It’s no secret that the world of Fintech is shaking up the banking industry as we know it and has been for the last several years. The pandemic only accelerated its growth, proving – digital transformation is necessary and imminent, especially for credit unions, regional, and community banks.

To add insult to injury, the rise of neobanks (digital-only banks) such as Revolut, Chime, and BlueVine have created even more competition providing consumers and SMBs with enhanced digital customer experiences and a variety of digital banking options.

However, the caveat here is that neobanks can’t necessarily compete with traditional banks who partner with BaaS providers for the long haul since they don’t hold a banking license or have the same long-term trust and reputations. Additionally, customer acquisition costs are too expensive, and partnerships with banks are costly, ultimately affecting their profits.

The proof is in the pudding – despite questionable sky-high valuations, some neobanks are barely profitable, and many others have folded. One example of this is BBVA’s neobank acquisitions Simple and Azlo shuttering just last year.

What is Banking-as-a-Service for Banks?

Banking-as-a-Service is an end-to-end process enabling financial institutions to execute all financial services through a cloud platform or API (Application Programming Interface) – a software intermediary that allows two applications to talk to each other.

Banks partner with BaaS providers, such as Loquat, to embed customizable services, products, and features that personalize the customer experience to compete with neobanks and their big bank competitors. In short, BaaS allows FI’s to provide personalized financial services to their customers or members at their point of need which reduces abandoned registrations, churn and ultimately profits.

Banking-as-a-Service Market Potential and Outlook

From mobile apps, digital wallets, and digital identity to AI, machine learning, and cloud-based infrastructure, Banking as a Service boasts impressive benefits for financial institutions to fill in the gaps where legacy systems and manual processes can no longer keep up.

Five Reasons You Should Invest in BaaS Now

1. BaaS Solves Multiple Market Challenges

There are many challenges that financial institutions, especially smaller community banks, regional banks, and credit unions, are facing today. But we will focus on three top challenges that Banking as a Service can solve.

A Cultural Shift to Innovation – This is apparent when we look at how successful tech giants such as Amazon, Uber, Walmart, and PayPal have paved the way for innovation by incorporating financial services into their digital customer experience. These digital advancements have set an expectation that everyday consumers are demanding, from making digital payments and accessing their finances to opening bank accounts and applying for loans in minutes rather than days!

Security Breaches and Fraud – Cyber-attacks, fraud, money laundering, and security breaches are rising. Many financial institutions are left scrambling because it impacts their bottom line and reputation. It is a common concern that digital ecosystems can create more security risks. However, by adopting Loquat’s BaaS solution, financial institutions invest in six layers of security and KYC and KYB built into the enrollment process with AML capabilities and SOC2 compliance.

Additionally, Artificial Intelligence and Machine Learning embedded into the Loquat platform will not only alert FI’s of attacks but be better equipped to prevent them as they learn new techniques. Simply put, by avoiding digital transformation, banks are still susceptible to security breaches with no accurate detection and prevention in place.

Increasing Competition – Fintechs such as neobanks pose a significant threat because they target some of the most profitable areas in financial services and allure consumers with the convenience of digital capabilities and faster service.

In 2015, Goldman Sachs predicted that new digital banking competitors, or what they coined “shadow bank”, would account for upwards of $4.7 trillion in annual revenue diverting from traditional financial services. The good news is that BaaS platform solutions create a bridge for traditional banks to close the gap in this competition, backed by their long-term trust, reputation, and stability.

2. BaaS Has the Potential for High Growth and Adoption

BaaS has already proven its enormous potential, with many banking giants adopting this technology. However, a large percentage of the market is left behind, specifically credit unions and regional and community banks, which would immensely benefit.

The banking world is poised to move away from products to experiences and ecosystems embedded in real-time, and BaaS is the solution to make this a reality. In addition, core systems are becoming legacy because a technology stack constantly evolves to meet customer or member needs and expectations, setting up financial institutions for the future.

