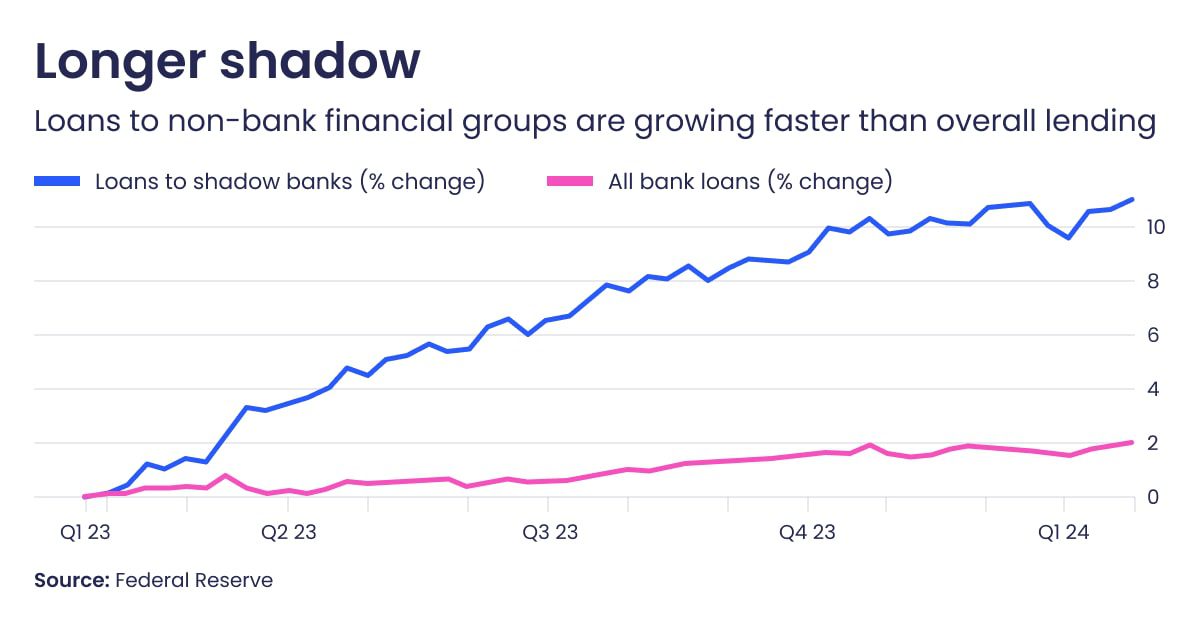

US lenders’ debt to shadow banks passes $1tn

The US banking industry is witnessing a concerning trend as lenders‘ debt to shadow banks has surpassed $1tn. This surge in loans to shadow banks has raised alarm bells among regulators due to the lack of information and oversight regarding the risks involved.

Shadow banks, including hedge funds, private equity firms, and direct lenders, are leveraging these funds to make investments and extend loans to borrowers that traditional banks have been discouraged from lending to directly.

This phenomenon highlights the growing role of shadow banking in the financial system and the potential risks it poses. Regulators are now grappling with the challenge of monitoring and regulating these non-traditional lenders to ensure financial stability.