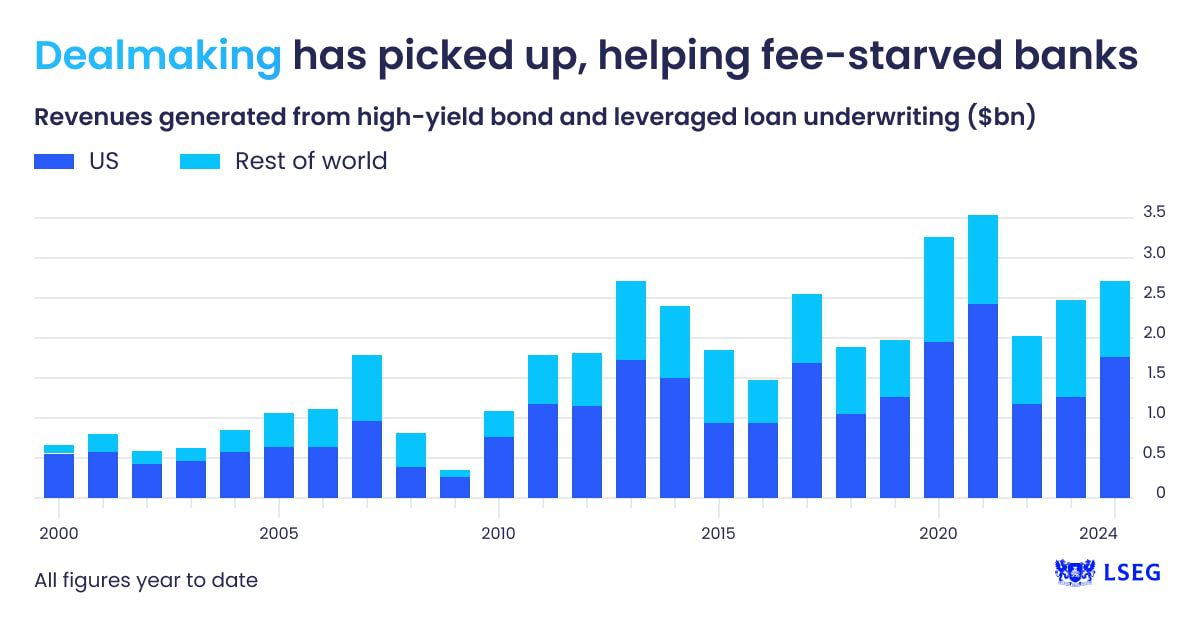

Shift in the market presents an opportunity for banks

The shift in the market towards refinancing in public markets is driven by the prospect of rate cuts, making it a more attractive option for borrowers looking to reduce their debt burden.

This trend is particularly evident in the private credit sector, where approximately $10 billion worth of loans have been refinanced in public markets. Bank of America’s data highlights the significant movement towards this alternative financing option, as borrowers seek to take advantage of lower interest rates.

For banks, this presents an opportunity to recover from losses incurred in 2022 when they financed deals that turned out to be unprofitable. By capitalizing on the current market conditions and offering more competitive loan options, banks can regain their footing and potentially increase their profitability in the future.

Read the full article at:

https://on.ft.com/4bPxgD8