3. What Does the ROI Look Like?

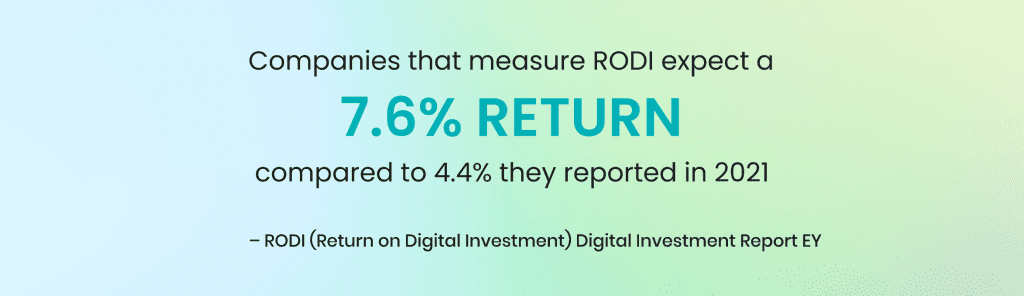

According to Ernst & Young, companies including banks continue to make hefty investment bets on digital transformation, with the majority seeing it as a top business strategy and critical to survival. In 2022, 41% of executives are measuring returns, up from 23% from the year before and they are now seeing the fruits of this labor.

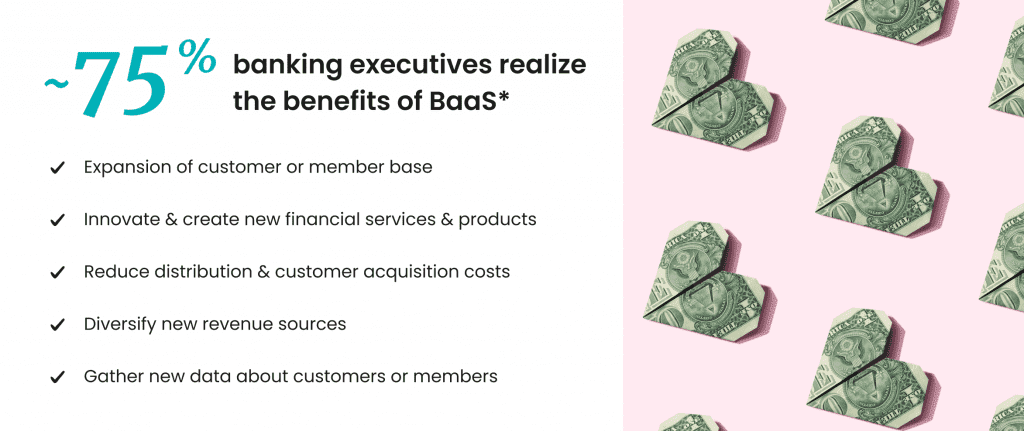

Additionally, many banks are looking to partner with BaaS providers as it is a much less costly investment than attempting to build their own BaaS platforms in-house. With more and more financial executives realizing the myriad of benefits with BaaS solutions including healthy net margins in the 40+ percentile, investing in BaaS is a no-brainer.

4. The Competitive Advantage of BaaS

The competitive advantage is significant for BaaS because of its versatility and customization. With so many Fintech players entering the market, it is wise for financial institutions to size up who they partner with. BaaS technology stacks are not all the same, and the differentiator will be how the service offerings meet the specific needs of the financial institution they partner with.

The Loquat BaaS platform is designed with the small business member or customer in mind while keeping security and compliance the number one priority. From the mobile app customer experience and digital identity technology to the built in KYC and KYB enrollment process and AI powered fraud detection, Loquat’s proprietary flow is unmatched in the world of BaaS.

5. A BaaS Provider’s Key Differentiator – The Team

Not all BaaS providers are created equal. This is often because many aren’t backed by a team of experts who have worked extensively in the areas of financial services, technology, compliance, and anti-money laundering.

Loquat has many key differentiators compared to competitors. However, the main difference is certainly our world-class executive team.

Loquat Executive Team

- Hail from banking conglomerates such as Goldman Sachs, CitiGroup, and BNY Mellon.

- Holding C-suite positions in financial services, technology and transformation, software development, AML compliance, security risk, and global entrepreneurship in both private and public sectors.

- The Loquat team deeply understands the market and the industry from the inside out to develop Loquat as the premier BaaS solution during this period of digital evolution.

- The Loquat team has a heart for SMBs and local financial institutions such as credit unions, regional and community banks with a mission to empower ESG goals by modernizing local economies.

Learn more about the Loquat team.

Although the Loquat name may be newer to you, our proprietary flow also has key strategic partner(s) behind them. Behind those partners are thousands of successful clients and integrations with every major core.

When it comes to making sound investments, we believe that the proprietary flow built into the Banking as a Service platform that Loquat Inc. has developed solves every problem that a financial institution faces that many of our competitors are unable to match.

Let us show you how Loquat works – Book a Demo Today!

Thinking about partnering with us – Learn How