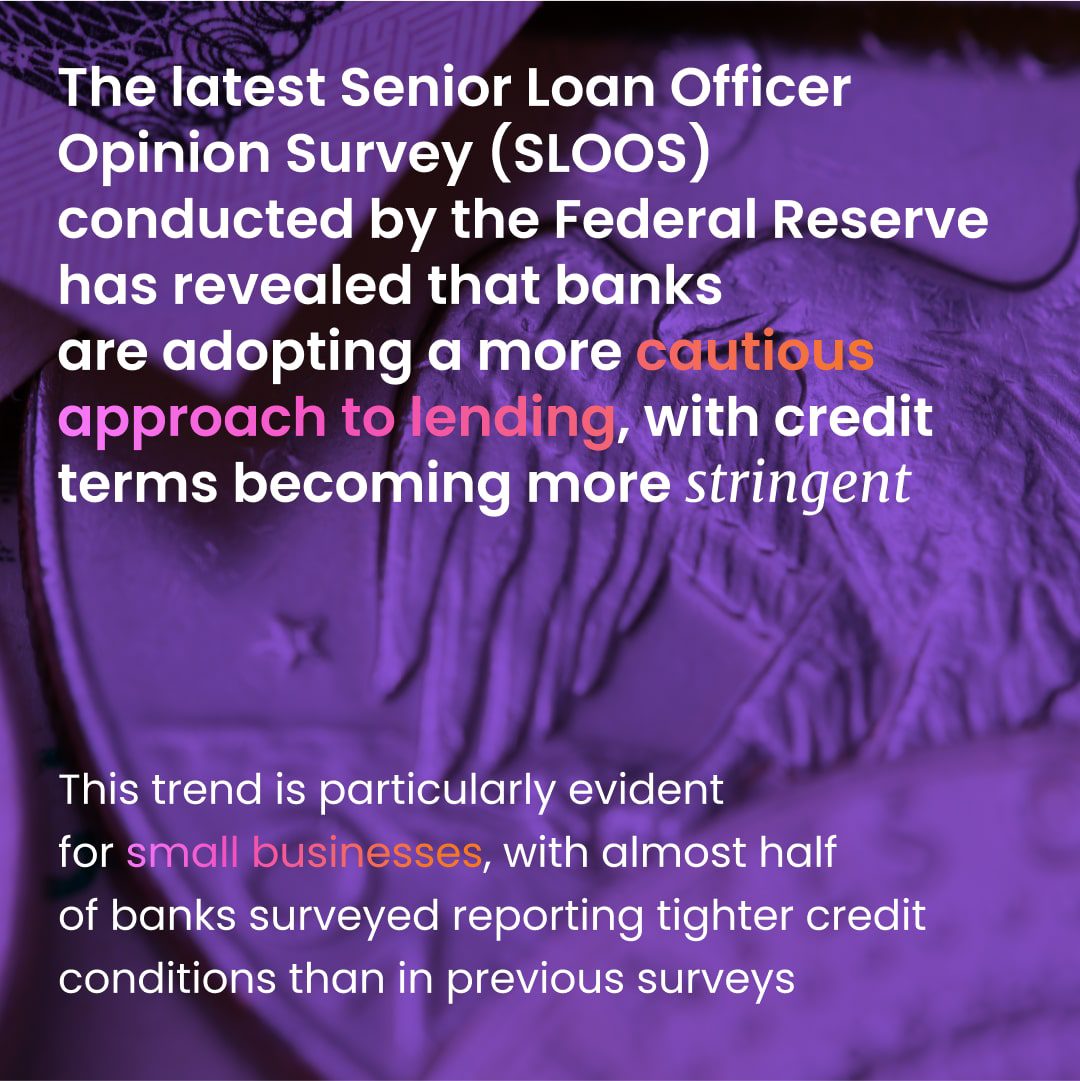

Navigating monetary policy uncertainty in 2026

After a series of rate cuts in 2025, the Federal Reserve is signaling a more cautious stance heading into its January meeting. While markets had anticipated further easing, the Fed’s outlook shows a stronger economy and only one more cut expected in 2026. This divergence underscores the importance of keeping a close eye on policy signals and economic data as firms strategize for growth.

Source: https://rsmus.com/insights/economics/another-fed-rate-cut-january.html

Feel good Sunday: Silence as medicine

In a world that never stops talking, scrolling, reacting, updating, and alerting, silence becomes a rare and precious gift. Pico Iyer reminds us that silence is more than absence of sound. It is a space where clarity grows, perspective deepens, and presence takes root.

Silence is not emptiness. It is the universal medicine for a life lived too fast. Let it heal your mind, refresh your heart, and center your spirit.

Source: https://www.ted.com/talks/pico_iyer_silence_the_universal_medicine

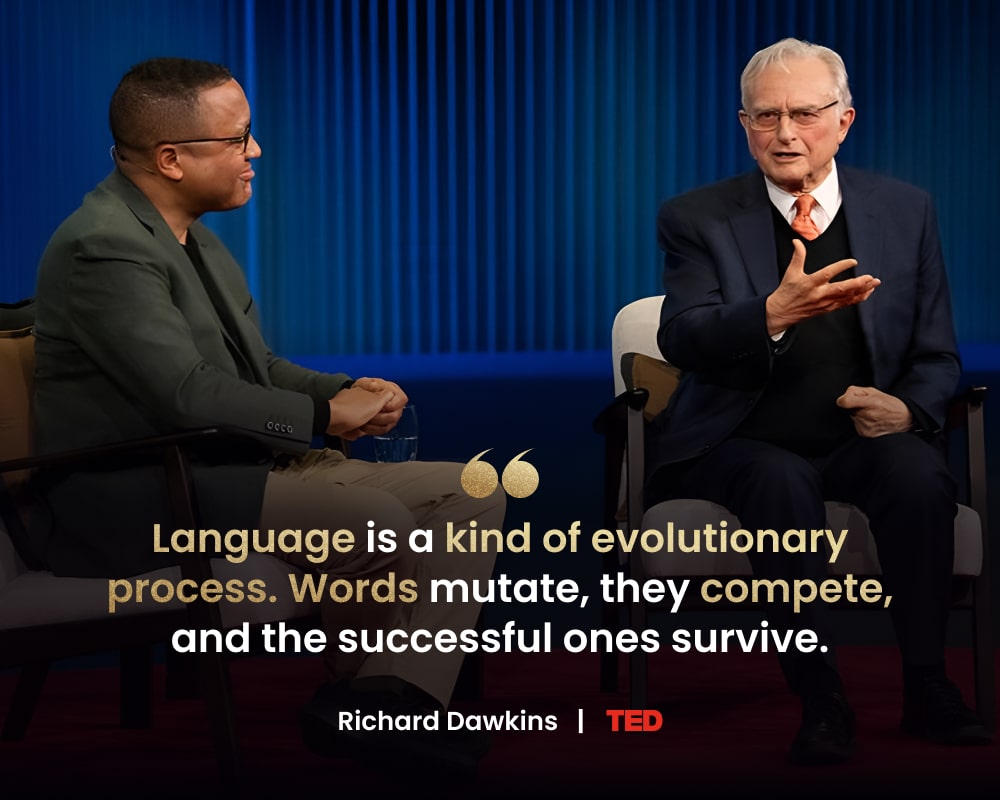

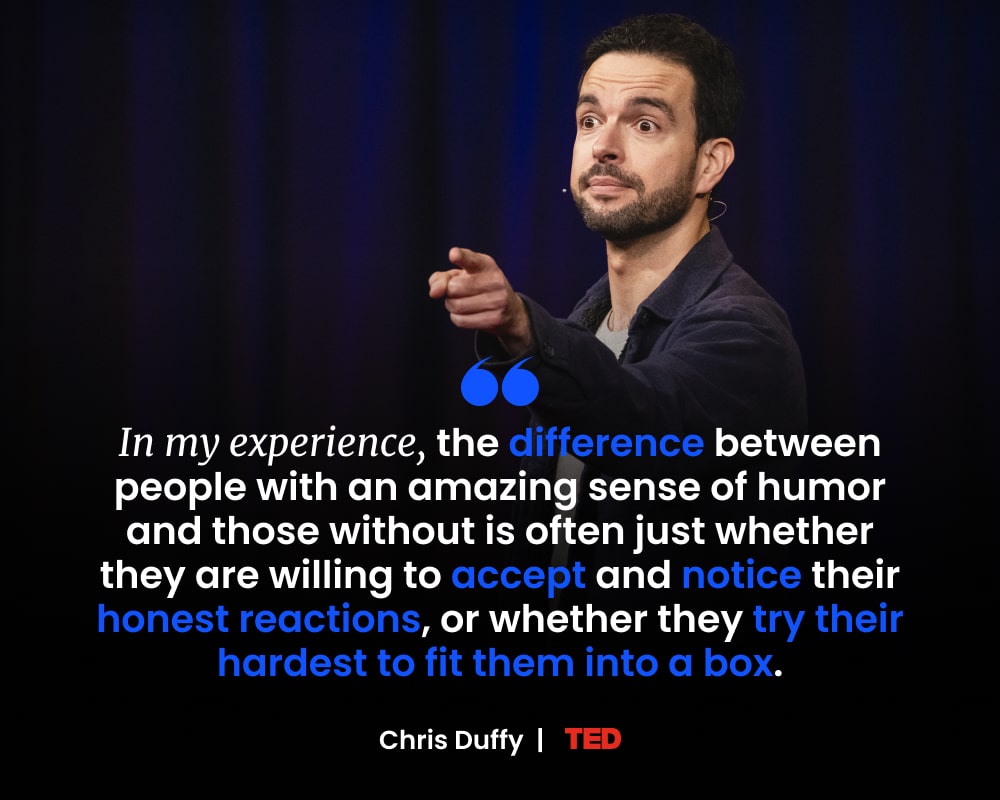

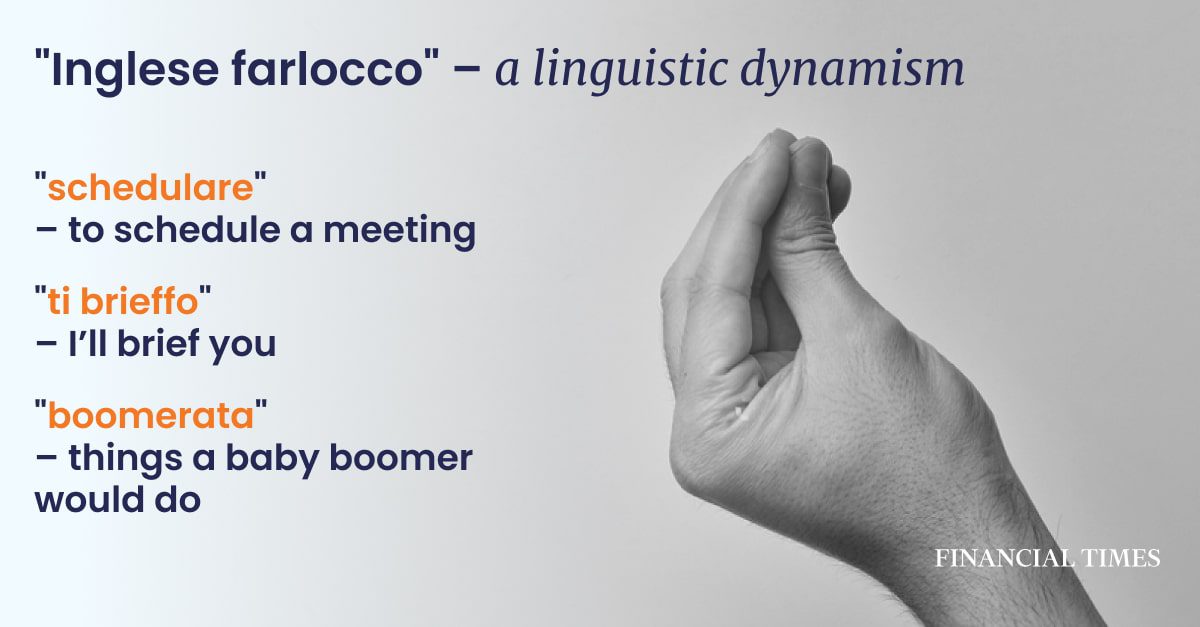

Curious Saturday: When technology shapes the way we speak

Language is one of the most human things we have. Yet as AI systems learn from us and we learn from them, the boundary between human and machine expression is becoming harder to spot.

Adam Aleksic unpacks how this shift is happening, why it matters, and what it means for authenticity in a world increasingly mediated by algorithms.

Source: https://www.ted.com/talks/adam_aleksic_why_are_people_starting_to_sound_like_chatgpt

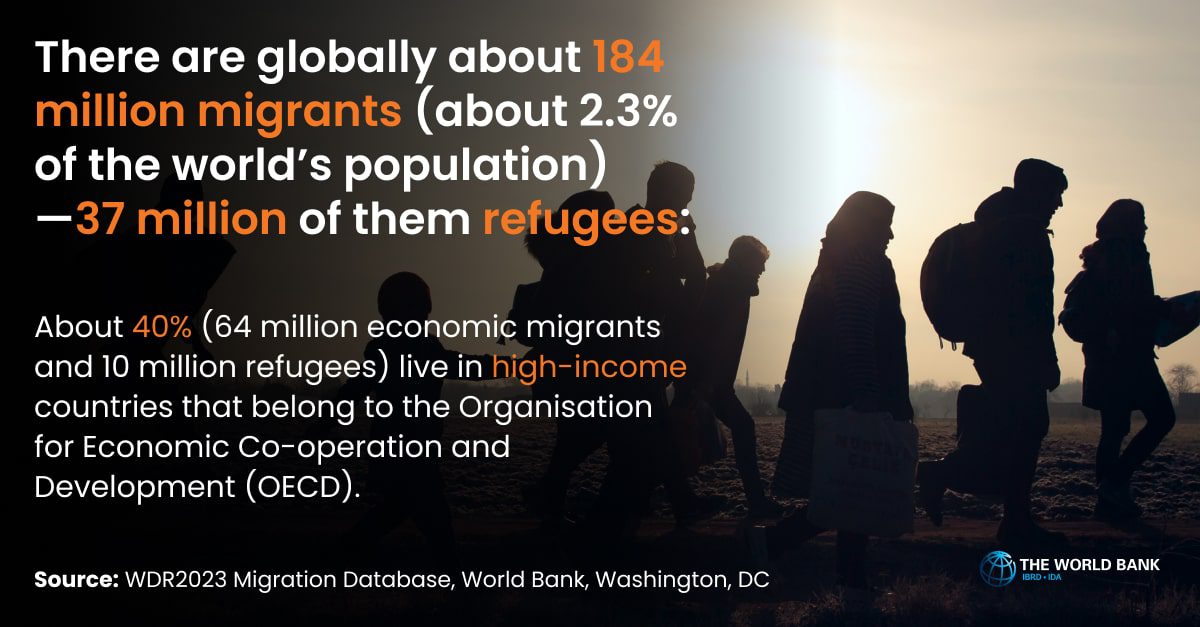

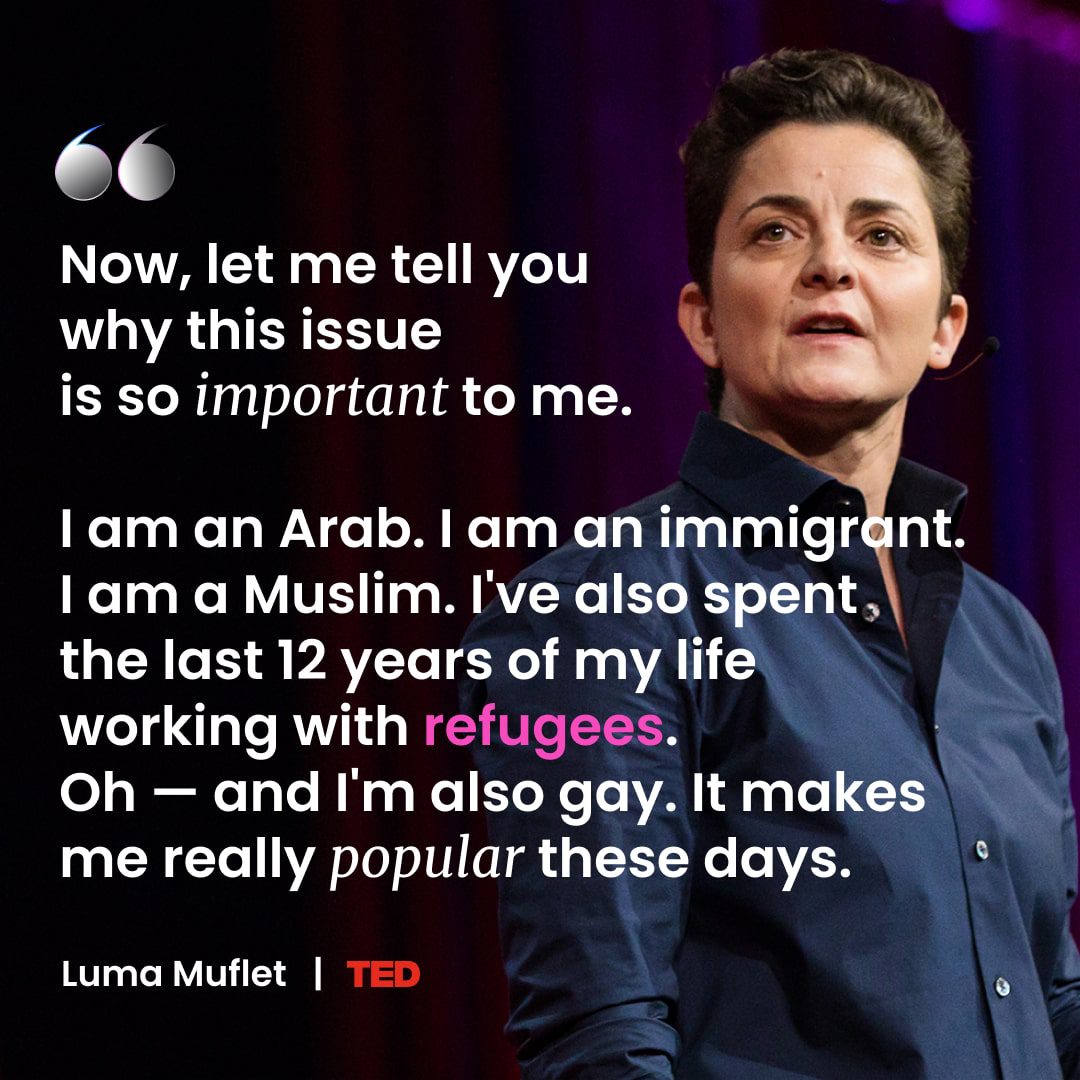

From crisis to inclusion: Rethinking refugee support

Recent actions at the UN underscore how refugee protection continues to be contested in global politics. With decisions that may impact the operations of key humanitarian agencies and ongoing crises in multiple regions, the world is reminded that #equitable treatment for displaced people requires persistent engagement from policymakers, NGOs, and the business community alike.

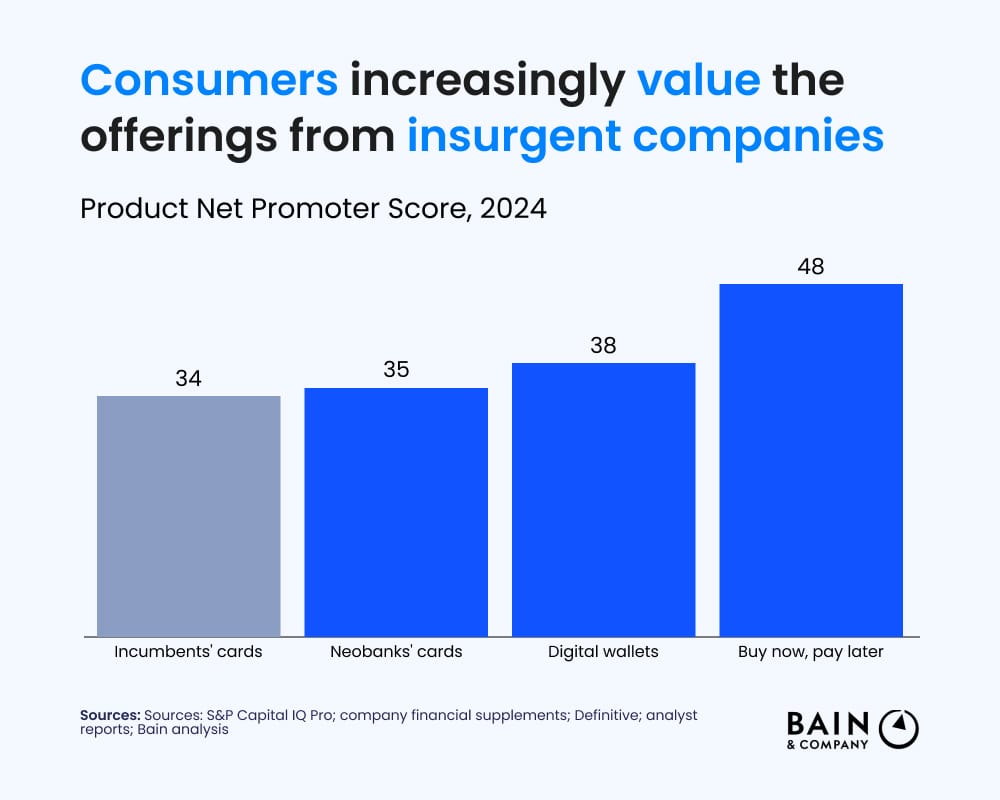

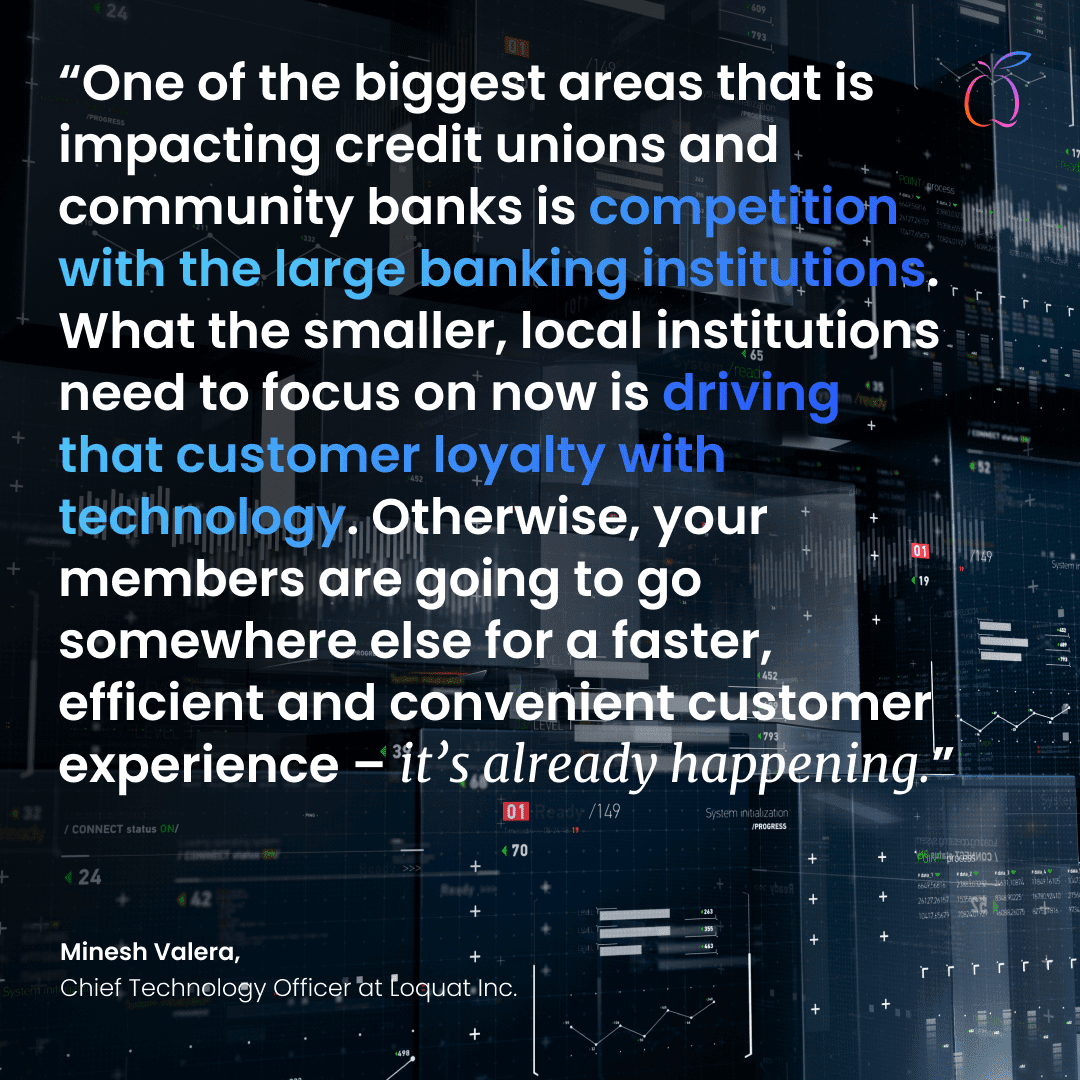

Loquat insights: A shift from transactions to experience-driven expectations

Banks and credit unions are no longer competing only with each other. They are being measured against the best digital experiences people use every day.

In the first episode of Loquat Insights, John Gernhauser shares why expectations have shifted from transactional interactions to experience driven journeys, and why customers expect speed, simplicity, and protection without sacrificing human support.

Digital does not replace the branch. It empowers choice. When technology supports staff, streamlines work, and embeds intelligent fraud controls, FIs can deliver both convenience and confidence.

Watch Episode 1 to hear how the right balance of digital and human experience is shaping the future of banking https://loquatinc.io/insights/john-gernhauser-what-major-trends-are-shaping-the-future-of-banking-and-credit-unions-today/

