ESG: A Sustainable Investment Framework

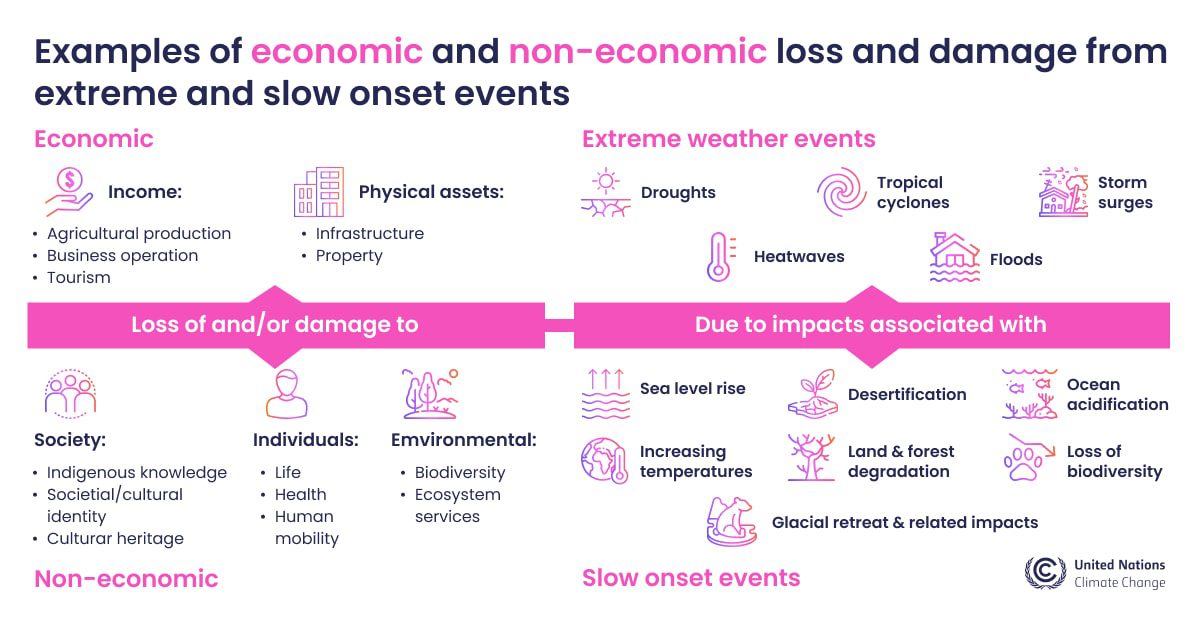

ESG, an abbreviation for Environmental, Social, and Governance, is a handy framework used to assess the sustainability and ethical impact of investments. It takes into account various factors, both economic and non-economic, to evaluate the performance and potential risks associated with companies.

The environmental aspect of ESG focuses on how companies impact the natural environment. It scrutinizes their carbon emissions, water usage, waste management, and biodiversity conservation efforts. Companies that prioritize environmental practices tend to attract investors who value sustainability and are genuinely concerned about climate change and resource depletion.

The social aspect of ESG analyzes a company’s impact on society. It delves into factors like labor rights, employee diversity and inclusion, community engagement, and product safety. Companies with positive social practices tend to foster strong relationships with their employees, customers, and communities, ultimately leading to long-term success.

The governance aspect of ESG evaluates a company’s leadership, management structures, and transparency. It examines factors like board diversity, executive compensation, shareholder rights, and ethical business practices. Companies with robust governance practices tend to have effective risk management strategies and are accountable to their stakeholders.

By considering both economic and non-economic factors, ESG offers a comprehensive approach to assessing investments.