Banking: bolder strategies to service customers and society are essential

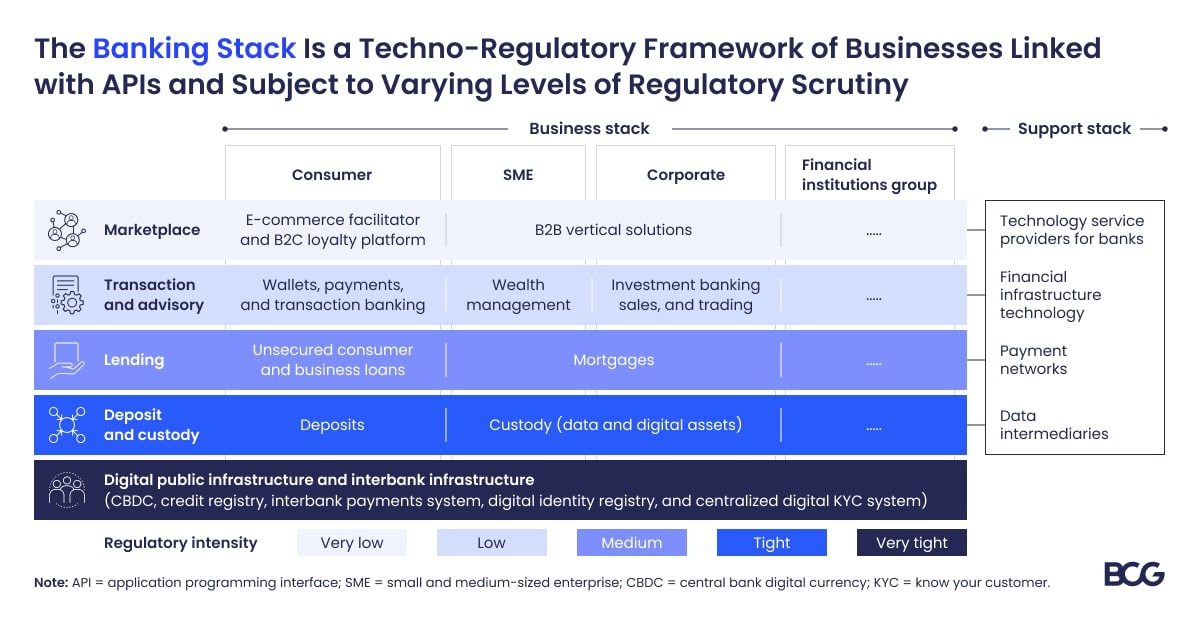

Banks must adapt to disruption in the global financial ecosystem by redefining their competition, partnerships, and value delivery. They need support from governments and regulators.

To succeed, banks should prioritize higher productivity, reduce complexity, and embrace a digital-first approach. Adopting a zero-based business model can increase productivity by 40%.

To enhance value, banks should exit low-return assets and invest in growth areas with favorable returns on equity.

A simplified business model, actively managed balance sheet, modern platform operating model, and digitalization are crucial. Banks should leverage data, technology, and strategic partnerships to build competitive capabilities.

Banks should adopt a “tech product company” mindset, empowering business teams as “product owners” to prioritize customer-centric iterations and collaboration with technical teams.

Incremental transformation is no longer enough. Banks must break free from legacy setups and take a holistic approach to drive economic growth, finance the climate transition, and create lasting shareholder value while fulfilling their obligations to customers and society.