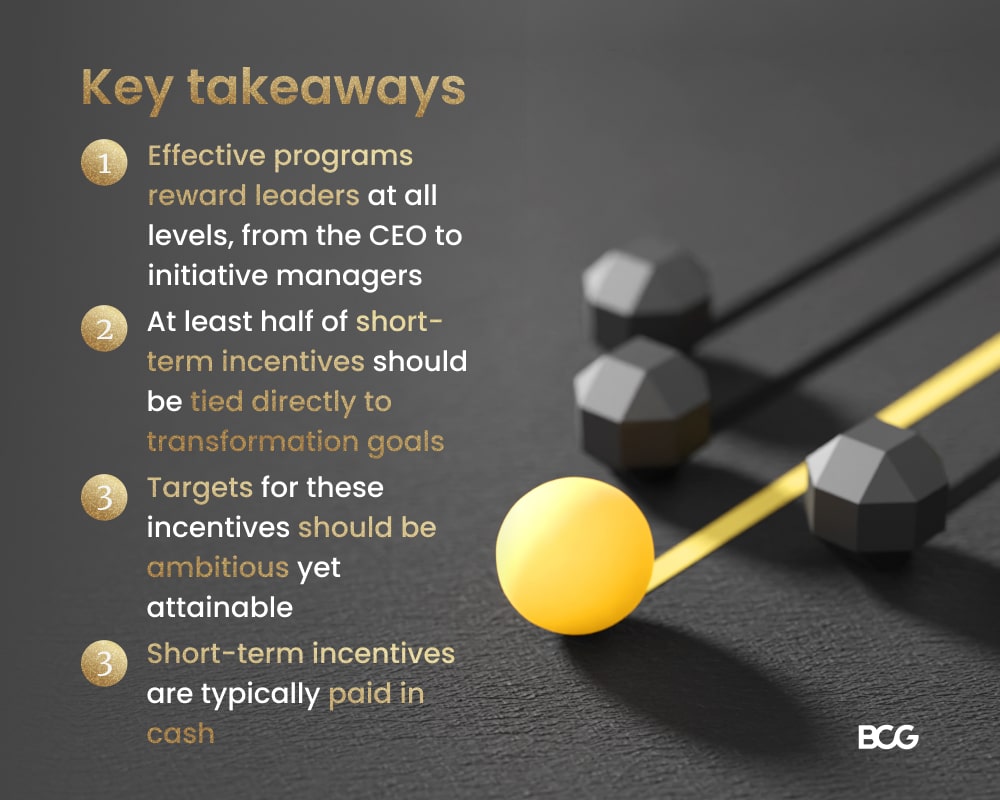

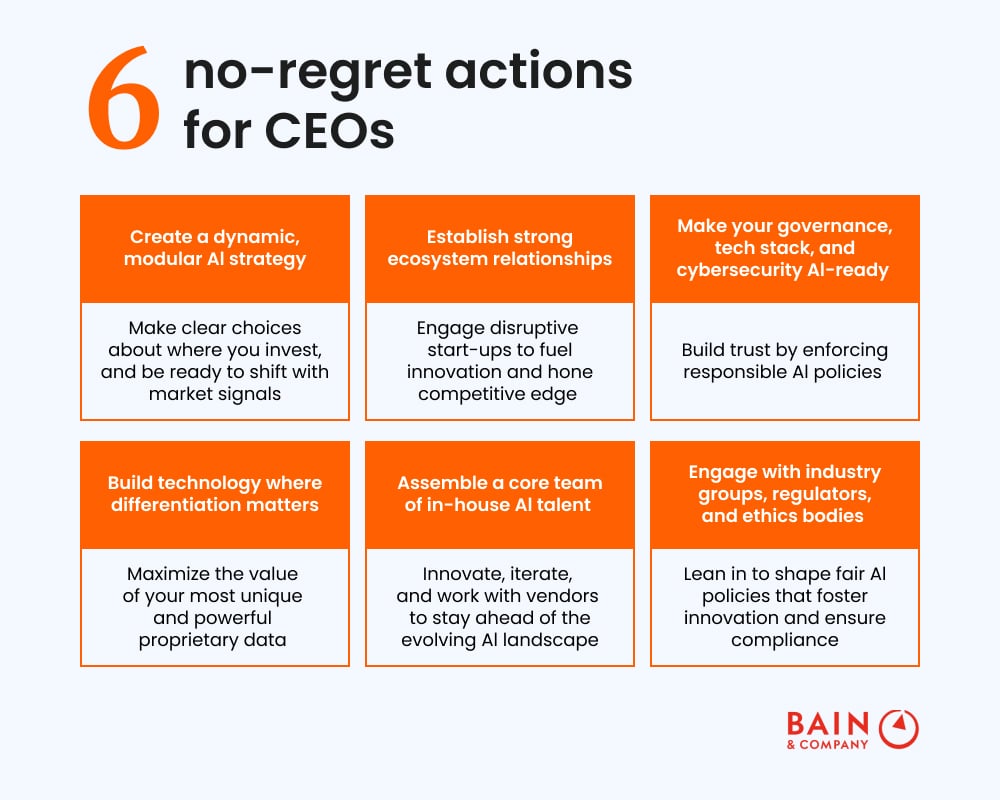

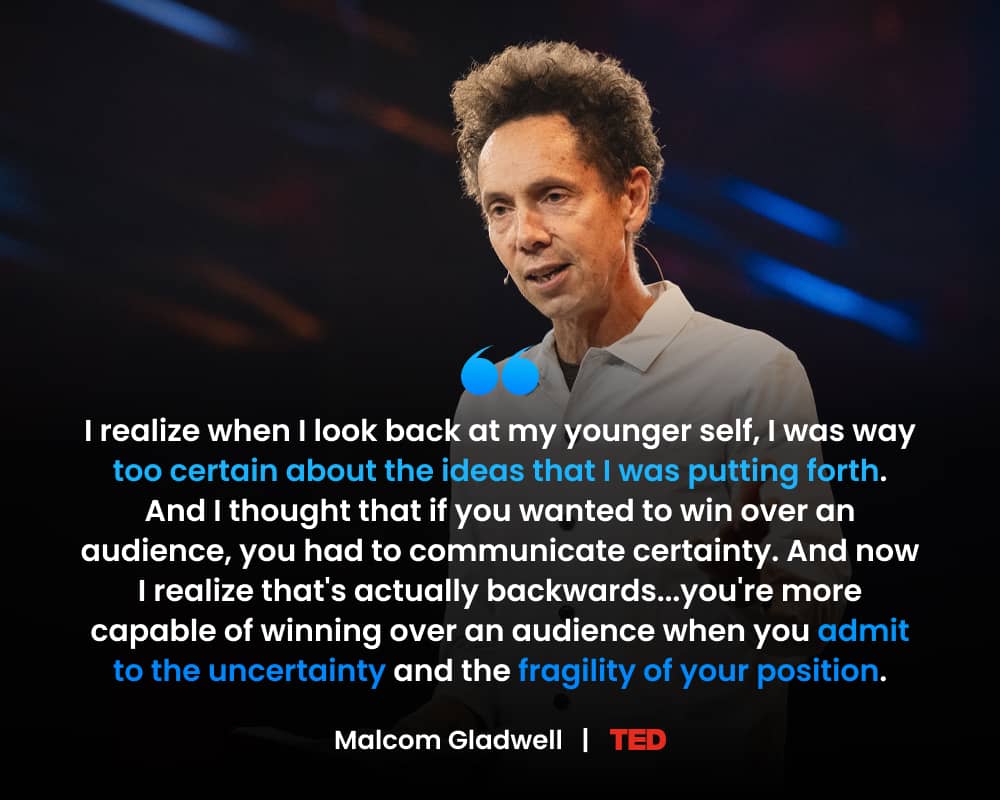

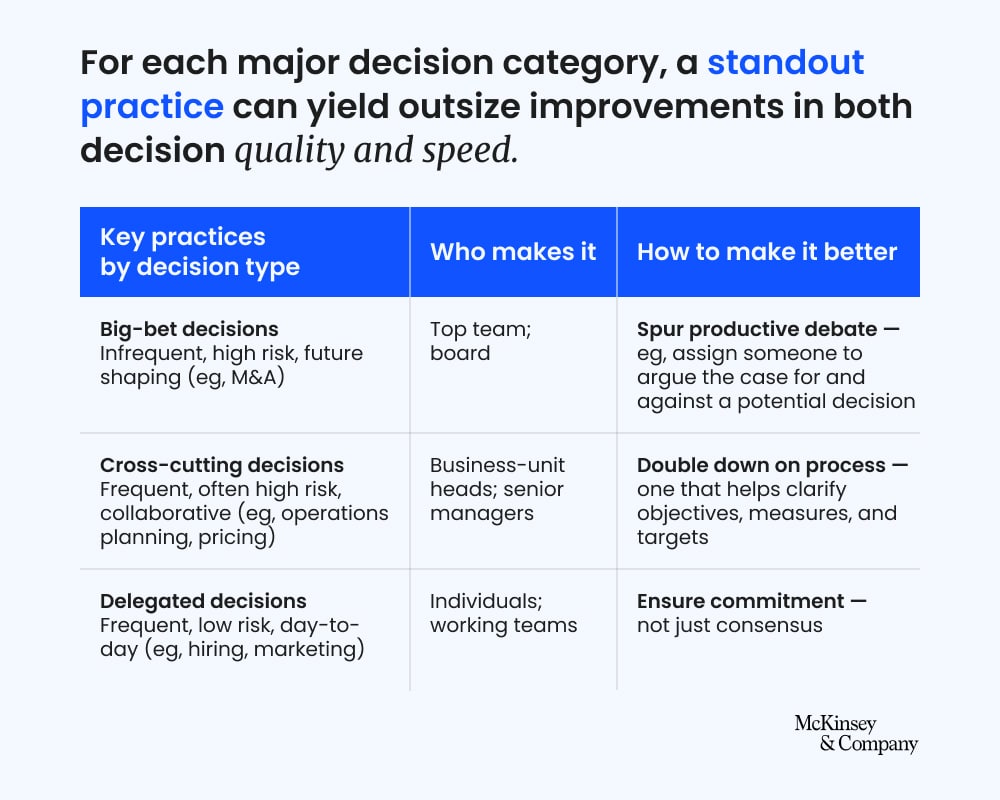

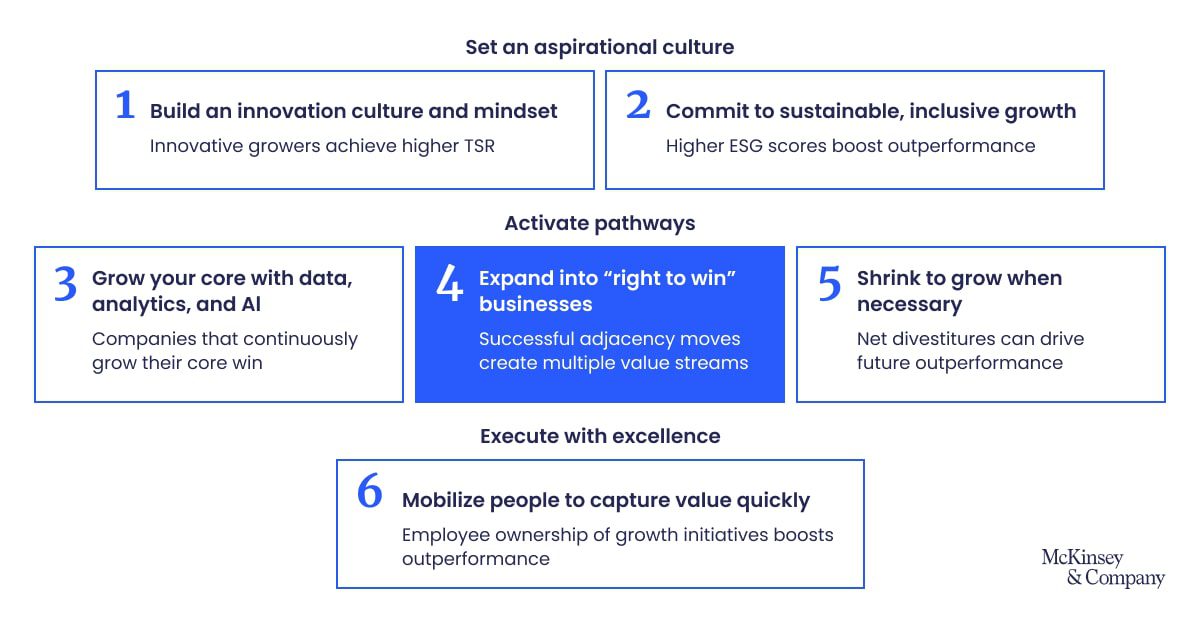

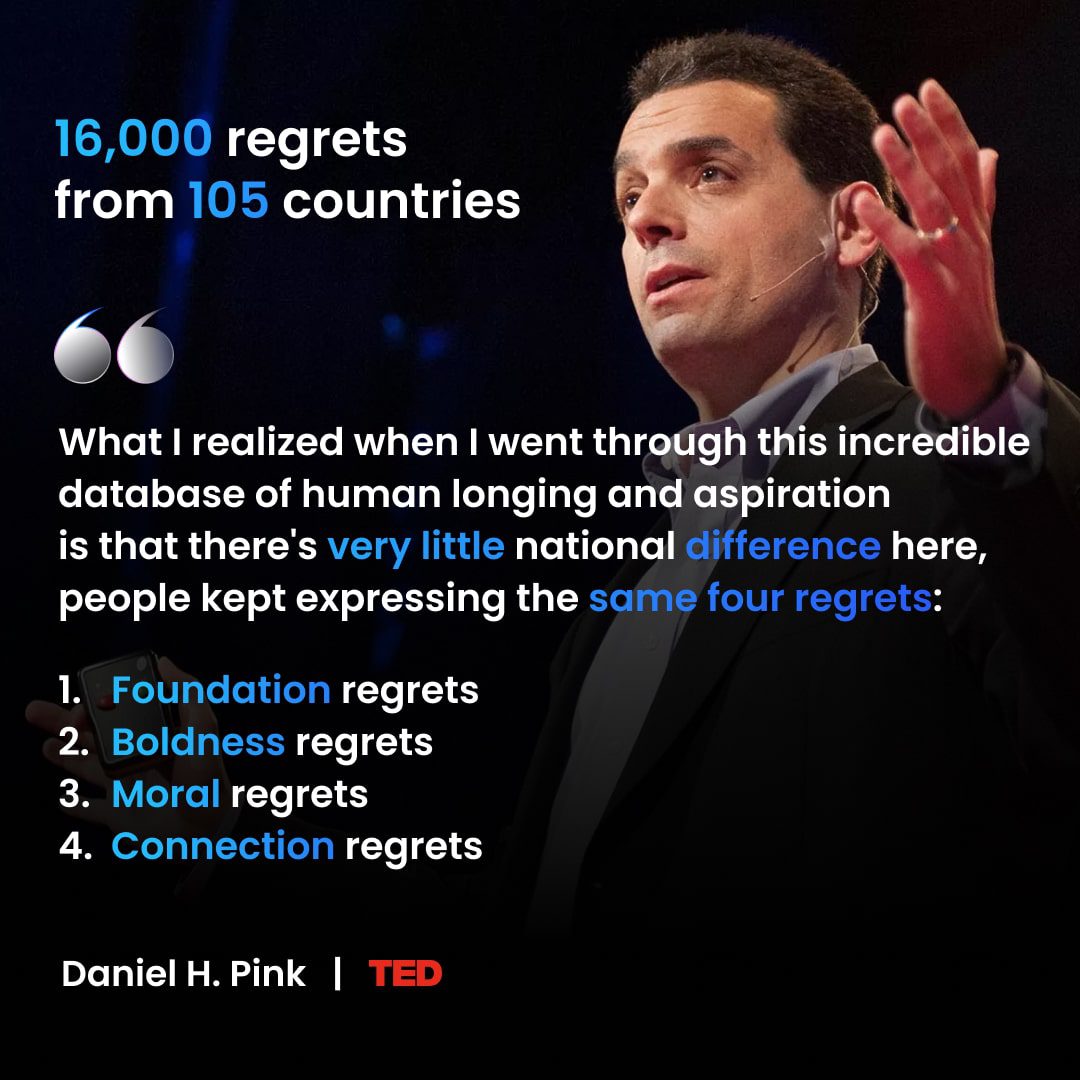

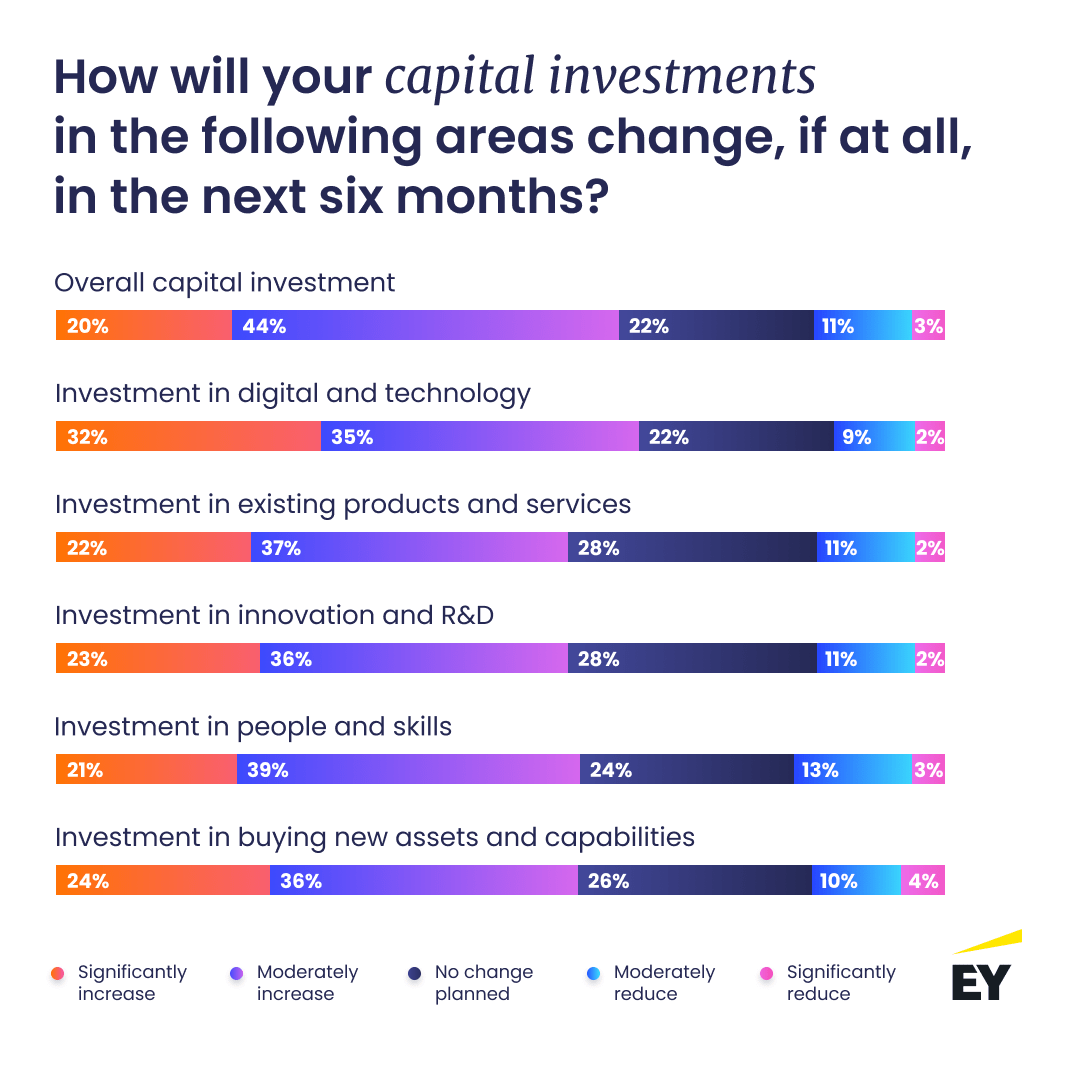

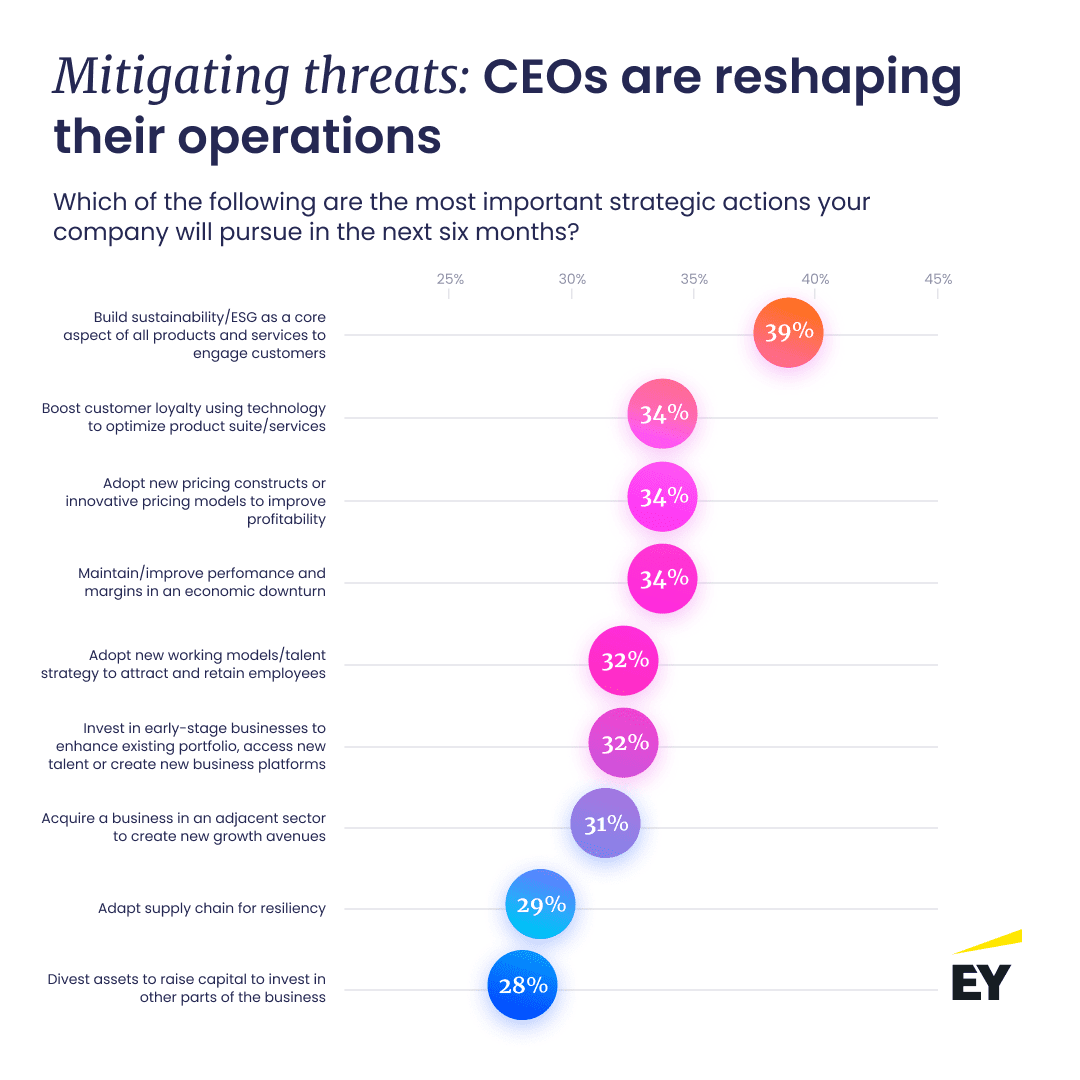

From caution to conviction in the C-Suite

Many CEOs are rethinking how they deploy capital, time, and leadership attention. Instead of spreading resources thin across dozens of initiatives, the most confident leaders are concentrating on a smaller number of bold strategic bets.

The logic is simple. Focus creates momentum. Clear priorities accelerate execution. And disciplined trade-offs reduce regret.

In a volatile environment, winning strategies are not about doing more. They are about choosing better, committing earlier, and backing decisions with conviction.

This shift toward fewer, higher-impact bets is becoming a defining leadership trait for the next decade.

Source: https://www.bcg.com/publications/2025/ceos-guide-bolder-bets-fewer-regrets

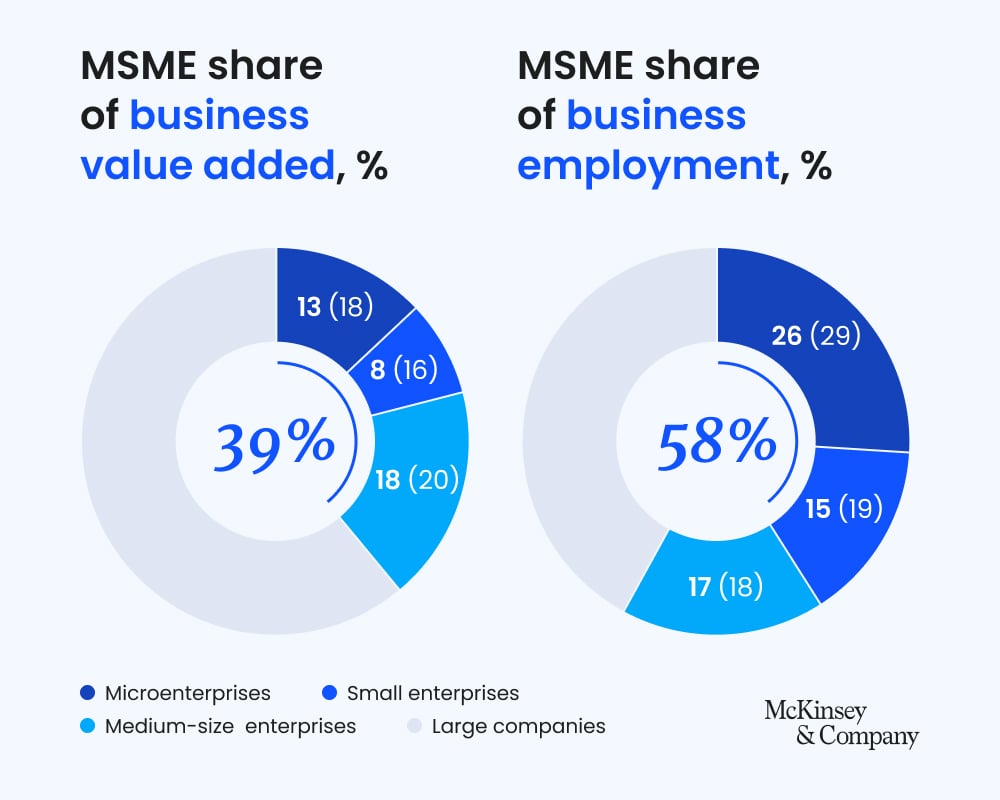

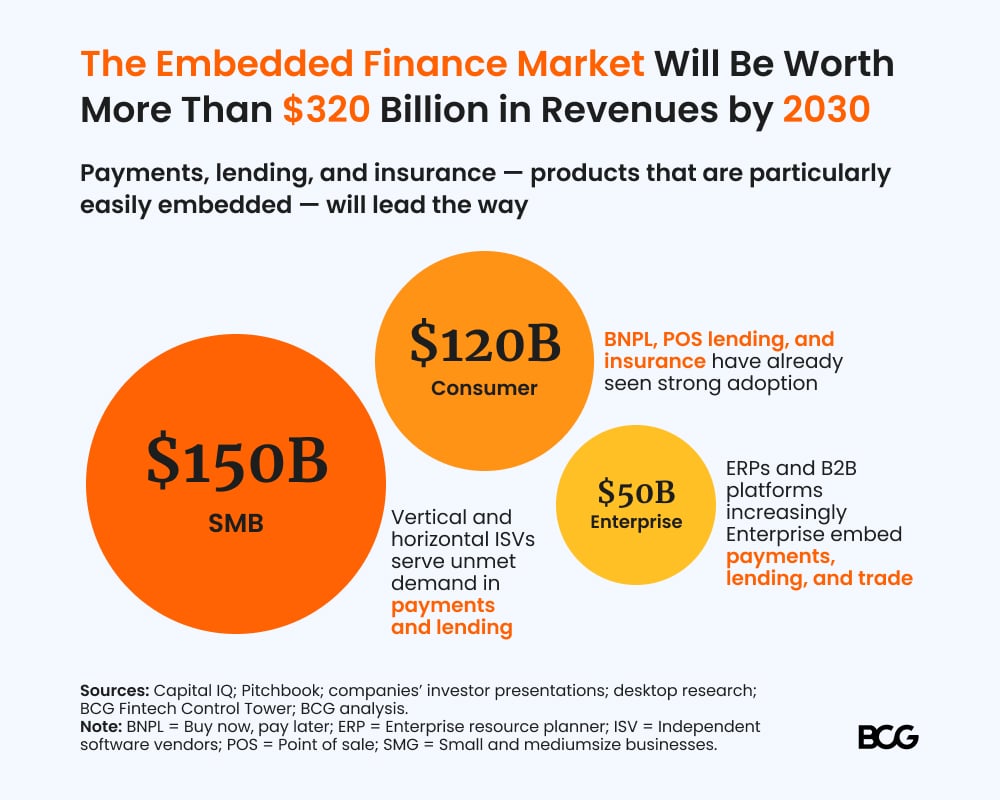

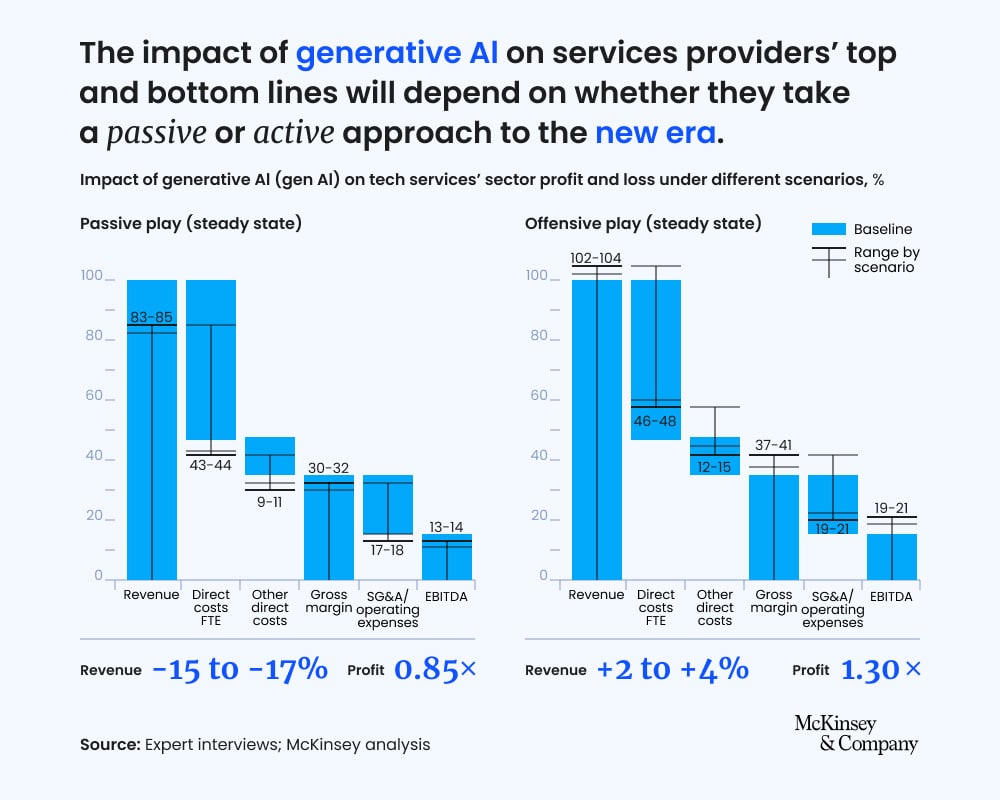

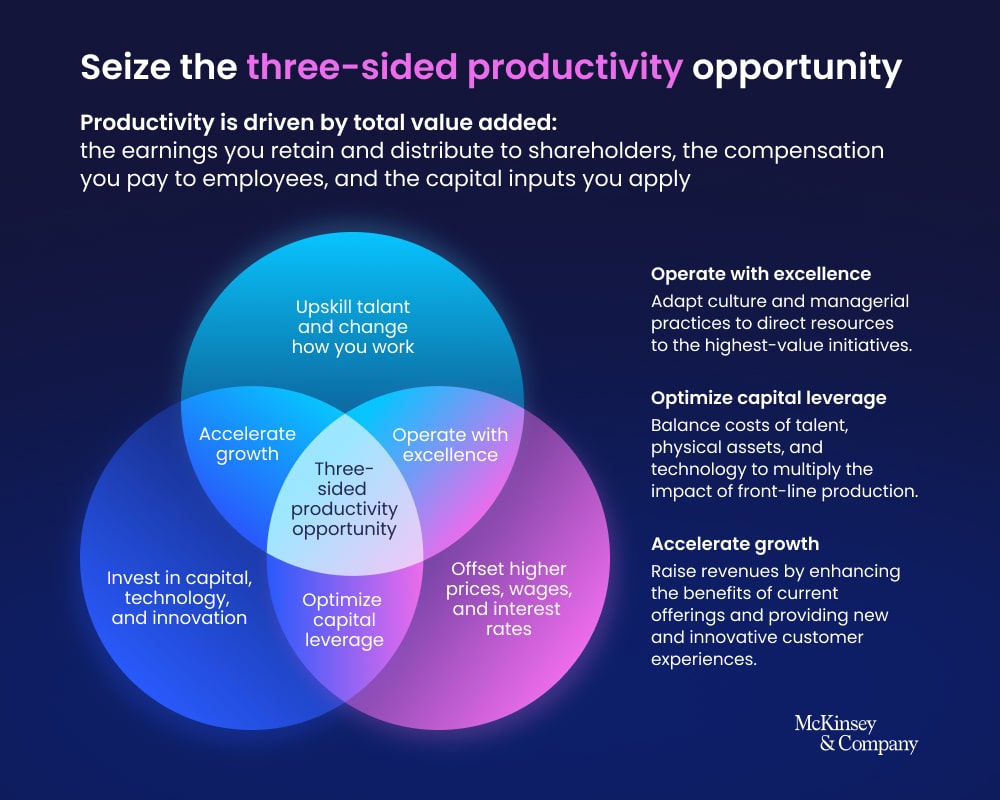

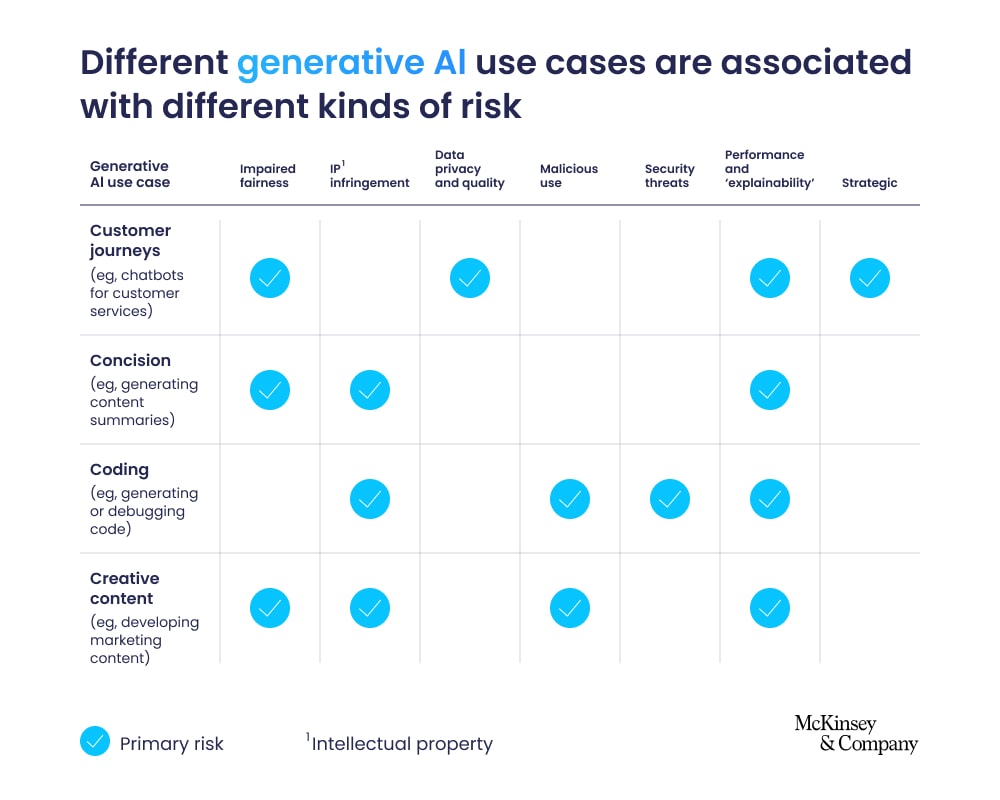

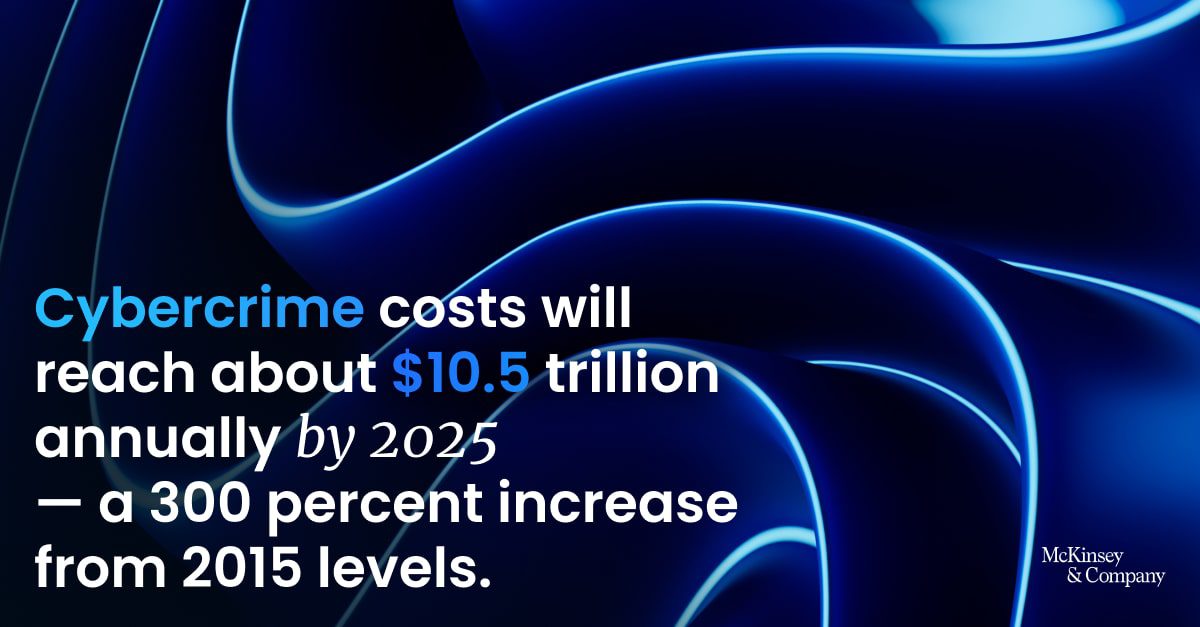

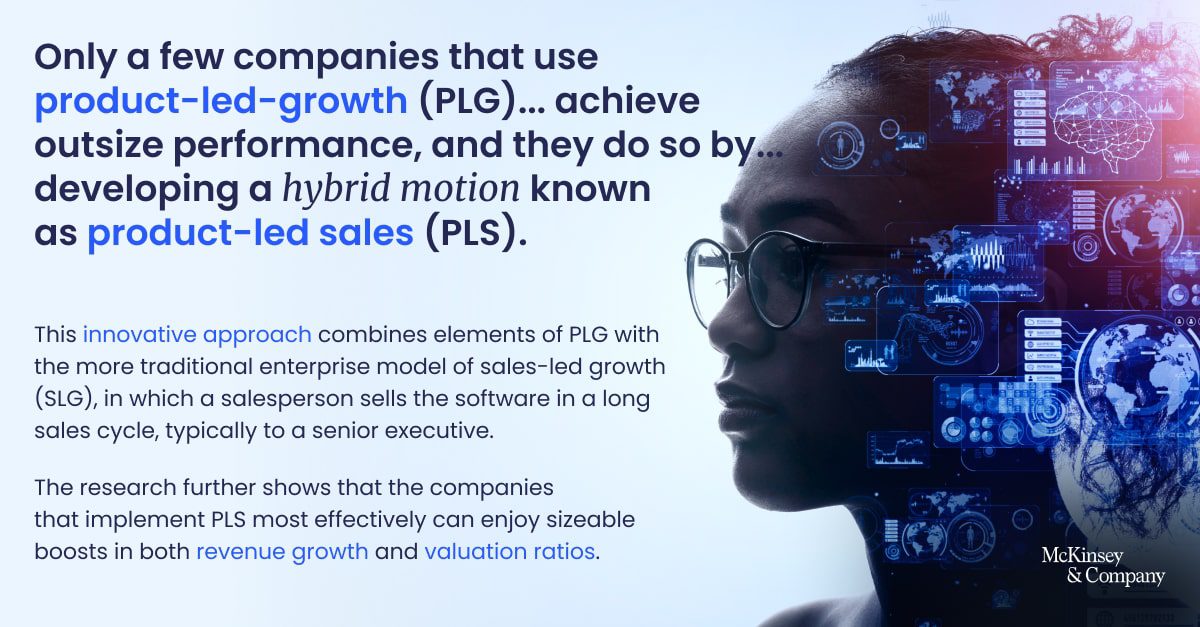

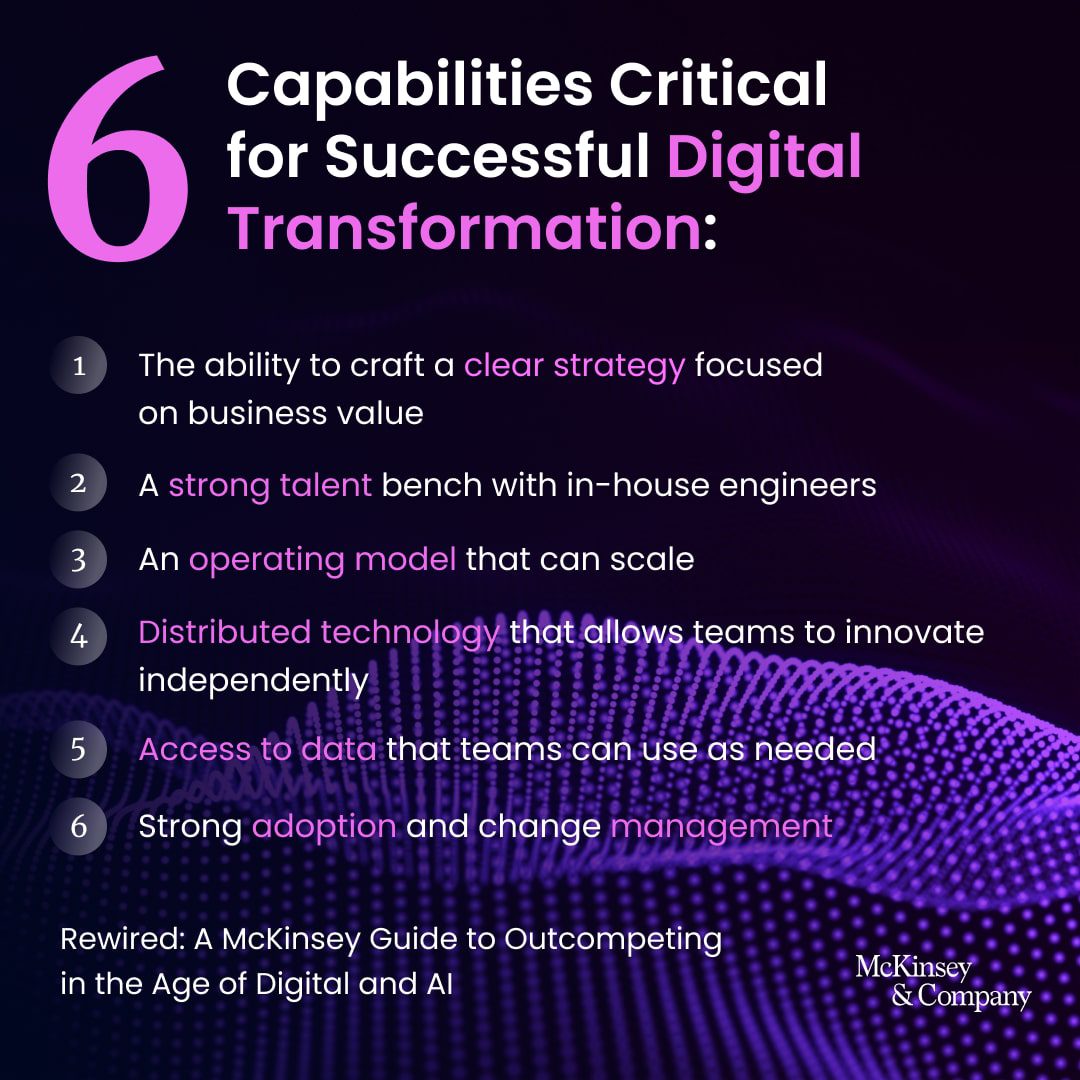

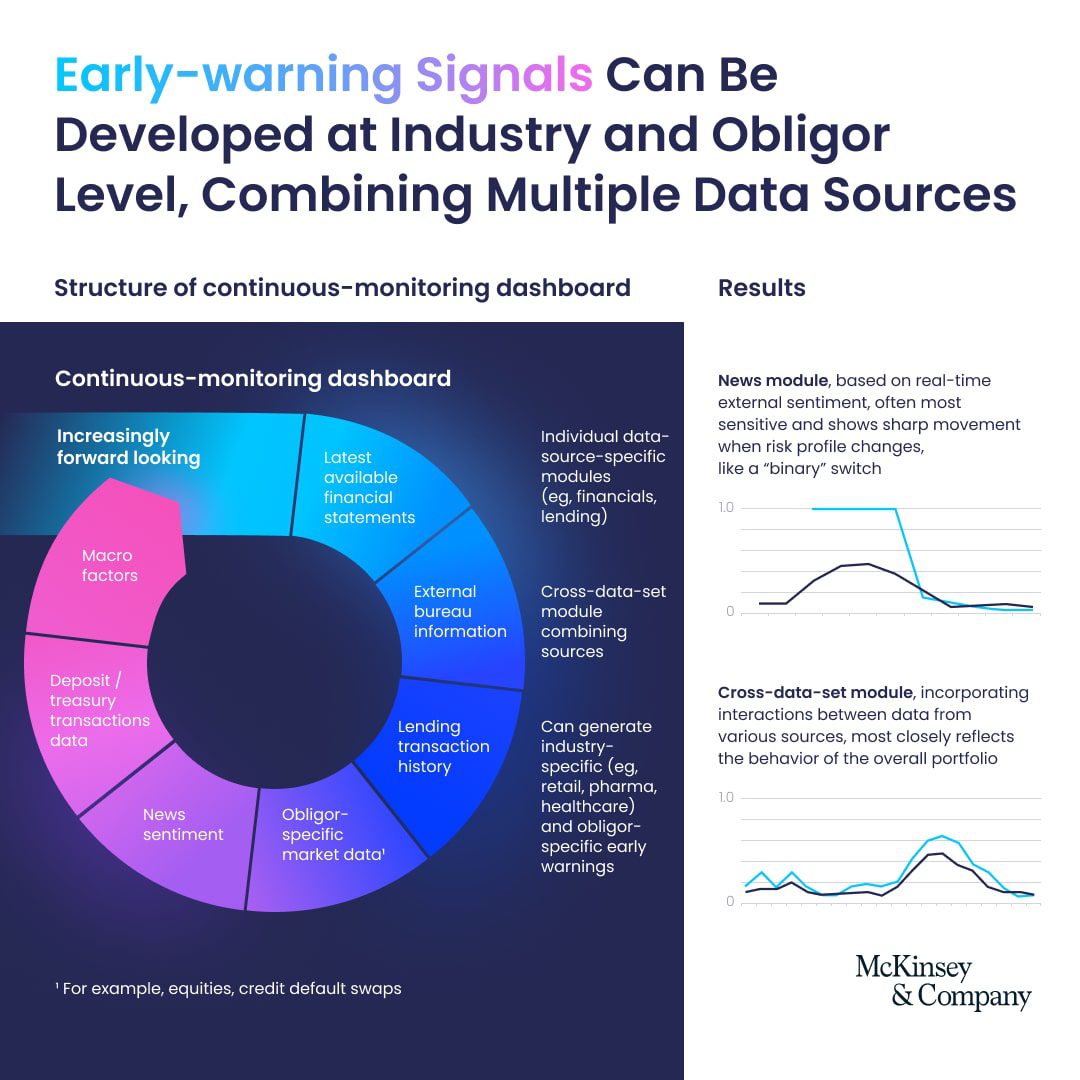

Why Integrated Software Vendor maturity is becoming a payments imperative

Integrated software vendors (ISVs) are moving from simple payment enablement to becoming true growth partners for FIs.

