Generative AI is increasing the risk of deepfakes and fraud in banking

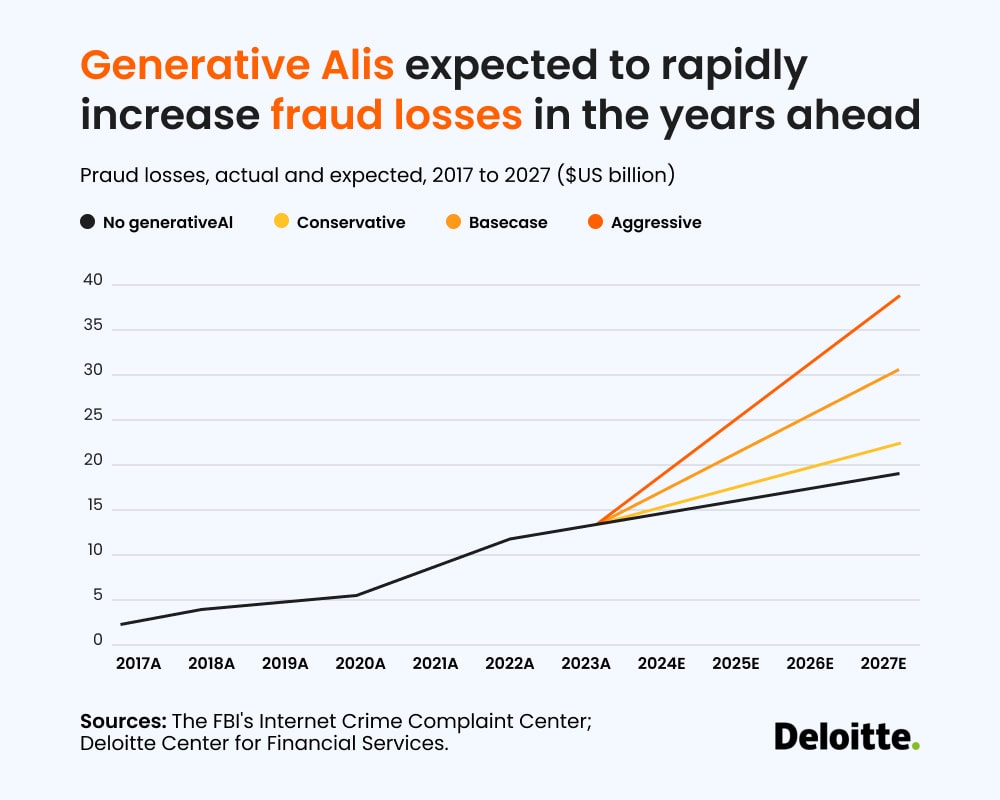

The capabilities of genAI open up new opportunities for criminals, broadening the scope and scale of fraudulent activities targeting financial institutions and their clients. Rapid technological advancements pose challenges for banks striving to outpace fraudsters. GenAI-driven deepfakes employ self-learning systems that continuously improve their ability to evade detection technologies.

In response, banks are increasingly partnering with third-party providers to develop anti-fraud solutions. A threat to one organization can jeopardize others; therefore, bank leaders must formulate collaborative strategies both within the industry and beyond to effectively address fraud related to generative AI.

This may require collective action across the banking sector, collaborating with trusted technology partners on strategic initiatives while clearly defining liability responsibilities concerning fraud among all parties involved.