Insights for Credit Unions in 2024: Navigating the economy and interest rates

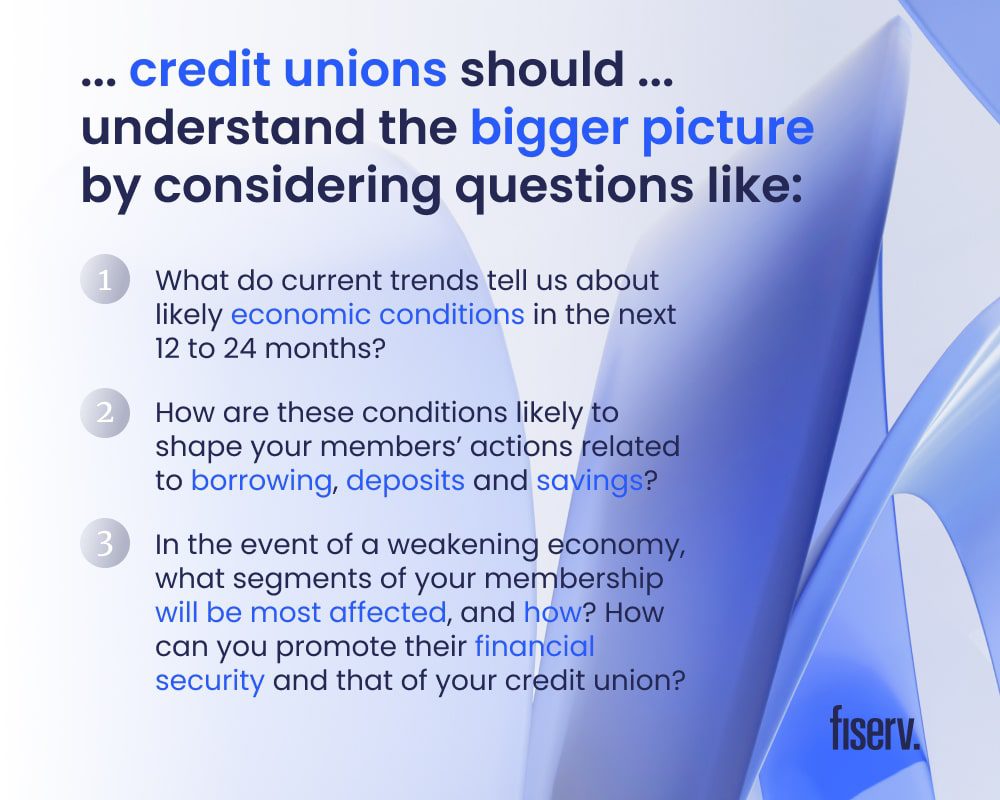

In the upcoming year, credit unions should keep a close eye on the economy and interest rates. While higher earners may be less affected by deteriorating consumer financial health, it’s crucial for credit unions to monitor all income levels. Various factors like inflation, geopolitical instability, and supply chain disruptions could further weaken the economy and impact individuals across the income spectrum.

Despite recent inflation decreases, wages are starting to outpace price increases, particularly for lower-income individuals. While this is positive news, concerns remain about unsustainable spending and debt levels, especially among the lower income brackets.

Credit unions need to pay attention to rising debt levels, driven by significant growth in auto loans and credit card debt – key areas for credit union products. Managing these risks prudently will be essential in 2024 and beyond.