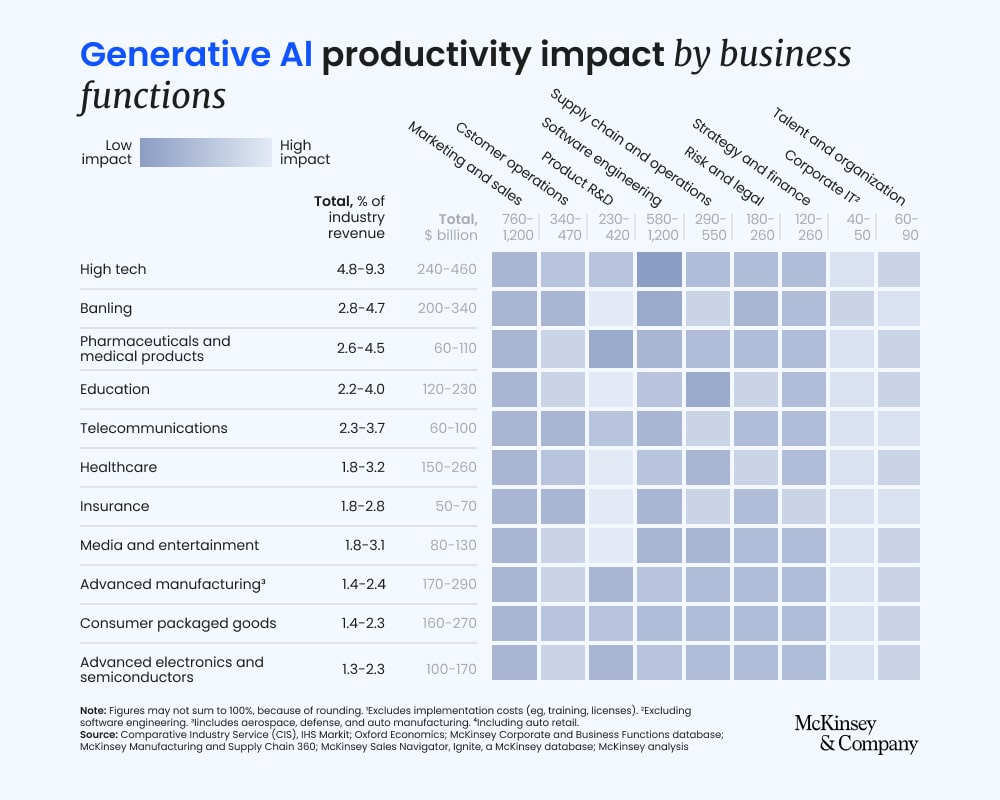

McKinsey’s latest research outlines how mature ISVs differentiate themselves through deeper integration, clearer value propositions, and a sharper focus on merchant outcomes. The most advanced players do not treat payments as an add on. They embed them into workflows, data, and decision making.

For banks and payment providers, the takeaway is clear. ISV maturity is no longer a nice to have. It is becoming a key driver of distribution, retention, and long term payments growth.

Leadership guided by conscience

Today we honor Martin Luther King Jr. (MLK) and his enduring reminder that real leadership often requires courage. Progress rarely comes from safe or popular choices, but from individuals willing to act when conscience calls. His words remain as relevant today as ever.

Feel good Sunday: Seeing humanity through art

In his TED Talk, George Butler shares a powerful practice of slowing down in places defined by urgency and disruption. Rather than capturing quick images, he spends hours drawing people and environments shaped by conflict.

This deliberate pace changes the interaction. Sketching becomes a way to listen, to build trust, and to see individuals beyond the headlines that often reduce complex lives to brief moments. Butler shows that observation is not passive. It is an act of presence and respect.

A thoughtful reminder for Sunday: when we slow down and truly look, we often understand more than we expect.

Source: https://www.ted.com/talks/george_butler_why_i_spend_hours_sketching_in_conflict_zones

Curious Saturday: How Technology Shapes Everyday Life

In her TED Talk, Nicola Twilley explores how one quiet piece of technology reshaped what we eat, how we shop, and how food systems operate behind the scenes. The refrigerator did not just make food colder. It transformed supply chains, shifted consumer habits, and redefined expectations around freshness and availability.

Twilley invites us to look beyond innovation as novelty and consider how everyday tools influence behavior, resilience, and access. A thoughtful reminder that some of the most powerful transformations happen out of sight, changing daily life one habit at a time.

Source: https://www.ted.com/talks/nicola_twilley_how_the_fridge_changed_food

A climate anomaly that raises important questions

Almost all of the world’s glaciers are shrinking. Yet scientists have identified a rare exception: a high-altitude glacier that is still growing.

Researchers say the growth is driven by highly localized conditions, not a reversal of global warming. The broader pattern of ice loss and rising sea levels remains unchanged.

The real lesson is nuance. Climate systems are complex, but isolated anomalies do not outweigh global trends.

Source: https://www.popularmechanics.com/science/environment/a69827017/glacier-anomaly/

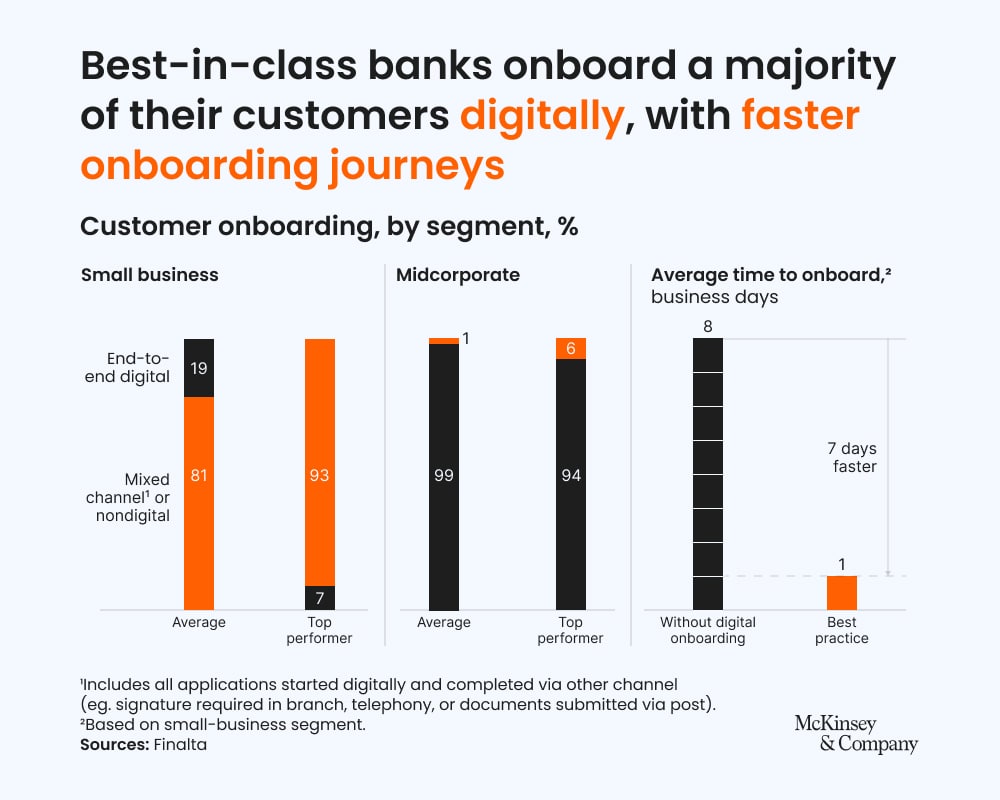

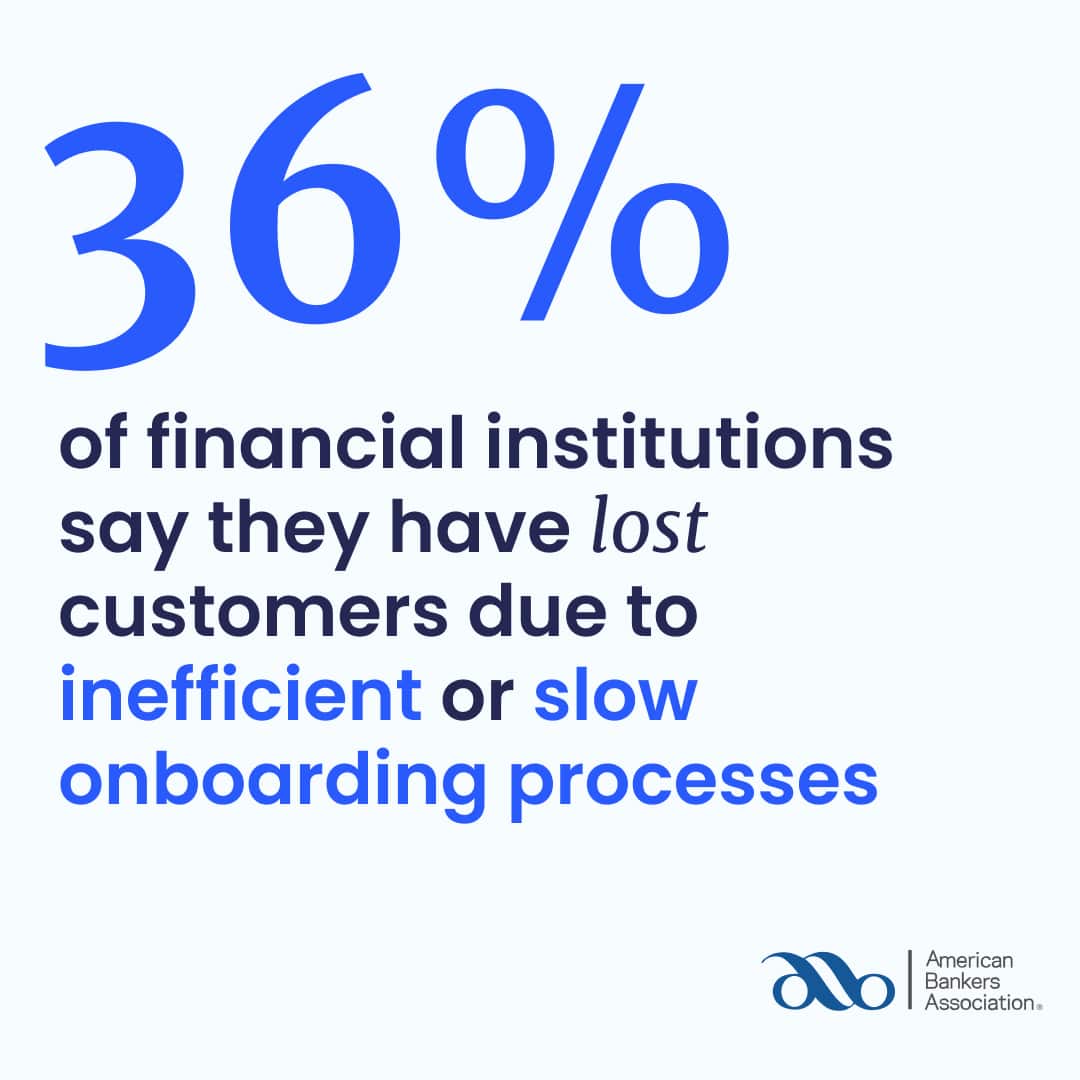

From days to minutes: Loquat’s blueprint for modern onboarding

Operational friction has long been a barrier in business banking.

America First results show what’s possible when those barriers come down.

By removing manual workflows and digitizing the journey, they’ve accelerated onboarding time from days to minutes — even seeing some applications completed in just five minutes.

This is the type of measurable efficiency that helps FI serve more businesses, more effectively.

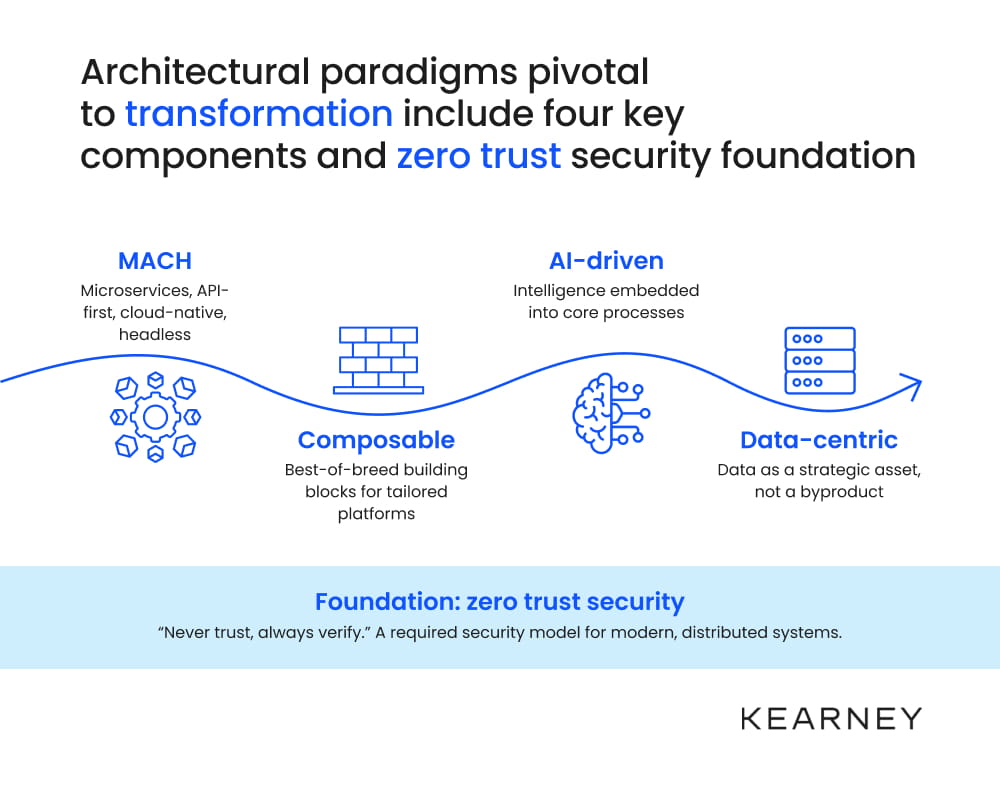

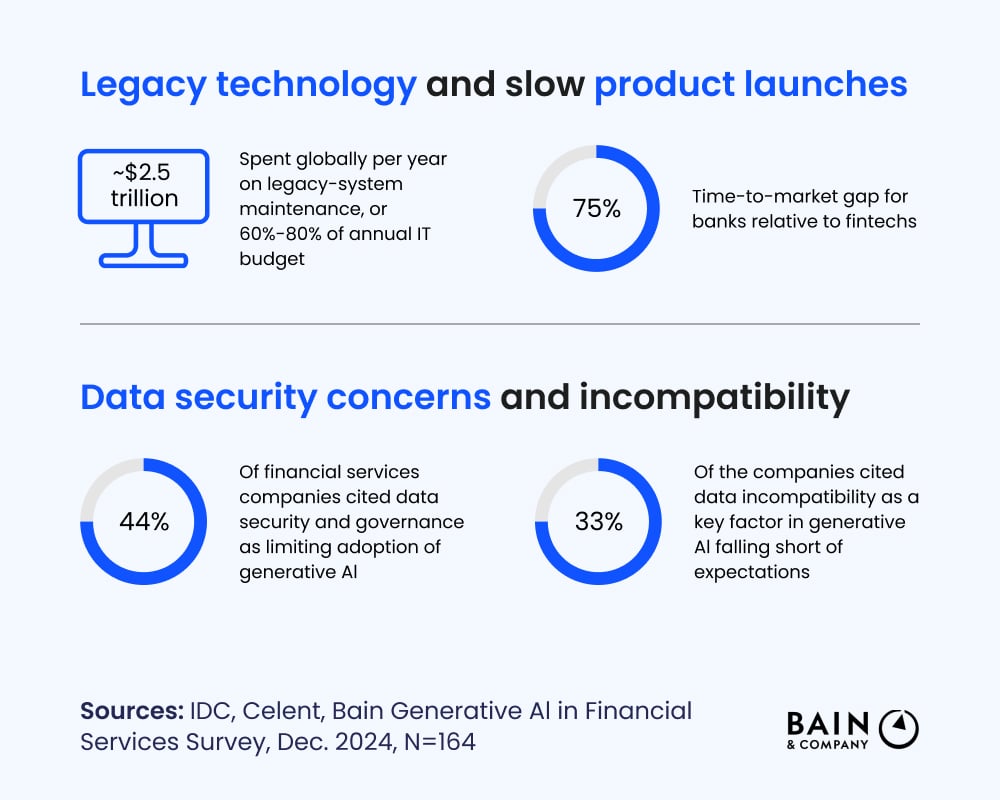

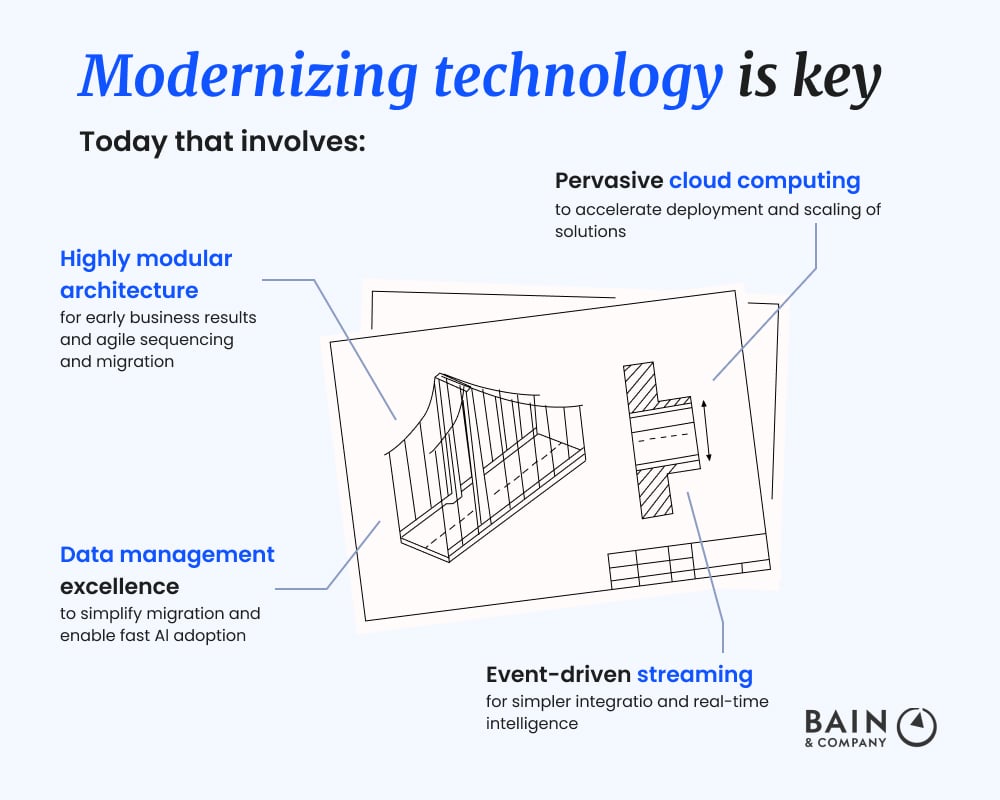

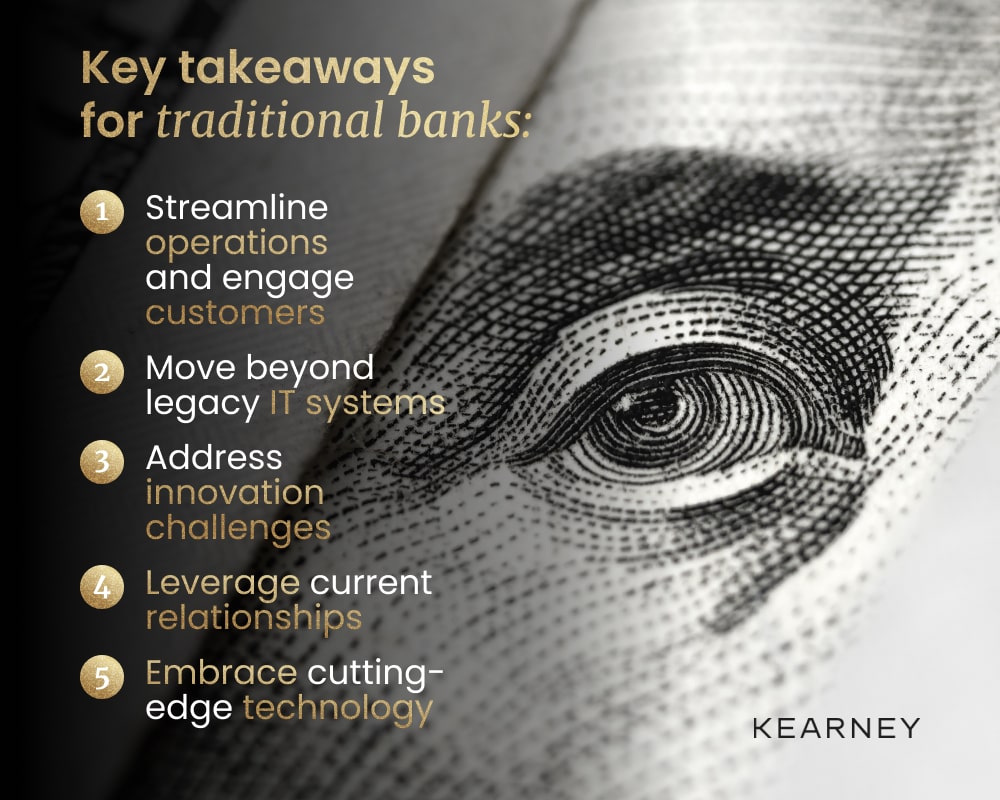

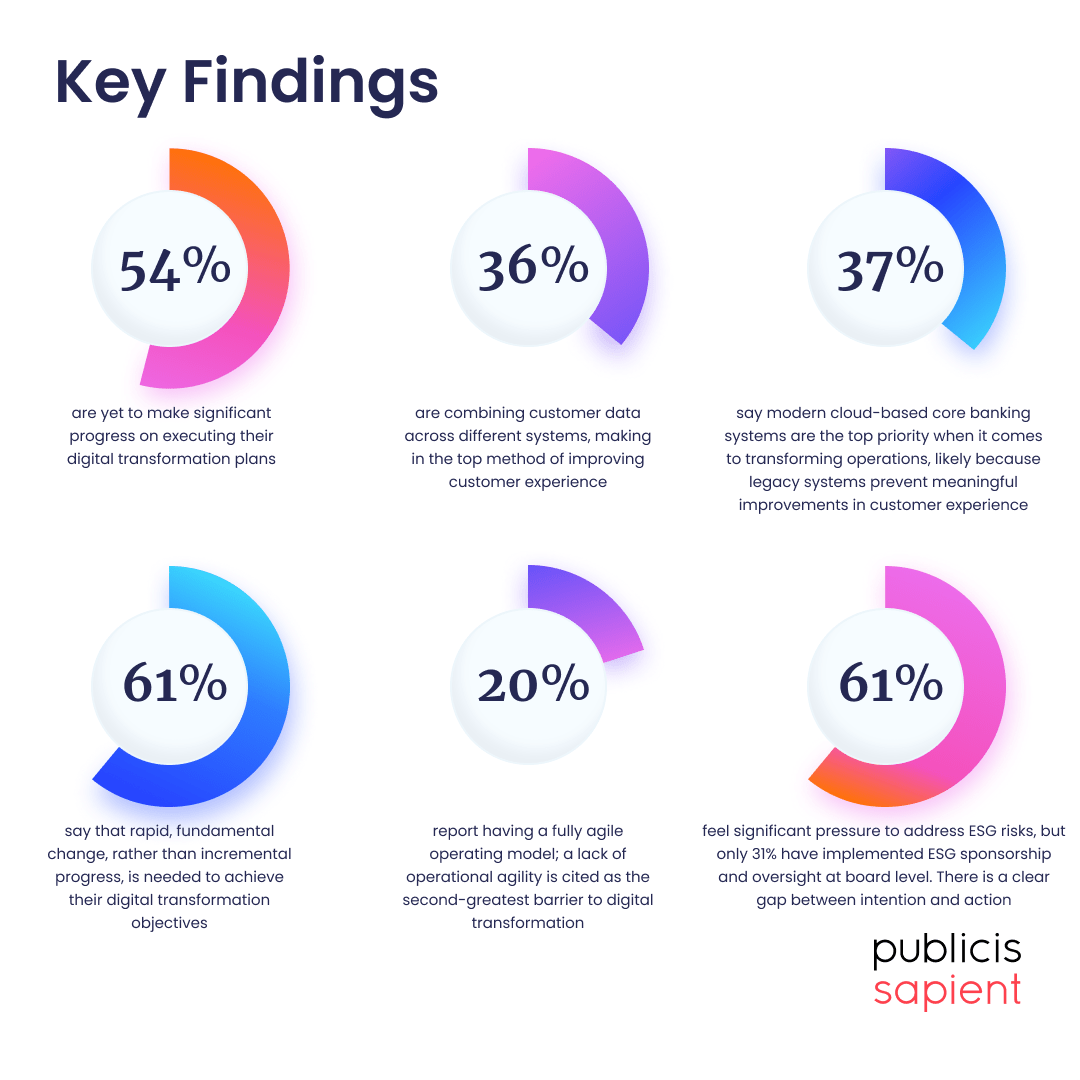

Leapfrogging legacy in financial services

Legacy systems continue to hold many FIs back, not because of a lack of ambition, but because transformation is often approached incrementally.

Kearney’s latest analysis shows how leading FIs are leapfrogging traditional modernization paths by rethinking operating models, technology stacks, and execution speed. Instead of gradual upgrades, they are prioritizing scalable platforms, modular architectures, and business led transformation.

The result is faster time to value, lower long term cost, and greater resilience in a market defined by constant change.

Source: https://www.kearney.com/industry/financial-services/article/leapfrogging-legacy

