Generative AI for banks: Managing risk and compliance

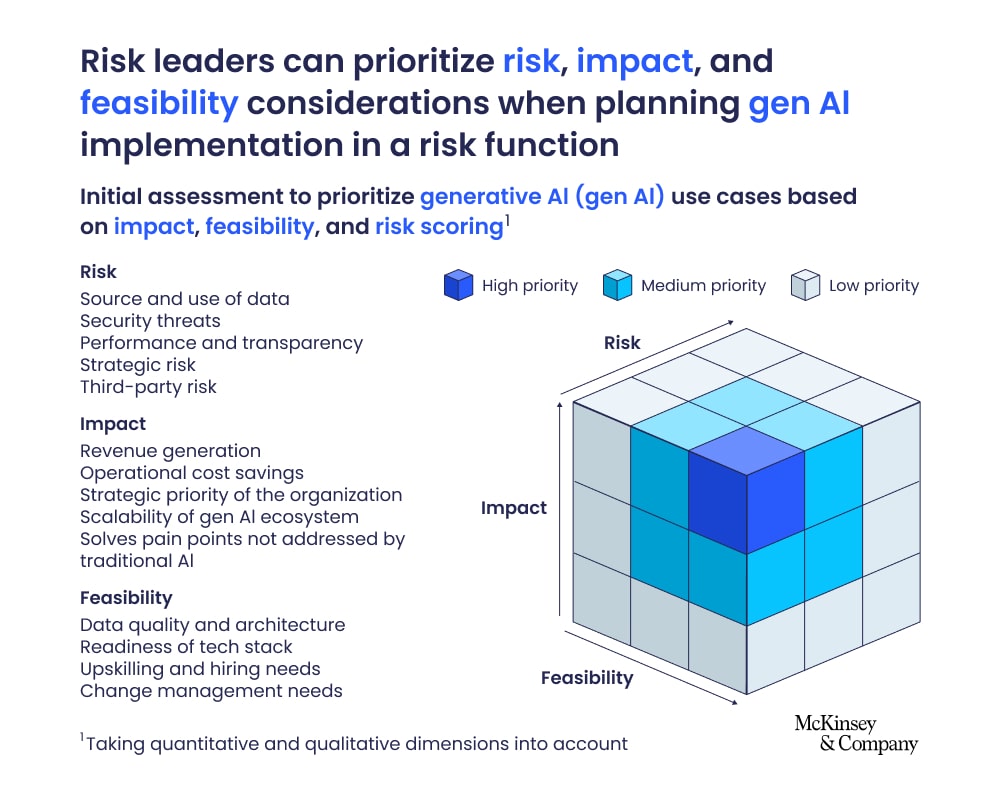

Over the next five years, generative AI has the potential to automate and improve various aspects of risk control, from regulatory compliance to climate risk management.

It is crucial for risk and compliance teams to establish clear boundaries for the implementation of gen AI within their organizations.

By utilizing gen AI, banks can shift their focus from mundane tasks to strategic risk prevention and collaboration with business units. This approach allows risk professionals to provide valuable insights for new product development and business decisions, as well as proactively address emerging risk trends.

Key applications of gen AI include regulatory compliance, financial crime detection, credit risk assessment, data analytics, cyber risk management, and climate risk evaluation. By embracing gen AI, banks can streamline operations, enhance decision-making processes, and strengthen overall risk and compliance functions.