Buy now, pay later: A convenient lifeline or a looming debt trap?

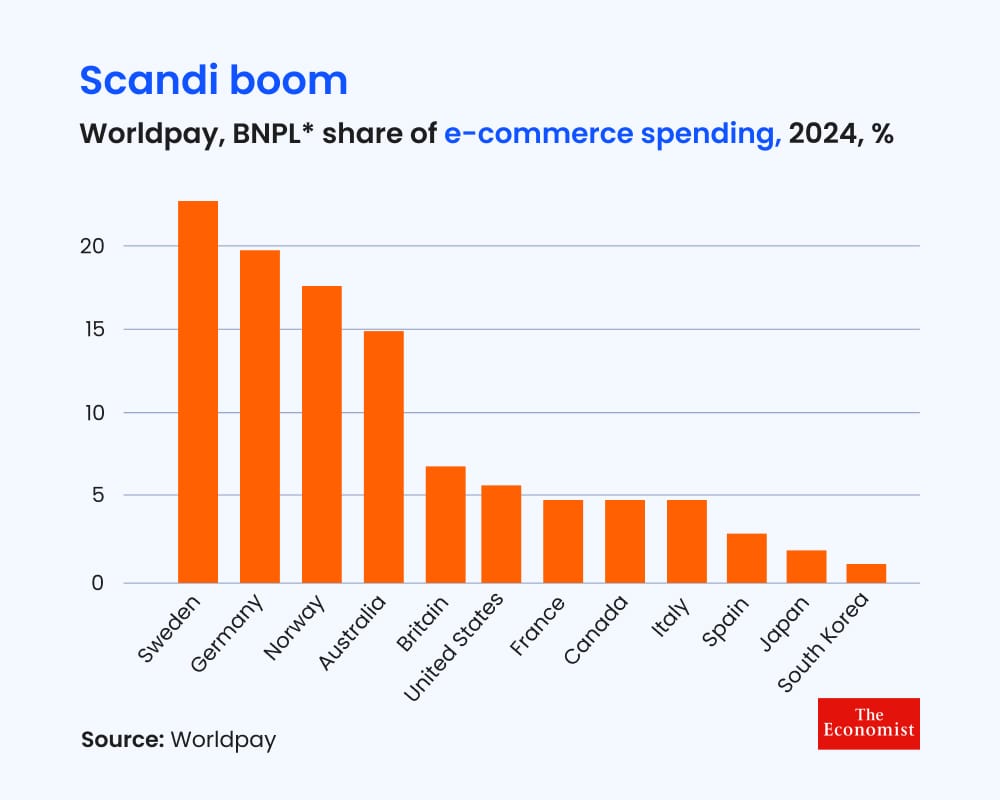

Buy Now, Pay Later (BNPL) services like Klarna, Affirm, and Afterpay are becoming mainstream around the globe. With consumer uncertainty high, even basic purchases — groceries, lunch orders, concert tickets — can now be split into interest‑free installments.

That convenience is a double-edged sword:

- For many, it offers short-term relief and greater #payment flexibility at checkout.

- But critics warn BNPL is expanding debt into everyday spending — especially for financially vulnerable users.

Globally, BNPL transactions have exploded — from ~$50 billion in 2019 to ~$370 billion by 2023. Still, experts say growth may be outpacing protections — and sustainability.

Bottom line: BNPL is filling a financial gap, but without education and regulatory guardrails, it risks morphing from a convenience to a crisis.