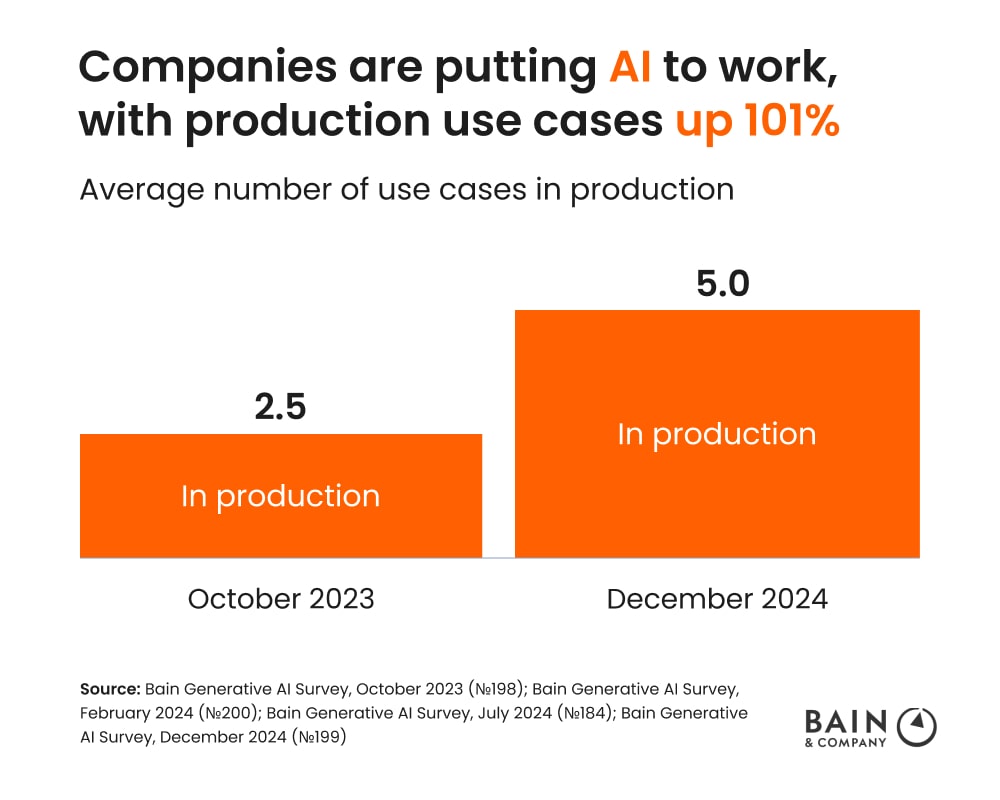

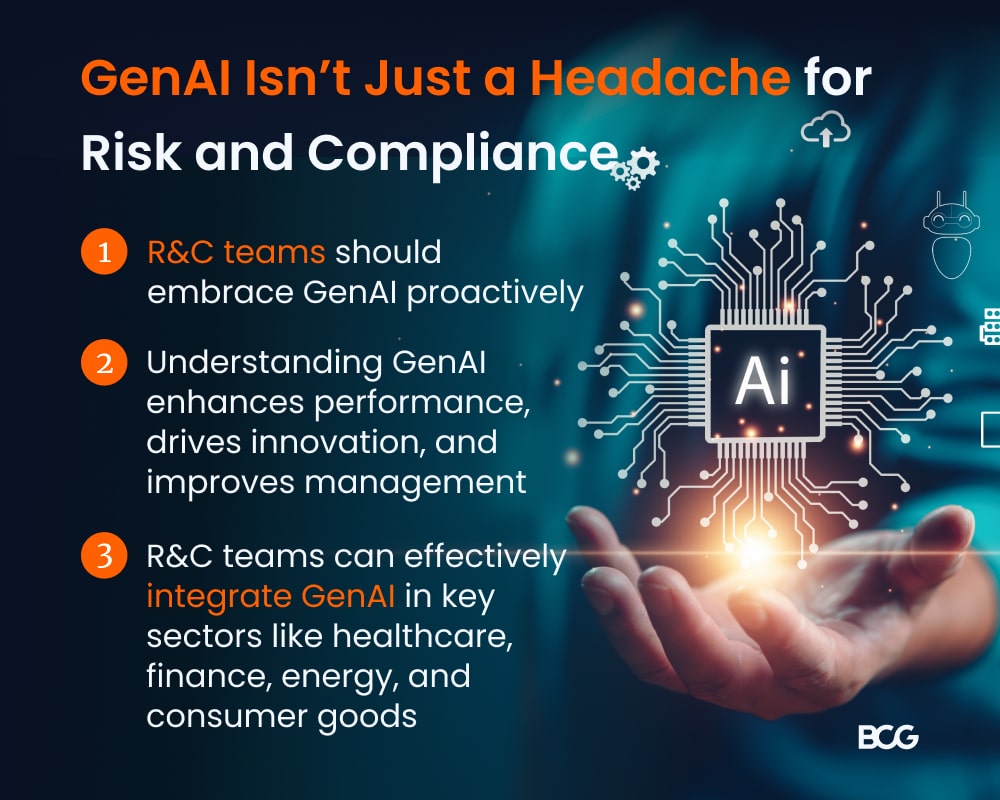

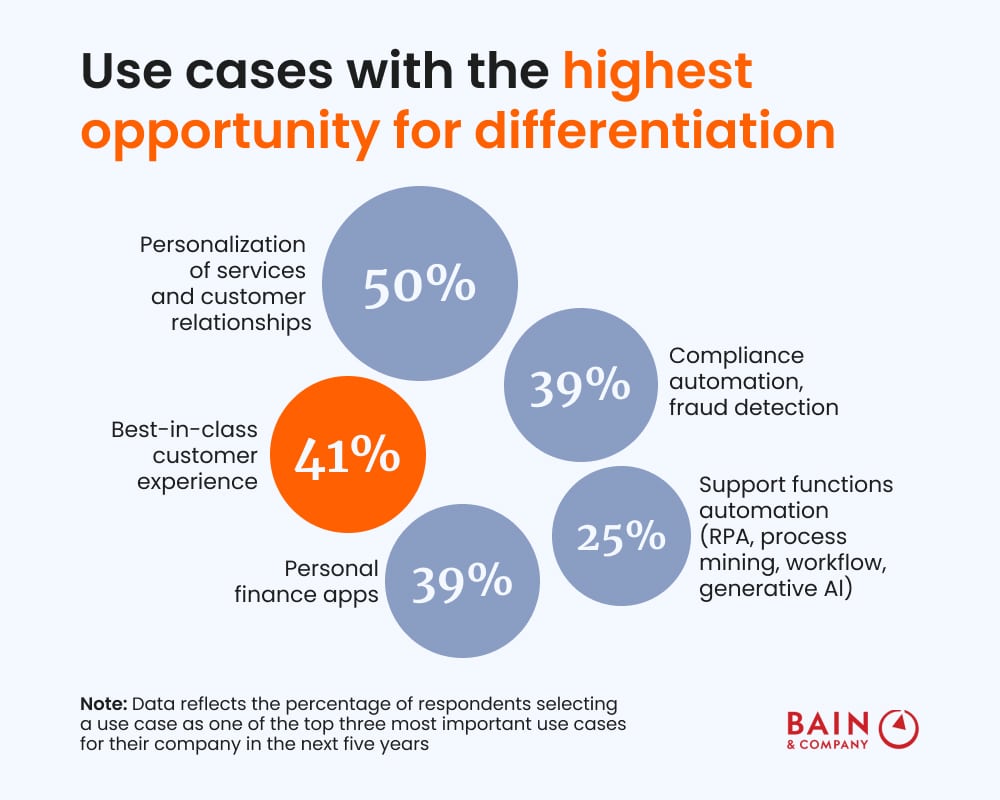

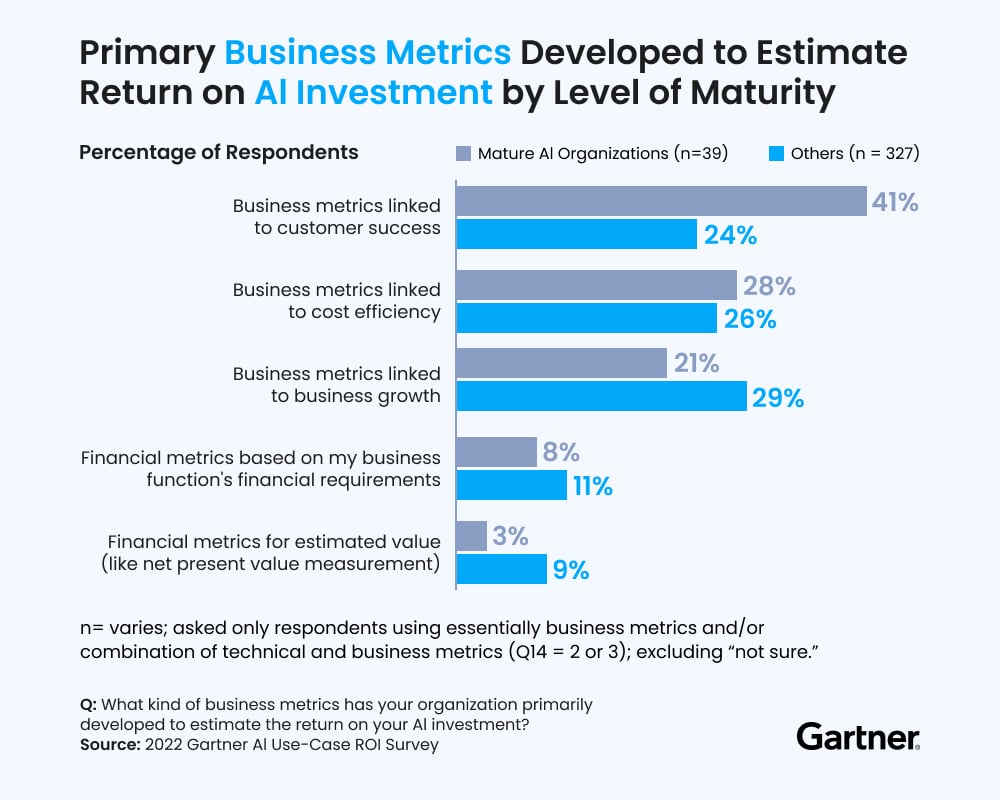

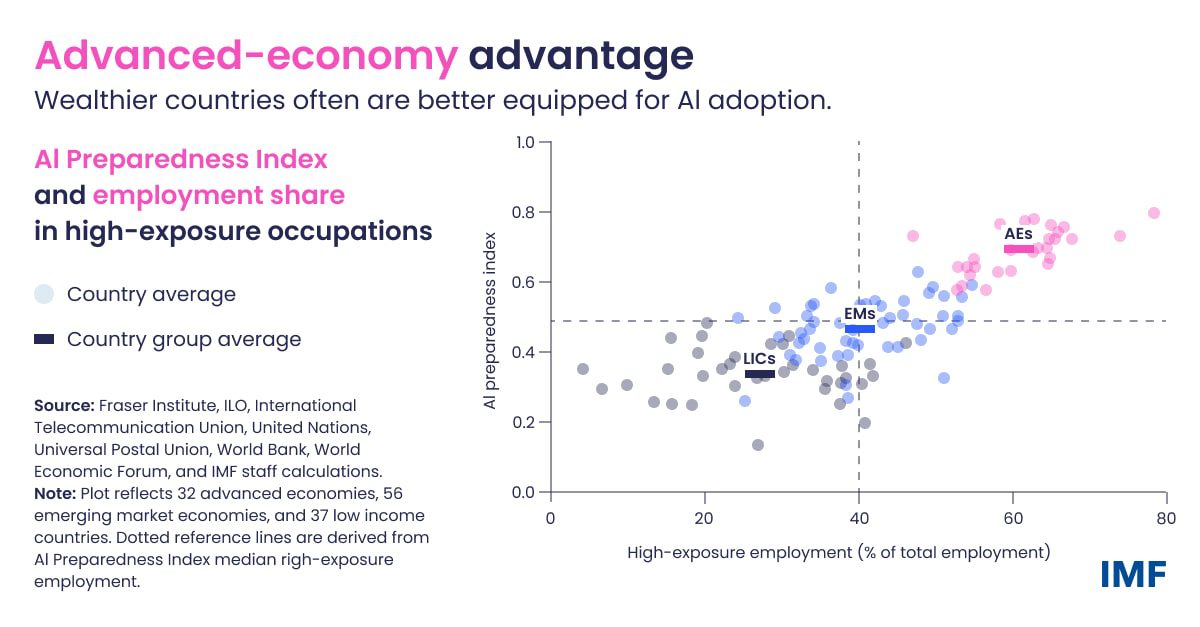

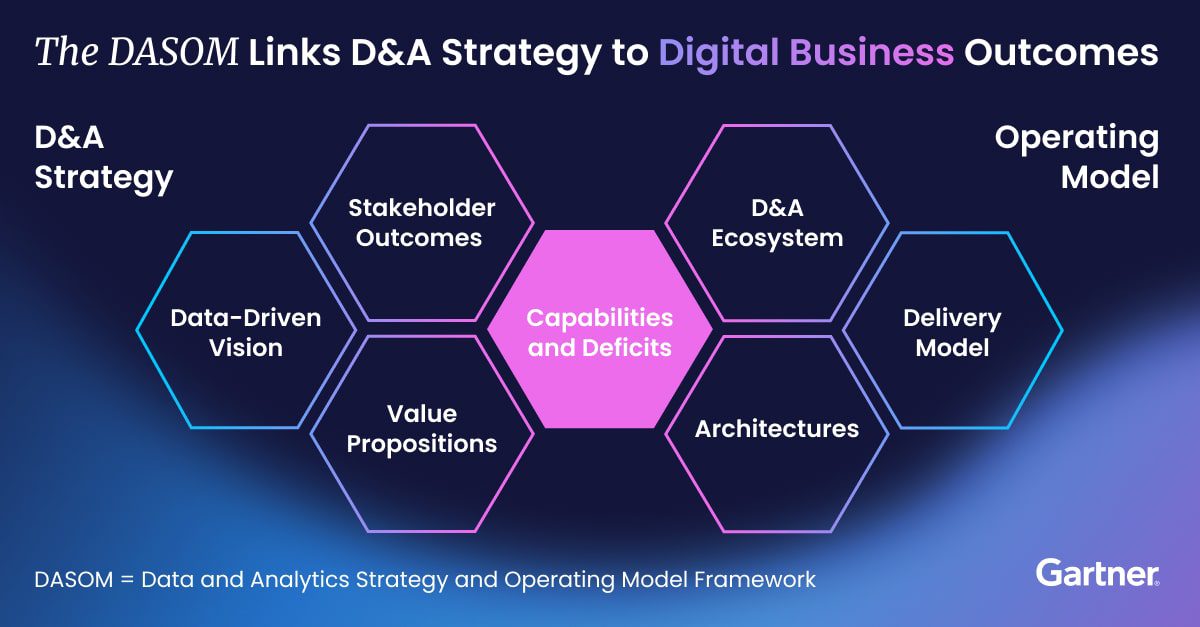

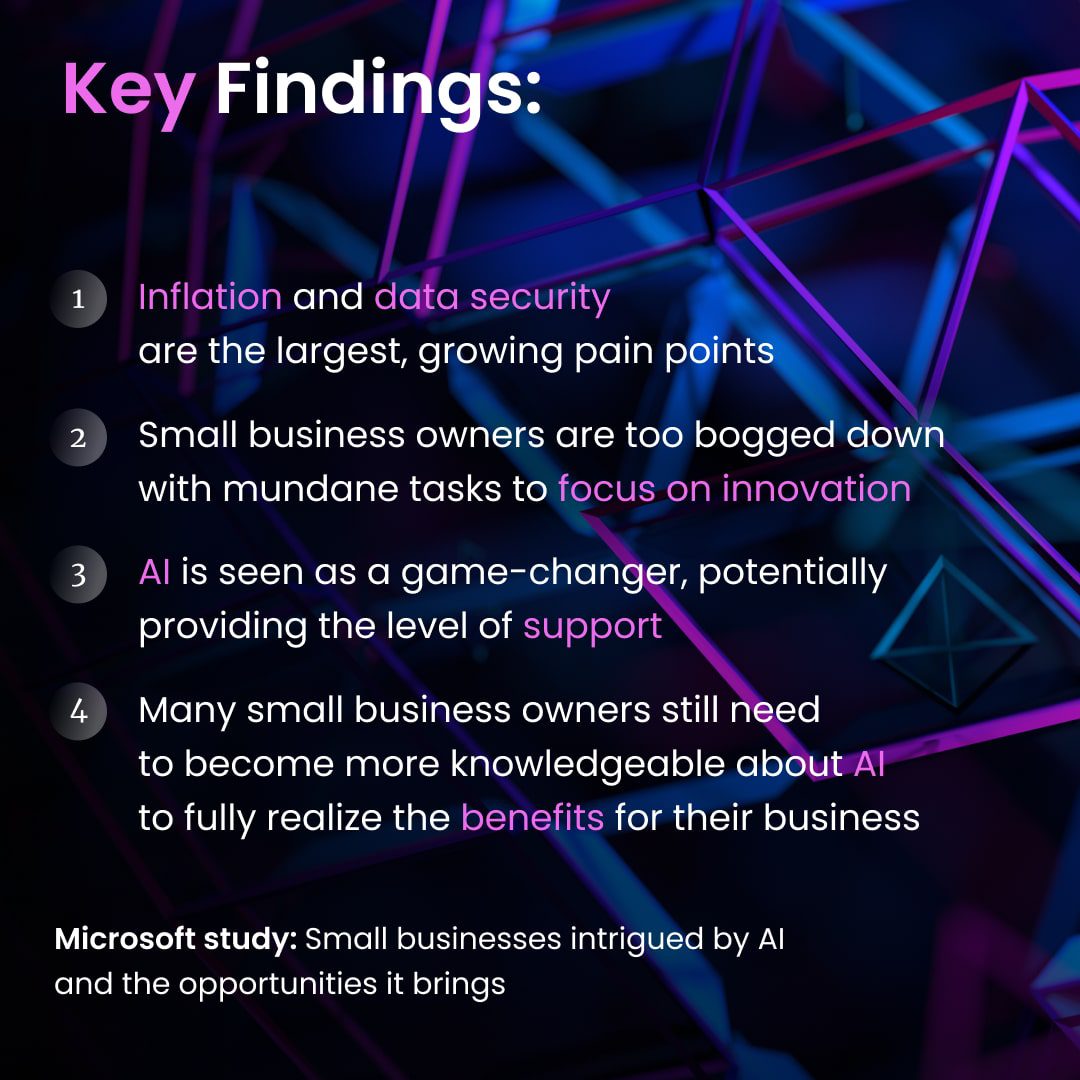

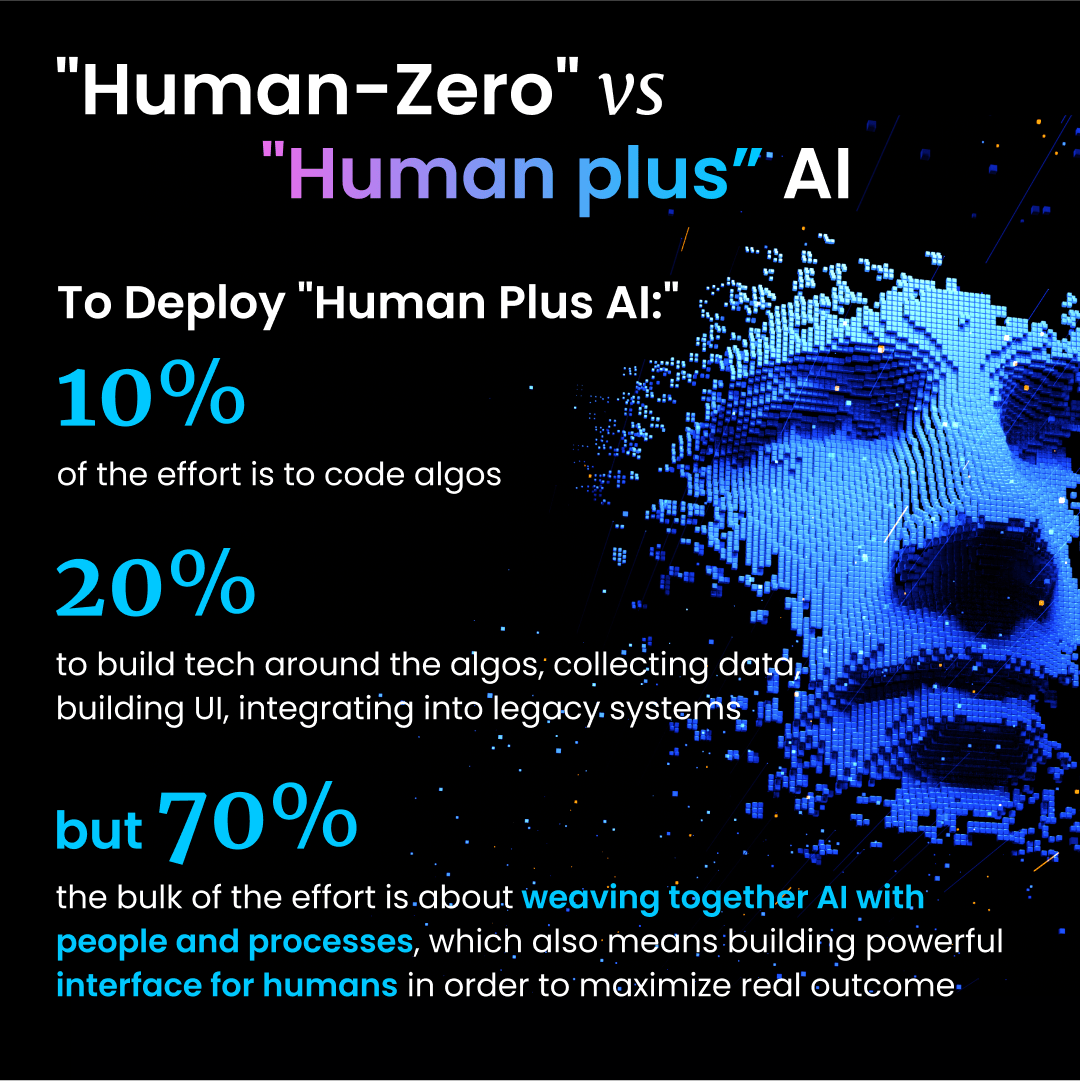

In financial services, AI value comes down to execution

Most FIs now have an AI strategy. Far fewer are seeing scaled impact.

Bain points to execution as the real differentiator. In banking and capital markets, legacy infrastructure, fragmented data, and regulatory demands often keep AI stuck in pilot mode. The firms making progress focus on a small number of high-value use cases and build governance, risk, and compliance into delivery from day one.

In financial services, AI advantage is not created by ambition alone. It is created by disciplined execution in production.

Source: https://www.bain.com/insights/the-gap-between-ai-strategy-and-reality-is-execution/

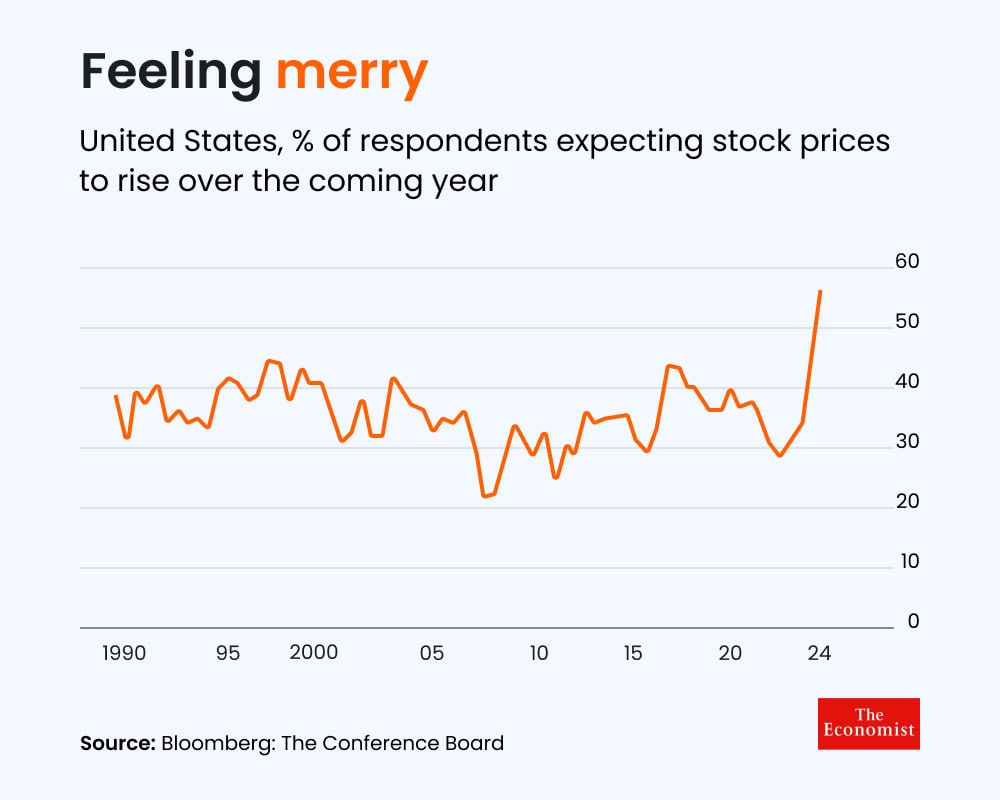

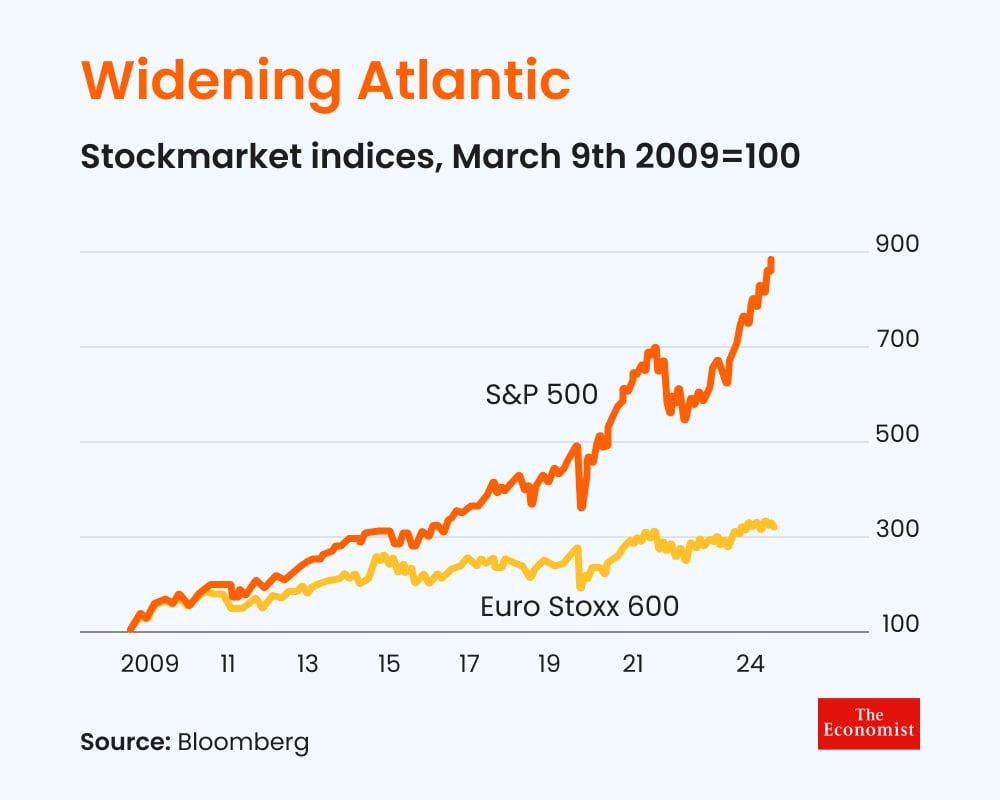

A bullish start to 2026, with fewer fears of a market shock

Optimism is high as we enter 2026.

Global equity valuations are elevated, particularly in US tech. Surveys show steady gains with minimal market shock fears.

What’s notable? High valuations reflect confidence in corporate earnings growth rather than speculation.

The key question now: Can fundamentals meet expectations? Discipline and a long-term view may be crucial for investors.

Feel good Sunday: Small habits, big mental shifts

What if rewiring your brain did not require a massive life overhaul, but a simple daily practice?

In his TED Talk, Timm Chiusano explores how consistent reflection can reshape the way we think, learn, and show up each day. The idea is simple, yet powerful: progress often comes from noticing patterns, not chasing perfection.

Curiosity starts with paying attention to what we experience and how it shapes us over time.

Source: https://www.ted.com/talks/timm_chiusano_the_daily_practice_that_could_rewire_your_brain

Curious Saturday: What happens when we let nature lead

In her TED Talk, Isabella Tree shares a hopeful reminder that restoring nature does not always require complex solutions. Sometimes, the most powerful change begins by stepping back and allowing natural systems to recover on their own.

Through rewilding, she shows how patience, trust, and humility can transform landscapes, strengthen biodiversity, and reconnect people with the living world around them. The lesson extends beyond ecology. Growth often comes not from control, but from creating the right conditions and letting progress unfold.

A thoughtful message for the end of the week and a quiet reminder that resilience can be beautifully wild.

Source: https://www.ted.com/talks/isabella_tree_3_tips_to_make_your_world_beautifully_wild_nov_2025

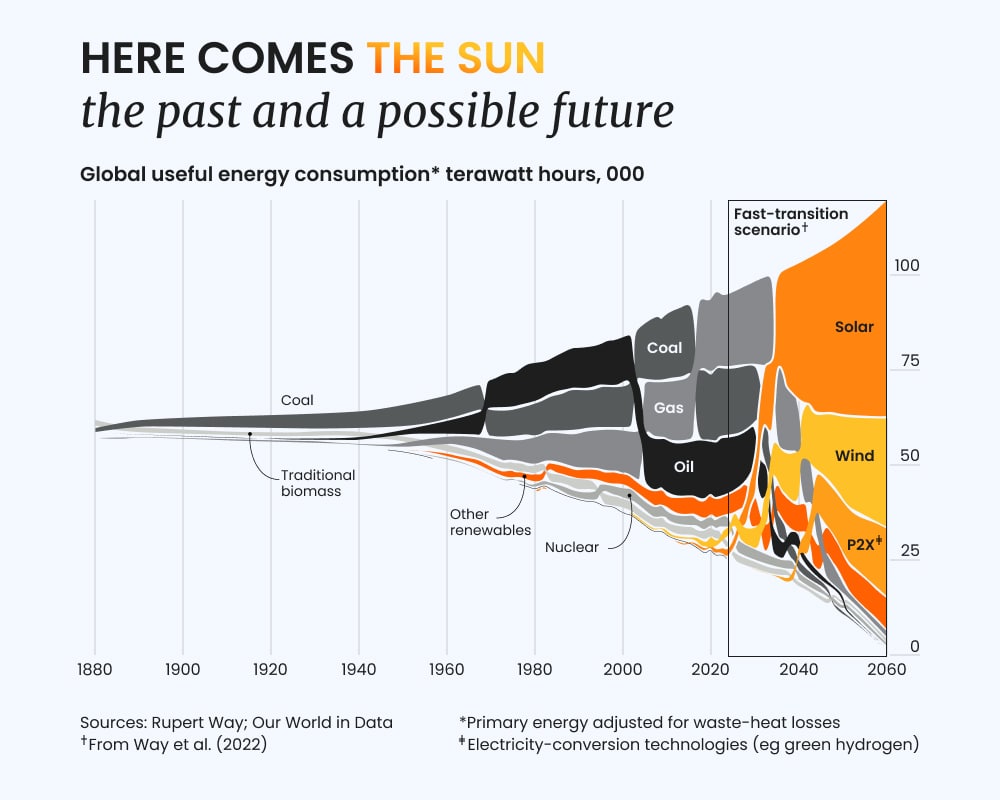

Climate progress at risk despite clean energy boom

In 2025, clean energy investment grew, but climate policy faced major setbacks.

U.S. regulatory rollbacks impacted global commitments, creating uncertainty for businesses amid critical temperature warnings from scientists.

As the FT notes, future success relies more on political will than technology. Consistency and leadership are vital for real climate progress.

Source: https://www.ft.com/content/b5e8d5ab-21cf-4b9b-98c7-4e236b95bb78

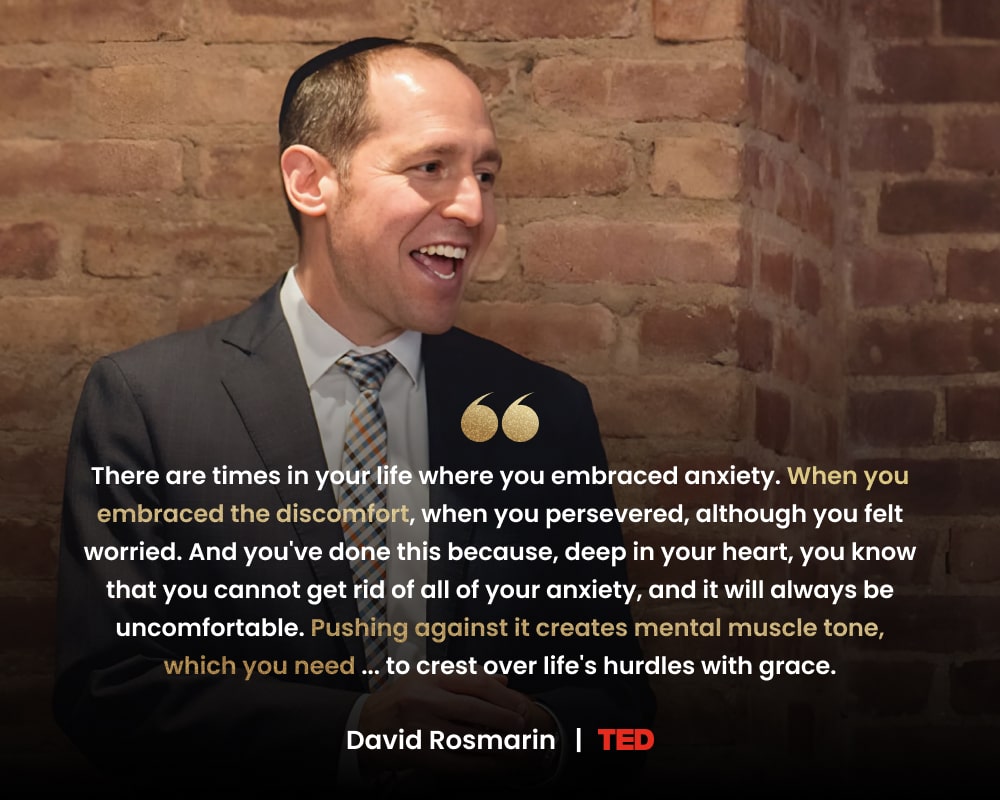

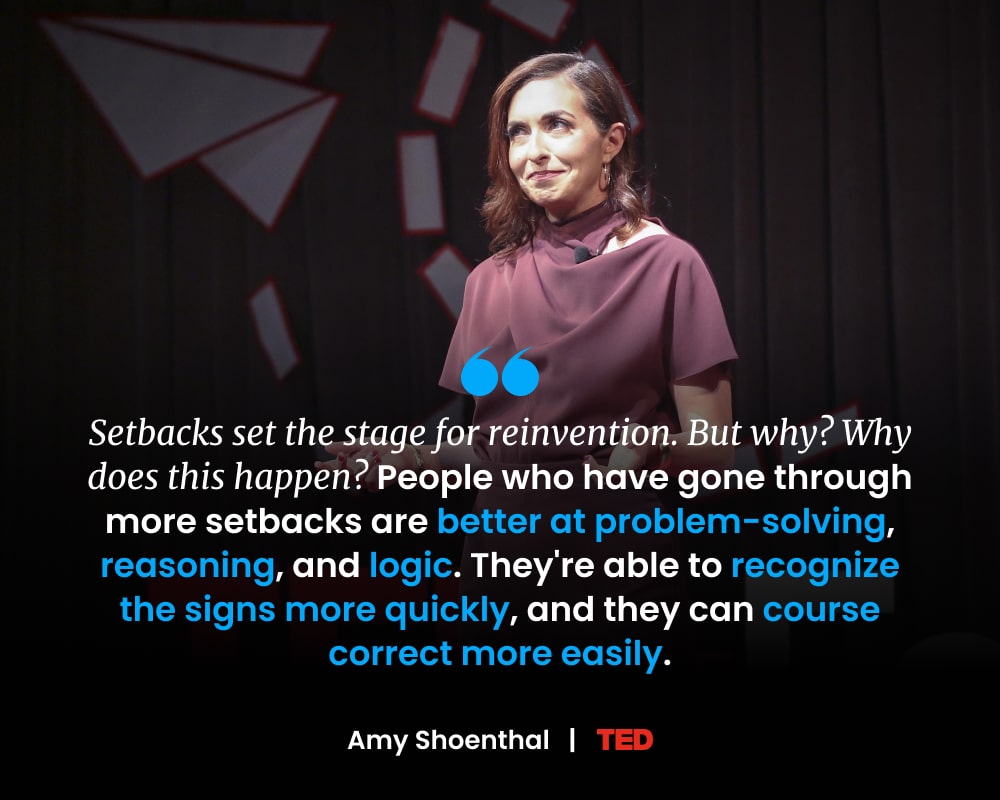

Strength is built in the stretch

Growth often feels uncomfortable because it requires change. The moments that test patience and resolve are often the ones that shape long term success.

Resilience is built by staying committed through uncertainty.

