Are US banks ready for consolidation?

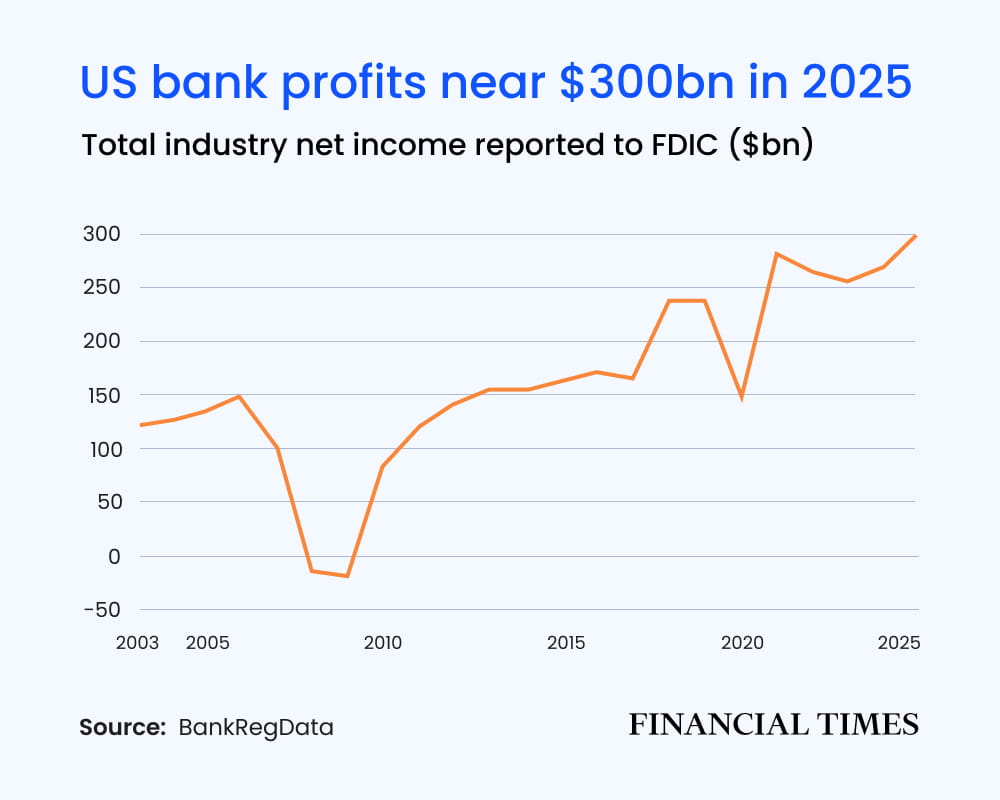

The US banking sector remains fragmented, with over 4,000 federally insured institutions. Rising regulatory and technology costs create strong incentives for consolidation.

Yet, non-crisis mergers and acquisitions have fallen below 50% of the historical average since the global financial crisis (GFC). M&A activity among large banks has dropped to just 10% of pre-GFC levels due to regulators’ anti-consolidation stance. Despite this, many in the industry believe this position will eventually change.