Small businesses deserve better banking services

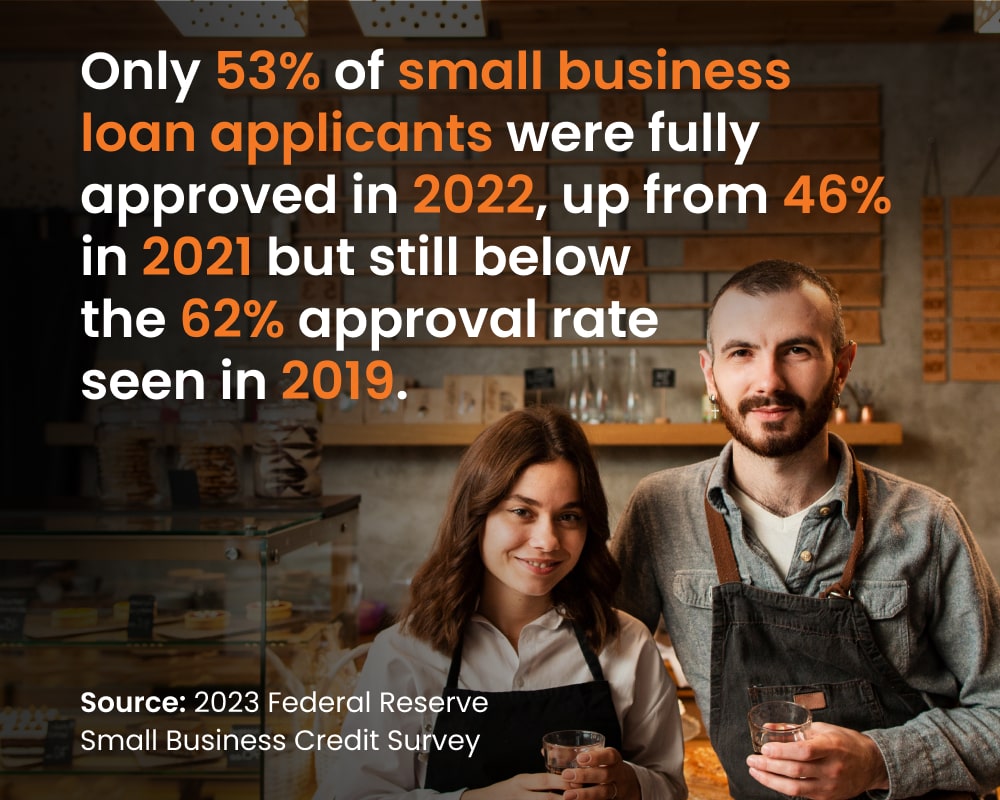

The data from the 2023 Federal Reserve Small Business Credit Survey highlights the ongoing challenges faced by smaller businesses in accessing financing. Despite some improvement in approval rates from the previous year, the approval rate for loan, line of credit, and cash advance applicants remains below pre-pandemic levels.

The discrepancy in approval rates can be attributed to the risk management practices of large banks, which may not be well-suited for serving the needs of small and medium-sized businesses (SMBs). Due to the potential regulatory risks involved, many mega banks may be hesitant to extend credit to smaller clients who represent a relatively small portion of their overall revenue.

This underscores the need for better banking solutions tailored specifically to the unique requirements of SMBs, in order to facilitate their growth and success in the current economic landscape.