The high-stakes balance: Interest rates, independence, and investor confidence

With inflation still sticky and job growth strong, the Fed continues to hold off on rate cuts — and markets are paying close attention to how those decisions are made.

Key takeaways from WSJ:

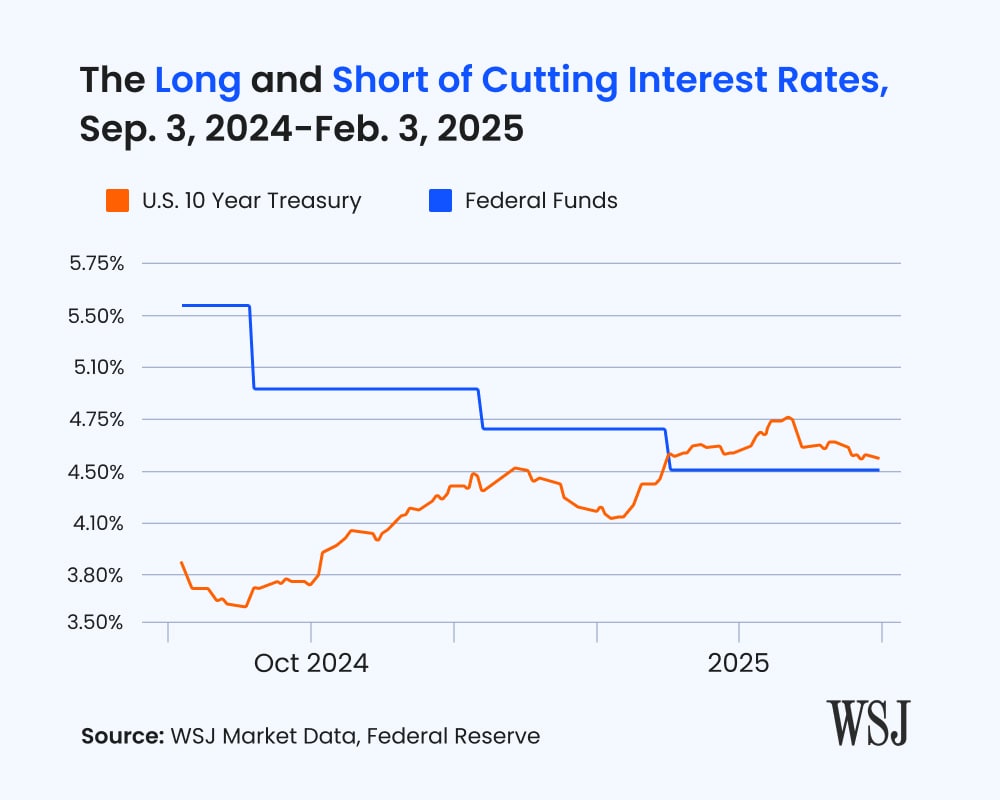

- Long-term Treasury yields are rising, not falling — suggesting growing concern over policy direction and stability

- The Fed’s independence remains crucial: attempts to influence monetary policy could risk investor confidence

- Higher uncertainty = higher borrowing costs as investors demand more return to hedge volatility

Bottom line: Stability in policy signals matters as much as the policy itself