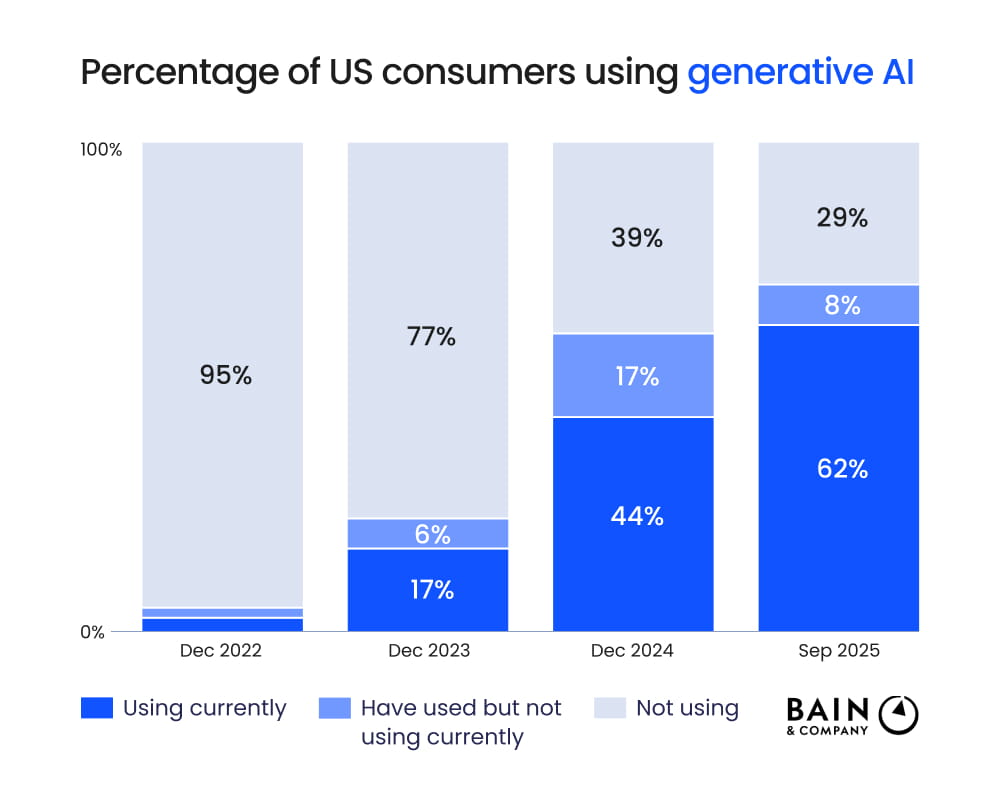

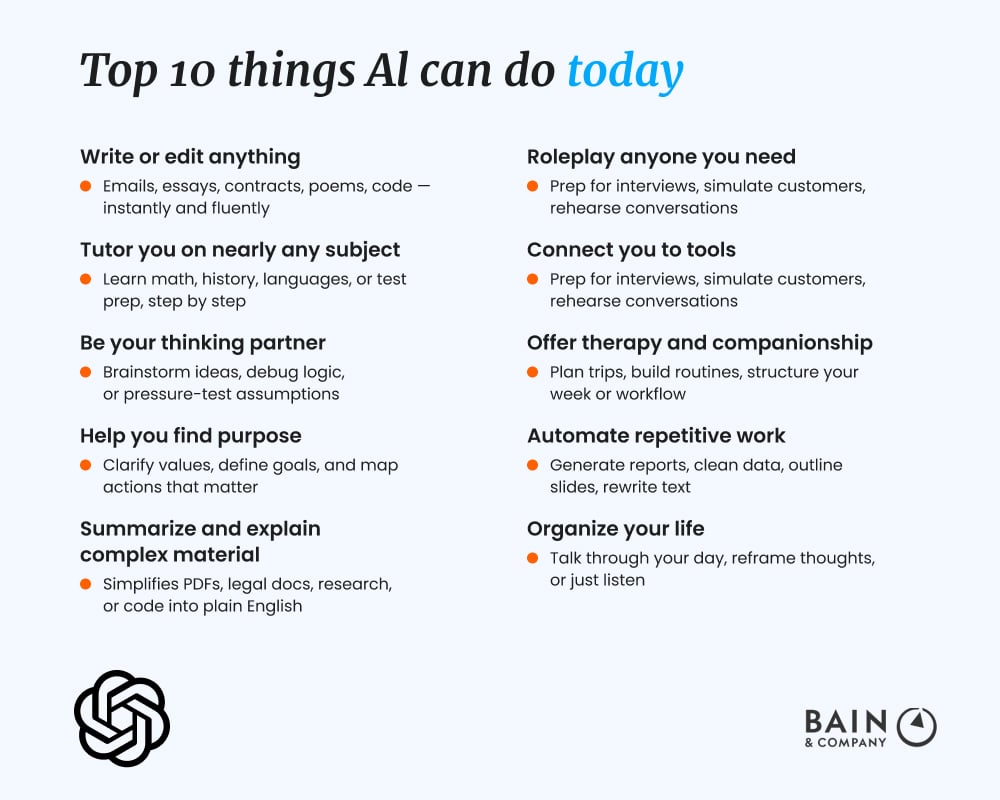

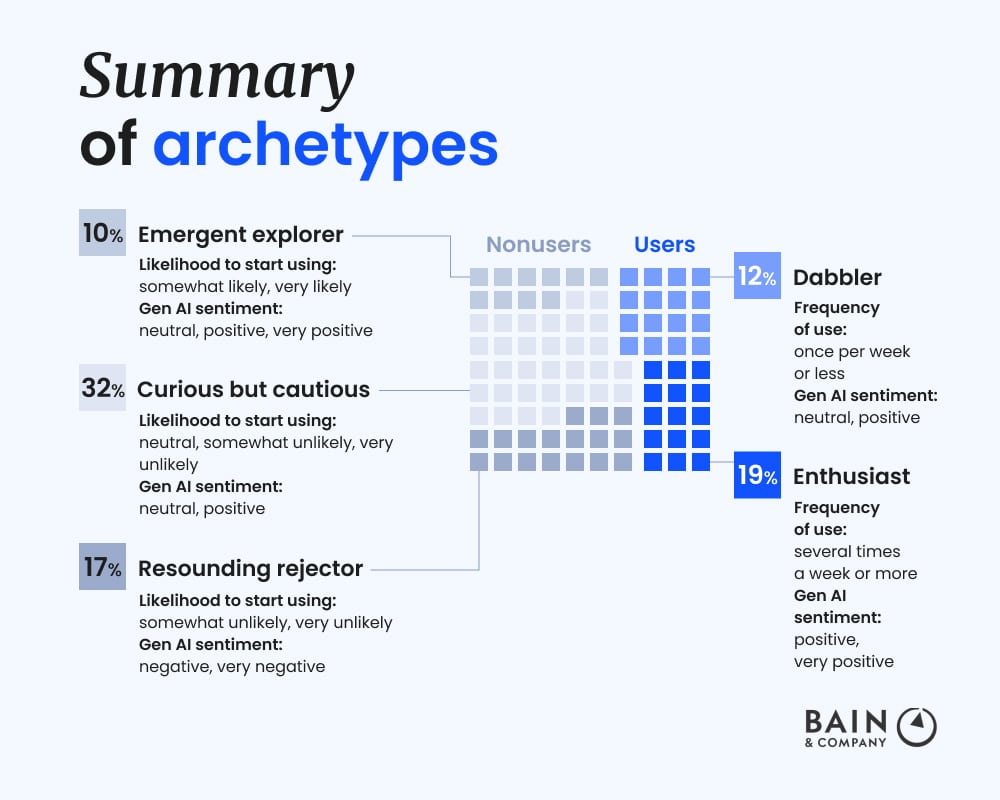

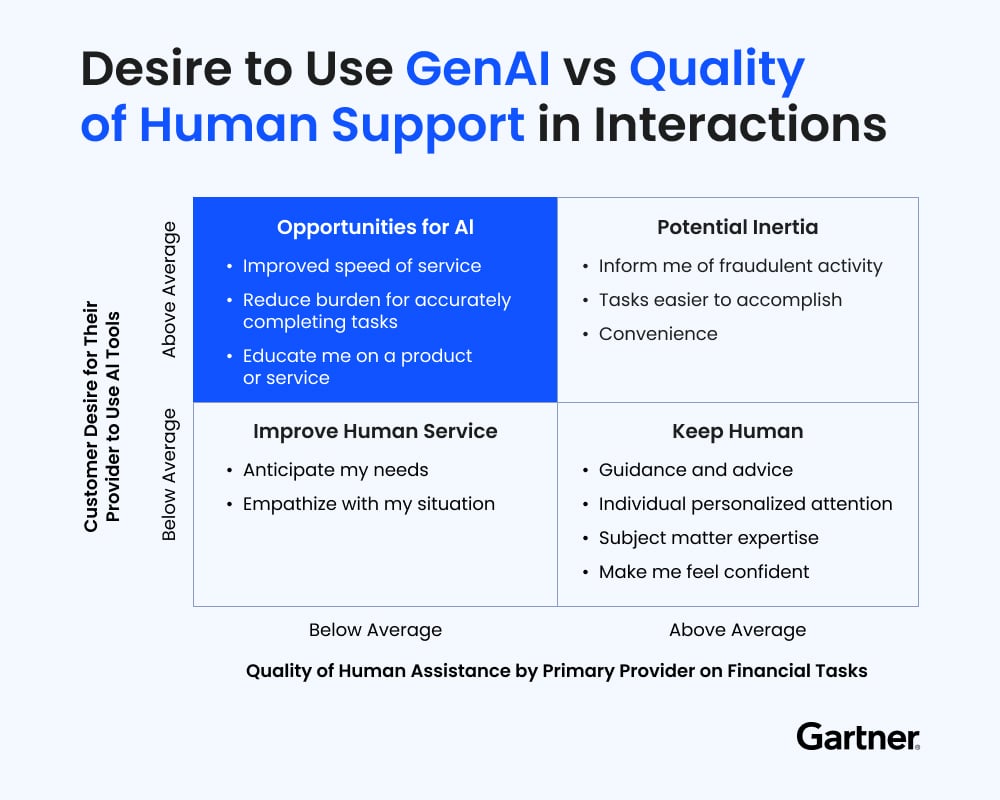

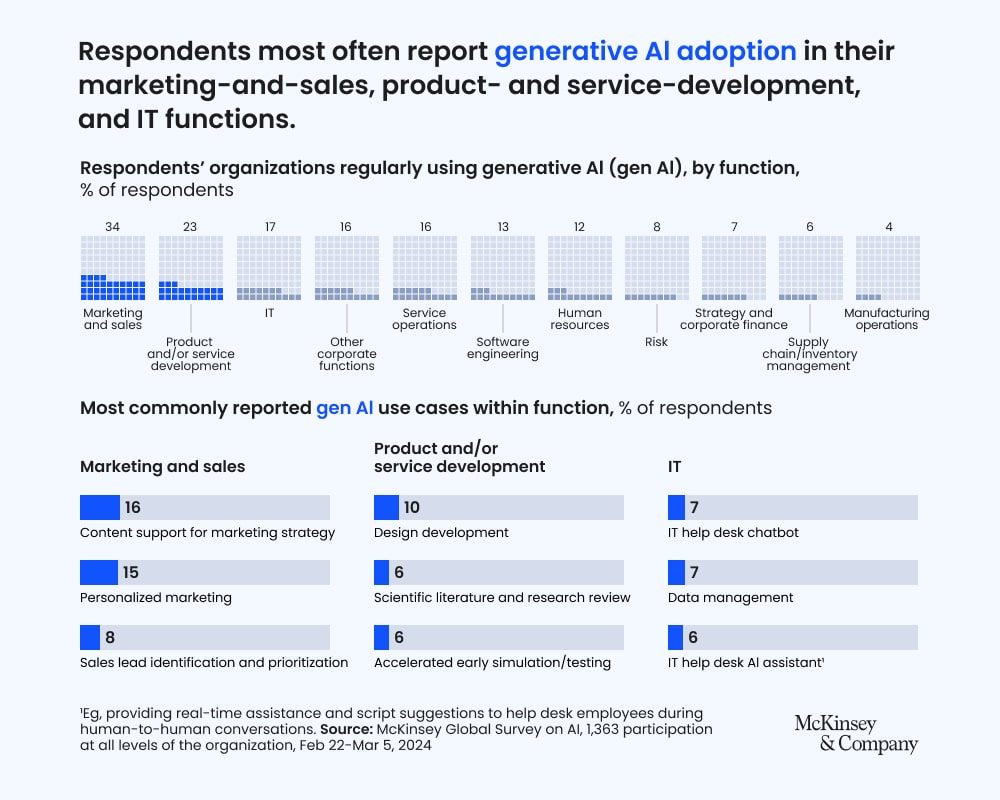

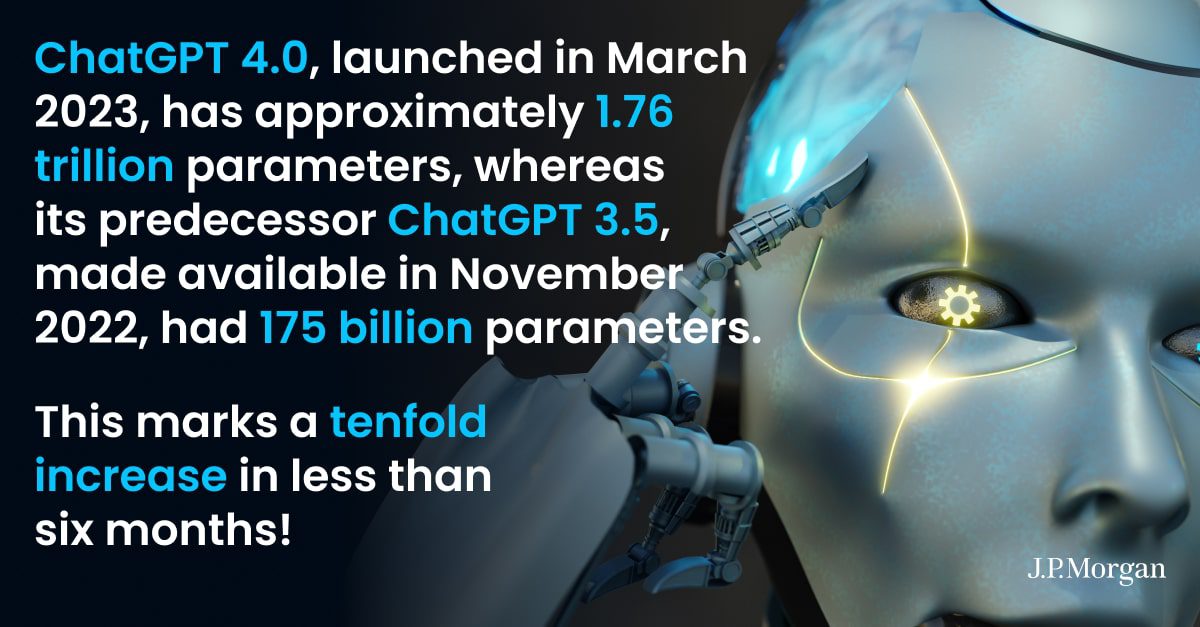

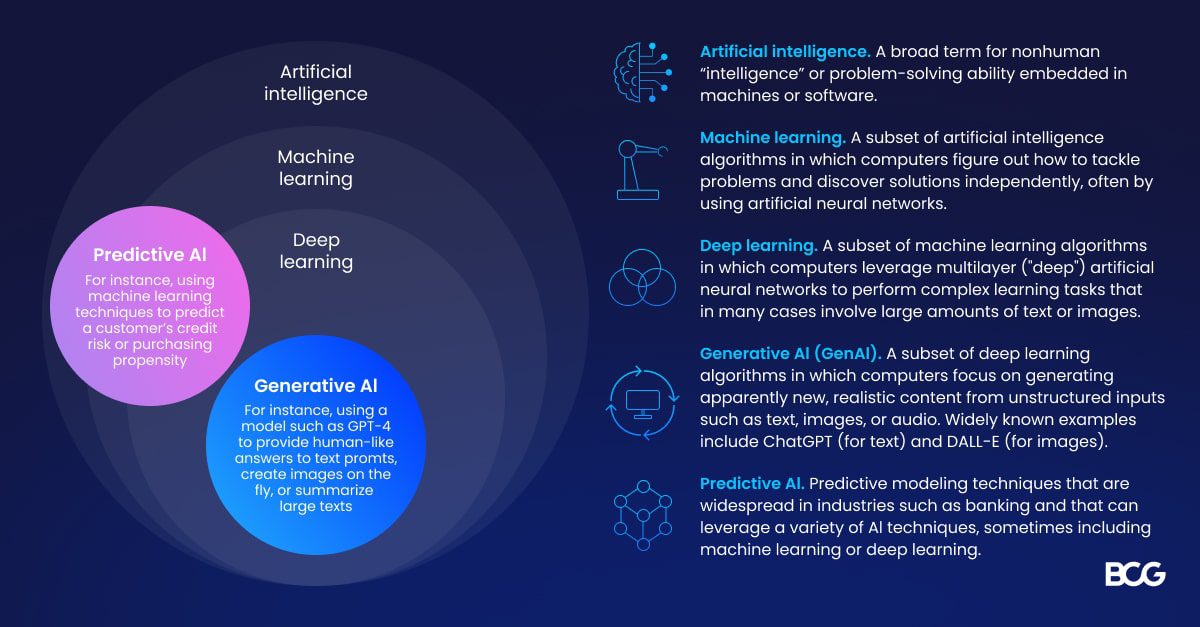

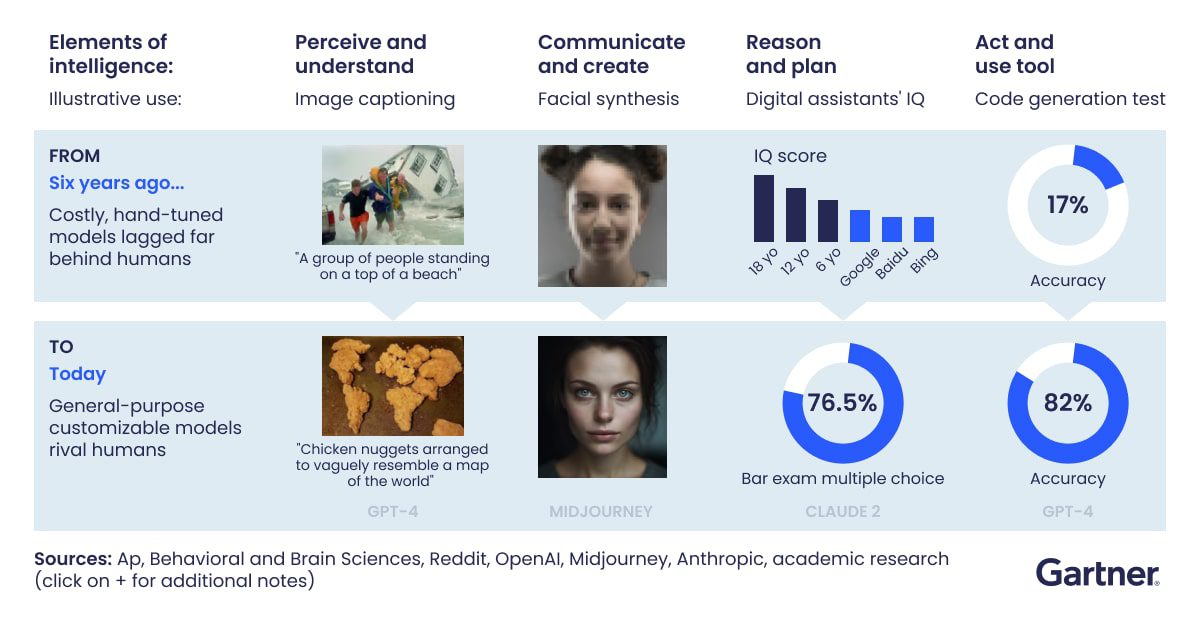

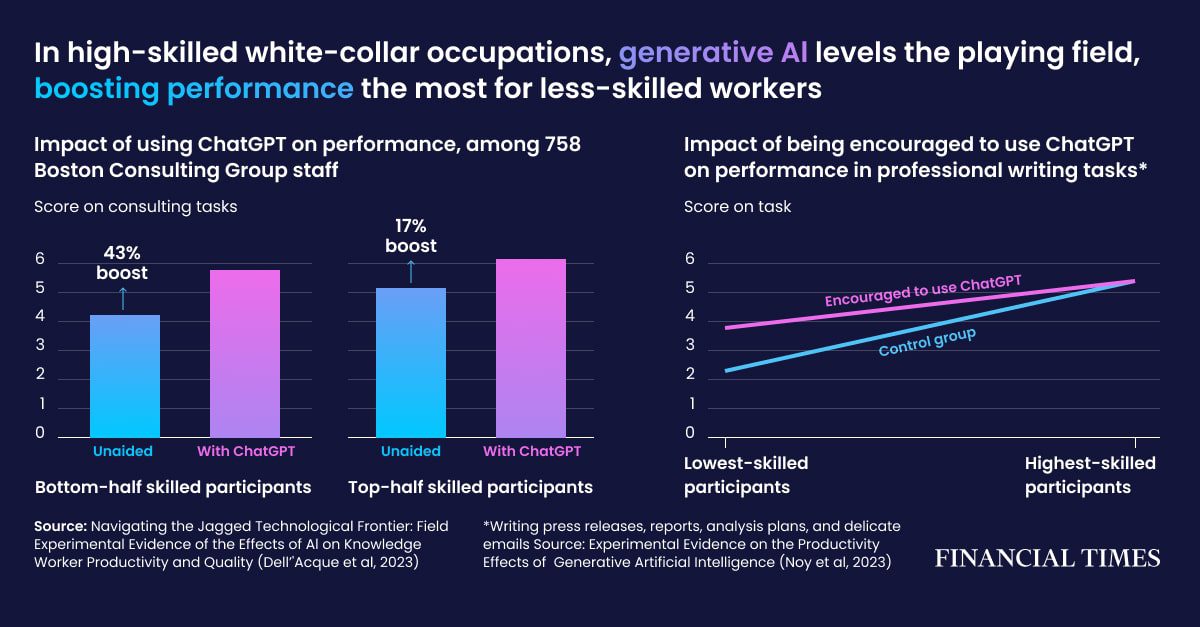

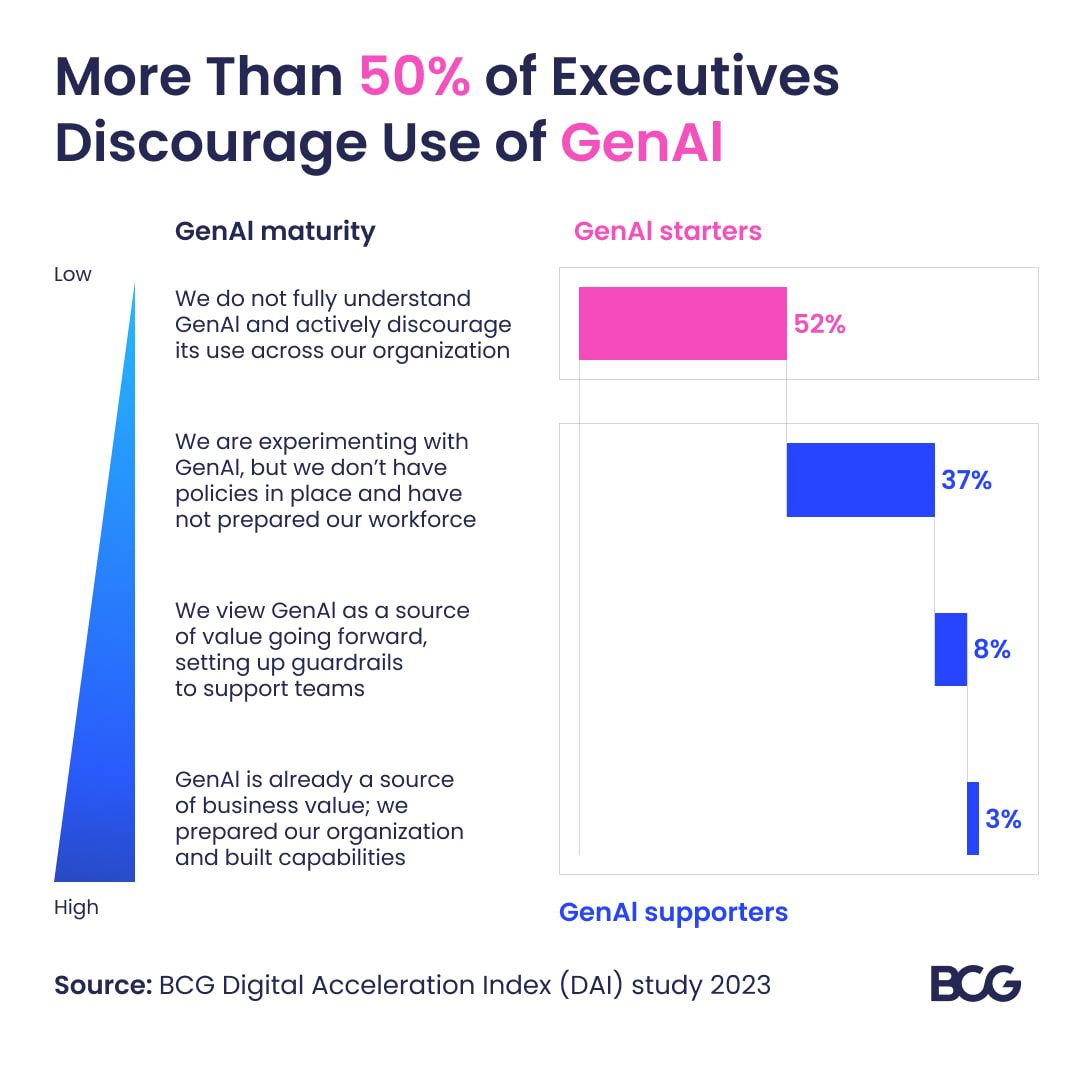

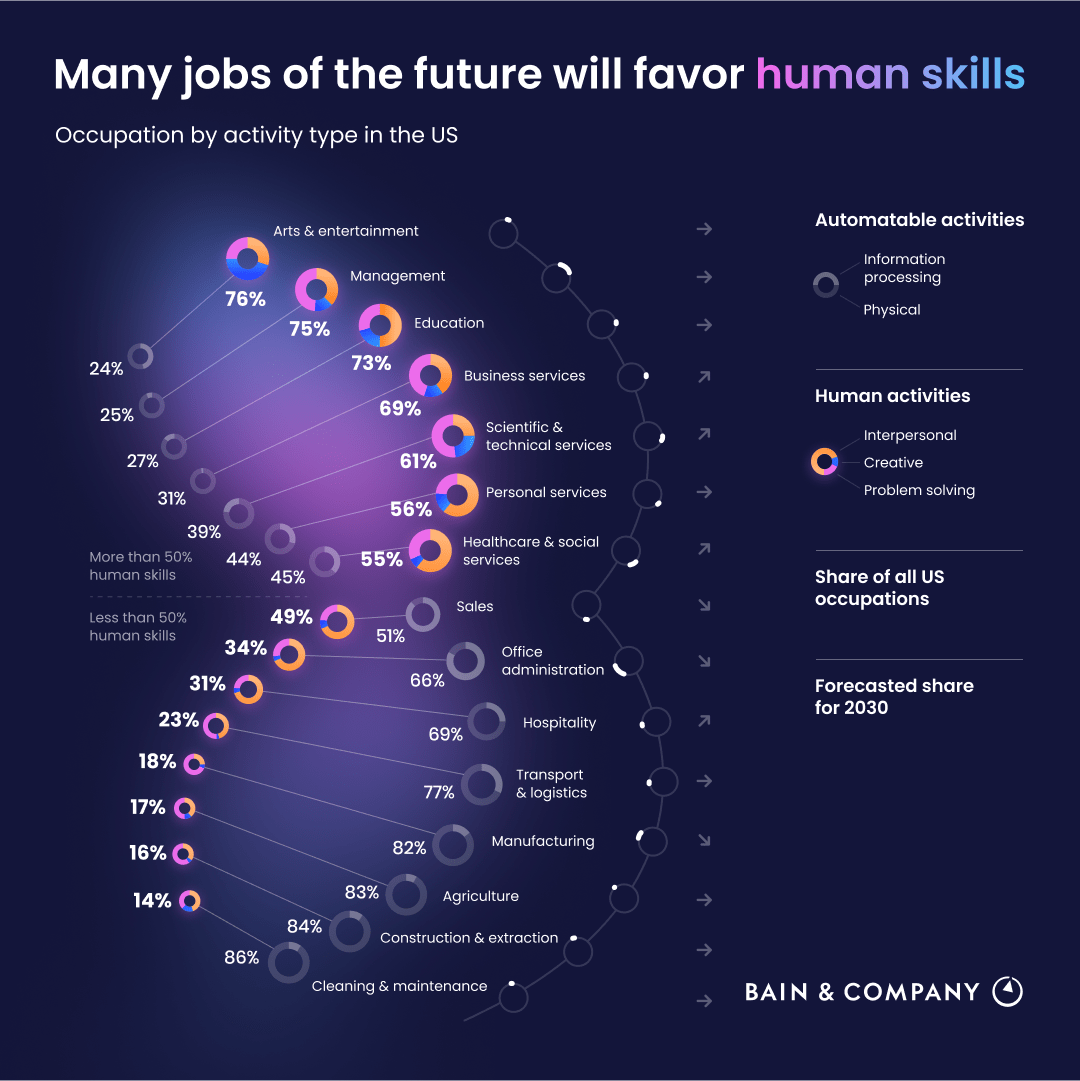

How US consumers are adopting Gen-AI

GenAI is no longer a future concept for consumers. New data from Bain shows rapid adoption across everyday use cases, signaling a clear shift in how people interact with technology.

As usage expands, expectations around speed, personalization, and trust continue to rise. For businesses, the takeaway is clear. Consumer behavior is moving faster than most operating models.

Understanding how people are actually using AI is becoming just as important as building it.

Source: https://www.bain.com/insights/how-us-consumers-are-adopting-generative-ai-snap-chart/

Empowering smarter decisions with Loquat IQ

The future of analytics is not about dashboards alone. It is about empowering every user to think strategically.

Loquat IQ transforms how FIs engage with their data, helping teams move beyond metrics toward analysis that drives real outcomes.

That is how insight becomes impact.

Loquat

Looking ahead to 2026

America’s economic outlook is turning more optimistic as 2026 approaches. According to The Economist, a rare alignment of fiscal and monetary forces could lift growth beyond recent expectations.

Tax refunds from the One Big Beautiful Bill Act, renewed government spending after last year’s shutdown, and looser financial conditions are all set to flow through the economy. Add potential tariff rollbacks and further rate cuts, and the result could be a meaningful acceleration in GDP after a softer 2025.

The key question is sustainability. Stronger growth may test inflation control and long term fiscal credibility. Still, with no immediate global shock on the horizon, the balance of risks is shifting from slowdown to upside surprise.

For leaders and institutions, 2026 may demand readiness not for restraint, but for momentum.

Source: https://www.economist.com/finance-and-economics/2025/12/30/americas-economy-looks-set-to-accelerate

Feel good Sunday: Wisdom for a planet in crisis

In times of climate anxiety and global uncertainty, Tariq Al-Olaimy offers a grounding reminder: the solutions we need are not only technical — they are human.

Drawing on spiritual wisdom, he reframes our relationship with the planet as one rooted in stewardship, humility, and care, not dominance or extraction. The message is hopeful: when we shift how we see our role in the world, we unlock a deeper sense of responsibility and possibility.

A thoughtful pause for the end of the week, and a reminder that meaningful change often begins with how we choose to see, value, and care for what surrounds us.

Source: https://www.ted.com/talks/tariq_al_olaimy_the_spiritual_wisdom_we_need_for_a_planet_in_crisis

Curious Saturday: The art of better negotiation

Most people think negotiation is about leverage, quick wins, or having the strongest position in the room. Kathryn Valentine challenges that idea showing that the most successful negotiators focus less on winning and more on understanding.

Her insight is simple but powerful: great negotiators listen deeply, ask better questions, and look for outcomes where both sides walk away stronger. Negotiation is not a battle — it’s a conversation designed to uncover what truly matters.

A good reminder that whether we’re navigating contracts, partnerships, or everyday decisions, curiosity is often our greatest advantage.

Source: https://www.ted.com/talks/kathryn_valentine_what_successful_negotiators_do_differently

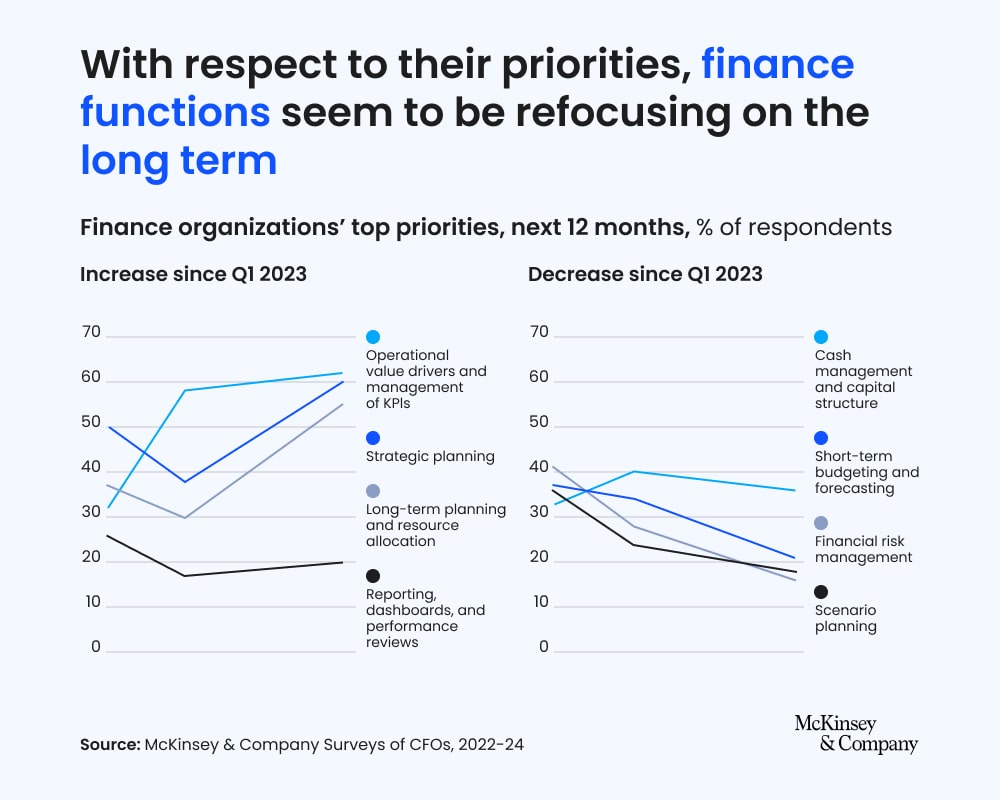

Energy transition: progress, but the hardest work is still ahead

The energy transition is moving — but not fast enough where it matters most. McKinsey’s latest take shows real progress in renewables and EVs, while the hardest physical challenges like hydrogen, carbon capture, and heavy industry continue to lag. Closing this gap will define whether climate goals remain aspirational or achievable.

The power of staying curious

Progress starts with curiosity. When we stay open to learning, we create space for innovation, growth, and smarter decisions — every step of the way.

Cheers to the New Year! 🎊

Here is to new beginnings, amazing achievements, and boundless creativity! 🌟 Let’s work together to make our beautiful planet a better place for all!

