BCG Global Payments Report: urgent action required by payment leaders

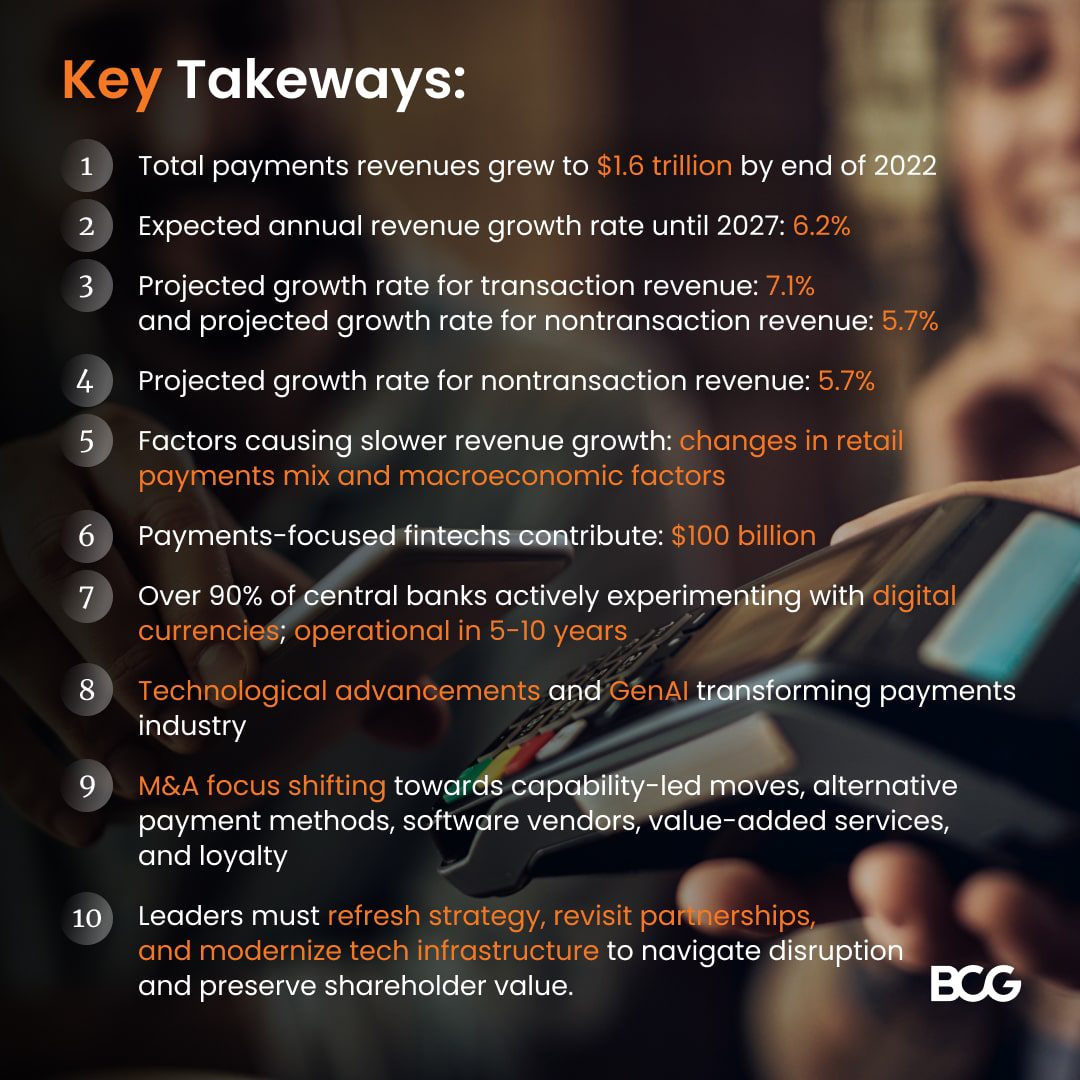

Financial institutions must modernize their technologies promptly for long-term advantage. Key highlights:

- Total payments revenues: $1.6 trillion

- Expected annual revenue growth rate until 2027: 6.2%

- Projected growth rate for transaction revenue: 7.1%

- Projected growth rate for non-transaction revenue: 5.7%

- Factors causing slower revenue growth: changes in retail payments mix and macroeconomic factors

- Payments-focused fintechs contribute: $100 billion

- Over 90% of central banks actively experimenting with digital currencies; operational in 5-10 years

- Technological advancements and GenAI transforming payments industry

- Regulatory authorities increasing scrutiny on risk management and compliance practices

- M&A focus shifting towards capability-led moves, alternative payment methods, software vendors, value-added services, and loyalty

- Leaders must refresh strategy, revisit partnerships, and modernize tech infrastructure to navigate disruption and preserve shareholder value.

https://www.bcg.com/publications/2023/bcg-global-payments-report-2023

LOQUAT Inc., a banking-as-a-service (BaaS) platform, can with help the diverse needs of customers, allowing banks and financial institutions to offer a range of products and services with varying fees, features, and requirements.

Schedule a demo today and learn how LOQUAT Inc. can help: https://loquatinc.io/demo/