In uncertain economic times, we empathize with many financial institutions that are facing an uphill battle of post-crisis recovery from the pandemic, rising costs due to inflation and rate hikes, swiftly changing compliance regulations, technological disruption and now — the looming threat of a recession.

This harsh reality is prompting bank executives to take a long, hard look at how and where they can reduce costs and open up more opportunities for revenue.

Despite the grim outlook for 2023, there is still hope for credit unions, and regional and community banks to create more opportunities for revenue growth and reduce costs on a continual basis with the help of digital banking technology.

Credit unions, regional and community banks can position themselves to win, even during a financial crisis by leveraging innovative technology. Embedded finance (Banking as a Service), artificial intelligence, machine learning, cloud-based infrastructure, digital payments, digital identity, mobile apps, and wallets are being leveraged by top banks to meet the demand of current and future bank members.

Why are Costs Rising Faster than Revenue for Banks?

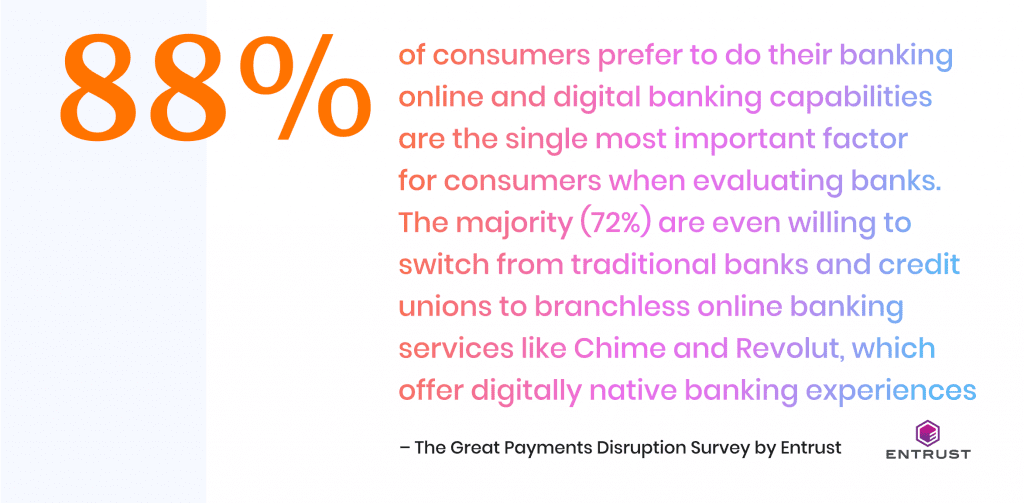

Since the last financial crisis in 2008 costs have been rising faster than revenue for banks. With the onslaught of regulations comes increases in compliance and regulatory costs to boot.

Over the past decade, financial institutions have also been generating lower returns on assets as compared to other industries. For example, just 0.8 percent returns were achieved in 2019 as compared to 5.7 percent for communications services according to Oliver Wyman. A major reason for this is that even today, financial institutions are not using technology assets as efficiently as they could which means they face significant threats to banking giants and challenger banks.

There are many more variables that banks can control when we analyze why and how they have historically experienced revenue leakage, customer churn, and profit losses. Let’s explore.

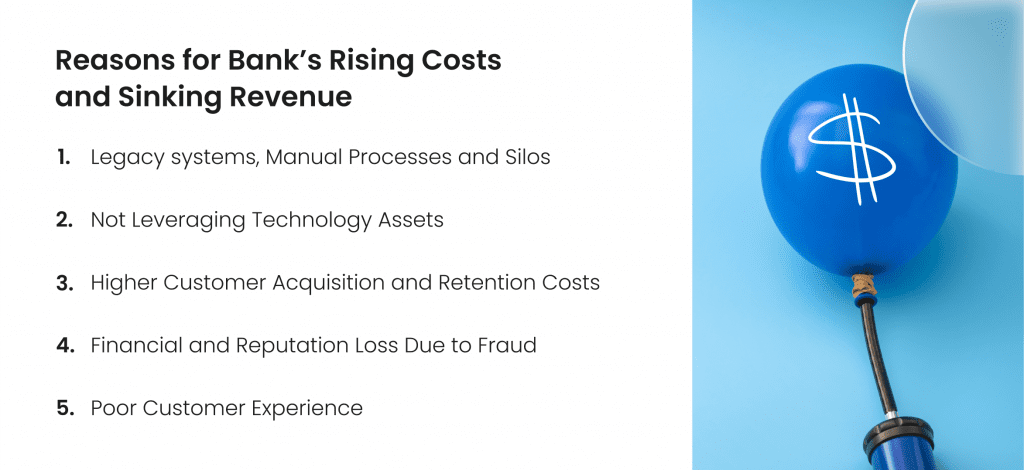

Legacy systems, Manual Processes and Silos

Some of the most common issues financial institutions have been experiencing are working with outdated legacy systems, relying on manual processes, and silos. Not only do these older systems take more time and overhead but they increase the rate of error, processing times, and reduce the ability to innovate, capture data and personalize the customer experience. This results in customer churn and a potential negative reputation, which is not something any bank can sacrifice in hard economic times.