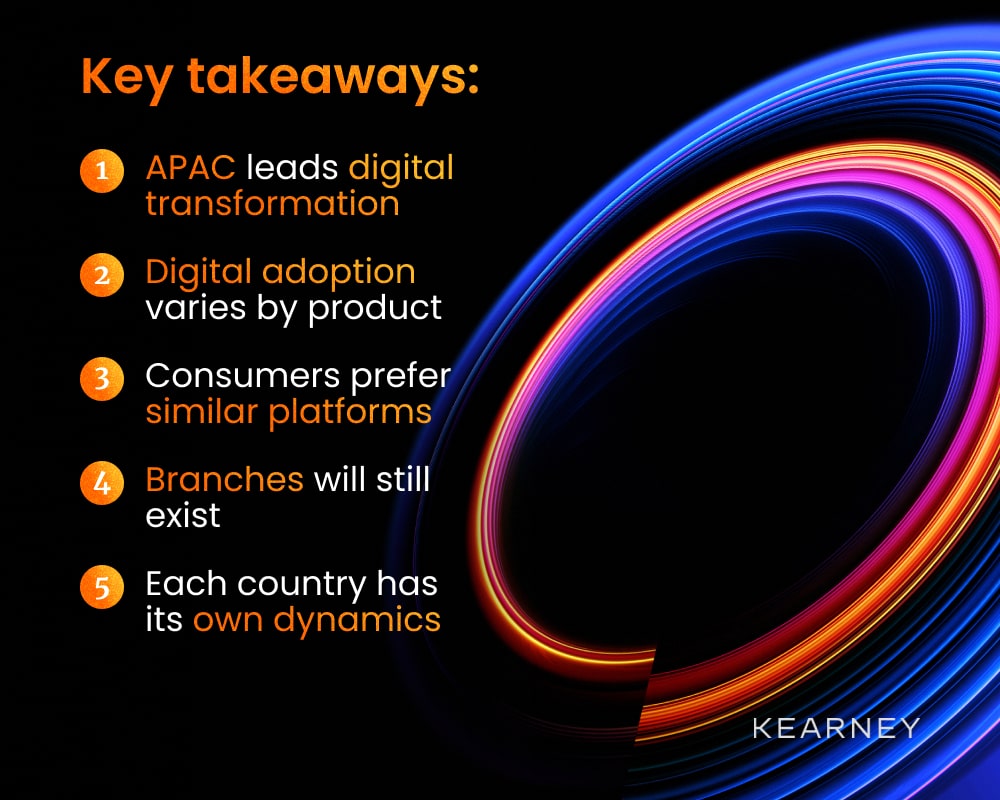

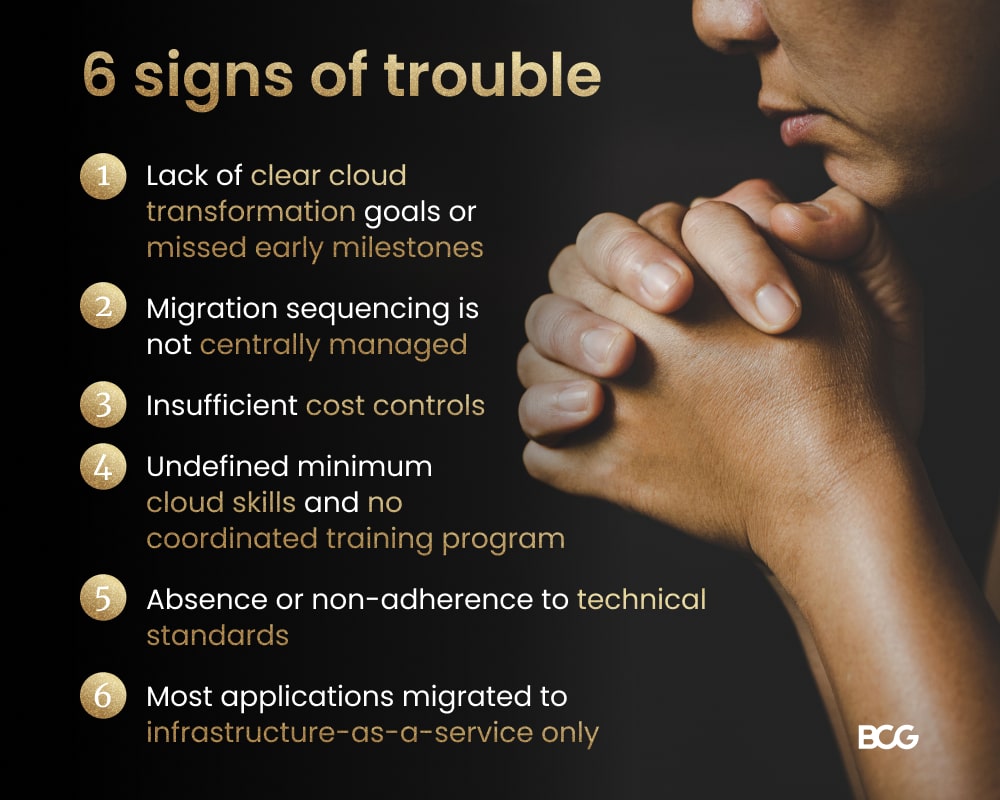

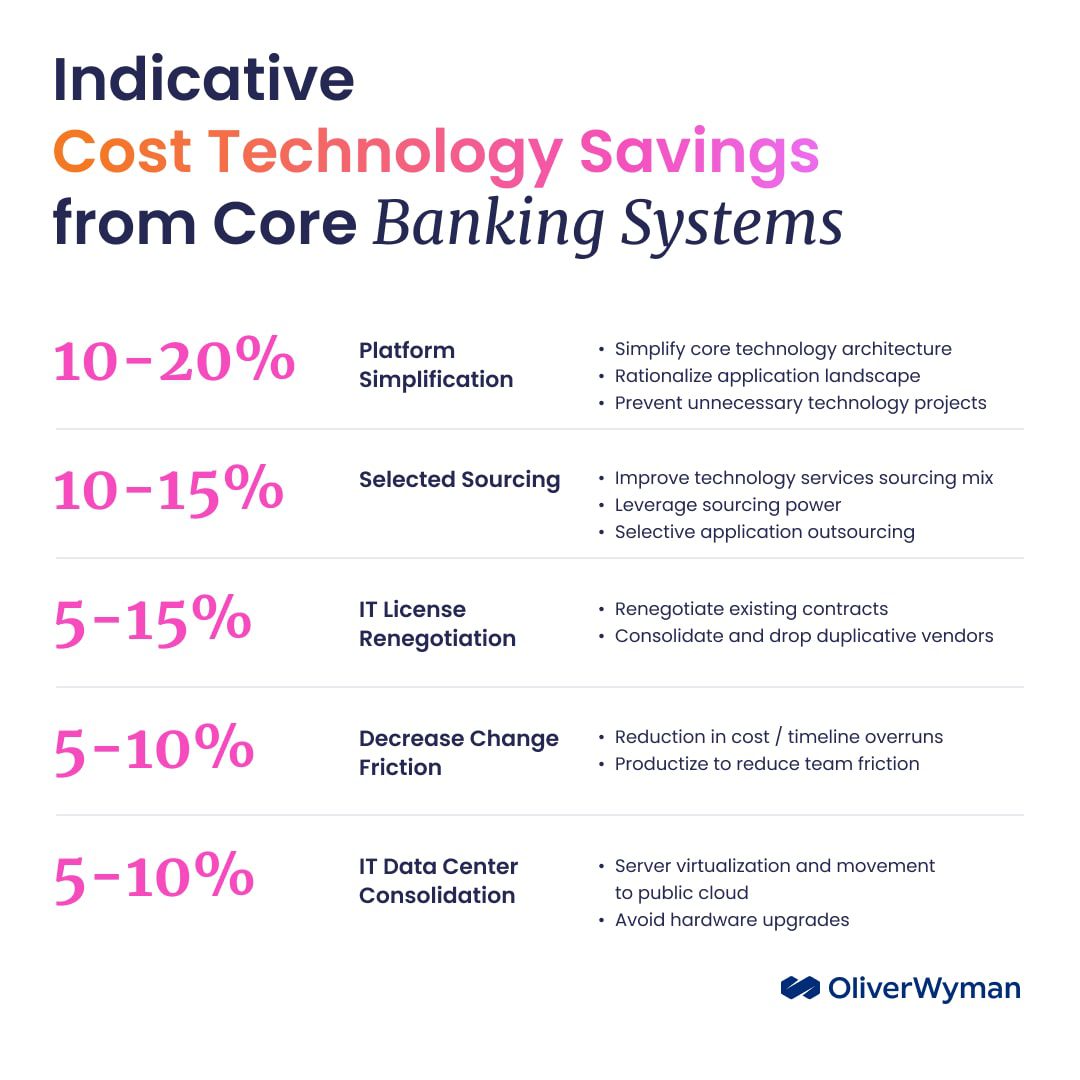

Leapfrogging legacy systems in financial services

For years, FIs have talked about modernizing core systems. Kearney’s latest perspective makes a sharper point: incremental upgrades are no longer enough.

Key takeaways for banks and credit unions:

- Legacy cores limit speed and innovation, especially as customer expectations continue to rise

- Modular, cloud-native architectures allow FIs to modernize in phases while reducing risk

- Business outcomes not technology upgrades should lead transformation decisions

- FIs that leapfrog can compress years of transformation into months, gaining real competitive advantage

The message is clear: modernization leaders are not just upgrading systems, they are changing how decisions get made, products launch, and value is delivered.

As competitive pressure increases, the real question is not if FIs modernize — it’s how fast they can move beyond legacy thinking.

Source: https://www.kearney.com/industry/financial-services/article/leapfrogging-legacy

US growth surges but the signals are mixed

The US economy grew at a 4.3% annualized rate in Q3 — far above expectations.

The headline number reflects a sharp rebound driven by:

- Consumer spending, particularly healthcare and computing

- Government defense outlays

- Exports, alongside falling imports that boosted net trade

But beneath the surface, the picture is more complex. Consumer confidence is weakening, business investment slowed, and economists warn the bar for sustained growth in Q4 is now extremely high — especially as shutdown effects and tariff dynamics filter through.

Source: https://www.ft.com/content/fea44f00-6e54-4bd0-b722-6b029ad4411c

Feel good Sunday: Redefining bravery, one leap at a time

We often think courage means being fearless. Michelle Khare’s TED Talk flips that idea on its head.

By attempting some of the world’s most dangerous stunts, she shows that bravery is not about the absence of fear — it is about learning how to move forward with it. Preparation, support, and self-trust turn fear from a stopping point into a teacher.

Her story is a powerful reminder that growth rarely happens in comfort. Sometimes, the biggest breakthroughs come when we choose to show up, take the leap, and discover what we are capable of on the other side.

A thoughtful message for a slower Sunday: fear does not disqualify you — it might be the very thing guiding you toward growth.

Source: https://www.ted.com/talks/michelle_khare_why_i_attempt_the_world_s_most_dangerous_stunts

Curious Saturday: Why conscious leadership rejects win-lose thinking

So much of how we are taught to think — in business and in life — is framed as win or lose. But what if that mindset is quietly holding us back?

In his TED Talk, John Mackey challenges the assumption that success must come at someone else’s expense. He argues that win-lose thinking narrows our perspective, fuels unnecessary conflict, and limits what organizations can achieve.

By shifting toward win-win and win-win-win thinking, leaders can unlock more creativity, trust, and long-term value — for customers, employees, partners, and society.

It’s a reminder that the most sustainable outcomes do not come from beating others — they come from creating shared value.

Source: https://www.ted.com/talks/john_mackey_the_trap_of_win_lose_thinking_and_how_to_escape_it

Another record-breaking year is not a coincidence

2025 is projected to be among the hottest years ever, likely ranking second or third globally. This trend of extreme global warming, driven by greenhouse gas emissions, brings serious consequences: record heat, rapid ice melt, and more frequent severe weather events.

These figures highlight the reality of climate change — unpredictable weather patterns, ecosystem disruptions, and heightened risks for communities worldwide. The urgency for enhanced mitigation and adaptation efforts has never been clearer if we aim to keep global warming in check.

Keep moving forward

Midweek momentum can fade — but Thursday is the perfect reminder that progress doesn’t have to be loud to be meaningful. Small steps, steady focus, and a clear sense of purpose can carry you further than you think. Whatever your goals look like today, take one action that brings you closer. Consistency compounds.

🎄 Merry Christmas! 🎄

As we celebrate this holiday season, we’re grateful for the relationships, collaboration, and trust that make our work meaningful throughout the year.

Wishing our clients, partners, and community a Christmas filled with warmth, rest, and time well spent with those who matter most. May the season bring renewed energy and inspiration as we look ahead to the year to come.

Happy Holidays from all of us. ✨

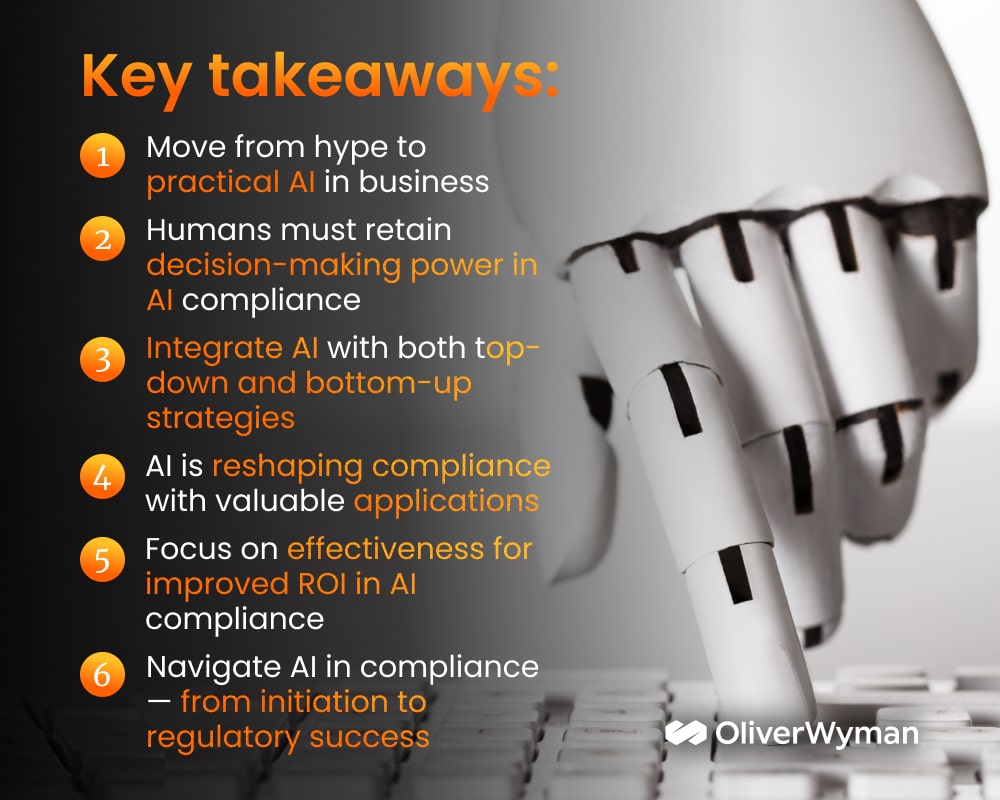

How banks turn AI ambition into measurable results

Many banks are no longer asking if they should use AI — they’re asking how to make it deliver real impact.

OliverWyman highlights a growing divide between institutions running isolated AI pilots and those pursuing active AI transformation — where leadership commitment, operating model redesign, and scaled execution turn AI into a performance driver.

Winning banks are embedding AI into core workflows, rethinking decision-making, and aligning talent, data, and governance around clear business outcomes. The result is not just efficiency — it’s faster growth, better risk management, and more resilient operating models.

For FIs , AI advantage will not come from experimentation alone. It will come from decisive execution at scale.

Happy Holidays from Loquat!

As the year comes to a close, we want to thank our partners, clients, and team members for the trust, collaboration, and shared momentum throughout the year.

We are proud of what we have built together and excited for what lies ahead.

Wishing you and your loved ones a joyful holiday season and a healthy, successful New Year.

Why investors may have to wait until 2026 for clarity

Investors are heading into year-end with an unusually cloudy view of the US economy.

After the longest government shutdown in US history disrupted key data collection, delayed jobs and inflation reports are offering directional signals — but little conviction. Even as the Fed cuts rates to a three-year low, policymakers remain divided on what matters more: a softening labor market or stubborn inflation.

With incomplete data and methodological distortions clouding recent readings, confidence may not return until fresh, uninterrupted data arrives in the new year. Until then, markets — and the Fed — are largely in wait-and-see mode.

In moments like this, uncertainty itself becomes the signal.

Source: https://www.ft.com/content/5ee82ed0-6bed-470a-84cc-9dfb3e44f897

Feel good Sunday: Flag football is changing the game in every sense

Troy Vincent Sr. reminds us why sports matter far beyond the scoreboard.

His TED Talk highlights the incredible rise of flag football — a movement built on accessibility, safety, teamwork, and community. It is a sport where everyone can play: every age, every ability, every background.

What’s most inspiring? Flag football is becoming a global connector. It builds confidence, teaches leadership, and creates opportunities for young people who may never have had access to organized sports before.

It is proof that when you expand the field of play, you expand what people believe is possible.

A beautiful reminder: inclusion does not weaken the game; it strengthens it.

Source: https://www.ted.com/talks/troy_vincent_sr_touchdown_the_flag_football_movement_is_here

Curious Saturday: AI Is finally reading what humans could not

What if some of our biggest scientific breakthroughs are already written down somewhere — just buried in notebooks, maps, and records too vast for humans to process?

In her fascinating TED Talk, Sara Beery reveals how AI is uncovering scientific knowledge that’s been hidden for centuries. By digitizing and analyzing old field notes, museum records, and ecological observations, AI can spot patterns that were impossible to see before — from biodiversity collapse to long-term climate impacts.

The takeaway: AI is not replacing scientists — it’s giving them superpowers. It helps us connect dots across time, scale insights globally, and surface knowledge we did not even know we had.

Source: https://www.ted.com/talks/sara_beery_how_ai_is_unearthing_hidden_scientific_knowledge

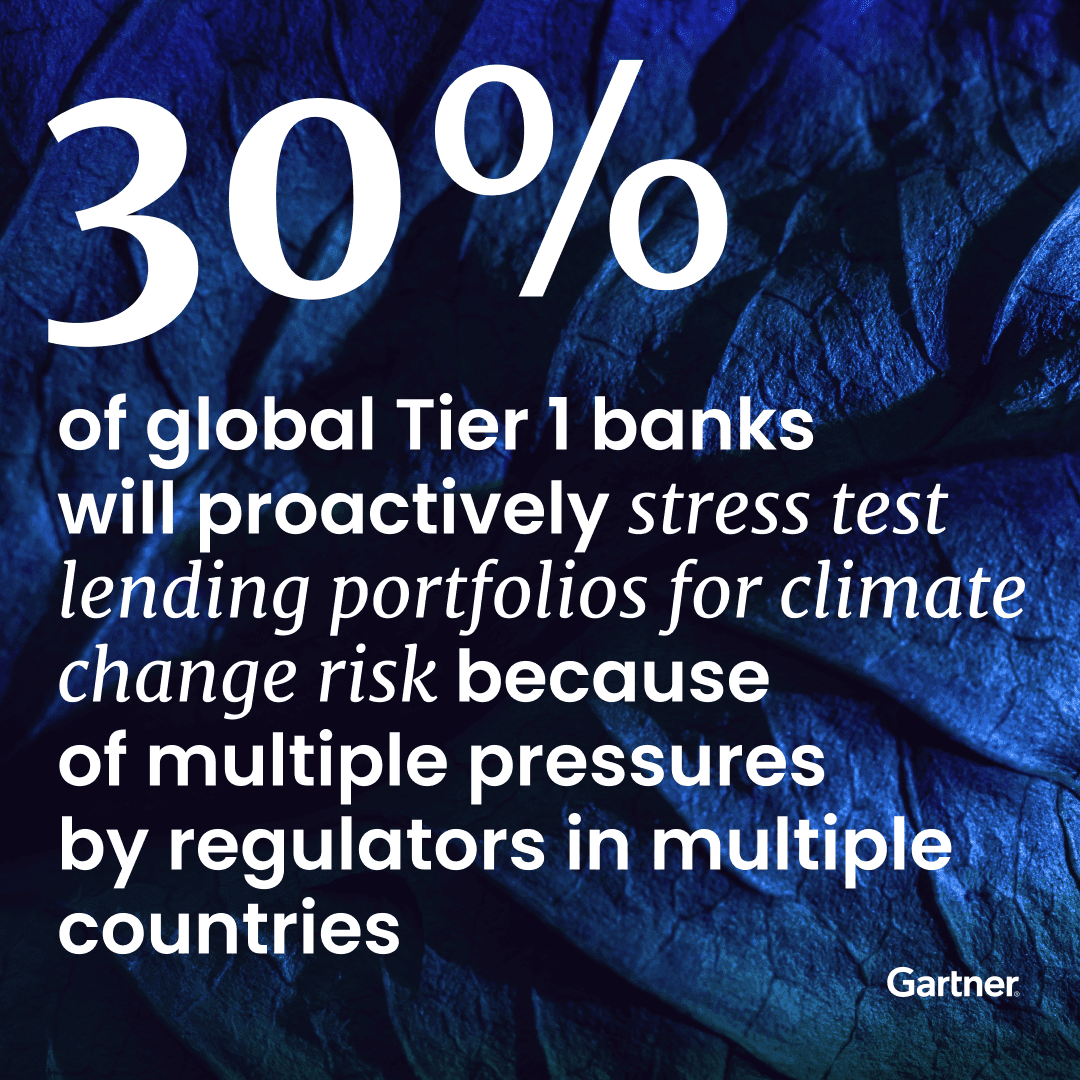

Why climate change could reshape global financial stability

Climate risk is no longer a distant threat — it’s becoming a financial accelerant. According to new BCG analysis, even small increases in global warming can push markets, insurers, and entire economies past nonlinear tipping points, creating abrupt shifts in asset values and balance-sheet exposure.

For FIs , the implications are clear:

- Physical and transition risks will increasingly interact, amplifying shocks

- Traditional models that assume smooth, gradual change are now dangerously outdated

- The real vulnerability lies not only in climate itself, but in the speed at which markets reprice risk once thresholds are crossed

Preparing for this new era requires deeper scenario planning, dynamic monitoring, and technology that helps financial institutions adapt ahead of the curve. Because once systems tip, there’s no returning to business as usual.

Source: https://www.bcg.com/publications/2025/climate-change-trigger-financial-tipping-points

Why America First’s business members are feeling the Loquat difference

Behind every metric is a better experience for business members. America First has shared overwhelmingly positive feedback from members who are seeing:

- Faster approval turnaround

- Effortless document uploads

- Clearer progress tracking and transparency

When onboarding becomes intuitive, members feel the impact immediately. This is the type of progress that strengthens relationships and builds long-term loyalty.

Cautious easing: What the Fed’s 9–3 vote means for 2026

The Fed delivered its third straight rate cut, but internal divisions signal a more cautious path ahead.

At 3.5%–3.75%, rates are now at a three-year low — yet policymakers remain split on whether inflation or the cooling labor market poses the bigger risk.

This is shaping up to be one of the Fed’s most divided periods in years, and the next few months of data will be pivotal.

Loquat drives breakthrough results for America First’s business onboarding

Strong early results from America First show what happens when FIs modernize business onboarding with Loquat.

In the first month alone, AFCU saw:

- 400% increase in online business banking applications

- Onboarding time cut from days to minutes

- Some applicants completing the entire journey in five minutes

Staff and members are already calling out the improvements — faster approvals, smoother document uploads, and better transparency from start to finish.

These outcomes validate the work we’re doing together: removing manual friction, accelerating decisions, and giving businesses a modern onboarding experience.

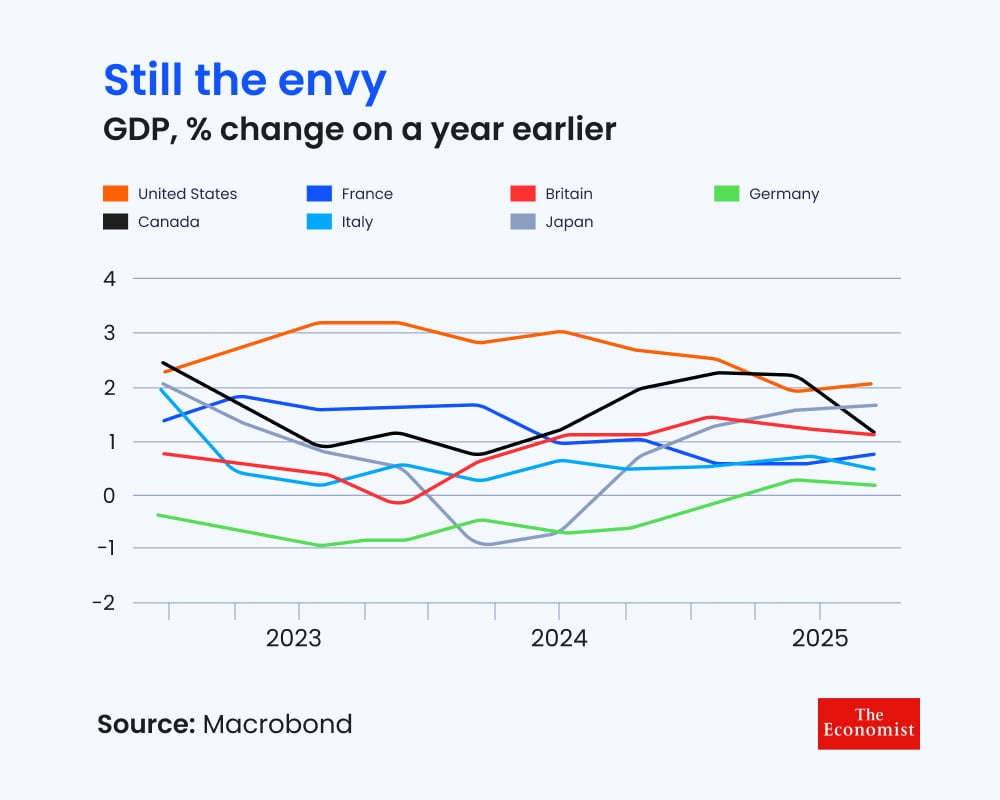

The standout economies of 2025

Despite fears of a recession early in the year, global GDP is on track to grow around 3% matching last year’s pace, supported by strong labor markets and steady market performance. But behind this stable aggregate picture is sharp divergence.

According to The Economist’s annual ranking, Portugal claims the title of 2025’s top-performing economy, driven by strong GDP growth, low inflation, rising tourism, and a vibrant stock market. Southern Europe more broadly continued a remarkable run, with Greece and Spain also near the top.

Meanwhile, several northern European economies struggled under the weight of inflation and slow growth. The U.S., despite a solid job market, landed only in the middle of the pack — held back by elevated inflation relative to peers.

The data tells a clear story: Inflation management and growth momentum defined economic success in 2025. Countries that balanced both rose to the top. Those unable to do so fell behind.

As we look ahead to 2026, the key question becomes whether these trends stabilize — or if shifting global trade, interest-rate paths, and geopolitical tensions reshape the landscape again.

Source: https://www.economist.com/finance-and-economics/2025/12/07/which-economy-did-best-in-2025

Feel good Sunday: Finding strength through artistry

Misty Copeland’s story is a powerful reminder that resilience isn’t always born from force — it can emerge from expression, creativity, and the courage to show up as ourselves.

Through dance, she found not just discipline, but identity, purpose, and freedom. Her journey shows how artistry can become a lifeline — helping us push through barriers, rewrite expectations, and hold on to ourselves even in the hardest moments.

On this Sunday, her message invites us to reconnect with the things that ground us, move us, and remind us who we are.

Source: https://www.ted.com/talks/misty_copeland_how_i_found_resilience_through_artistry

Curious Saturday: The thrill and wisdom of staying curious

In a world that rewards quick answers, we often forget the value of not having them all. Harini Bhat’s TED Talk is a reminder that curiosity — especially in moments of uncertainty is not a weakness. It is an advantage.

Whether you are building a business, tackling climate challenges, or navigating change, embracing ambiguity opens the door to better questions, better ideas, and better outcomes.

As Harini puts it, wonder expands our world. Certainty can shrink it.

Here’s to staying curious, even when the path is not fully clear.

Source: https://www.ted.com/talks/harini_bhat_the_thrill_of_not_knowing_all_the_answers

The race to dim the sun

As climate risks escalate, a new frontier is emerging — private companies experimenting with blocking sunlight to cool the planet.

Start-ups like Make Sunsets and Stardust are moving faster than governments or universities, raising millions to test “solar geoengineering” technologies. Supporters argue that entrepreneurs can innovate quickly. Critics warn that profit-driven climate tinkering could create global risks we don’t yet understand.

With little regulation and growing investor interest, the debate is clear: Who gets to decide whether we dim the sun — and how do we ensure global safety, transparency, and accountability?

Every lost application is a lost relationship

The reality is simple: manual onboarding creates leakage.

Lost applications → lost revenue → lost long-term relationships.

John Gernhauser says it best: Loquat’s automated onboarding flow gives FIs the ability to capture more business without sacrificing speed, compliance, or experience.

With Loquat, every applicant gets a smooth, guided experience — and FIs get the conversions they have been missing.

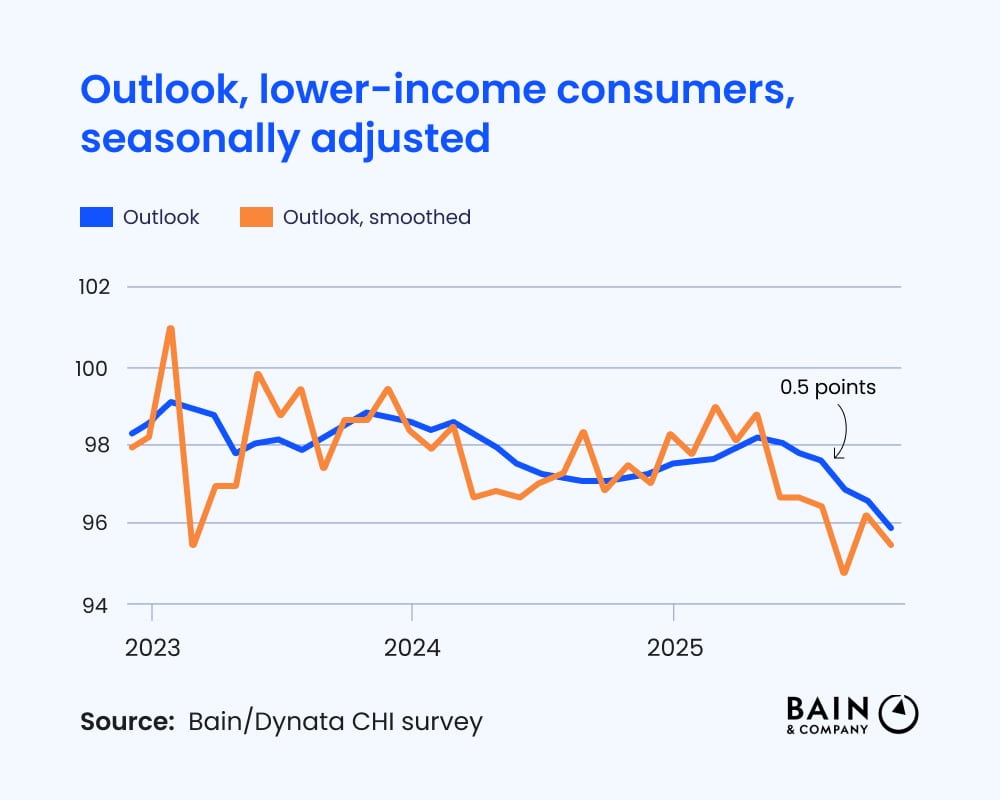

Consumer health diverges across income groups

The latest Bain / Dynata Consumer Health Index (CHI) shows growing strain among lower-income Americans — now in a six-month decline that rivals the post-Covid downturn.

In November:

- Overall CHI dipped to 99.4

- Lower-income outlook fell to 95.6

- Spending intentions dropped sharply (–5.6 points)

- Saving intentions hit a two-year low

While middle-and upper-income consumers remain steady, lower-income households are weakening across multiple measures — signaling potential trouble once official data resumes.

For businesses, this divergence across income groups increases the importance of knowing the source of their revenue and demand.

Source: https://www.bain.com/insights/us-consumer-health-indexes/

Agentic payments: The next big shift for FIs

Kearney describes agentic payments as a major leap forward in digital commerce — shifting from user-initiated actions to intelligent payments that act on behalf of the customer.

Why this matters for FIs:

- Transactions become predictive, not reactive

- Fraud detection becomes anticipatory

- Customer effort drops while satisfaction rises

- New value pools emerge through data-driven insights

Agentic payments are not just another upgrade. They represent a structural change in how money flows across digital ecosystems and an opportunity for FIs to redefine their role in the customer journey.

A divided Fed sets the stage for December

The latest Fed minutes reveal a central bank grappling with an unusually wide split over what comes next for interest rates. With inflation inching higher and the labor market showing signs of strain, policymakers are sharply divided on whether a December rate cut is the right move.

Some members believe further easing will be needed soon — especially as job growth weakens and economic data gaps emerge following the recent government shutdown. Others argue it’s too early to cut again, pointing to still-elevated inflation and resilient growth as reasons to pause.

With the December meeting approaching, the Fed must make a pivotal decision amid incomplete data and an economy sending mixed signals. One thing is clear: the path forward won’t be a foregone conclusion.

Source: https://www.ft.com/content/c5f202a7-b8c1-42ec-bc9c-db5d71748c26

Feel good Sunday: Unlocking your flirting superpowers

In her uplifting TED Talk, Francesca Hogi reframes flirting as something far more meaningful than witty lines or charm. At its core, she says, flirting is simply connection — the courage to be present, open, and authentically yourself.

Hogi challenges the idea that flirting is about impressing someone. Instead, it’s about showing genuine curiosity, expressing warmth, and letting your personality shine without fear of rejection. When you approach others from a place of confidence and kindness, you create space for real human connection.

Her message is a reminder that all of us already have “flirting superpowers” — empathy, attention, humor, and vulnerability. We just need to give ourselves permission to use them.

For your Sunday: lean into connection, embrace playfulness, and let your authentic self lead the way.

Source: https://www.ted.com/talks/francesca_hogi_how_to_unlock_your_flirting_superpowers

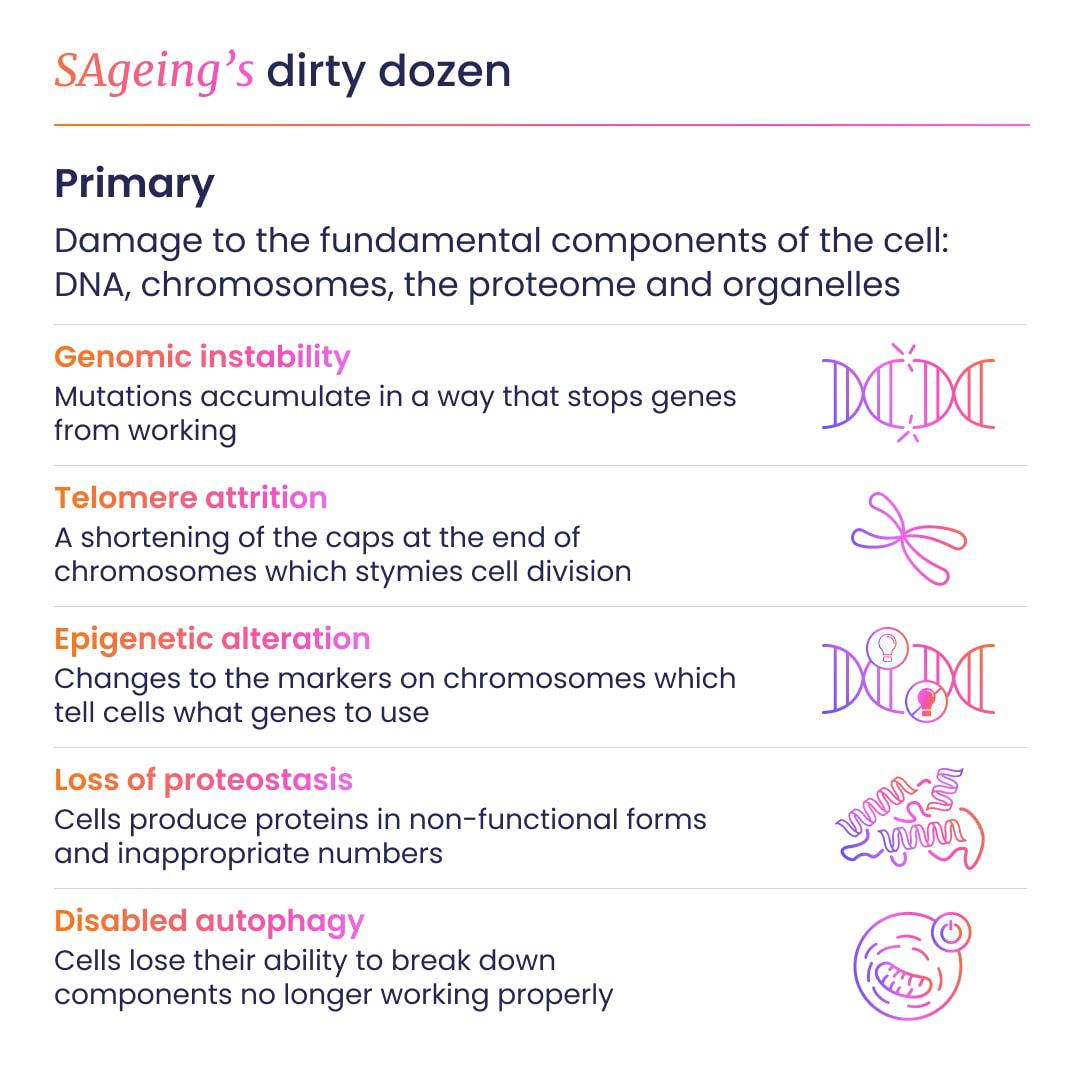

Curious Saturday: The 3 best predictors of how well you’ll age

In her fascinating TED Talk, researcher Juulia Jylhävä reveals that healthy aging isn’t just about genetics or luck — it comes down to a few powerful predictors we can influence throughout our lives.

Her team’s research highlights three key factors that most strongly determine how well we age:

- Our cognitive resilience — keeping the brain active and challenged

- Our psychological well-being — managing stress, nurturing optimism, and building emotional balance

- Our physical strength and mobility — maintaining muscle, staying active, and protecting functional independence

What makes these predictors so encouraging is that they’re modifiable. We can build habits today that meaningfully shape the decades ahead.

