NFIB’s latest small business economic trends report reveals some noteworthy insights:

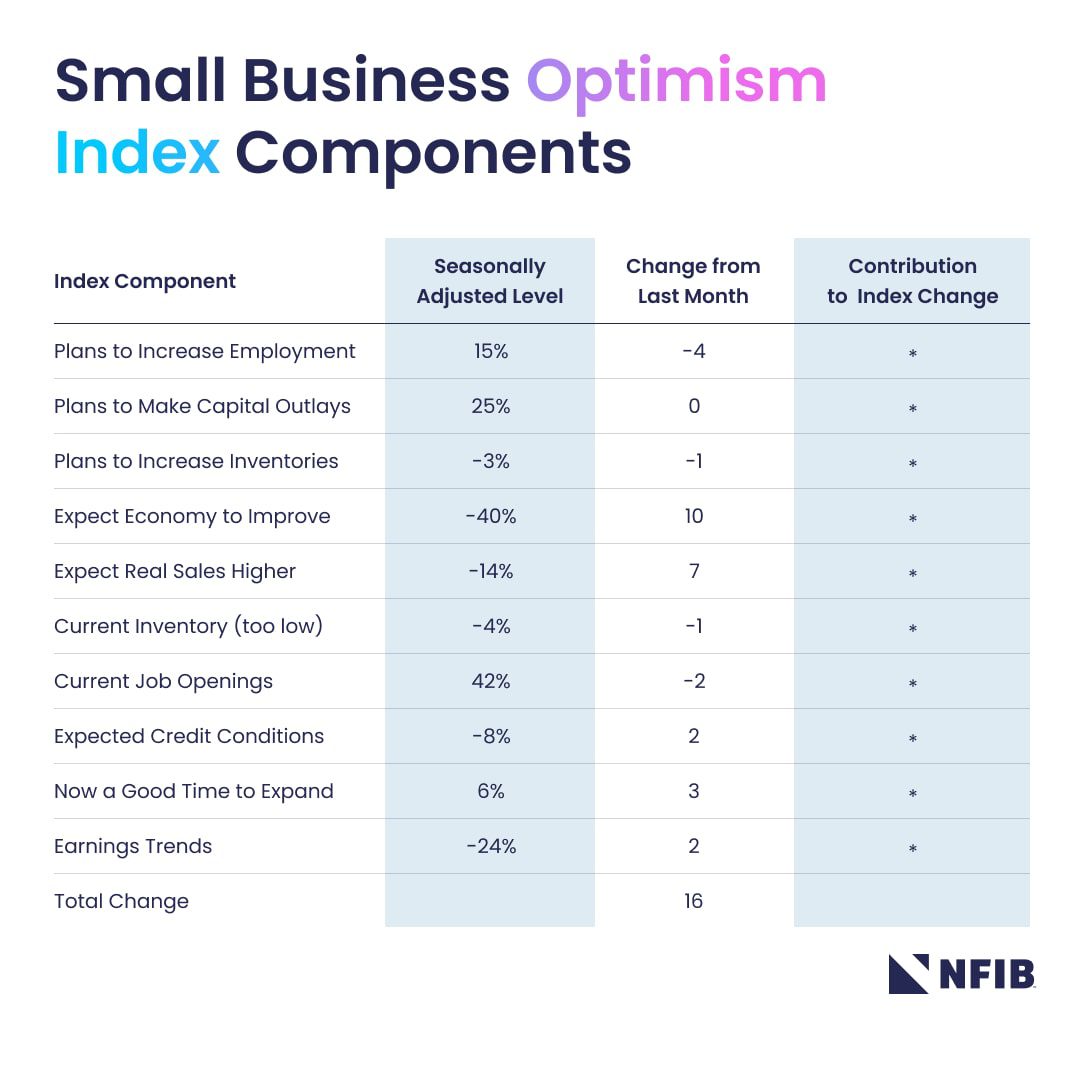

- There has been a slight improvement in small business owners’ expectations for better business conditions in the next six months. The percentage of owners with this positive outlook increased by 10 points from May, reaching a net negative 40%. While this is still not ideal, it is 21 percentage points better than last June.

- The difficulty in finding qualified employees remains a challenge for small businesses, with 42% of owners reporting job openings that are hard to fill. This figure has remained stubbornly high.

- The outlook for higher real sales has also improved, with a 7-point increase from May to a net negative 14%.

- Hiring remains a priority for many small business owners, as 59% of them reported hiring or attempting to hire in June. However, a staggering 92% faced difficulties finding qualified applicants.

- Capital outlays have been made by 53% of owners in the past six months, primarily on new equipment, vehicles, and facility improvements. Additionally, 25% of owners plan to make capital outlays in the coming months. – The sales performance in the past three months has been lackluster, with a net negative 10

https://www.nfib.com/surveys/small-business-economic-trends/

Loquat, an innovative financial technology company, developed and operates a proprietary banking as a service platform designed with the small business customer in mind by a world-class team of former banking executives, fraud specialists, technology and digital transformation experts, and business owners. The end-to-end-platform allows credit unions and community banks to improve or launch a streamlined digital banking functionality aimed at serving small and medium-sized businesses (SMB) from new account onboarding through delivering lending options, while preventing fraud without sacrificing on the user experience. To learn more about Loquat, visit www.loquatinc.io