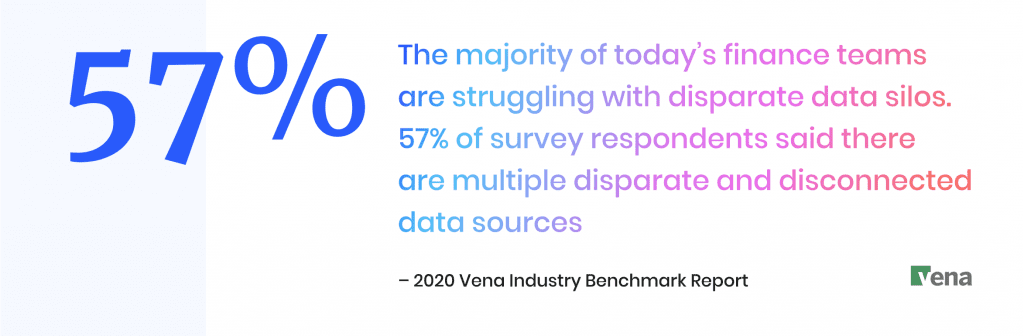

When it comes to silos, simply put, they don’t speak to each other. Data silos severely limit their ability to extract data and ultimately analyze it to understand changes in customer or member behavior for reporting on regulatory compliance, developing new products, and other critical functions.

Higher Customer Acquisition and Retention Costs

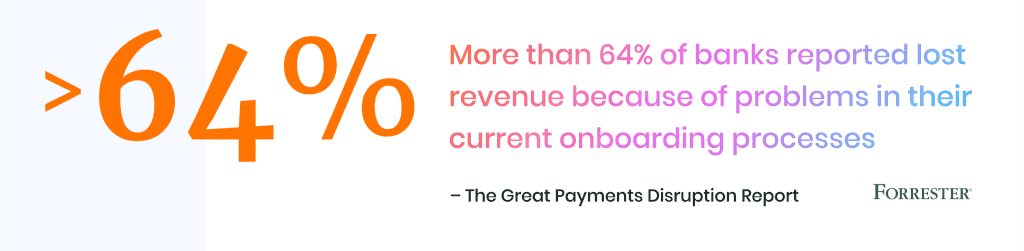

According to Oliver Wyman, the average acquisition cost is in the range of $100 – $200 for banks. Customer acquisition is remarkably higher when banks have to work harder at marketing or if their marketing efforts aren’t targeted. But where they experience the most issues is in the onboarding process.

This results in profits lost to digitally advanced competitors. When banks leverage digital technology such as Banking as a Service, the customer acquisition cost decreases to $5 – $35, it allows them to capture new sources of revenue and consistently develop new processes and innovative products tailored to the customer journey reducing abandoned onboarding.

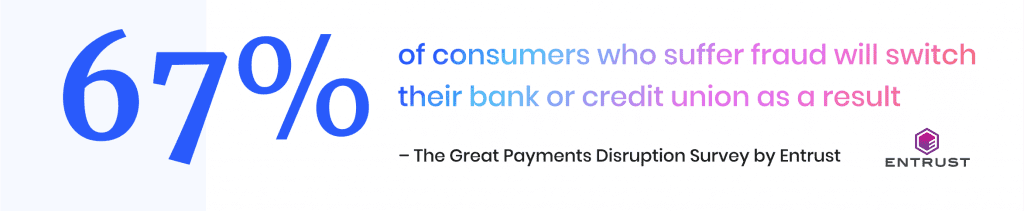

The Cost of Fraud Goes Beyond Money

Financial institutions have much to lose from fraud — not only the direct financial losses or non-compliance fines but also indirect costs like lost customer loyalty and reputation. Given the amount of competition in the industry, consumers and SMBs have more banking options from large banks to fintech disrupters.

To prevent these consequences, community and regional banks and credit unions will not only need to improve their security offerings, but also be transparent in communicating with their members on how advanced technology is keeping their accounts and payments secure.

Poor Customer Experience

Due to the widespread adoption of simple, efficient digital ecosystems such as Amazon and Uber, today’s consumers have a high bar of expectations. Unfortunately, legacy systems do not have the same instant access to data or personalization of the customer experience. The pandemic only accelerated the need to go digital and many consumers and SMB’s want seamless experiences or banks will suffer abandoned onboarding and customer churn at increasing rates.

Banks Must Take Bold Action to Maintain Financial Health

Banks, and more specifically credit unions, regional and community banks are on the precipice of change. They will need to take bold leaps forward to advance digitally in order to remain competitive and relevant to SMB’s who expect digital tools and services that align with their business model, if they want to retain current members and attract new ones.

The Solution: Banking as a Service

Banking as a Service (BaaS) helps banks with a smaller footprint to grow, adapt, innovate and most importantly meet the demands of their SMB customers by personalizing the customer experience and offering customized products that only BaaS has the ability to do. This will allow credit unions and the like to remain competitive and combat potential revenue loss by reducing fraud and customer acquisition costs and increasing speed and efficiency.

Banking giants are using open platforms that leverage simple application program interfaces (APIs) to connect to third-party data sources in real time which improves real-time decisions, protects consumers against fraud, boosts the bottom line and protects the bank’s reputation. This is the power of BaaS.

BaaS is an incredible opportunity for financial institutions of all sizes to expand their revenue sources at a low cost and it is agile and scalable for new market opportunities.

It’s time for small regional banks, community banks, and credit unions to take advantage of Banking as a Service and this is possible with Loquat Inc.

5 Reasons Why You Should Partner with Loquat Inc.

- Loquat is a banking-as-a-service platform that offers an end-to-end digital bank solution enabling account opening, cash available, debit card, and loan disbursement in 5+ minutes.

- The Loquat digital platform is designed with the small business customer in mind – to enhance the customer experience with seamless integration and customizable features.

- Loquat’s technology prevents fraud with six layers of security, KYC and KYB built into its enrollment process, and identity verification within minutes.

- High-Availability cloud-based API infrastructure to conveniently integrate into your banking environment.

- We work with financial institutions to ensure that the Loquat Banking as a Service platform is fully integrated with your business model and the customer experience.

We’d love to show you how Loquat is the fast, secure, and convenient way for financial institutions to offer digital banking to small businesses – book a demo today by contacting us at fi@loquatinc.io

Learn more about how we can help your financial institution here.