For your Saturday curiosity spark: aging well isn’t a mystery — it’s a practice. Small steps now can create a stronger, brighter future later.

Source: https://www.ted.com/talks/juulia_jylhava_the_3_best_predictors_of_how_well_you_ll_age

How rising heat is quietly fueling America’s sweet tooth

A new study finds that as temperatures rise, Americans buy more soda, juice, and ice cream — often without realizing how much extra sugar they’re consuming.

Between 54°F and 86°F, purchases of sugary drinks and frozen treats go up, and under worst-case climate scenarios, researchers project we could consume an extra three grams of sugar per day by 2095.

The impact is greatest in low-income communities and regions less used to heat, showing how warming can quietly worsen health risks like obesity and diabetes.

Climate change doesn’t just affect the planet — it affects our plates, too.

Source: https://www.washingtonpost.com/climate-environment/2025/09/09/temperatures-sugar-soda-ice-cream/

Hear your members’ voices, build what they need

America First Credit Union is seeing strong early adoption of its new digital business account opening — making it faster and easier for businesses to become members.

Loquat is proud to support America First as they continue investing in digital-first experiences that remove friction and help business owners move at the speed they need.

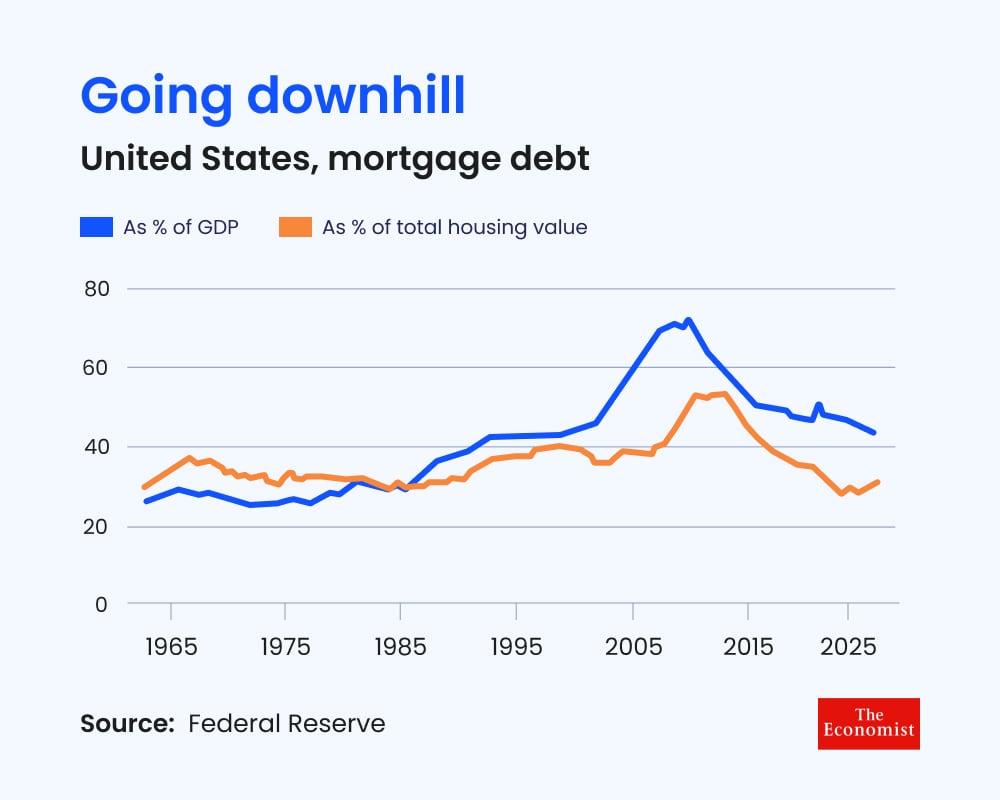

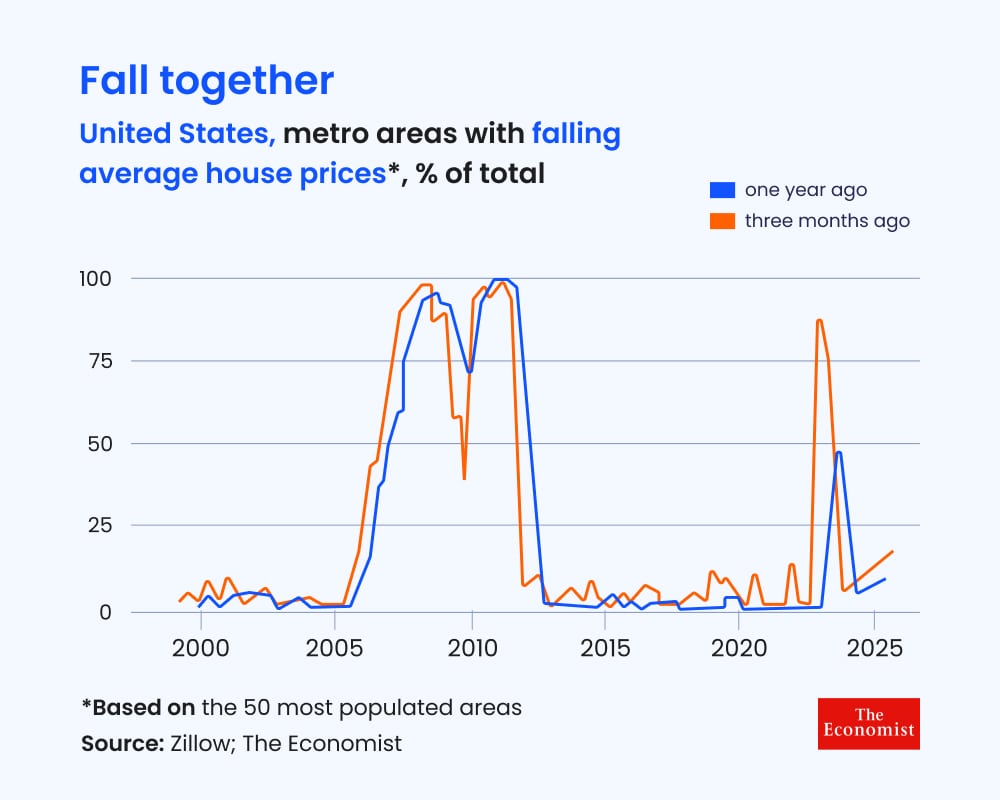

A mortgage market in retreat

America’s mortgage market is shrinking fast. Higher rates, soaring monthly payments, and years of tightened lending standards have pushed new mortgage activity to historic lows.

With fewer qualified buyers, home sales are stalling, builders are cutting back, and rents are climbing as demand overwhelms limited supply.

The result: a deepening housing shortage that’s reshaping affordability and leaving more Americans locked out of homeownership.

Reinventing customer experience with AI: From efficiency to loyalty

Today’s AI imperative goes far beyond cost-cutting – it is about transforming how customers experience your brand. According to Bain, companies that embed AI into both their front-stage customer interactions and the backstage operations that power them unlock a powerful “triple play”: increased customer loyalty, more engaged employees, and stronger revenue growth.

The message is clear: the journey is not just about saving dollars – it’s about rethinking how to deliver value to your customers, employees, and business as a whole.

Source: https://www.bain.com/insights/ai-wont-just-cut-costs-it-will-reinvent-the-customer-experience/

Loquat CEO Zarina Tsomaeva to speak at FiNext Awards & Conference Dubai 2026

We are pleased to announce that Loquat CEO Zarina Tsomaeva will be speaking at the FiNext Conference in Dubai on February 11.

Zarina will discuss how Loquat’s digital banking platform supports financial institutions with faster onboarding, virtual cards, automated lending, and compliance monitoring through the CALM portal. She will also discuss how Loquat IQ uses AI-driven insights to improve decision-making and performance for financial institutions.

Please join Zarina at Finext to learn how Loquat helps financial institutions modernize their operations and better serve their customers.

Feel good Sunday: Listening to Earth’s heartbeat

In his inspiring TED Talk, Yadvinder Malhi shares a beautiful idea: the Earth has a heartbeat — a living rhythm shaped by forests, oceans, seasons, and all the ecosystems that keep our planet in balance.

By measuring this heartbeat through science and observation, we’re reminded of something profound: We’re part of a much larger, living system — one that thrives when we pay attention, protect it, and stay connected to the natural world.

Malhi’s message isn’t just about data or research. It’s about wonder. It’s about noticing how vibrant, resilient, and interconnected our planet truly is.

So this Sunday, take a moment to step outside, breathe, and tune in. The Earth is speaking — and its heartbeat is full of hope.

Source: https://www.ted.com/talks/yadvinder_malhi_how_to_measure_the_planet_s_heartbeat

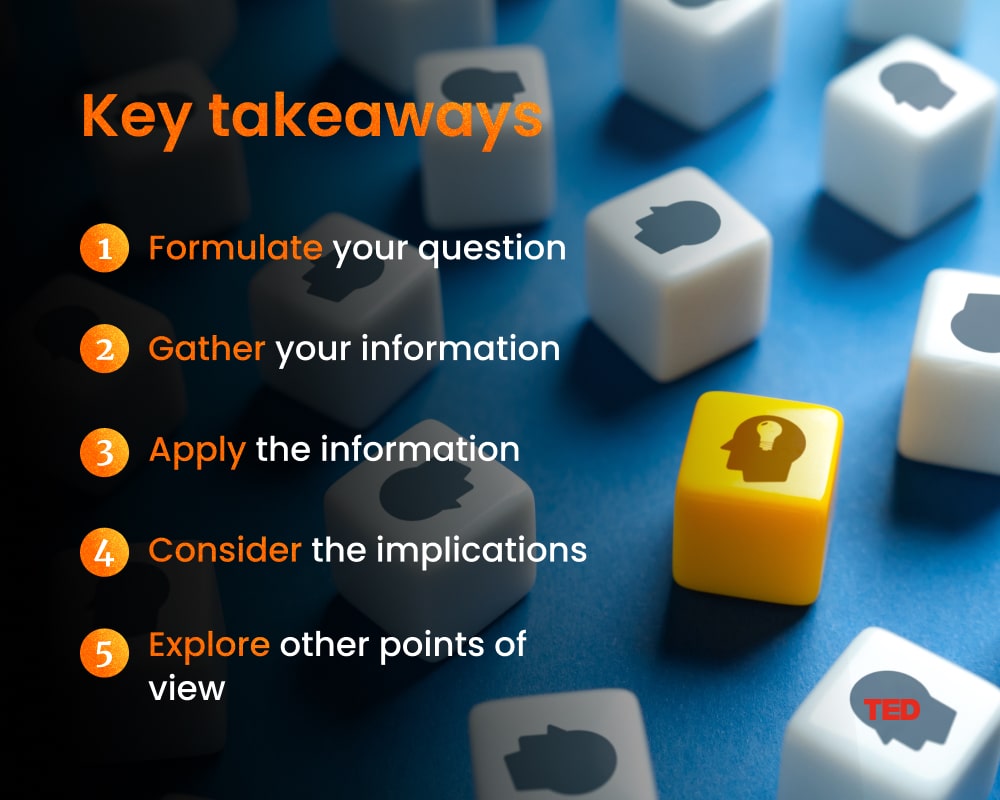

Curious Saturday: Keeping our critical thinking alive in an AI world

As AI becomes more woven into daily life, it’s tempting to lean on it for everything — from drafting messages to making decisions. But Advait Sarkar reminds us of something essential: the more we outsource our thinking, the more we risk losing our own intellectual edge.

Sarkar argues that our minds thrive when we wrestle with ideas — when we question, analyze, and create. AI can speed things up, but we give meaning to the work.

Curiosity isn’t optional in the age of AI — it’s a skill worth protecting.

Source: https://www.ted.com/talks/advait_sarkar_how_to_stop_ai_from_killing_your_critical_thinking

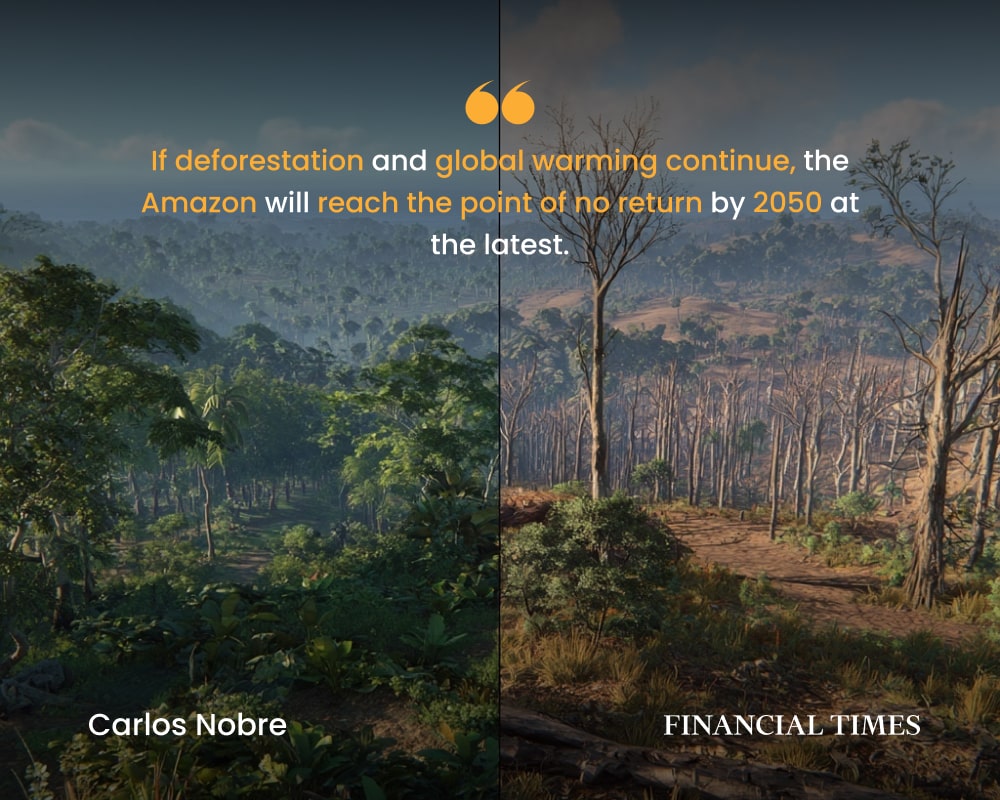

The Amazon’s tipping point is closer than we think

As COP30 unfolds in the heart of the Amazon, Brazil’s leading climate scientist Carlos Nobre is sounding the alarm with renewed urgency. His decades-long warning about a potential “tipping point” — a threshold beyond which the rainforest collapses into a degraded savannah — is now “much closer” than once believed.

With 18% of the Amazon already deforested, rising temperatures, intensifying droughts, and surging wildfires, Nobre warns that continued warming and land loss could push the biome past the point of no return by 2050. The consequences would be global: massive carbon release, destabilized weather systems, and heightened risks of epidemics and food insecurity.

Yet amid the stark science, Nobre remains hopeful. Recent drops in deforestation, stronger climate commitments from emerging economies, and the rise of younger climate leaders give him confidence that action is still possible — and necessary.

His message is clear: preserving the Amazon isn’t just a regional issue. It’s a safeguard for the entire planet.

Source: https://www.ft.com/content/28f1a67c-331e-4081-b2b3-5f2d325d38c7

Happy Thanksgiving from the Loquat team!

Today is a moment to pause and appreciate what truly matters — community, connection, and the people who make our days meaningful.

Thanksgiving reminds us that progress is not only measured in metrics or milestones, but in the relationships we build and the support we share along the way.

Whether you’re gathering with loved ones, celebrating from afar, or simply taking a quiet moment of rest, here’s to gratitude, generosity, and hope for the season ahead.

Wishing everyone a warm, joyful, and restorative Thanksgiving.

The gold rally that’s too hot to ignore

Gold’s meteoric rise has stunned markets this year — surging to a record $4,380/oz, falling sharply, then rebounding again. With prices now more than 55% higher than January, analysts are scrambling to explain the rally. And most of the usual theories don’t add up.

Institutional investors aren’t fleeing to safety, central banks aren’t buying at the scale needed to move markets, and macro shocks haven’t aligned with gold’s almost straight-line ascent.

What does fit?

A wave of speculative money. Hedge funds built record long positions, ETFs saw heavy inflows, and the latest pullback appears tightly linked to shifts in these highly reactive flows. What began as modest central-bank interest seems to have snowballed into a classic momentum trade.

The warning from the Economist is clear: when rallies are driven by hot money rather than fundamentals, the turn — when it comes — can be painful.

A useful reminder of how quickly sentiment, not strategy, can reshape markets.

Source: https://www.economist.com/finance-and-economics/2025/11/16/beware-the-scorching-gold-rally

Tech upgrade at smaller credit unions

Smaller credit unions are showing how agility beats size when it comes to digital transformation. At the recent VentureTech 2025 conference, two standout examples illustrated the point:

- Southwest Financial Federal Credit Union went fully digital and branchless, embracing remote staff and fintech tools long before the pandemic

- Seaport Federal Credit Union carved out a profitable niche serving money service businesses, using a compliance-tech foundation to turn underserved businesses into a growth engine

Source: https://www.finopotamus.com/post/venturetech-2025-small-cus-leverage-tech-in-a-big-way

Why the Fed Is hitting the brakes on rate cuts

The Fed is signaling caution as it weighs any further rate cuts. Vice Chair Philip Jefferson emphasized that while policy is moving closer to neutral, uncertainty around inflation, job growth, and delayed economic data means the Fed must move slowly. With markets pulling back expectations for a December cut, all eyes are now on upcoming economic insights — especially the Beige Book — to guide the next step.

Feel good Sunday: Rewild your world

In her uplifting TED Talk, Isabella Tree shares three simple yet powerful tips for rewilding our world. From giving space for nature to recover, to welcoming the unpredictable beauty of the wild, she reminds us that sometimes, stepping back allows life to flourish in ways we never imagined.

Rewilding isn’t just about landscapes — it’s about mindset. It’s about trust, patience, and rediscovering balance with the natural rhythms around us.

So today, let’s take a cue from nature: pause, breathe, and make a little room for wildness — in our backyards, our routines, and our thinking.

Source: https://www.ted.com/talks/isabella_tree_3_tips_to_make_your_world_beautifully_wild_nov_2025

Curious Saturday: The surprising science of flow

Ever wondered why your blood — and ketchup — share something in common?

In his fascinating TED Talk, Sean Farrington explores how the physics of ketchup helps us understand how blood flows through our bodies. By studying “non-Newtonian” fluids (like ketchup that resists then suddenly gushes out), scientists can improve medical devices, predict clots, and even design better treatments for heart conditions.

Sometimes, the key to saving lives can be found in your kitchen cabinet.

Source: https://www.ted.com/talks/sean_farrington_why_your_blood_should_flow_like_ketchup

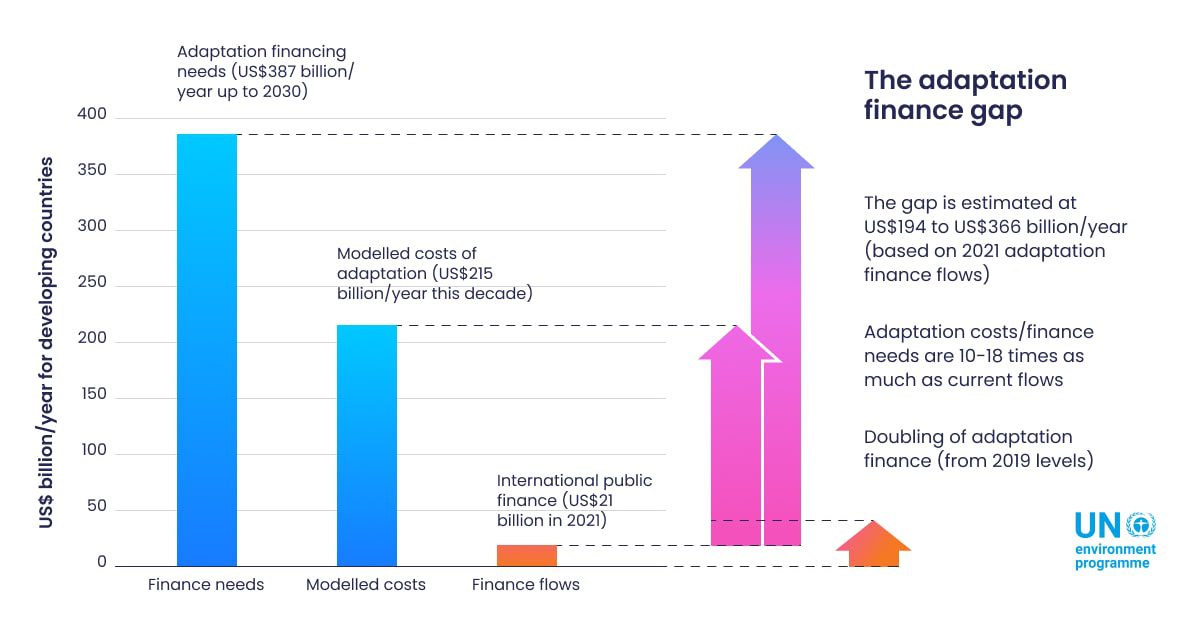

Adaptation: The other half of climate survival

At COP30, the spotlight has shifted from slowing climate change to surviving it.

As temperatures soar and disasters intensify, the global conversation is turning toward adaptation — strengthening communities, cities, and economies to withstand a hotter, harsher world.

From Phoenix’s “heat-ready” initiatives and Venice’s flood barriers to new climate resilience bonds in Tokyo, adaptation is no longer a distant goal. It’s an urgent necessity — and a major opportunity for innovation.

Every dollar invested in resilience pays dividends — economically and socially. Yet, adaptation financing remains far below what’s needed.

Source: https://www.ft.com/content/caf9895d-63b7-4410-969a-2cee05910213

Keep going, keep growing

Progress doesn’t always shout — it often whispers through the quiet effort you give each day. Keep showing up, keep learning, and trust that small steps forward will lead to meaningful change.

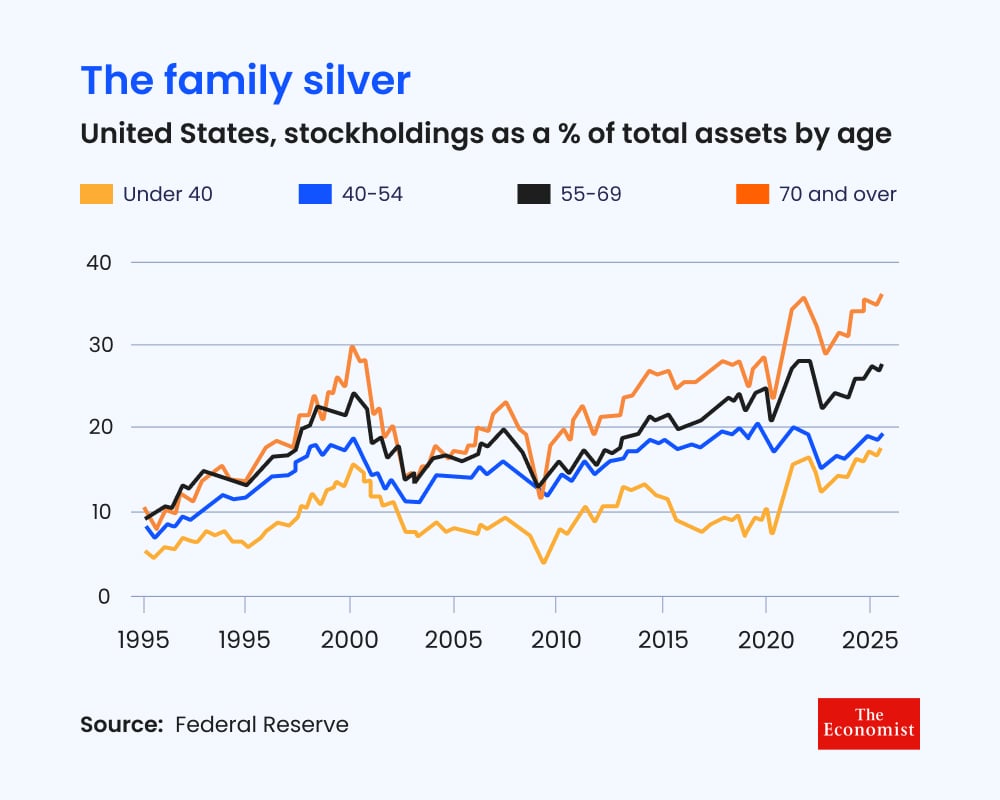

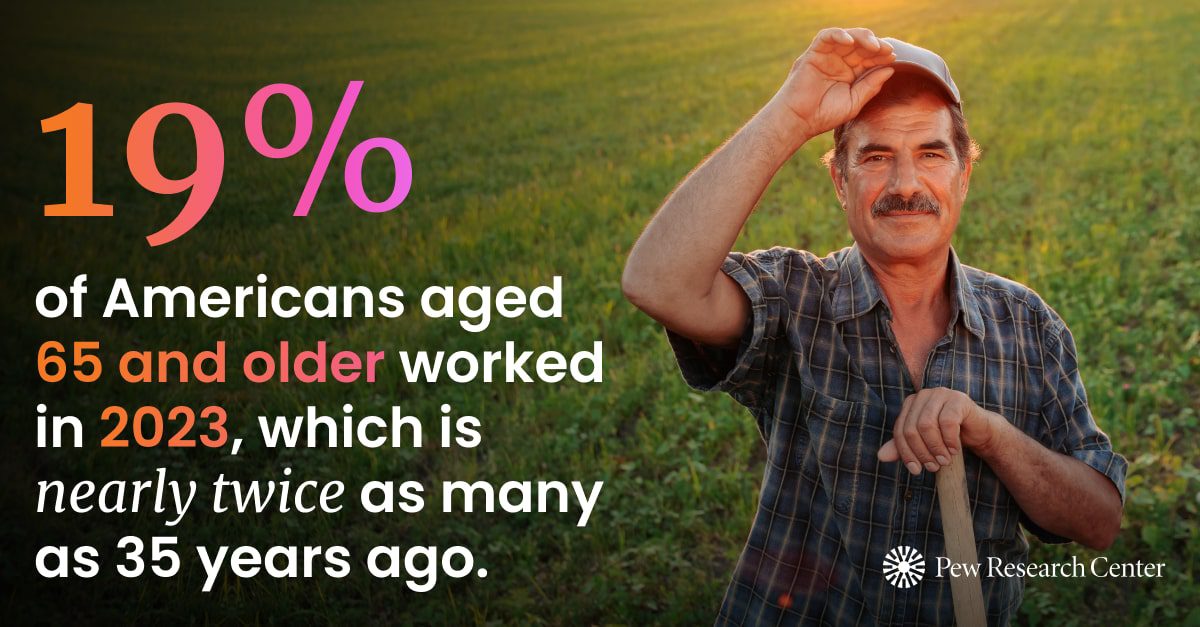

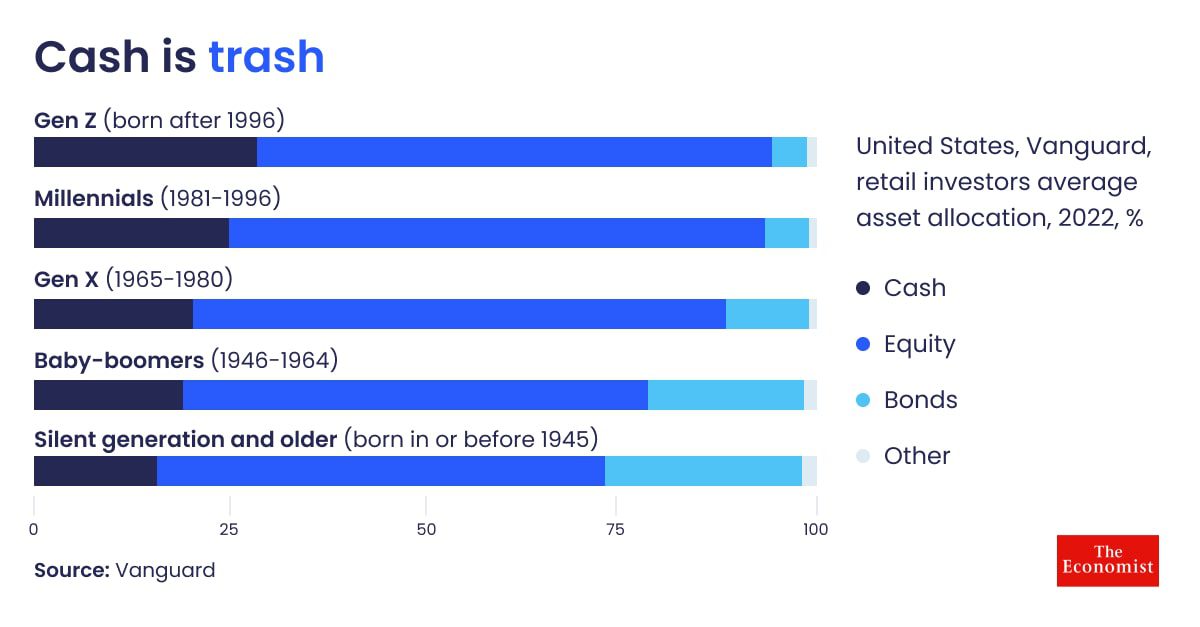

The silver surge in stocks

America’s stock market boom is being fueled by a surprising group — older investors. Those aged 70 and above now hold nearly 40% of all U.S. stocks and mutual funds, a dramatic increase from past decades. Many retirees are embracing equities, moving away from bonds in search of higher returns and drawn by the confidence of long bull markets.

But while a stock-heavy portfolio may make sense for some individuals, the broader market could face challenges if these investors begin to sell during a downturn. The resilience — or reaction — of this “silver generation” could shape how the next market cycle unfolds.

Source: https://www.economist.com/finance-and-economics/2025/11/11/old-folk-are-seized-by-stockmarket-mania

U.S. bank M&A accelerates as regulatory logjam breaks

Under the current administration, U.S. bank mergers are moving at the fastest clip in more than 30 years — with approvals now taking as little as four months, down from nearly seven under prior leadership.

For dealmakers, that speed is transforming the landscape. Nearly 150 mergers worth $45B have closed this year, marking 2025 as one of the busiest years since 2021. From Fifth Third’s $10.9B Comerica deal to Huntington’s rapid double acquisition streak, momentum is building — and banks are racing not to miss the #consolidation wave.

Source: https://www.ft.com/content/72c16455-c11c-4e0a-9ddb-882d1a5e7647

A cooling job market — Signals of a shifting economy

Private data is revealing early signs of softness in the U.S. labor market — even as official government reports remain paused.

Recent private-sector analyses show slower job creation and a sharp rise in layoffs. ADP data points to modest hiring, concentrated in large companies and specific regions, while Challenger, Grey & Christmas reports the highest monthly job cuts since 2003 — led by warehousing and tech.

Behind the headlines lie deeper forces: trade policy uncertainty, stricter immigration trends, and the growing impact of AI reshaping business investment and hiring.

Source: https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook/weekly-update.html

Feel good Sunday: Lifting others as you climb

When Refilwe Ledwaba became South Africa’s first Black woman helicopter pilot, she realized that breaking barriers wasn’t enough — she had to open the sky for others too.

In her TED Talk, Refilwe shares how she’s turning representation into opportunity — training young girls from rural communities to become engineers, pilots, and scientists.

Her message is simple but powerful: visibility creates possibility. When one person flies, others learn they can too.

Source: https://www.ted.com/talks/refilwe_ledwaba_how_to_empower_the_next_generation_of_pilots

Curious Saturday: The rise of AI agents from assistants to teammates

AI is moving fast — but the next frontier isn’t just smarter models. It’s autonomous agents that can think, plan, and act on our behalf.

In his TED Talk, Swami Sivasubramanian explains how AI agents will change how we work and live:

- They’ll understand goals instead of just commands.

- They’ll collaborate with other agents to complete complex tasks.

- And they’ll free humans to focus on creativity and strategy.

The real challenge? Building trust and responsibility into these systems from the start.

Source: https://www.ted.com/talks/swami_sivasubramanian_everything_you_need_to_know_about_ai_agents

A decade after Paris: Promises deferred, progress denied

Ten years after the Paris climate accord, a critical year for global climate action is falling short.

A new U.N. report shows that fewer than one-third of countries have updated their emissions plans — leaving the world with only a “limited picture” of our collective progress. Even if all submitted pledges are met, emissions would drop just 17% by 2035 — far below the 37% needed to stay below 2°C of warming.

What’s missing isn’t technology or knowledge — it’s political will.

The message is clear: bending the curve isn’t enough. We have to break it.

Source: https://www.washingtonpost.com/climate-environment/2025/10/28/climate-pledges-united-nations-ndc/

Strength in flexibility

Adaptability is not surrender — it’s strategy.

The most resilient leaders and organizations are those that bend, learn, and rebuild stronger than before.

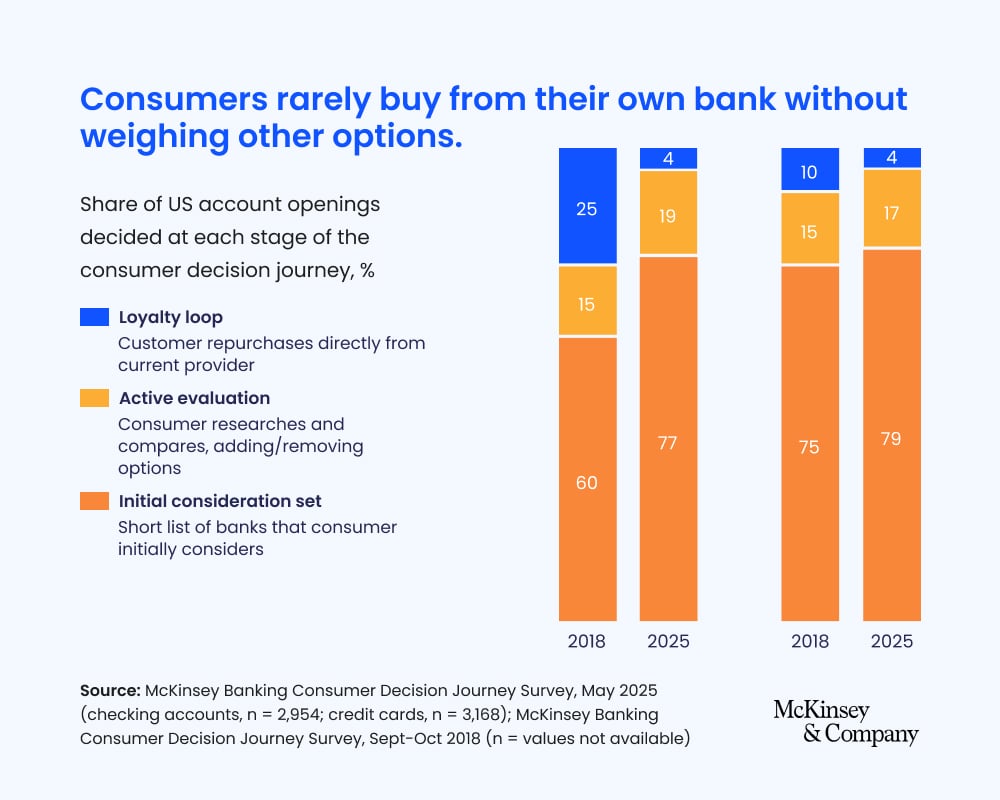

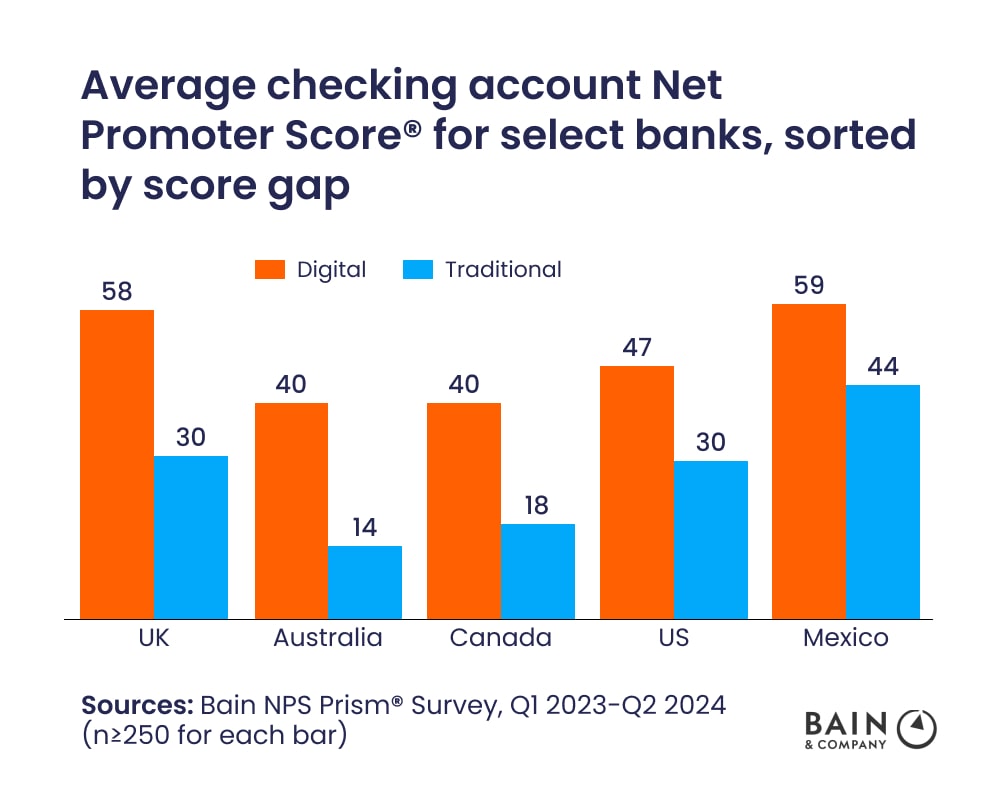

The loyalty loop is closing

In 2018, a quarter of Americans opened new checking accounts directly with their existing bank. By 2025, that number has fallen to just 4%.

Consumers today are more digital, less loyal, and far more deliberate about where they bank. AI, mobile, and new intermediaries are rewriting the consumer decision journey — putting greater weight on awareness, precision targeting, and seamless, personalized engagement.

Banks that win in this environment will be those that embed AI into customer journeys, anticipate needs, and make every interaction frictionless — no matter the channel.

Source: https://www.mckinsey.com/industries/financial-services/our-insights/global-banking-annual-review

🇺🇸 Honoring those who serve 🇺🇸

Today, we pause to recognize the courage, dedication, and sacrifice of all who have served in the U.S. Armed Forces.

At Loquat, we’re grateful to the veterans within our communities and our industry — individuals who bring leadership, resilience, and integrity to everything they do.

Your service inspires us to build a future grounded in purpose, teamwork, and perseverance.

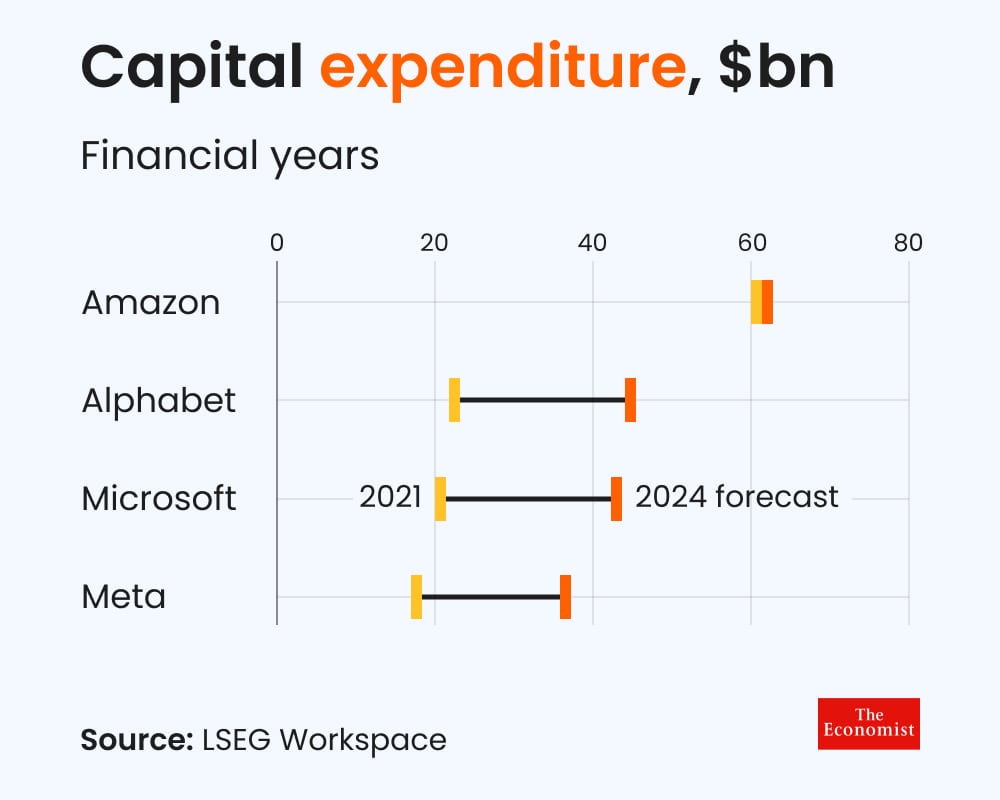

America Inc: Growth or gambit?

U.S. corporate profits are roaring — nine consecutive quarters of growth and a $1 trillion capital expenditure wave. But peel back the AI glow, and a split emerges.

While tech giants like Amazon, Microsoft, and Meta drive most of the new investment, nearly half of the S&P 500 are cutting back — from automakers and oil majors to consumer goods firms. Tariffs, trade uncertainty, and policy whiplash are leaving much of the non-AI economy frozen in place.

The question for 2026: is corporate America’s engine firing on all cylinders — or running too hot on one?

Source: https://www.economist.com/business/2025/10/23/american-big-business-faces-a-1trn-capex-question

Feel good Sunday: The strength within

In her TED Talk “The Wonder of Weightlifting,” Dr. Jaime Seeman reminds us that strength isn’t just about muscle — it’s about confidence, resilience, and rediscovering what your body can do.

Her journey from medical doctor to competitive lifter shows how small, consistent acts of self-discipline can transform not only physical health but mental and emotional wellbeing.

Source: https://www.ted.com/talks/jaime_seeman_the_wonder_of_weightlifting

Curious Saturday: Inside the mind of a newborn

Ever wondered what it’s like to see the world for the very first time?

Neuroscientist Claudia Passos Ferreira explores how newborns experience life in their earliest days — how they perceive colors, faces, and sensations before language or memory begin to shape their world.

From the first heartbeat to the first gaze, her talk reveals how much infants already understand and feel — and how this early awareness connects to what makes us human.

Source: https://www.ted.com/talks/claudia_passos_ferreira_inside_the_mind_of_a_newborn_baby

Burying carbon, building hope: Norway’s bold climate experiment

What if one country could help Europe reverse its carbon footprint — literally?

Norway is turning that idea into action. Backed by its government and major energy players, the Northern Lights project is the world’s first carbon shipping and storage network — designed to capture CO₂ from factories across Europe and bury it deep beneath the North Sea.

If successful, this initiative could store up to 5 million metric tons of CO₂ annually — a model for how technology, policy, and industry can align to fight climate change.

It’s a massive experiment with equally massive implications: can innovation offset hard-to-abate emissions, and can collaboration make it scalable?

Source: https://www.washingtonpost.com/climate-solutions/2025/07/21/carbon-capture-northern-lights-terminal/

Evolving with purpose

In an industry built on trust and tradition, progress means embracing change with purpose.

At Loquat, we believe innovation isn’t about disruption for its own sake — it’s about creating better experiences for financial institutions, teams, and customers alike.

Let’s keep moving banking forward — thoughtfully, confidently, and together.

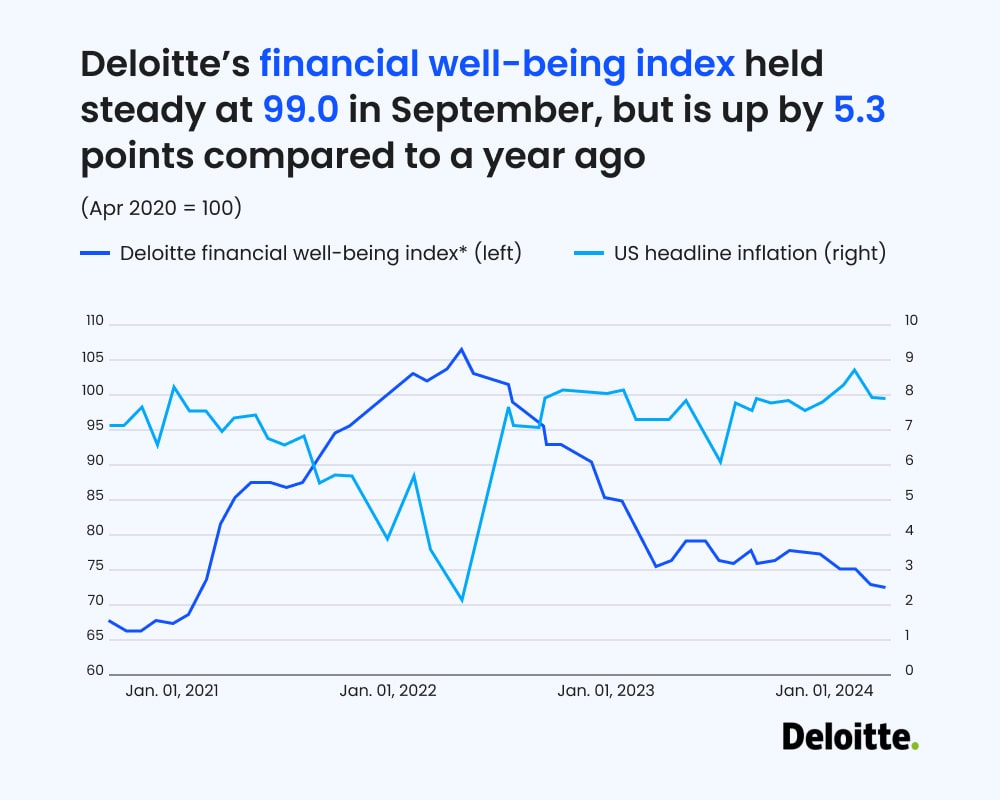

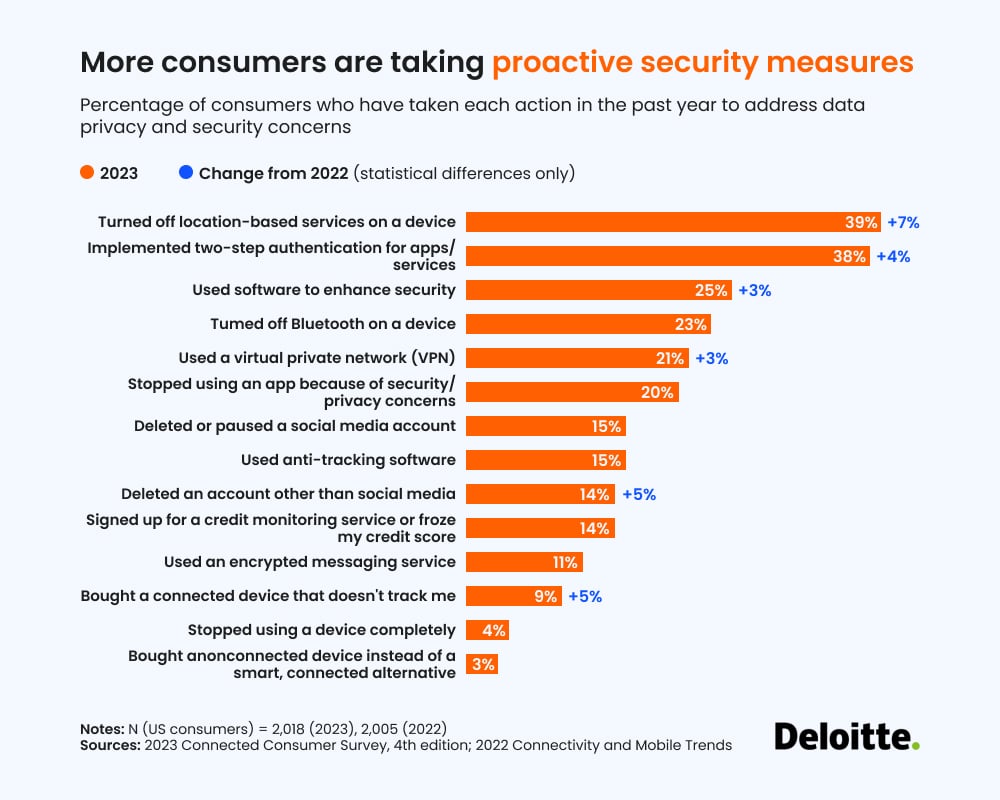

Consumers plan to spend — but with caution this holiday season

Deloitte’s 2025 Holiday Retail Survey shows a confident yet cautious U.S. consumer. While total holiday spending is projected to rise modestly, shoppers are being selective — focusing more on value, early deals, and digital convenience.

Even as inflation pressures ease, financial realities continue to shape behavior: nearly half of consumers plan to spend the same or less than last year, and many are prioritizing essentials over splurges.

It’s a reminder that while the economy remains resilient, consumer confidence is still tempered by lingering uncertainty.

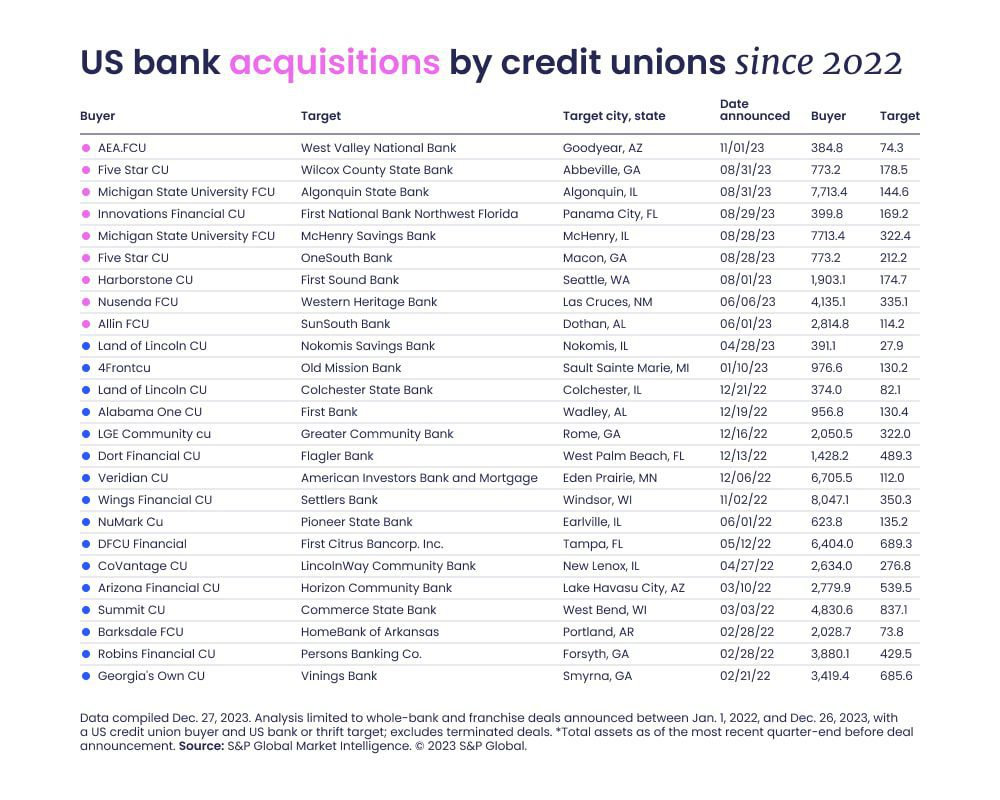

Credit unions evolve: Growth through M&A and innovation

As member expectations rise and competition intensifies, credit unions are redefining how they grow. Beyond traditional mergers and acquisitions, today’s leaders are exploring new pathways — leveraging digital capabilities, expanding field of membership, and pursuing partnerships that enhance both reach and relevance.

Sustainable growth now means balancing scale with purpose — and finding the right blend of strategy, technology, and community focus to thrive in a shifting financial landscape.

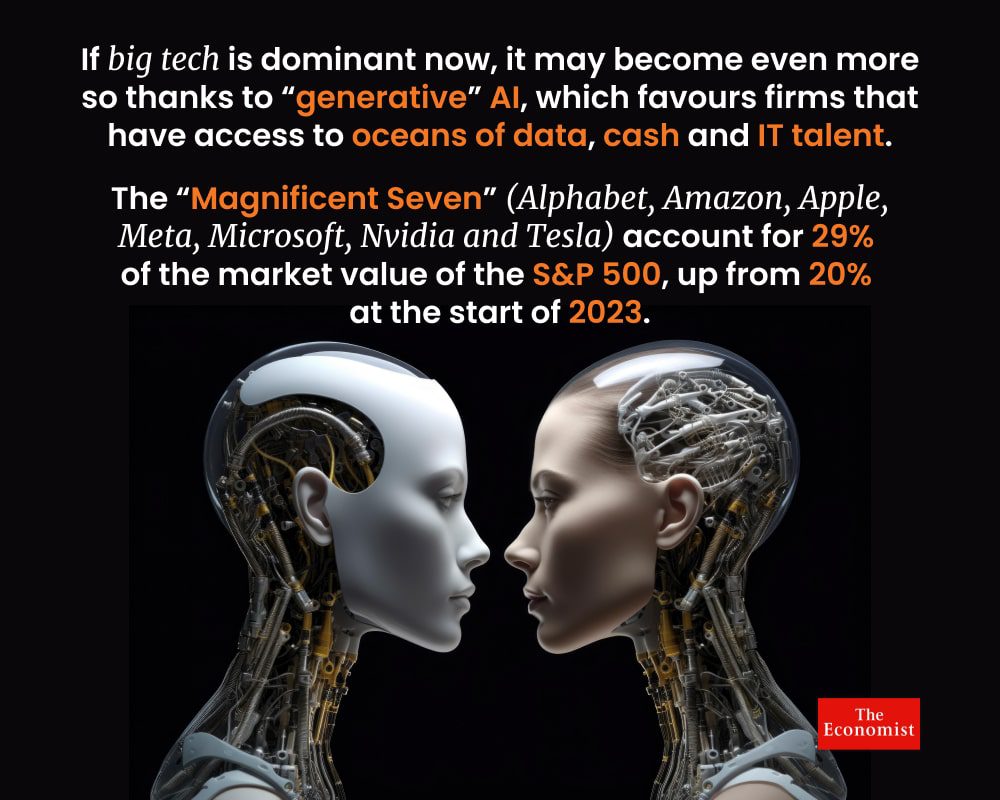

The AI boom — and echoes of the 1990s

In the 1990s, the internet created a new economic orbit around Silicon Valley. Today, AI is doing the same — fueling growth, optimism, and massive investment.

But as Rana Foroohar notes, this time the story comes with new constraints and higher stakes. AI’s surge is capital intensive, energy dependent, and driven by a few cash-rich giants rather than startups fueled by debt.

Still, the parallels to the dotcom era are hard to ignore: soaring valuations, a market led by a narrow group of tech titans, and a wave of investor exuberance that may be outrunning fundamentals.

The key question isn’t whether AI will reshape industries — it will — but whether the growth story can sustain itself without overheating the system that powers it.

Source: https://www.ft.com/content/834487ce-2357-40c4-bf45-34562e522755

Feel good Sunday: The art of mastery in chocolate and beyond

Amaury Guichon doesn’t just make desserts — he sculpts stories out of chocolate. His intricate, lifelike creations remind us that #mastery is born from patience, precision, and a deep love of the craft.

Whether in pastry, design, or leadership — creativity thrives where curiosity meets discipline.

Sometimes, inspiration isn’t about doing something new — it’s about doing something beautifully well.

Source: https://www.ted.com/talks/amaury_guichon_a_pastry_chef_works_his_chocolatier_magic_live

Curious Saturday: The power of perception

Mind reader and mentalist Oz Pearlman doesn’t claim to have supernatural powers — instead, he reveals just how much our thoughts, expressions, and body language give away without us realizing it.

His live demonstrations show that “reading minds” is really about reading people — attention to detail, emotional intelligence, and the subtle cues we all send.

It’s a reminder that real insight doesn’t come from magic — it comes from listening deeply and observing closely.

Source: https://www.ted.com/talks/oz_pearlman_the_art_of_reading_minds

When less ice means more fire

As glaciers melt under the pressure of global warming, Iceland’s scientists are uncovering another startling consequence — a rise in volcanic activity. With ice retreating, the Earth’s crust rebounds, magma production increases, and the potential for more frequent or intense eruptions grows.

This phenomenon isn’t confined to Iceland — similar risks lurk in Antarctica, Alaska, and the Andes, where millions could face impacts ranging from water-supply disruption to aviation chaos.

It’s a reminder that climate change doesn’t just heat the planet — it can also awaken the fire beneath it.

Leading through change

True leadership isn’t about avoiding uncertainty — it’s about moving forward through it. Progress in business often starts with a willingness to challenge what’s comfortable, learn fast, and stay the course when others hesitate.

Every small decision to improve, adapt, and innovate adds up.

Big banks cheer Q3 — but keep a cautious eye on 2026

America’s largest banks just posted a strong Q3, with the top six earning nearly $41B—up 19% year over year — on the back of robust dealmaking, corporate spend, and resilient consumer activity. Leaders point to stable deposits and low delinquencies, while wealth inflows and trading volumes continue to rise. Still, execs flagged cross-currents to watch: a cooling labor market, pockets of credit stress, and policy/geopolitical uncertainty. The takeaway is that the momentum is real, but risk management and disciplined growth remain the name of the game.

Stop choosing between efficiency and future-growth — it’s time to do both

For decades, business leaders have accepted a familiar trade-off: innovate tomorrow while sacrificing today’s cost-effectiveness, speed, or certainty. But the business environment has changed. Slowing growth, rising capital costs, intense competitor pressure — and now AI and digital tools making imitation easier — mean the old trade-off isn’t sustainable.

BCG argues it’s time to do both. By linking a company’s “exploit” (core operations) and “explore” (innovation) efforts to the customer journey, CEOs can accelerate progress without sacrificing performance.

Source: https://www.bcg.com/publications/2025/how-ceos-can-conquer-traditional-innovation-tradeoffs

Investors keep dancing — Even as the “bubble” warnings get louder

Warnings about overinflated markets are getting harder to ignore. From the IMF to the Bank of England, policymakers are cautioning that asset prices may be “well above fundamentals,” and that sharp corrections could be ahead.

Yet optimism prevails. Investors continue to buy the dip, confident that central banks will step in if things get rough — a mindset born from years of monetary rescue operations since 2008.

It’s a fascinating paradox: the louder the bubble talk gets, the stronger the belief in a safety net.

Will this confidence prove justified, or are markets just dancing until the music stops?

Source: https://www.ft.com/content/ce8bc257-5f06-4005-bd36-b094a9b91938

Feel good Sunday: When ordinary people do extraordinary things

Sometimes, courage begins with a simple belief — that the law can be a force for good.

When a group of citizens in Guyana discovered an oil giant’s plans to drill off their coast, they refused to accept that profit should outweigh people or planet. Led by lawyer Melinda Janki, they turned to the country’s constitution — one that guarantees every citizen the right to a healthy environment.

Against all odds, they won. Their story is a reminder that even in the face of enormous power, persistence and principle can prevail. Change often starts with one voice daring to say “no.”

Source: https://www.ted.com/talks/melinda_janki_how_we_took_on_an_oil_giant_and_won/transcript

Curious Saturday: The hidden cost beneath the shine

Gold has long symbolized security, beauty, and value. But behind its gleam lies a global story of environmental strain, human risk, and economic imbalance.

In her TED Talk, Claudia Vega uncovers how the demand for gold comes with invisible costs — deforestation, mercury pollution, and unsafe working conditions that ripple across entire communities.

Her message is a powerful reminder that value isn’t just measured in what we hold, but in how responsibly we obtain it. True wealth comes when ethics and sustainability weigh as much as profit.

Source: https://www.ted.com/talks/claudia_vega_the_hidden_cost_of_buying_gold

A warming world and the uneven cost of adaptation

As global temperatures rise, farmers are adapting by changing crops and improving irrigation. However, climate change is still projected to reduce crop yields worldwide.

A recent study in Nature indicates that every additional degree of warming could lead to a daily loss of 120 calories per person. This impact will not be uniform; while all farmers face challenges, those with limited resources will experience hunger more severely.

Maintaining open and connected food systems is crucial for mitigating these effects — highlighting that cross-border collaboration is both an economic necessity and a moral imperative.

Source: https://www.economist.com/podcasts/2025/10/10/health-scare-the-row-at-the-heart-of-the-shutdown

Every step forward counts

We often wait for the perfect moment — the right resources, the ideal timing — before taking action. But real progress begins with what’s already in front of us.

No matter where you are in your journey, excellence starts with a single, intentional step forward.

Fresh look, timeless mission — the revamped Loquat website is now live

We’re excited to unveil Loquat’s new website — designed to better reflect who we are and how we help financial institutions deepen relationships with both business and consumer customers.

From expanded product offerings to LoqWhat AI and our CALM Portal, we continue to simplify banking while empowering financial institutions to modernize with confidence.

We’re also proud to share that Loquat’s Business Account Opening and CALM Portal are now available through the Q2 Marketplace — making it easier than ever for financial institutions to integrate Loquat’s tools directly within their digital ecosystem.

And please join us in welcoming John Gernhauser, our new Regional Head of Business Development and Client Success, as we continue to grow our impact across the industry.

Step into the new era of banking – visit our new website 👉 https://loquatinc.io/

Strategic alignment defines the modern bank

Recent insights from International Banker point to five strategic choices that determine whether transformation accelerates growth or adds complexity:

- Delivery that’s agile, not monolithic

- Planning that starts with measurable value

- Funding that scales with outcomes

- Execution that unites business and technology

- Migration that reduces risk through precision

Each decision reflects alignment — between ambition and delivery, vision and discipline. Banks that achieve this alignment are not just modernizing; they’re building resilience for what comes next.

Cracks in the credit: Are we seeing early signs of financial stress?

US consumers are still spending — but underneath the surface, pressure is building. Auto loan delinquencies are nearing 2010 levels, sub-prime defaults are accelerating, and financial markets are starting to take notice.

When the most vulnerable borrowers struggle, it often signals deeper issues ahead for household finance. Rising delinquencies and tightening credit could ripple far beyond the sub-prime segment — testing the resilience of lenders and households alike.

Source: https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook/weekly-update.html

Feel good Sunday: Rediscovering wonder through AI-made imagination

What if technology didn’t make our world colder — but stranger, funnier, and more alive?

In his TED Talk, filmmaker Matan Cohen Grumi reminds us that AI doesn’t have to be about algorithms replacing art. Instead, it can help us see magic in the mundane — a pizza floating through space, a UFO at your doorstep, or a coffee cup that suddenly starts dancing.

It’s not about perfection. It’s about play.

AI, in the right hands, becomes an instrument of joy — a way to reawaken our sense of imagination, humor, and curiosity about everyday life.

Source: https://www.ted.com/talks/matan_cohen_grumi_friendly_pizza_ufos_and_the_joy_of_ai_generated_video

Curious Saturday: The future of energy is abundant, not scarce

In his recent TED Talk, Matt Tilleard explains that for most of history, whoever controlled energy resources controlled the world. But renewable energy flips that logic. Once you build a solar panel or wind farm, the fuel is free.

That’s not just cleaner energy — it’s a fundamental shift from scarcity to abundance. And that abundance opens new opportunities for innovation, resilience, and shared prosperity, especially in regions that have long been left out of the energy conversation.

It’s a timely reminder: the best thing that can happen to the energy industry isn’t more extraction — it’s more imagination.

Source: https://www.ted.com/talks/matt_tilleard_the_best_thing_that_could_happen_to_the_energy_industry

Rethinking the energy transition: What’s actually moving the needle

Power demand is surging — driven by heat, electrification and AI — while fossil fuels still supply most generation.

The takeaway isn’t doom; it’s focus. The FT’s latest deep dive highlights three levers with real momentum:

- Scaling renewables (and storage) far faster

- Modernizing grids for reliability and interconnection

- A pragmatic nuclear comeback to supply 24/7, zero-emission baseload

Source: https://www.ft.com/content/66bb8907-0081-45d4-9797-7416b8468f6e

Keep building — Even when it’s hard to see progress

Momentum isn’t always visible.

Some days, progress looks like showing up, refining, or simply staying the course.

In business, as in life, growth rarely happens in a straight line. But every small step — every improvement, every conversation, every challenge met with patience — compounds into something greater.

Keep showing up. The results are closer than they seem.

Resilience in motion: The U.S. economy holds steady amid rate cuts

Against a backdrop of weak job numbers and ongoing uncertainty, the U.S. economy continues to outperform expectations.

While the Fed‘s recent rate cut signaled caution, underlying indicators tell a more balanced story — steady household spending, rising investment, and record-high markets all point to a resilient economic core.

Even with slower employment growth, shifting demographics and migration trends mean the labor market may be healthier than it looks on paper.

In short: America’s fundamentals remain sturdy, and the Fed’s easing could extend the current momentum — provided policy and politics stay in sync.

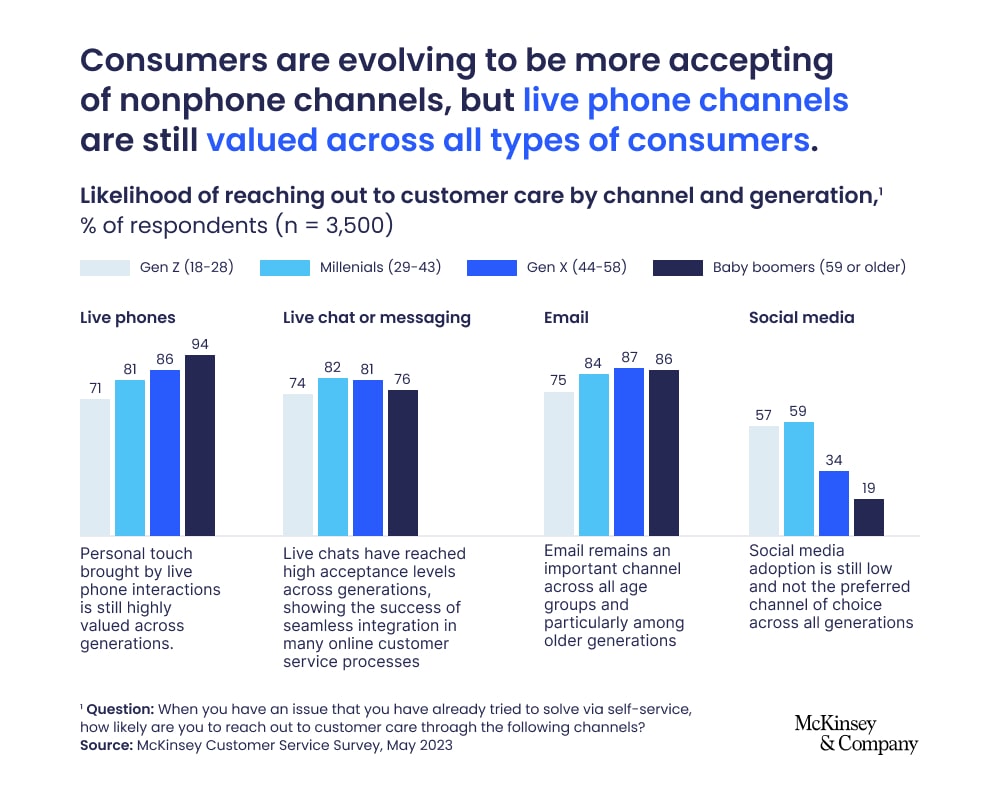

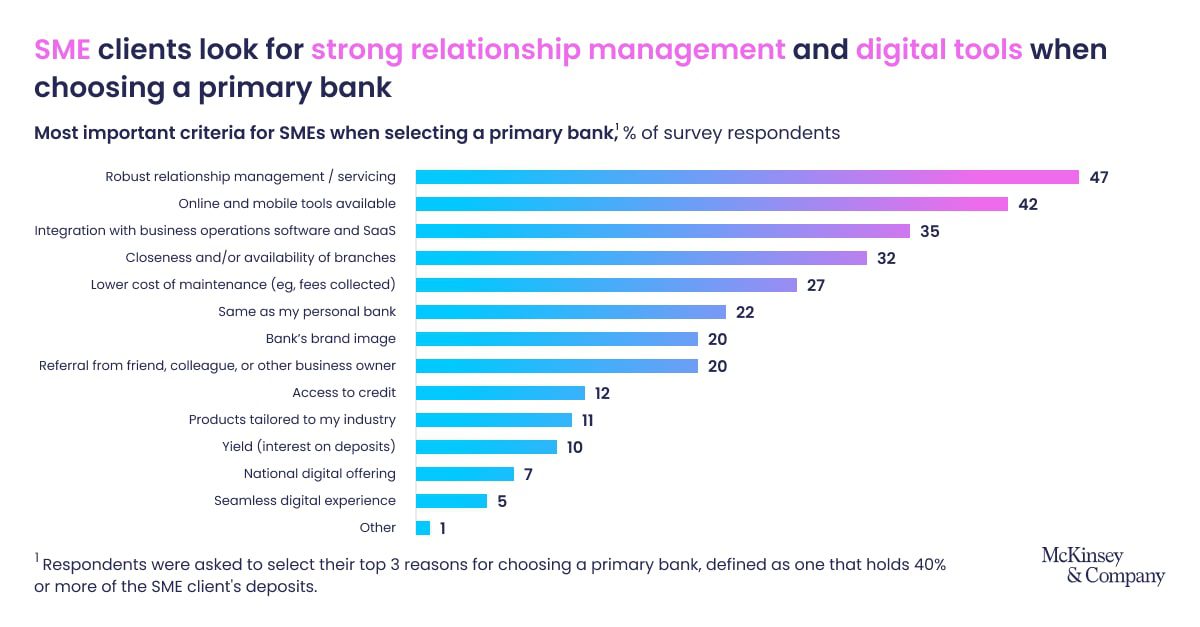

Midcap banks are at a crossroads

A generation of customers raised on seamless digital experiences expects more — speed, personalization, and purpose-driven service.

McKinsey’s latest research shows that midcap institutions that act now to #modernize tech stacks, empower teams with data-driven insights, and redefine relationship banking are best positioned to win the next decade.

It’s not just about keeping up with fintechs — it’s about reimagining what it means to be a relationship bank in a digital-first world.

Gold’s record-breaking rally is reshaping how investors think about diversification